When you're getting into Forex trading, one of the first things you'll need to wrap your head around is the cost of trading — and this often comes in the form of Forex trading fees. Whether you're a beginner or an experienced trader, understanding these fees is crucial for managing your trading costs and maximising your profitability. After all, even small fees can add up over time and impact your bottom line.

So, what exactly are these fees, and how do they work?

Types of Forex Trading Fees

There are three primary types of fees in forex trading: spreads, commissions, and overnight financing fees. Let's break them down to get a better idea of how they impact your trades.

The most common fee you'll encounter is the spread. The spread is the difference between the buy and sell price of a currency pair. For instance, if you're trading EUR/USD, the broker may offer a buy price of 1.2005 and a sell price of 1.2000. meaning the spread is 0.0005. or five pips. Essentially, brokers make money from this difference. While it's a relatively simple concept, it's something to keep in mind as even small spreads can add up, especially with high-frequency or short-term trading.

Another common fee structure involves commissions, where brokers charge a fixed fee for every trade. Some brokers choose this model because it can offer tighter spreads, which are beneficial if you're making lots of trades. However, these commissions can quickly add up, so you need to consider whether a commission-based model works best for your trading style. If you're a high-frequency trader, a commission-based model could ultimately be more cost-effective, but for those who trade less often, it might not be the most economical choice.

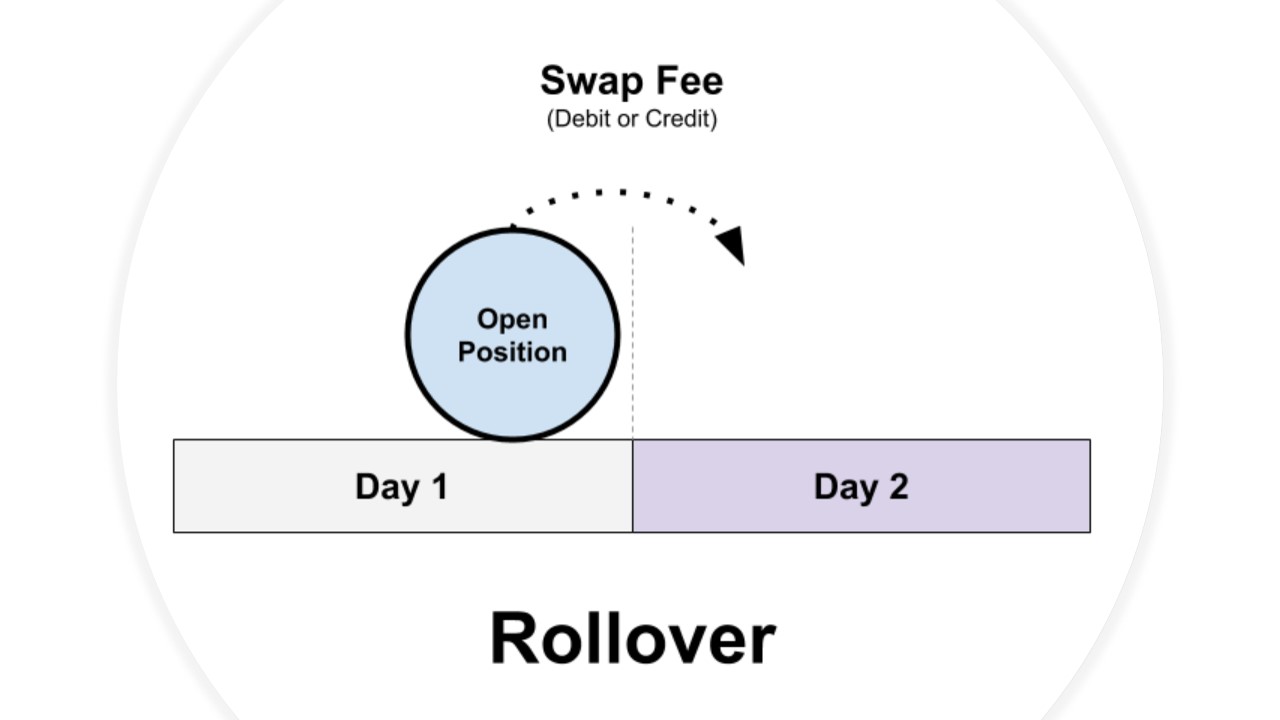

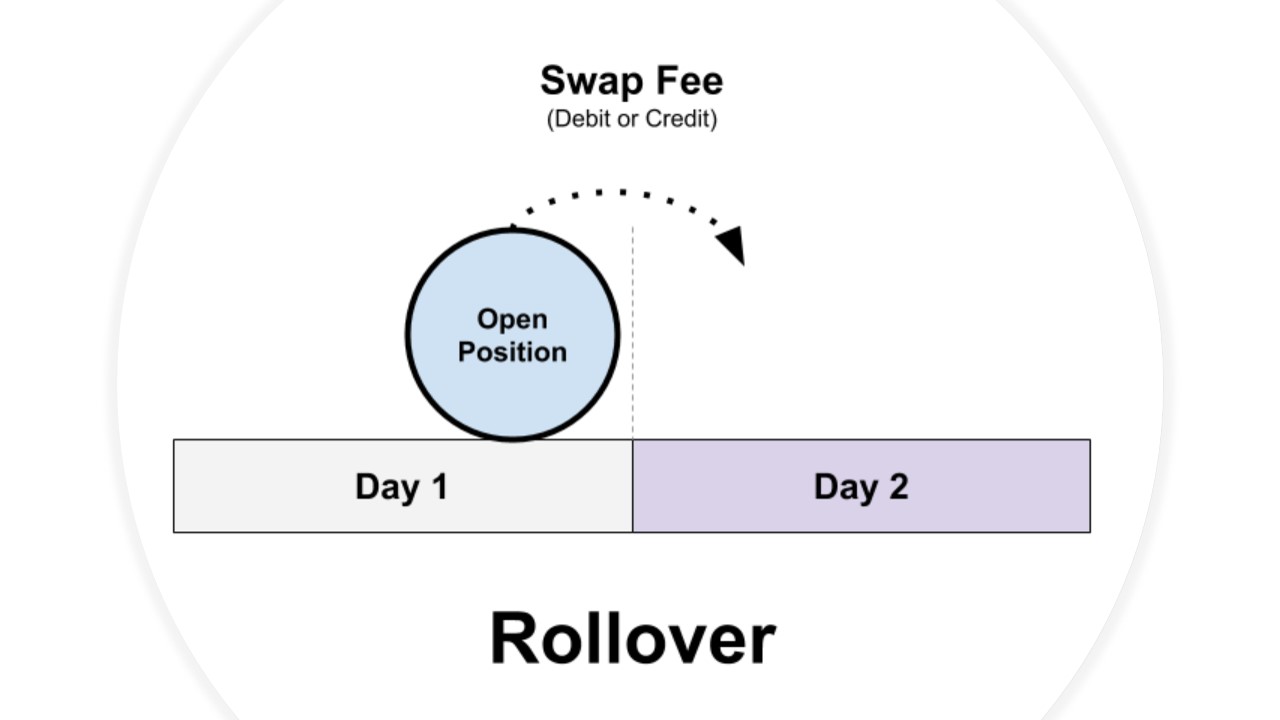

The third fee you'll likely encounter is the overnight financing fee, also known as the swap fee. This applies if you leave a position open overnight. Brokers charge a fee for borrowing money to keep that position open, and this can either be a debit or a credit, depending on the interest rate differential between the two currencies involved. If you're holding positions for several days or longer, these fees can add up, so it’s essential to be aware of them when deciding whether to keep your positions open overnight.

How Forex Brokers Charge Fees

How Forex Brokers Charge Fees

When choosing a broker, it's essential to understand how they charge these fees. There are two main types of fee structures: commission-based brokers and spread-based brokers. Commission-based brokers tend to charge a fixed commission on each trade, but they usually offer tighter spreads. This model is often more suited for traders who execute a high number of trades. For those looking for simplicity, spread-based brokers might be more appealing since they typically charge a wider spread but don't have a commission fee. While this can be more straightforward, if you trade frequently, the wider spread can still end up being more expensive.

However, always be cautious of "zero spread" accounts, as they often come with higher commissions or hidden fees that can eat into your profits. The best broker for you depends largely on your trading style. For example, if you're a scalper or day trader, a broker with tight spreads and low commissions is probably your best bet. On the other hand, if you're a swing trader or long-term investor, a spread-based broker might work out more cost-effectively in the long run since you won't be paying a commission every time you trade.

Factors That Influence Forex Trading Fees

A variety of factors also influence the fees you pay when trading forex. For instance, account type plays a role. Many brokers offer tiered account structures where higher-tier accounts come with lower spreads or reduced commissions. These accounts, however, often require a higher deposit, making them better suited for experienced traders or those willing to invest more upfront.

Leverage is another factor to consider. When you use leverage, you're borrowing money to increase the size of your trade, which can magnify both profits and fees. Leverage tends to increase overnight financing fees, so it's crucial to keep this in mind when calculating your costs. Additionally, trading volume can impact the fees you're charged. Many brokers offer lower fees for higher trading volumes, which is a benefit for active traders.

The currency pair you trade can also affect your fees. Major currency pairs like EUR/USD or GBP/USD tend to have lower spreads due to their liquidity, while exotic currency pairs often have wider spreads, meaning you'll pay more to enter and exit a trade.

How to Minimise Forex Trading Fees

To minimise the impact of trading fees, it's important to be strategic. One of the most effective ways to reduce costs is by choosing the right broker. Compare the total cost of trading across brokers, factoring in spreads, commissions, and overnight fees. If you're a day trader, keep an eye on the number of trades you execute — the more trades you make, the higher your overall costs. Focus on fewer, more calculated trades rather than trying to profit from every minor price movement.

If you're holding positions overnight, try to limit this as much as possible to avoid incurring unnecessary swap fees. When you do hold positions overnight, it's a good idea to pay attention to the interest rate differentials between currencies, as this can help reduce swap costs. Active traders should also look for brokers that reward high-volume trading with lower fees or discounts.

In conclusion, understanding and managing forex trading fees is crucial for maintaining profitability. By carefully selecting your broker, being mindful of the fees associated with your trades, and using strategies to reduce your costs, you'll be better equipped to navigate the forex market effectively. It's all about making informed choices that fit your trading style and goals.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

How Forex Brokers Charge Fees

How Forex Brokers Charge Fees