Nuclear energy is a topic that has seen a resurgence in interest recently, as the world looks for cleaner and more sustainable energy alternatives. While the technology itself has been around for decades, there's been a growing realisation that nuclear power can play a crucial role in the energy mix of the future, especially as concerns over climate change and the transition to renewable energy sources intensify. For those looking to tap into this sector, investing in nuclear energy stocks might seem like an exciting opportunity. But how exactly does the market for these stocks work, and what should potential investors know?

Understanding the Nuclear Energy Market

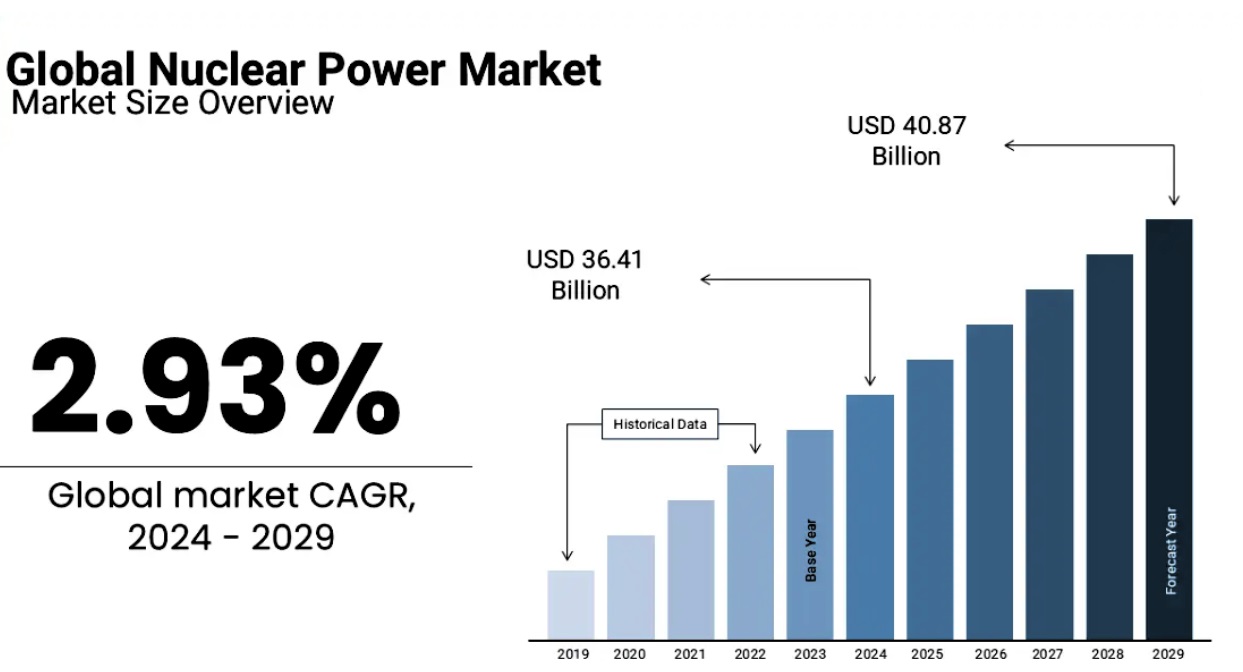

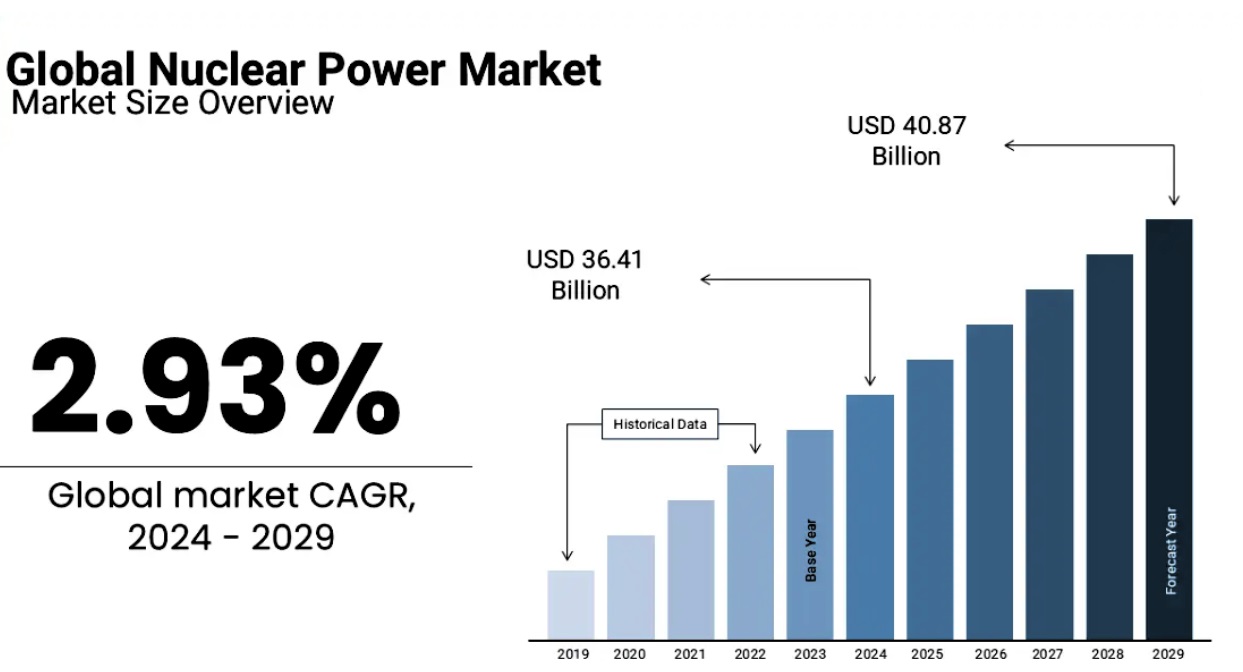

The nuclear energy market, like any sector, is influenced by a variety of factors, from technological advancements to government policy. On the surface, nuclear energy may seem like a niche industry, but it plays a much larger role in the global energy landscape than many realise. Today, nuclear power is responsible for around 10% of the world's electricity, with the majority of that coming from established nuclear plants across countries like the United States, France, and Russia. The market's future, however, looks to be even brighter.

Governments around the world have recognised the need to reduce their carbon footprints, and nuclear energy is often viewed as a reliable, low-emission energy source that can help achieve this. Several countries have also committed to expanding their nuclear fleets, while others are exploring the next generation of nuclear reactors, such as small modular reactors (SMRs), which are safer and more cost-effective. This shift is creating a strong sense of optimism within the industry, and it's no surprise that investors are starting to take note of this potential for growth.

Governments around the world have recognised the need to reduce their carbon footprints, and nuclear energy is often viewed as a reliable, low-emission energy source that can help achieve this. Several countries have also committed to expanding their nuclear fleets, while others are exploring the next generation of nuclear reactors, such as small modular reactors (SMRs), which are safer and more cost-effective. This shift is creating a strong sense of optimism within the industry, and it's no surprise that investors are starting to take note of this potential for growth.

Key Players in the Nuclear Energy Stock Arena

When it comes to nuclear energy stocks, there are a few key players that investors may want to keep an eye on. The sector spans various areas, from utility companies that operate nuclear plants to manufacturers of nuclear equipment and technology. A few names stand out as major contributors to the nuclear energy landscape.

One notable company is Constellation Energy, a leading supplier of nuclear power in the US. The company owns and operates a large portfolio of nuclear plants, and its stock has benefitted from the growing interest in cleaner energy solutions.

Another major player is Exelon, which operates nuclear plants across the United States and has been at the forefront of renewable energy integration, including solar and wind, alongside its nuclear operations. NextEra Energy is another important company that has invested heavily in both nuclear and renewable energy sources, positioning itself as a leader in the transition to a more sustainable energy future.

Another major player is Exelon, which operates nuclear plants across the United States and has been at the forefront of renewable energy integration, including solar and wind, alongside its nuclear operations. NextEra Energy is another important company that has invested heavily in both nuclear and renewable energy sources, positioning itself as a leader in the transition to a more sustainable energy future.

Then, there are companies like BWX Technologies, which provides nuclear components and services, as well as Fluor Corporation, which is involved in nuclear plant construction and maintenance. These companies may not be as well known to the average investor, but they play a crucial role in the nuclear supply chain. By diversifying their investments across these different players, investors can gain exposure to the growth of the nuclear energy sector from multiple angles.

Investment Strategies for Nuclear Energy Stocks

When it comes to investing in nuclear energy stocks, there's no one-size-fits-all approach. As with any sector, it's important to do your research and consider the different strategies available. One approach is to invest in large utility companies like Constellation Energy or Exelon, which offer stable growth and dividends. These stocks tend to be more conservative investments, providing steady returns over time as the companies operate their nuclear plants and generate power. For those who prefer a lower-risk investment, these companies could be a good starting point.

Alternatively, there's the option of investing in smaller, more specialised companies that operate within the nuclear supply chain. Companies like BWX Technologies or Fluor may offer higher growth potential, but they come with a greater degree of risk. These stocks may be more volatile, as they're less insulated from broader market fluctuations, but they could benefit from increased demand for nuclear power and the development of new technologies like SMRs.

Another strategy is to invest in exchange-traded funds (ETFs) that focus on nuclear energy or clean energy. ETFs provide investors with diversified exposure to multiple companies within the sector, spreading the risk while still capturing potential gains. Several ETFs specifically target nuclear energy, and they offer an easy way for investors to dip their toes into the market without committing to individual stocks.

Whatever strategy an investor chooses, it's crucial to consider the potential risks and rewards. The nuclear energy market is still developing, and while there's strong growth potential, the industry is also susceptible to regulatory changes, public opinion, and safety concerns. Nuclear accidents or mishaps, like the infamous Fukushima disaster, can have a long-lasting impact on the market. That said, the nuclear sector is becoming safer and more advanced, and many experts believe it can be an important part of the clean energy future.

The Role of Government Policy and Regulations

It's also important to understand that government policy and regulations play a massive role in the nuclear energy market. The industry is highly regulated, and changes in government policy can have a direct impact on nuclear energy stocks. For example, countries that continue to invest in nuclear infrastructure are likely to see a boost in their nuclear power stocks, while those that plan to phase out nuclear energy may experience a slowdown.

On the flip side, favourable government policies that support the development of new nuclear technologies, like SMRs, can help drive growth in the sector. Governments around the world are looking for ways to meet their carbon reduction targets, and nuclear energy could be key in achieving those goals. This is why some investors see nuclear stocks as not just a financial opportunity, but also a way to support the transition to a more sustainable energy future.

The Growth Potential of Nuclear Energy Stocks

The future of nuclear energy stocks looks promising, especially as the world focuses more on reducing carbon emissions and investing in clean energy solutions. While nuclear energy still faces challenges, such as safety concerns and high initial costs, technological advancements and government support are creating a favourable environment for growth. Companies involved in nuclear power generation, technology, and supply chains are poised to benefit as demand for nuclear energy increases, particularly in regions where countries are expanding their nuclear fleets or exploring new types of reactors.

As an investor, understanding the trends driving the nuclear energy sector and keeping an eye on the key players can help you make informed decisions about where to allocate your money. Whether you choose to invest in established utility companies or smaller, specialised firms, the growth potential of the nuclear energy market is certainly worth considering.

In summary, nuclear energy stocks are an interesting option for investors looking to capitalise on the shift towards cleaner energy. By understanding the market dynamics, key players, and investment strategies, you can make a more informed decision about whether this sector is right for you. As the world continues to evolve and the need for sustainable energy grows, nuclear power could very well be one of the keys to a greener, more sustainable future – and investing in nuclear energy stocks could be your way of tapping into that potential.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Governments around the world have recognised the need to reduce their carbon footprints, and nuclear energy is often viewed as a reliable, low-emission energy source that can help achieve this. Several countries have also committed to expanding their nuclear fleets, while others are exploring the next generation of nuclear reactors, such as small modular reactors (SMRs), which are safer and more cost-effective. This shift is creating a strong sense of optimism within the industry, and it's no surprise that investors are starting to take note of this potential for growth.

Governments around the world have recognised the need to reduce their carbon footprints, and nuclear energy is often viewed as a reliable, low-emission energy source that can help achieve this. Several countries have also committed to expanding their nuclear fleets, while others are exploring the next generation of nuclear reactors, such as small modular reactors (SMRs), which are safer and more cost-effective. This shift is creating a strong sense of optimism within the industry, and it's no surprise that investors are starting to take note of this potential for growth. Another major player is Exelon, which operates nuclear plants across the United States and has been at the forefront of renewable energy integration, including solar and wind, alongside its nuclear operations. NextEra Energy is another important company that has invested heavily in both nuclear and renewable energy sources, positioning itself as a leader in the transition to a more sustainable energy future.

Another major player is Exelon, which operates nuclear plants across the United States and has been at the forefront of renewable energy integration, including solar and wind, alongside its nuclear operations. NextEra Energy is another important company that has invested heavily in both nuclear and renewable energy sources, positioning itself as a leader in the transition to a more sustainable energy future.