Global macro is a unique hedge fund investment strategy that leverages changes in macroeconomic and geopolitical variables across several countries.

Global macroeconomics is a top-down investment approach that focuses on the macroeconomic aspects of the global economy. This analysis delves into a smaller part of the global economy and examines the interrelationships between regions and countries. The origin of the global macro investment style can be traced back to the economist John Maynard KeynesMaynard Keynes formulated macroeconomic principles a century ago.

Global macro analysis focuses on representing central banks'Basic data points such as GDP, inflation, and interest rate policies. However, it also focuses on the political landscape and potential changes of these economies to predict their impact on the overall global macroeconomic environment. Global macro trading also has several other advantages, such as helping investors identify long-term trends and market opportunities in asset classes.

One of the most interesting parts of global macro strategies is its high attention to systemic risk, which is a factor that may affect other trading strategies in some form.

Let's take a look at the evolution of hedge fund global macro strategy and the events that have contributed to it.

1969: Establishment of Commodity Company

One of the earliest companies to adopt a global macro investment approach was Commodities Corporation. Commodities Corporation by HelmutWeymar and Amos Hostetter Sr were founded in 1969 with a capital of $2.5 million to leverage global macro trading opportunities in physical goods.

However, it later expanded to other trading varieties, such as currency.

The company gained widespread attention after successfully shorting the market in 1980. Commodities Corporation and Paine Webber Jackson&Curtis collaborated to launch a $23 million Princeton Futures Fund for American investors in 1981.

In 1997, the commodity company was acquired by Goldman Sachs for over $100 million. At the time of acquisition, the company managed nearly $1.8 billion in assets.

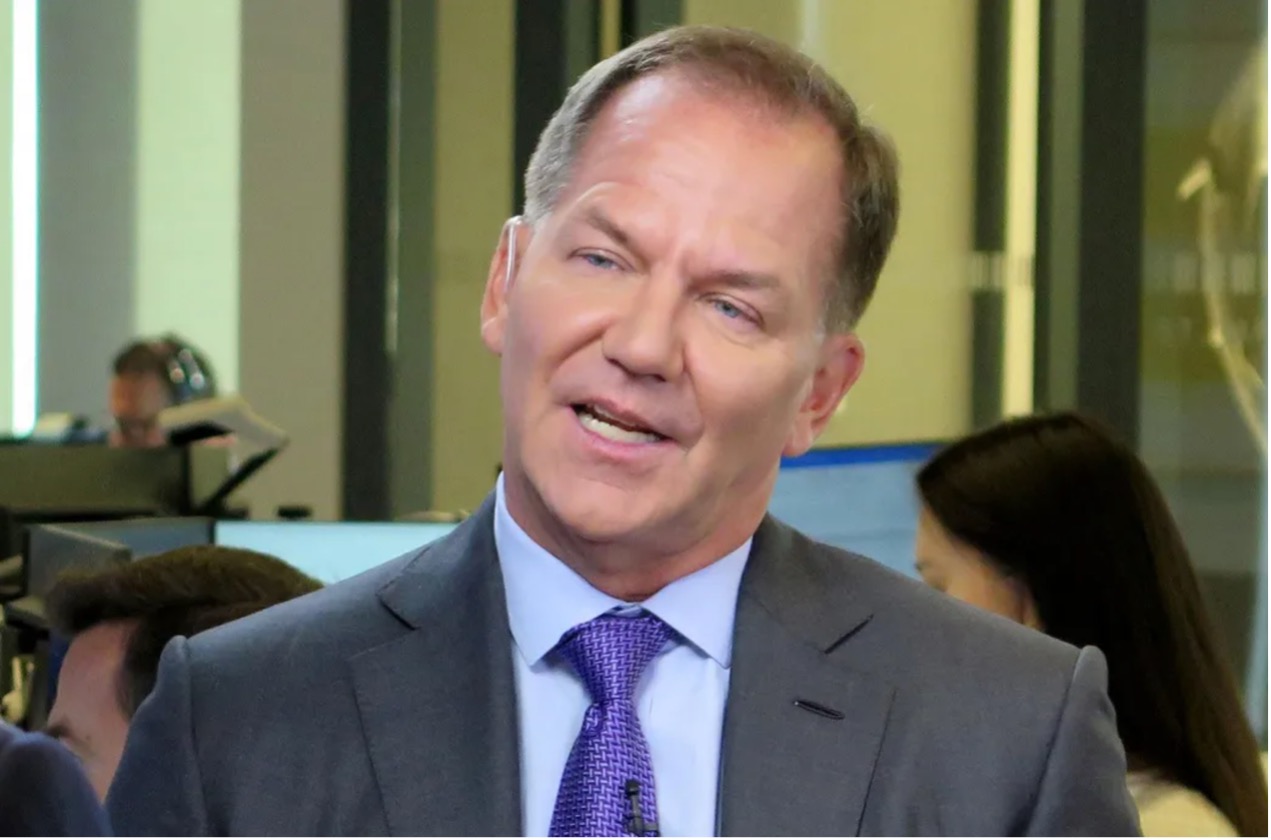

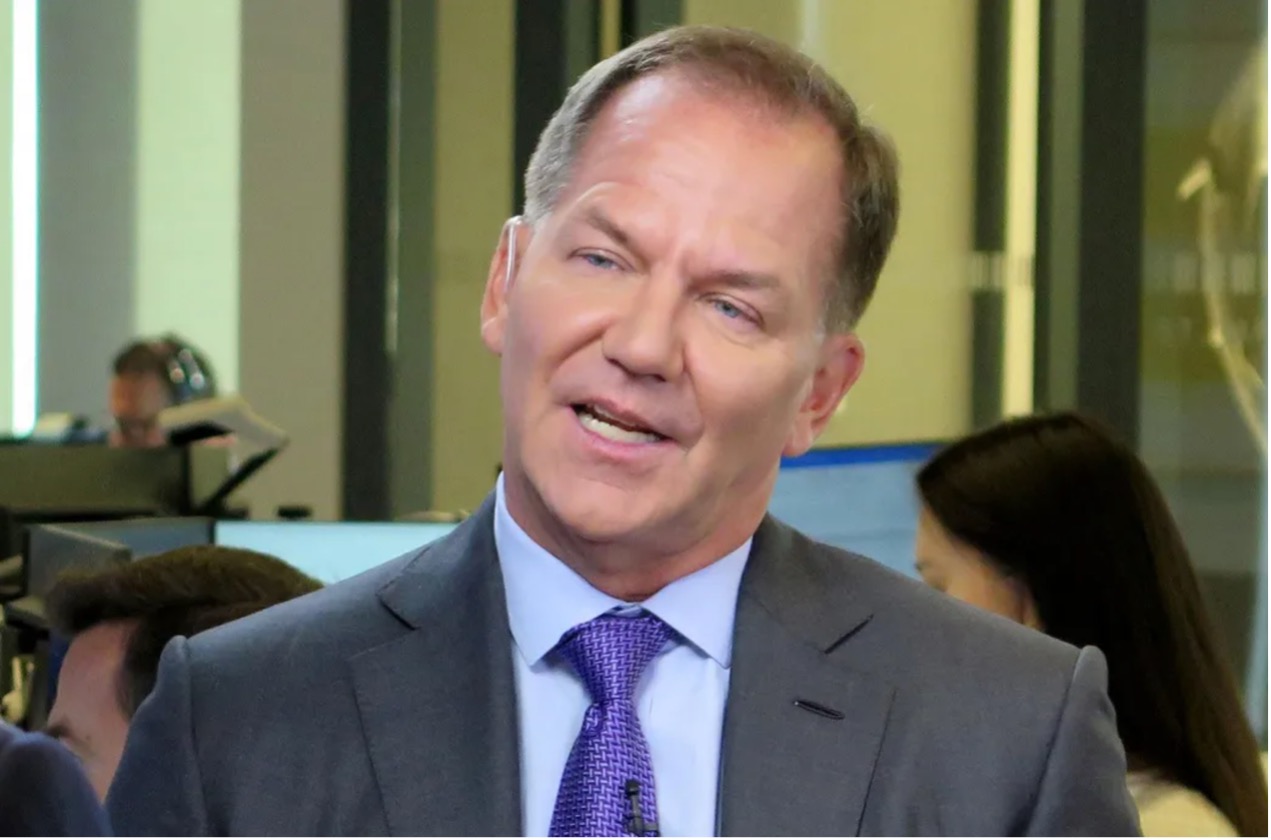

1987: Paul Tudor Becomes Rich Through Global Macro Strategy

Macro hedge fund manager Paul Tudor Jones predicted the stock market crash of 1987 and made a fortune from it. Jones 1976In 1980, he engaged in commodity trading at a cotton plantation and later ventured into global macro trading, establishing his hedge fund Tudor Investment Corp.

Although the market seemed very active in 1987, Tudor Jones began to notice that these stocks were severely overvalued. Tudor and his colleague Peter Borish spent a long time researching 1929A chart of the Wall Street crash in, analyzing historical market data, and comparing the market situation in 1987 with the situation in 1929 before the crash.

Two weeks before the market crash in October 1987, Tudor Investment Group conducted aggressive trading in the market, as others on Wall Street still did not notice. The Dow Jones Index plummeted in a single day22%, while Tudor Jones made a profit of $100 million.

1990-2000: Global Macro Volatility

In the 1990s, a few well-known fund managers dominated global macro strategies. These fund managers made leveraged directional bets, resulting in high volatility in returns. Since 2000Since the beginning of the year, investors have demanded institutionalization of hedge fund managers. Therefore, the assets flowing into these global macro funds have adopted stricter frameworks and risk management. This has led to a downturn in the global macro sector but stable returns.

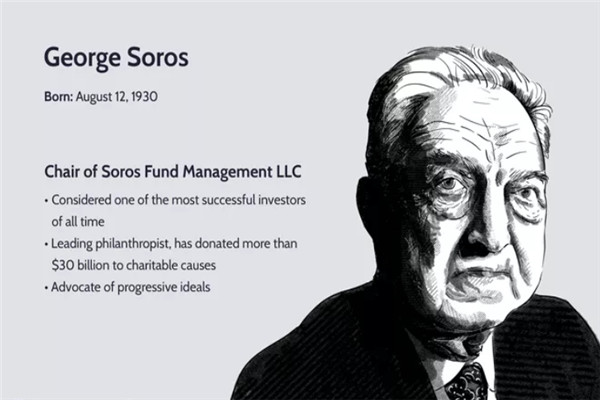

1992: George Soros short selling pounds

In September, George Soros adopted a macro hedging strategy and made a daily profit of 10% by shorting the poundUSD100mn The UK is part of the European Exchange Rate Mechanism (ERM), and other countries have forced it to depreciate the pound. After a series of resistance, England finally achieved currency fluctuations and the pound depreciated.

Soros used leverage to short the pound by $10 billion, earning a profit of $1 billion. This transaction is considered one of the greatest in the history of hedge funds, and Soros is widely referred to as the "person who defeated the Bank of England". According to LCHAccording to Investments, Soros Fund Management has generated over $43 billion in profits.

1994: Astor Asset Management Company was established

Robert Stein founded Astor Asset Management, the parent company of Astor Asset Management, based on the premise that macro investment is crucial for determining the direction of risky asset pricesFinancial. The fund mainly utilizes global macro strategies for approximately 20 years. Some of these strategies include multi asset and departmental rotation. The company provides revenue and pure alternative macro products.

1997: Global Economic Policy Uncertainty Index (GEPU)

The Global Economic Policy Uncertainty (GEPU) index was launched in 1997. This index is the GDP of the national EPU index for 21 countriesWeighted average: Australia, Brazil, Canada, Chile, China, Colombia, France, Germany, Greece, India, ireland, Italy, Japan, Mexico, Netherlands, Russia, South Korea, Spain, Sweden, United Kingdom, and United States.

EPU refers to the impact of government decision-makers on fiscal, regulatory, or monetary policy uncertainty.

2002: Establishment of Breven Howard Asset Management Company

Brevan Howard Asset Management was once considered the world's largest macro hedge fund. The fund was funded by Alan Howard and four others in 2002Established in, managed over $10 billion in investor assets as of September 30, 2020.

The company's overall strategy focuses on 'near term opportunities' and establishes an investment position of one to six months. As a macro hedge fund, the company's goal is to profit from "broad economic trends" when trading various assets such as commodities and currencies.

Credit Suisse Private Bank entrusted Brevan Howard with $2 billion to manage global macro funds. The company's return rate in 2007 was 25%, and its global macro fund's return wasDuring the 2008 financial crisis, it continued to perform well.

In the subprime crisis in 2007-2008, the credit foam led to long-term high volatility and insufficient liquidity. Therefore, many macro funds around the world are facing liquidity issues.

2010: Opalesque Roundtable

At the 2010 Opalesque Roundtable in New York, fund managers discussed global macro, its increasing importance, and the transition of investors towards global macro strategies.

Hedge fund manager John Burbank highly praises the global macro and defines it as' something that has a reason to be long or short compared to a fundamental stock perspective '. On the other hand, DoubleLine CapitalDescribing macro as a strategy of 'going anywhere, doing anything' means that global macro strategies have a high degree of flexibility and provide traders, analysts, or investors with multiple choices.

However, some hedge fund managers also believe that keeping up with the global macroeconomic situation may be troublesome as economic events occur within a day, and tracking them may be problematic.

2014: 2 Sigma raised $3.3 billion for its global macro fund

In October 2014, Two Sigma raised $3.3 billion for a macro hedge fund, which has been ongoing since 2008The most prominent financing since the subprime mortgage crisis in. Global macro funds aim to generate returns unrelated to the market. It is highly popular in global macro strategies for investors, including investing in stocks, fixed income, commodities, and currencies. The company mainly uses artificial intelligence and quantitative technology to execute its global macro strategy through the fund.

2015: Fengze Investment closed its global macro hedge fund

2015 was a year when many macro funds around the world suffered heavy losses. In October 2015, Fengze Investment Group announced the closure of its flagship global macro fund. Macro hedge funds are one of the world's worst performing large hedge funds this year.

The assets managed by funds managed by Michael Novogratz have decreased from a peak of $8 billion to below 20Billion US dollars, as some global macro investors redeemed their funds. Fortress Group's global macro funds bet on interest rates, currencies, commodities, fixed income, and stocks.

2015: BlackRock closes global macro hedge funds

In November 2015, BlackRock announced the closure of its macro hedge fund, The Global Ascent Fund. It used to be a fund worth billions of dollars, with assets managed byIn 2015, it fell below $1 billion.

Managers have underperformed in the 'macro' hedging categories that bet on interest rates, currencies, commodities, fixed income, and stocks. At that time, the fund was managed by Paul Harrison. It had a value of 46 in 2013The assets of one billion US dollars decreased by 9.4% in 2015.

2016: Global Macro Strategy and Brexit

When the UK voted to withdraw from the European Union (EU) in 2016, global hedge fund activity increased before the Brexit referendum.

Global macro hedge funds, which are confident of the UK's exit from the EU, hold long positions in Safe Haven Assets such as gold, as well as short positions in European stocks and sterling.

Global macro hedge funds with uncertain results also hold long positions in safe haven assets and other instruments during market fluctuations.

The NuWave matrix fund, which runs the CTA/system macro strategy, rose 12%, making trading decisions based on historical patterns rather than intuitive decisions. Quadratic, another macro management companyCapital Management announced its best return since its launch in May 2015.

2020: Global Macro Funds and Covid-19 Crisis

The COVID-19 pandemic has resulted in uneven global macro strategic performance. The average increase in systematic macro strategies in 2020 was 2.64%, far lower than the overall 5.22% increase in macro hedge funds.

Utilizing computer-based algorithms for global macro strategies in understanding 2020The devastating impact of the pandemic on financial markets is facing challenges. Economic uncertainty and sporadic lockdowns have had a negative impact on the portfolio positioning of artificial intelligence models.

two thousand and nineteenGlobal macro hedge funds, which have performed poorly in the past year, are ready to take a step ahead of the volatility caused by the pandemic. There are signs that some discretionary macro strategies are performing well while the coronavirus pandemic is still spreading.

However, historically low interest rates, central bank stimulus measures, and more predictable volatility patterns have made it difficult for the industry to identify and detect patterns that have emerged over the past decade.

conclusion

Over the years, global macro strategies have demonstrated their distinct performance from other asset classes and their ability to withstand volatile market conditions. Today, it is indeed a component of a diversified investment portfolio.

However, in recent years, there has been a change in mindset. Global macro investors mainly use trading algorithms and systematic investment methods, rather than traditional fundamental analysis.

Experts estimate that nearly 7% of hedge fund investments worth $3 trillion globally are made annuallyOur funds have shifted from global macro discretionary investment strategies to systemic hedge fund strategies. However, computer-based global macro funds also have their limitations.

Some global macro managers are now adopting a quantitative approach that combines in-depth fundamental analysis with complex system AI driven strategies.

According to the S&P 500 Index, there may be a period of robust global macro performance amidst various sources of geopolitical, economic, and policy uncertainty, as well as high asset valuations.