As is well known, hedge funds can generate the greatest returns on Wall Street, but they also come with great risks. Due to the fact that most hedge fund managers are speculators, they primarily focus on risk management. In this article, EBC Finance unveils the risk management model of hedge funds for you.

For retail traders, risk management is much simpler, because the amount of funds we deal with is small, the leverage ratio ratio is low, and the open positions are also small.

However, hedge fund managers spend most of their time on risk management. Let's first delve deeper into how hedge funds manage risk, in order to better optimize their risk management capabilities.

Hedge Fund Risk Management Process

When reading the following sections, you will find that the risk management strategies adopted by hedge funds are completely different from the habits of many retail traders.

When dealing with positions worth billions of dollars, hedge fund managers use more than just stop losses and good risk/return ratios. This process involves strategies such as hedging, risk modeling, and system risk assessment.

Hedge Fund Risk Model

Compared to retail traders, hedge funds have greater risks. Therefore, managers need to understand all possible scenarios where their positions may experience adverse changes. This is where risk modeling comes in handy.

Traditionally, the Fund will implement three different types of modelling: Value at risk, stress testing and scenario analysis.

Value at risk (VaR)

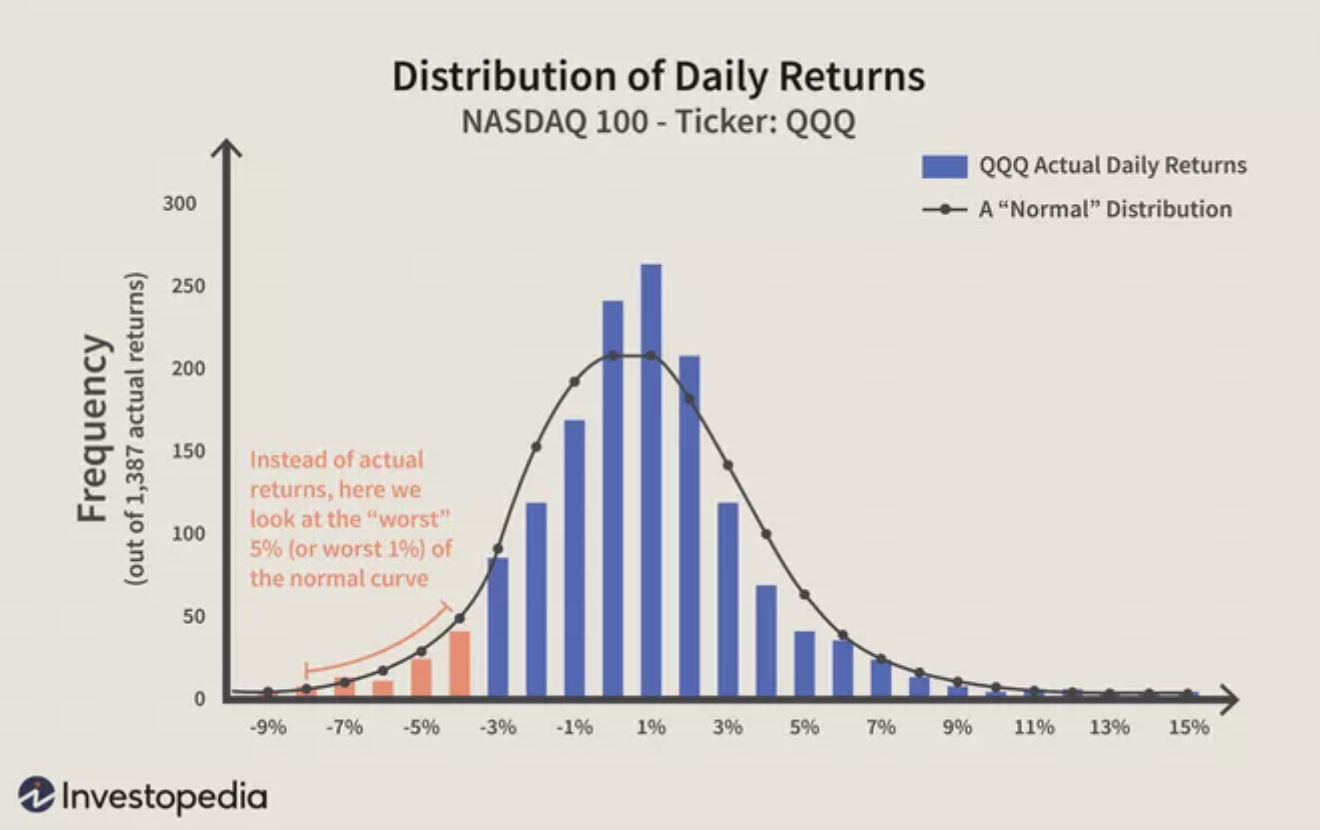

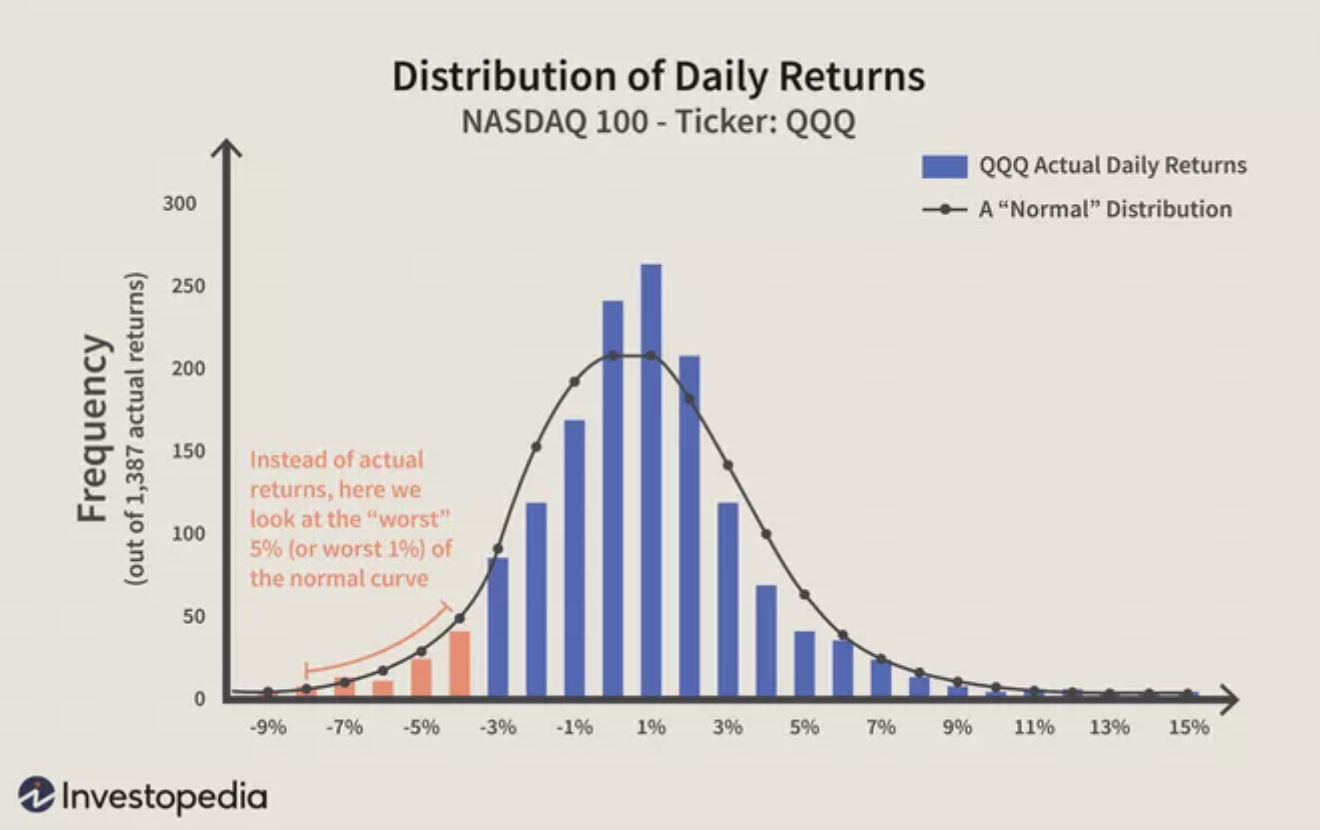

It is a type of statistical data used to quantify the potential downside risks that may occur in a portfolio or position within a specific time frame. This metric can be calculated in various ways, including history, variance covariance, and Monte Carlo methods.

1/Historical method, examining a person's previous return history and ranking them from the worst loss to the greatest gain - following the premise that past return experiences will affect future outcomes.

2/Variance covariance method. This method does not assume that the past will affect the future, but that the gains and losses are normal distribution. In this way, potential losses can be determined based on the standard deviation event of the average value.

Daily return distribution - Value at risk

Image by Julie Bang © Investopedia 2020

The final method for VaR is to perform 3/Monte Carlo simulations. This technology uses computational models to simulate the expected returns of hundreds or thousands of possible iterations.

For example, 95% VaR certainty and 20% asset risk represent an average expectation of losing at least 20% every 20 days. In this calculation, 50% of the losses still validate the risk assessment.

The 2008 financial crisis exposed these issues to relatively mild VaR calculations, underestimating the risk events that subprime mortgage portfolios may trigger. The risk margin is also underestimated, which results in a very high leverage ratio ratio in the sub portfolio. As a result, due to the sharp decline in the value of subprime mortgages, the undervaluation of incidence and risk level prevented institutions from covering billions of dollars in losses.

Stress testing is a computer simulation technique used to test the resilience of investment portfolios to potential future financial conditions, in order to identify hidden vulnerabilities in institutions and investment portfolios, and evaluate their ability to respond to adverse events and market conditions.

Stress testing helps measure investment risk and asset adequacy, as well as evaluate internal processes and controls. Stress testing can use historical, hypothetical, or simulated scenarios.

Historical stress testing

In historical scenarios, asset classes and investment portfolios are run through simulations based on previous crises. Examples of historical crises include the stock market crash in October 1987, the Asian crisis in 1997, andThe technology foam burst in 1999-2000.

Simulated stress testing

As for the method of stress testing, Monte Carlo simulation is one of the most well-known methods. This type of stress testing can be used to model the probability of various results given a specific variable. For example, the factors considered in Monte Carlo simulations typically include various economic variables.

scenario analysis

Revealed how specific events (such as interest rate changes) affect investment portfolios.

There are many different methods for conducting scenario analysis. A common method is to determine the standard deviation of daily or monthly investment returns, and then calculate the expected value of the investment portfolio if the returns generated by each investment are two or three standard deviations above and below the average return.

In this way, fund managers can simulate these extreme situations to have reasonable certainty about the changes in portfolio value within a given time period.

These three models provide fund managers with key insights into the positions they wish to take.

Position size

Like retail traders, fund managers also need to consider how much funds each position can utilize. The size of the position varies depending on the fund and there are no preset regulations.

Funds typically follow three different types of position sizes: hard limits (fixed amount of investment), guidance (variable amount of capital, but within investor guidance), or neither (determined by the fund manager).

According to the research paper, "How do hedge funds manage portfolio risk

According to Gavin Cassar and Joseph Gerakos, 56.4%Hedge funds do not adopt the first two forms of position size. Hedge funds have greater freedom over the assets they manage. This allows for greater potential returns, but also allows for occasional larger pullbacks.

Assess systemic and downside risks

Now that we understand some of the risk management strategies adopted by fund managers, we can evaluate their practicality. We will continue to refer to Gavin Cassar and Joseph GerakosAccording to the research report, funds that do not use formal risk models face greater downside and systemic risks. This is the result of a sample test of hedge fund performance during the 2008 stock market crash.

In a large sample of hedge funds, it is evident that managers who adopt formal risk models have lower downside potential, but do not have significant performance advantages. However, the paper points out that there may be other explanations for the results, including the company's risk culture, high-risk company selection models, and company selection models with adverse risk awareness.

summary

Hedge funds execute complex risk management strategies on their investment portfolios. Although the strategies used by fund managers are not necessary for individual investors, the foundation of risk management remains the same.

Key points review:

Fund managers evaluate all potential situations before building positions, which many retail traders fail to achieve.

Fund managers consider the maximum value of their positions to be proportional to their risk, i.e. risk/return ratio. If you risk a significant portion of your capital to win, then you should consider whether the maximum profit is worth it.

Fund managers have different forms of position sizes. Although most funds do not have strict restrictions, it is crucial to understand how much exposure your investment portfolio has at any given time.

Considering all these factors, it is evident that even at the institutional level, hedge funds are incorporating fundamental principles into their daily processes. So, as retail investors, we should pay more attention to risk management.