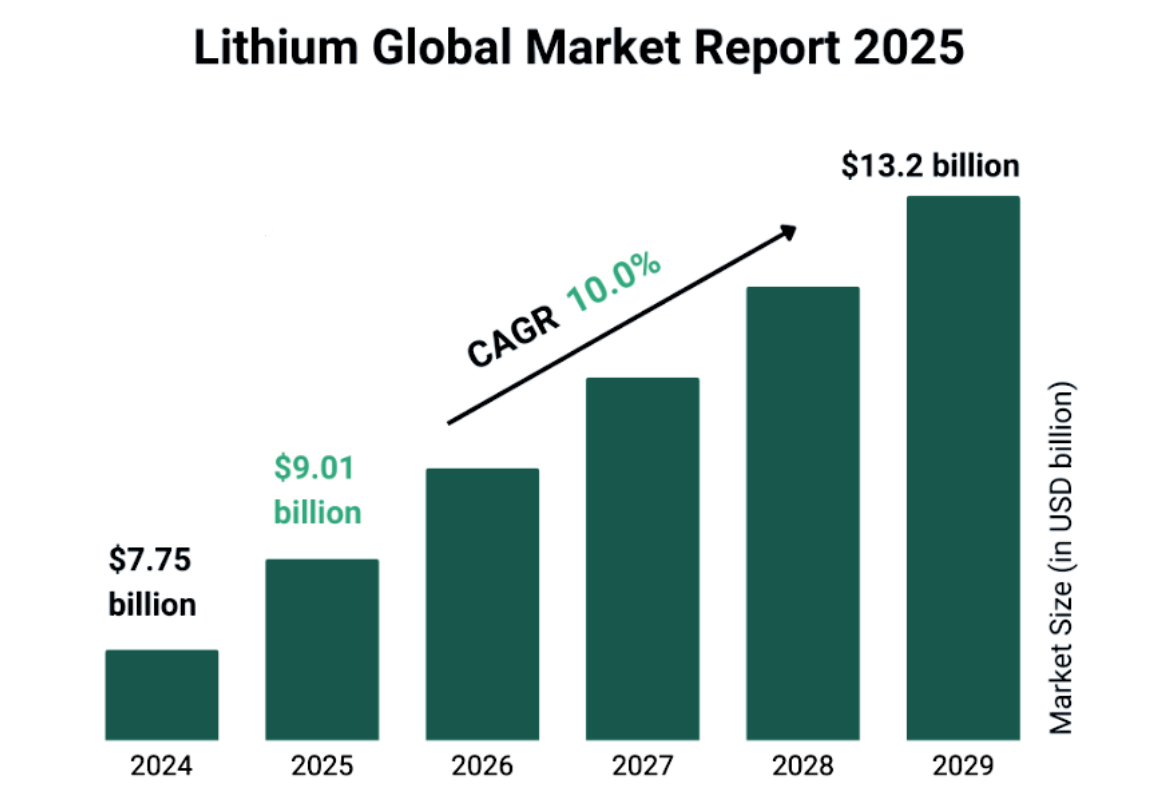

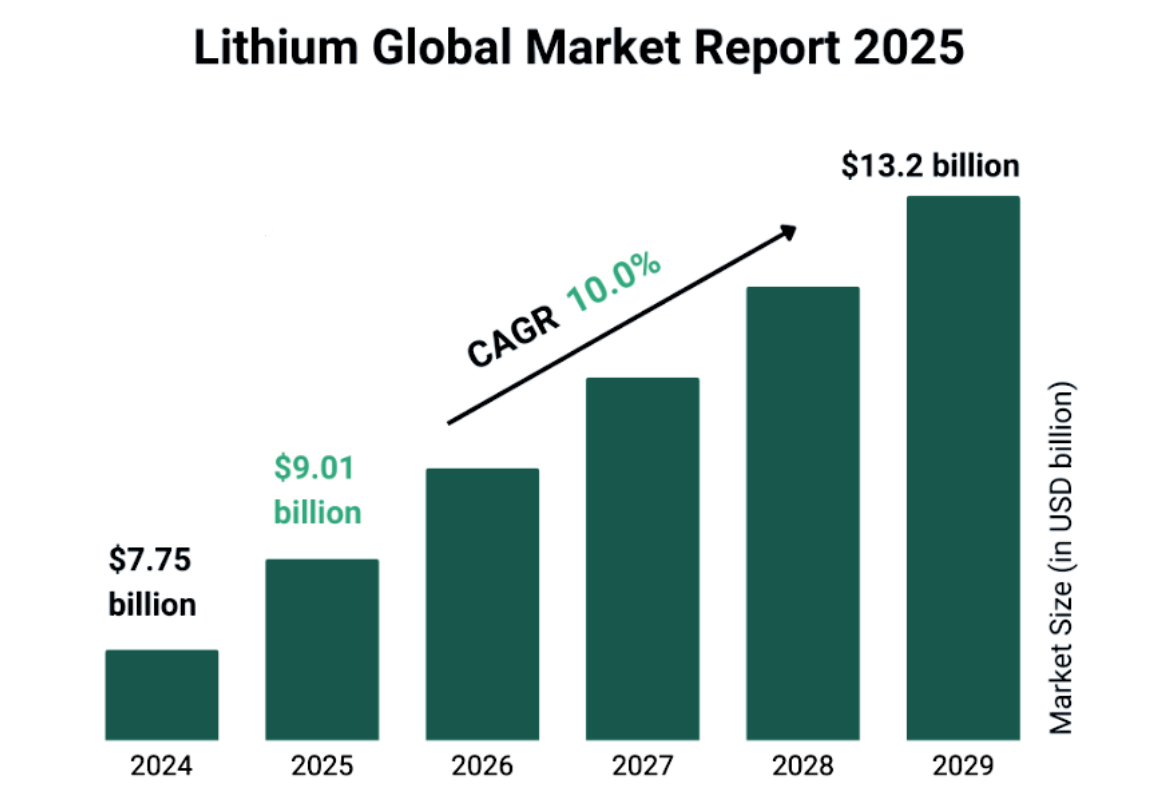

In recent years, the lithium stock market has been buzzing with activity, largely driven by the growing demand for electric vehicles (EVs) and clean energy. As the world shifts towards greener technologies, lithium has become a crucial element in the production of EV batteries, creating exciting investment opportunities. But which companies are leading the charge, and how have their stocks been performing? Let's take a look at the major players in the lithium market, the factors driving their growth, and what investors need to consider.

Leading Companies in the Lithium Market

Leading Companies in the Lithium Market

Several companies have emerged as key players in the lithium sector, benefiting from the growing demand for the metal. Among the leaders, Albemarle Corporation, SQM (Sociedad Química y Minera de Chile), and Livent Corporation are some of the most notable.

Albemarle Corporation: One of the largest producers of lithium globally, Albemarle has seen a significant surge in stock prices over the past few years. Their involvement in lithium extraction and production, combined with their focus on expanding capacity to meet growing demand for EV batteries, has placed them in a prime position. Their stock price has risen substantially, reflecting optimism about their future growth as the electric vehicle market expands.

SQM: A major player in the lithium mining space, SQM operates primarily in Chile, where they control some of the world's richest lithium deposits. Their stock has also surged, partly due to the increasing demand for lithium, especially from EV manufacturers. As electric vehicle production ramps up, SQM's strong position in the market has made it a popular pick for investors looking to capitalise on the green energy transition.

Livent Corporation: Specialising in lithium hydroxide, a critical component of EV batteries, Livent has seen its stock price rise in line with the growing demand for EVs. The company's focus on innovation and sustainable mining practices has helped it secure a solid foothold in the market, attracting both long-term investors and those looking to ride the wave of EV growth.

The Impact of Electric Vehicle Battery Demand on Lithium Stocks

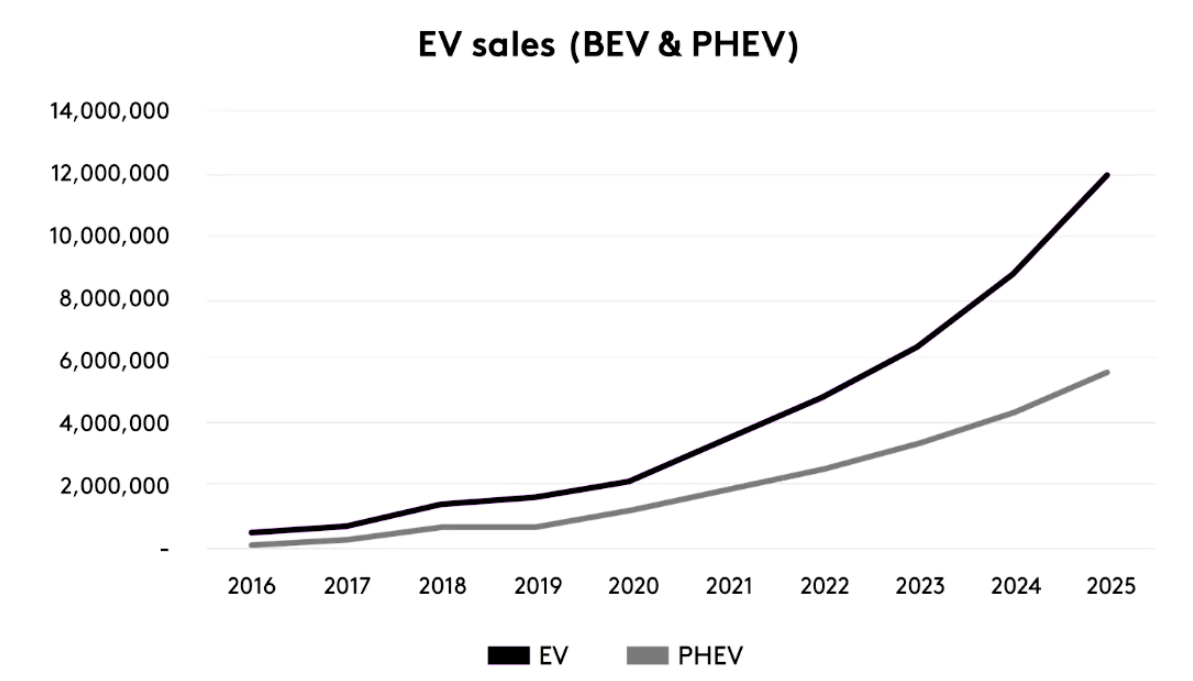

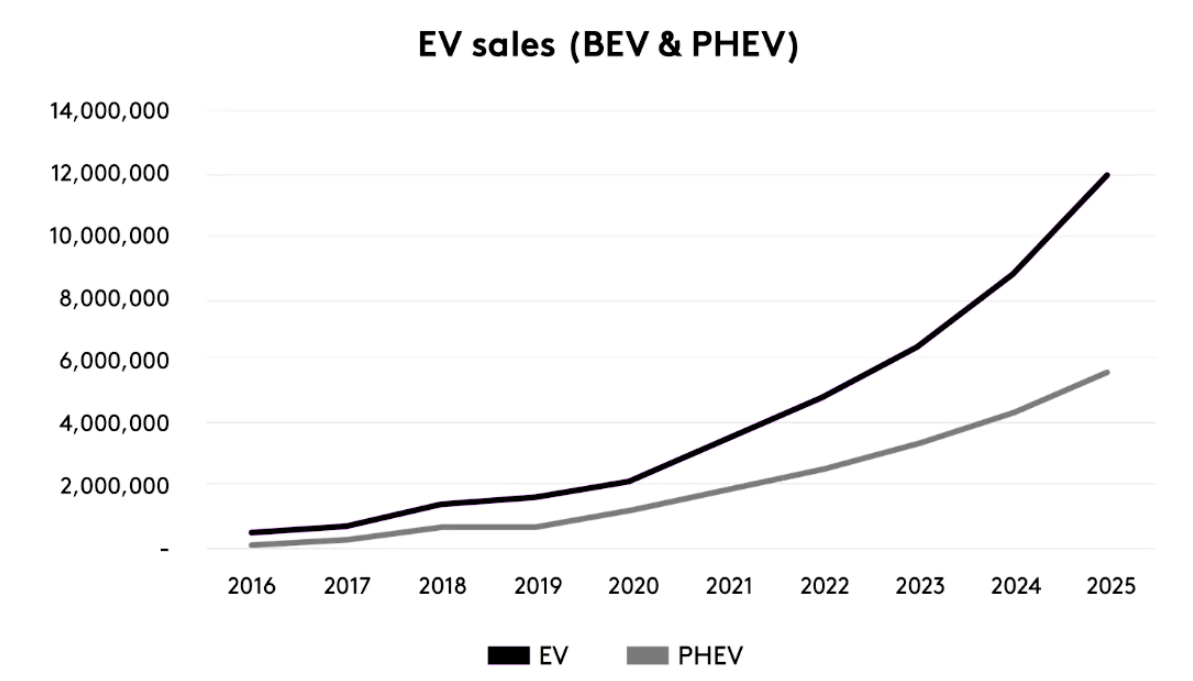

The increasing demand for electric vehicles has been a significant driver for the entire lithium market. Lithium-ion batteries, which are used in everything from smartphones to electric vehicles, are at the heart of this technological shift. As automakers like Tesla, BYD, and General Motors ramp up production of electric vehicles, the need for lithium has surged.

For example, Tesla's growth has played a major role in pushing up lithium stocks. The company's aggressive push to expand EV production and its commitment to sustainability has contributed to the skyrocketing demand for lithium batteries, making lithium stocks more attractive. This demand has been reflected in the stock prices of lithium producers like Albemarle and SQM, which have seen impressive gains as a result.

Lithium stocks, in particular, have been on an upward trajectory in 2023 and 2024. as electric vehicle sales worldwide hit record highs. Investors have been quick to recognise that the demand for lithium won't subside anytime soon, given the ambitious global electric vehicle production targets set by both private companies and governments. As a result, companies that control large lithium reserves and have established operations in key locations have enjoyed significant stock price growth.

Trends Shaping the Lithium Industry

Trends Shaping the Lithium Industry

As the lithium market continues to evolve, a few key trends are shaping its future:

Expansion of Lithium Mining Operations: Companies are aggressively investing in new lithium mining projects. With the growing demand, existing lithium producers are increasing production capacity to meet market needs. This trend is likely to continue, boosting stock prices for major lithium companies.

Lithium Recycling: As the push for sustainability grows, lithium recycling is gaining traction. Some companies are exploring ways to recycle lithium from old batteries to meet demand while reducing the environmental impact of mining. If successful, lithium recycling could lower costs and mitigate risks associated with over-mining, potentially stabilising the market.

Geopolitical Factors: Countries rich in lithium reserves, such as Chile, Argentina, and Australia, are becoming critical to global supply chains. Geopolitical tensions in these regions could affect lithium production and, consequently, stock prices. For example, political instability or trade disputes could disrupt supply, leading to price volatility in lithium stocks.

How to Invest in Lithium Stocks

For those looking to invest in lithium stocks, there are a few strategies to consider:

Long-term Investment: Given the expected growth in the lithium market, many investors are taking a long-term approach. Companies with strong fundamentals, such as Albemarle, SQM, and Livent, are well-positioned to benefit from the ongoing growth in the electric vehicle sector. Holding onto stocks of these companies for the long term could yield significant returns as demand for lithium continues to rise.

Short-term Opportunities: The volatility of the lithium market also presents opportunities for short-term traders. The price of lithium and lithium stocks can fluctuate based on geopolitical events, changes in supply and demand, and technological advancements. Traders who can spot trends early might profit from price movements in the short run.

Diversification: Diversifying within the lithium market can also be a smart strategy. By investing in a range of companies that cover different parts of the lithium supply chain—such as miners, refiners, and battery manufacturers—investors can spread their risk. This reduces the impact of fluctuations in one segment of the market on the overall investment portfolio.

Risks to Consider

Like any investment, there are risks involved in lithium stocks. Investors should be aware of the following potential challenges:

Oversupply Risk: As more companies rush to capitalise on the lithium boom, there's a possibility that the market could become oversaturated. This could lead to a decrease in lithium prices, particularly if new mining projects come online faster than demand can absorb them.

Technological Shifts: Lithium is currently the metal of choice for EV batteries, but future breakthroughs in battery technology could reduce the demand for lithium. If alternative technologies gain traction, such as solid-state batteries or sodium-ion batteries, lithium producers could face a decline in demand.

Environmental Concerns: Lithium mining can have significant environmental impacts, especially in areas facing water scarcity. For investors focused on sustainability, it's important to consider the environmental practices of lithium companies. Companies with strong environmental, social, and governance (ESG) practices are likely to attract more attention from responsible investors.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Leading Companies in the Lithium Market

Leading Companies in the Lithium Market Trends Shaping the Lithium Industry

Trends Shaping the Lithium Industry