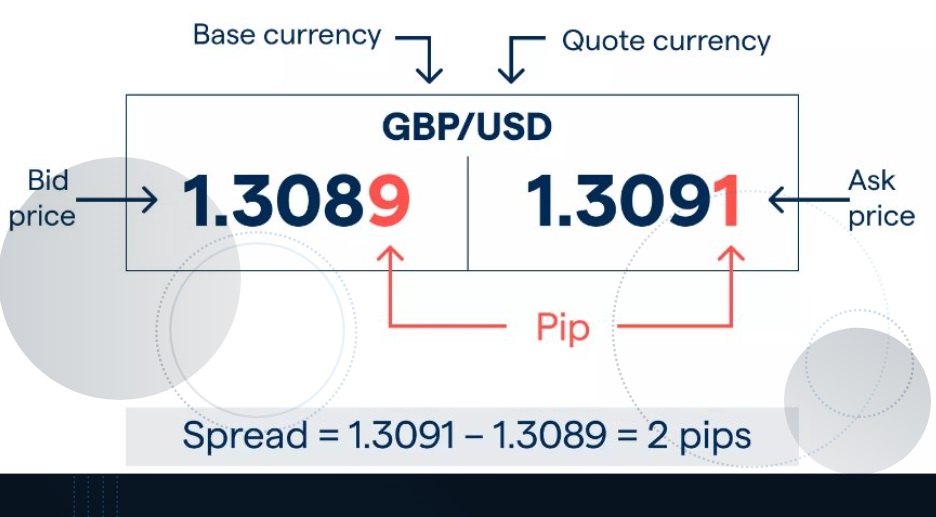

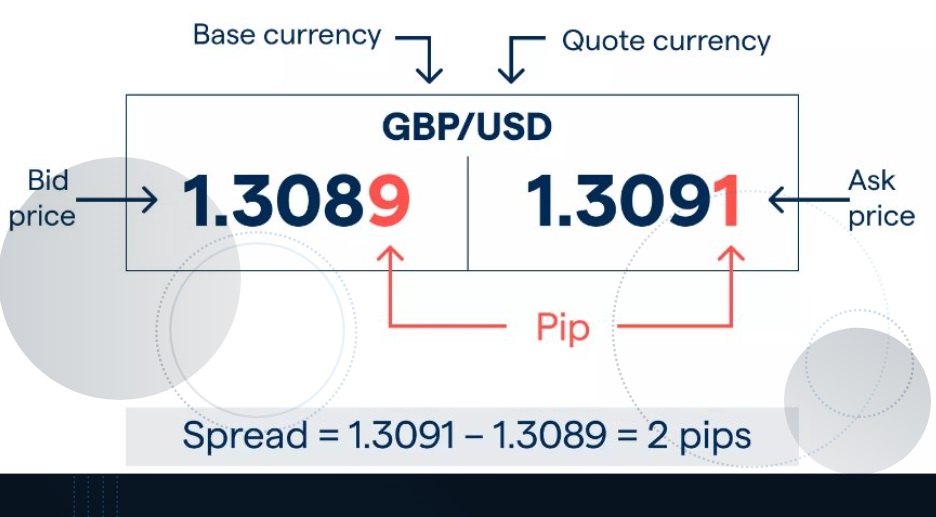

If you're new to Forex trading, you might be wondering, what exactly is a "spread"? At its core, the Forex spread is the difference between the bid price and the ask price of a currency pair in the foreign exchange markets. In simpler terms, it's the cost built into the buy and sell price of every trade. For example, if you're looking to buy the EUR/USD pair, the broker might offer a bid price of 1.3089 and an ask price of 1.3091. The difference between the 2 pips is the spread.

Spreads are one of the most important costs in Forex trading, and they play a crucial role in determining your overall trading costs and potential profits. Understanding how spreads work is vital because they affect how much you pay to enter and exit a trade. The smaller the spread, the cheaper it is to trade, which can be especially important when you're looking to make small profits from frequent trades.

Types of Forex Spreads

When it comes to Forex spreads, there are two main types you need to be aware of: fixed spreads and variable spreads. Both have their pros and cons, and choosing between them largely depends on your trading style and the type of broker you're using.

Fixed Spreads: As the name suggests, fixed spreads remain the same regardless of market conditions. They don't change, whether the market is calm or volatile. Fixed spreads are typically offered by brokers who operate on a market maker or "dealing desk" model. These brokers set their own prices and provide liquidity to traders, which is why the spread remains constant. One advantage of fixed spreads is that they can make trading more predictable, as you always know the cost of entering and exiting a trade. For beginners or traders with lower capital, fixed spreads can be an attractive choice since they usually come with smaller capital requirements.

Variable Spreads: These spreads change depending on market conditions, often widening in volatile markets and narrowing when conditions are more stable. They are offered by brokers that follow a non-dealing desk model, sourcing their prices from multiple liquidity providers. The primary advantage of variable spreads is that they typically offer more competitive and transparent pricing, especially during times of low market volatility. However, they can also lead to higher costs if the market becomes volatile or if liquidity decreases.

The type of Forex spread you choose can impact your trading strategy, as variable spreads can offer more transparency and potentially lower costs during times of low volatility, while fixed spreads might be more consistent.

Calculating and Measuring Forex Spreads

Now that you know what spreads are and the different types, let's break down how to measure them. Calculating a Forex spread is relatively simple. To find the spread, subtract the bid price from the ask price of the currency pair.

For example, if the bid price for EUR/USD is 1.1010 and the ask price is 1.1012. the spread would be 2 pips.

In Forex trading, a pip is the smallest unit of price movement for a currency pair. For most currency pairs, one pip is equal to 0.0001. So, when you hear traders talking about a "3-pip spread," it means the difference between the bid and ask price is 3 pips. To calculate the actual cost of the spread in forex trading, you also need to consider how much you’re trading. This is where lot size comes in.

For instance, if you're trading one standard lot (100.000 units of currency), a 3-pip spread in EUR/USD would cost you $30. assuming the pip value is $10 for a standard lot. If you're trading smaller positions, like mini or micro lots, the cost of the spread will be lower, but so will your potential profit.

Knowing how to calculate the spread helps you understand the cost of each trade and the potential impact on your profit margins. Remember, the tighter the spread, the less you'll pay to enter and exit a position, which can be crucial in competitive trading environments.

How Forex Spreads Impact Your Trading

The Forex spread directly affects the profitability of your trades. Since you are effectively buying at the ask price and selling at the bid price, you are immediately at a disadvantage as soon as you enter a trade. This means you need the price to move beyond the spread to begin making a profit.

For example, if you open a position in EUR/USD with a 3-pip spread, the price must move at least 3 pips in your favour before you start to see profits. If the price moves the other way, you'll be in a loss by the size of the spread. Therefore, it's crucial to factor in the spread when determining your entry and exit points and to consider this cost in your overall strategy.

Additionally, the size of the spread can impact your decision-making, especially when trading short-term strategies like scalping. A tight spread is more favourable for scalpers, as they rely on small price movements to generate profits. On the other hand, traders who hold longer-term positions may find wider spreads more manageable since the price movement needed to reach a profit will typically exceed the cost of the spread.

Managing Forex Spreads for Better Trading

Successfully managing Forex spreads is crucial for improving your trading performance. Here are a few strategies to help you reduce the impact of spreads on your trades:

Choose a Broker with Competitive Spreads: One of the most effective ways to minimise the cost of Forex spreads is by selecting a broker that offers tight, competitive spreads. Research brokers that provide variable spreads for popular pairs like EUR/USD, as these tend to be narrower compared to other pairs.

Trade during High Liquidity Hours: Forex spreads tend to be narrower during times of high market liquidity, such as when major financial markets (like London or New York) are open. Trading during these times can help you benefit from lower spreads, reducing your transaction costs.

Consider the Currency Pair: The Forex spread for different currency pairs can vary significantly. Major pairs like EUR/USD, GBP/USD, and USD/JPY tend to have the smallest spreads, while exotic pairs or less liquid currencies may have much wider spreads. If you are looking to minimise trading costs, focus on the most liquid pairs.

Use Limit Orders: Rather than entering the market immediately at the market price (which includes the spread), you can use limit orders to specify the price at which you want to buy or sell. This strategy allows you to avoid paying the spread if the market moves in your favour before your order is filled.

Incorporate Spreads into Your Risk Management: Be sure to factor in the Forex spread as part of your overall risk management strategy. Set stop-loss and take-profit levels that take into account the spread, especially if you're trading small time frames or high-volatility pairs.

In conclusion, understanding and managing Forex spreads is crucial to achieving profitability in forex trading. Whether you're just starting out or have years of experience, knowing how they work and how to incorporate them into your strategy can make all the difference.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.