Selecting the best Forex trading system is crucial for any trader, whether you're just starting or you're already experienced in the market. It's not just about making profitable trades—it's about having a reliable framework that suits your personal trading style and helps you manage risk effectively. Trading in the Forex market can be complex, and without the right system, it can be easy to lose sight of your goals.

What is a Forex trading system? How to evaluate and choose the right one? And what are the key elements that make a system successful. The answers to these questions will provide you with a solid foundation to understand how to navigate the Forex market with confidence.

What is a Forex Trading System

At its core, a Forex trading system is a set of rules that guides your trading decisions. These rules can be based on a variety of factors, such as technical indicators, Chart Patterns, or market sentiment. Essentially, a trading system helps you make informed decisions on when to enter or exit trades, which pairs to trade, and how to manage risk.

There are many different approaches to Forex trading, and the right system for you will depend on your personal preferences, experience level, and trading goals. Whether you're looking to trade full-time or part-time, and whether you're focusing on long-term trends or short-term opportunities, there's a system that can work for you. The key is finding one that fits your style, ensuring that it provides structure while also allowing flexibility to adapt to changing market conditions.

A good trading system is designed not only to help you identify potential opportunities but also to mitigate risk. It should be able to guide you through all market conditions, providing clarity even during periods of volatility. Moreover, a solid system helps to remove emotional decision-making, enabling you to trade more systematically and with discipline.

Key Components of a Successful Trading System

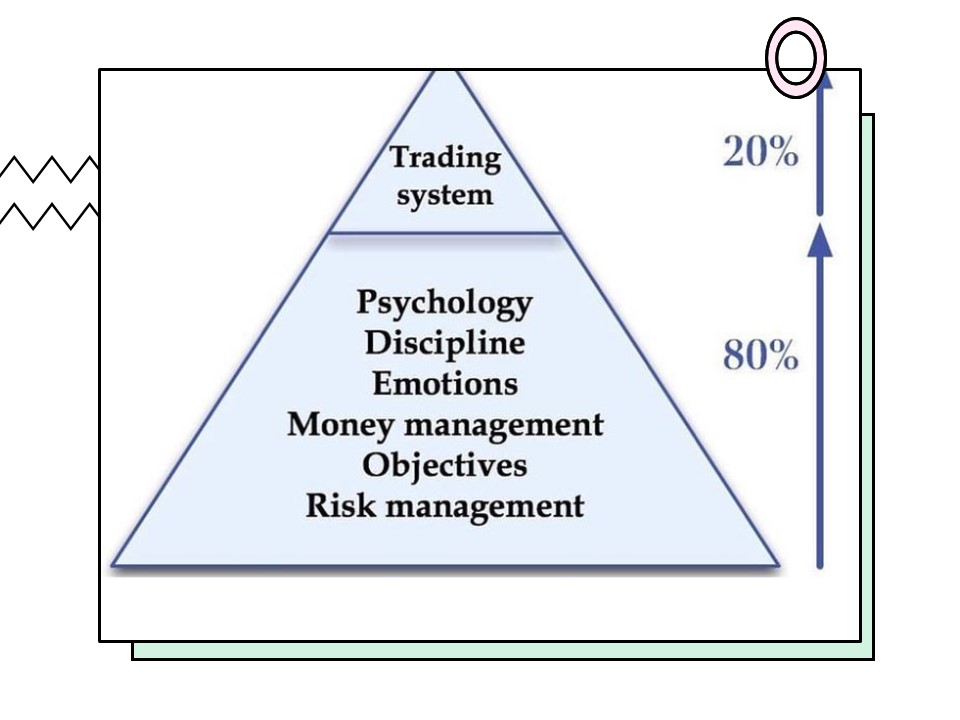

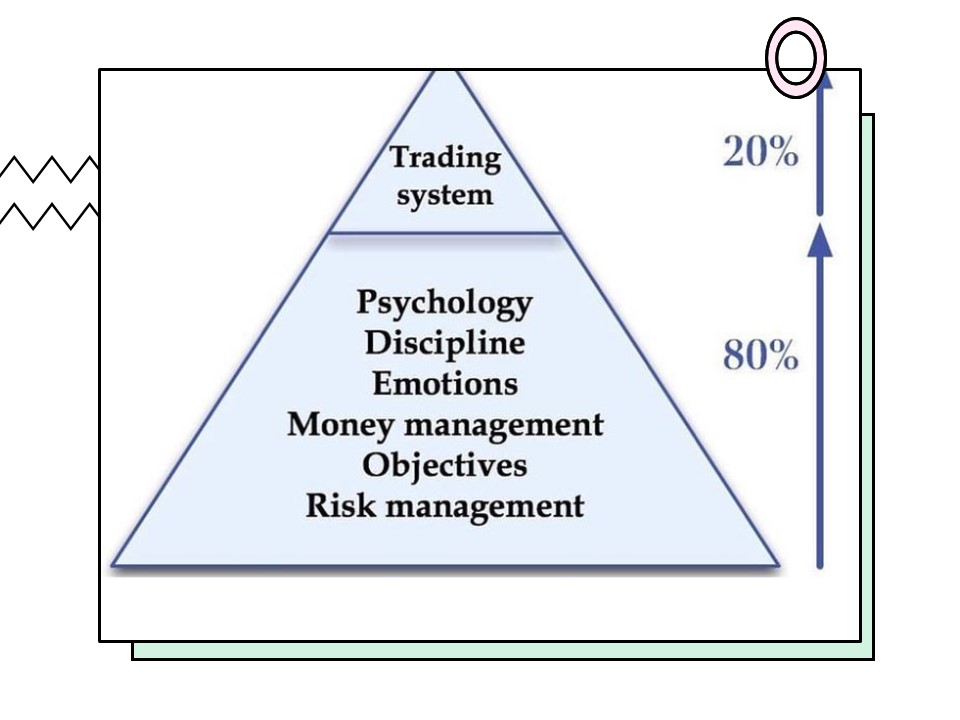

To build or choose the best Forex trading system, there are several key components to consider. A successful system is one that incorporates effective strategies for analysing the market, managing risk, and maintaining discipline. Let's dive into these elements:

Technical Analysis Tools

Most Forex trading systems rely heavily on technical analysis. This involves using charts, indicators, and past price data to forecast future market movements. Popular tools include moving averages, Relative Strength Index (RSI), Bollinger Bands, and Fibonacci retracements. These tools help traders identify trends, market reversals, and key support and resistance levels.

A system that incorporates solid technical analysis provides a structured approach to reading the market. It allows traders to make decisions based on data, rather than emotions or guesswork. The right combination of indicators is essential for identifying the best entry and exit points, helping traders make the most informed decisions.

Risk Management Techniques

No matter how experienced a trader is, risk management is always critical. Without it, even the best strategies can lead to significant losses. A strong Forex trading system includes specific rules for managing risk, such as setting stop-loss orders, taking profits at the right time, and never risking more than a small percentage of your trading capital on a single trade.

One of the most widely used techniques is the 2% rule, where you risk no more than 2% of your total capital on any trade. This ensures that even if you have a losing streak, your account won't be wiped out. Your system should also help you manage leverage, since using too much can be risky, especially in a volatile market.

Trading Psychology

Trading psychology plays a massive role in the success of any system. The ability to stick to your rules, even during periods of uncertainty or emotional stress, is what separates successful traders from those who fall short. A good trading system can support you by providing clear guidelines and structure, making it easier to manage emotions such as fear and greed.

Adherence to a set of rules helps remove the emotional aspect of trading, making it easier to follow your system without being influenced by external factors or impulse decisions. Over time, as you gain experience, you'll be able to fine-tune your psychological approach to trading, but a good system can help set the foundation.

Evaluating and Choosing the Right Trading System

Selecting the best Forex trading system isn't about picking one that promises instant profits or perfect results. The best system for you is one that matches your goals, trading style, and level of experience. There are a few critical factors to evaluate as you choose your system:

Assessing Your Personal Trading Style and Goals

Every trader has a different approach to the markets. Some prefer to trade based on long-term trends, while others focus on short-term movements. Some traders prefer a more hands-on, active approach, while others may use automated systems to manage trades. Your system should match your style, so you can work within your comfort zone and strengths.

For example, if you don't have time to monitor the markets all day, an automated or swing trading system that looks for opportunities within longer time frames may be best. If you prefer high-frequency trading, a scalping system might be more suited to your needs.

Back testing and Demo Trading

Once you’ve found a trading system that aligns with your preferences, it's time to test it. Back testing allows you to apply your system to historical market data to see how it would have performed in the past. While past performance doesn't guarantee future results, it can provide valuable insights into how effective the system might be.

Most brokers offer demo accounts, which allow you to practice trading without risking real money. Use this opportunity to familiarise yourself with the system, test out your strategies, and get comfortable executing trades in a risk-free environment.

Continuous Learning and Adaptation

Forex markets are always evolving, and your trading system should evolve with them. No system is perfect, and there will always be times when adjustments are needed. It's important to keep learning, stay informed about market developments, and be open to tweaking your system as you gain more experience.

Even the most successful traders regularly revisit and refine their systems to stay ahead of the curve. By embracing a mindset of continuous improvement, you'll be better prepared to adapt to new challenges and opportunities in the Forex market.

In the world of Forex trading, there's no one-size-fits-all system. The best system for you is the one that suits your individual trading style, risk tolerance, and goals. A good trading system will combine effective technical analysis, solid risk management, and a focus on trading psychology, allowing you to trade with confidence and consistency. The key is to evaluate, test, and refine your system as you learn more about the markets and develop your own trading expertise. With the right system in place, you'll be well on your way to becoming a more disciplined and successful Forex trader.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.