During the 16th to 17th centuries, due to the great adventures of European explorers, trade cooperation between continents continued to grow, and these exchanges and interactions drove the flourishing development of the financial field. EBC has sorted out those great innovations for everyone, let's take a look together.

Late 15th to 16th century

Great Discovery

Christopher Columbus arrived in America in 1492, and Vasco da Gama opened a route to India in 1498. With the promotion of Portugal and Spain, new trade routes were opened up, which could be reached without the need for intermediaries such as Arab countries and Venice at the timeIndia.

The Kingdom of Spain supported the Genoese Christopher Columbus in opening up a western route to India, ultimately connecting Europe and the Americas in 1492. These 'great discoveries'Marked the beginning of the globalization process and promoted strong growth in trade between continents: the "triangular trade" between Europe, Africa, and the Americas, as well as the "new worldThe trade between Europe and Asia caused by the Precious metals extracted by the colonies.

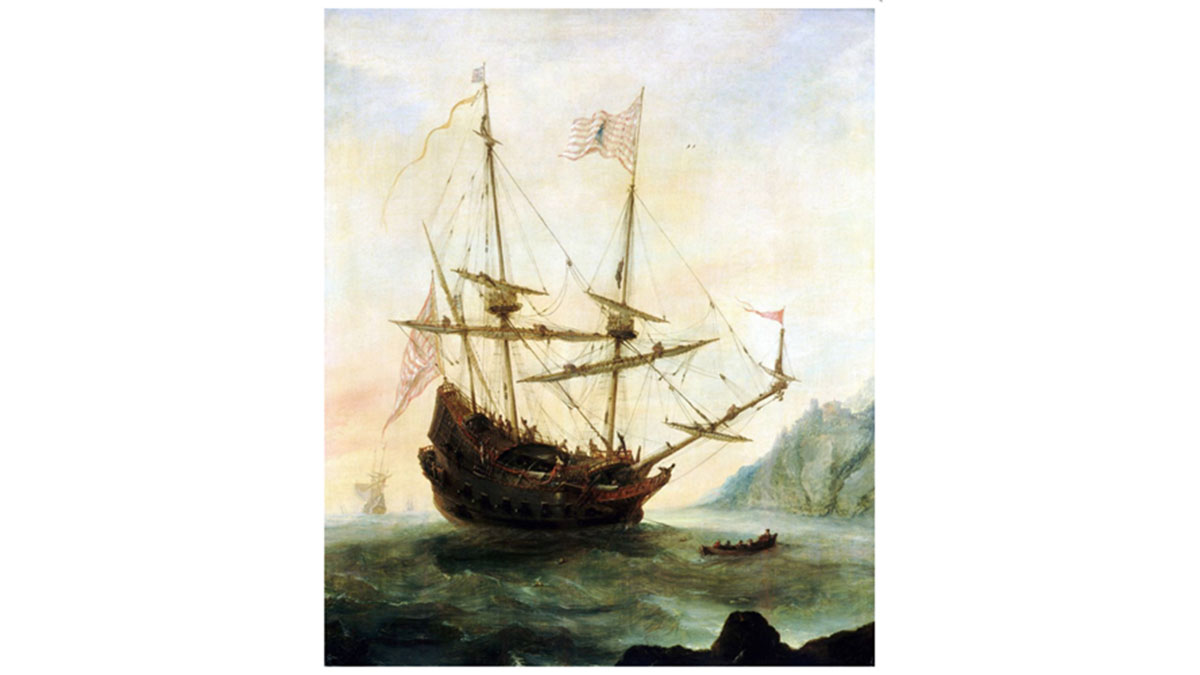

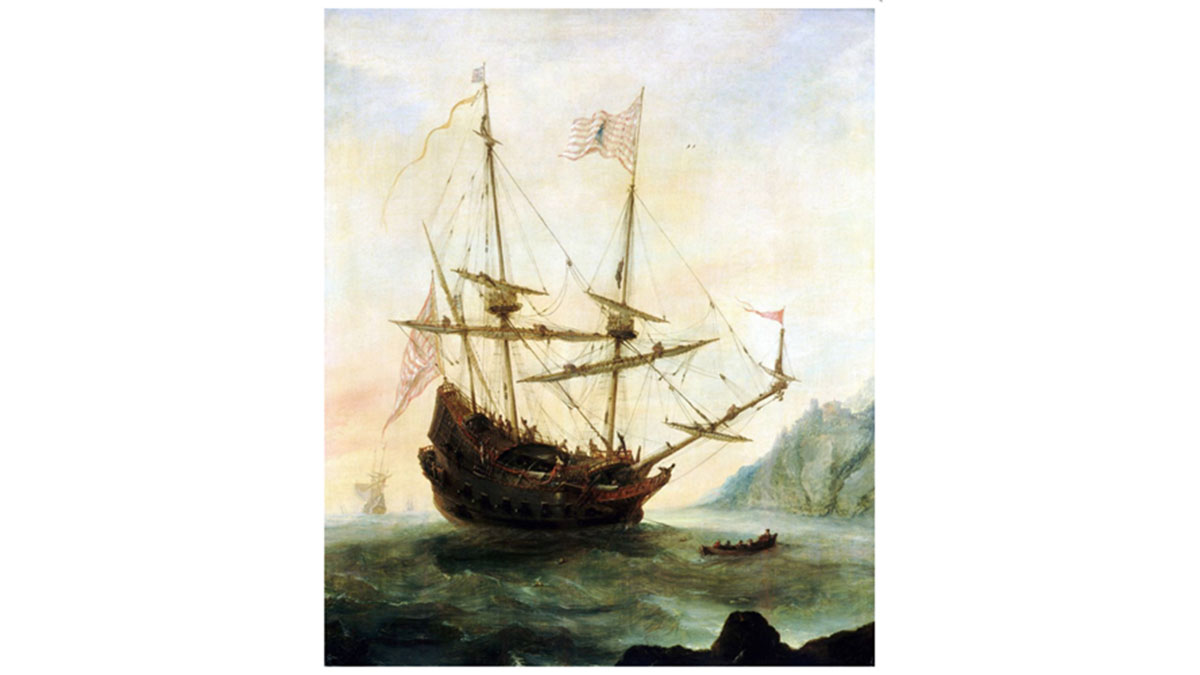

In August 1492, Christopher Columbus sailed the Santa Maria. Created by Andries van Eertvelt-Image: NMM, Greenwich/Leemage

Discoverer Monument (Portuguese: Padr ã o dosDescabrimentos is a monument in Portugal commemorating the 15th to 16th century maritime era and is also one of Lisbon's famous landmarks.

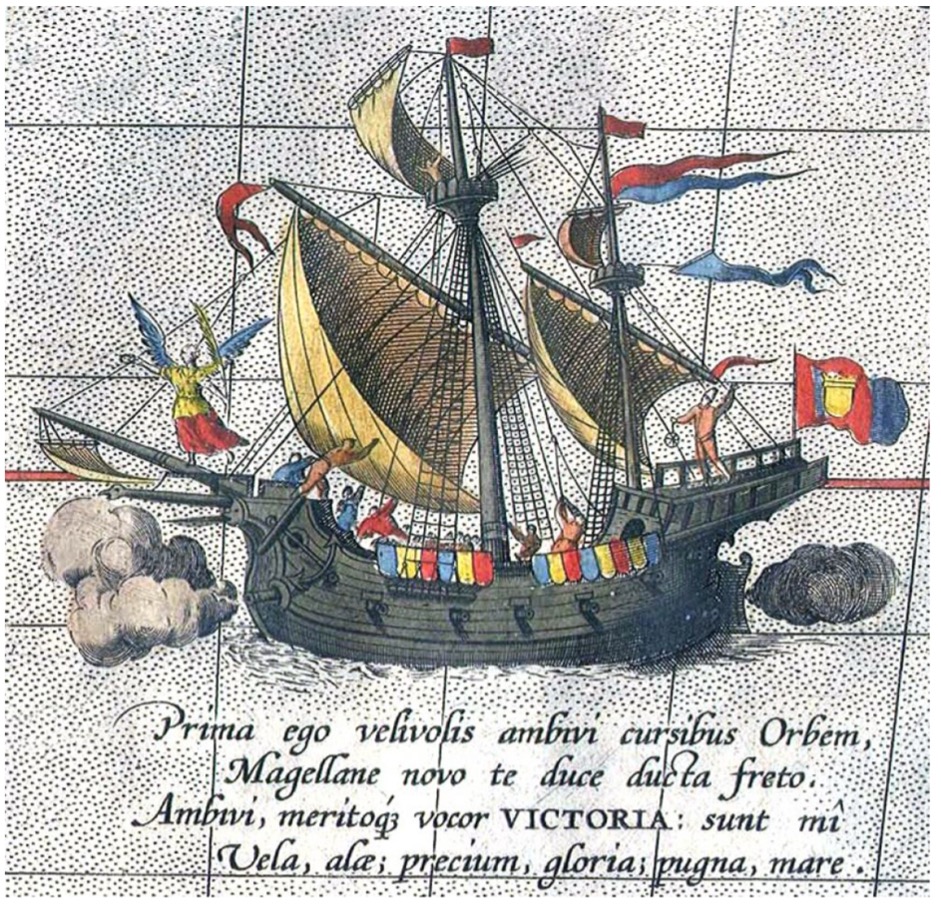

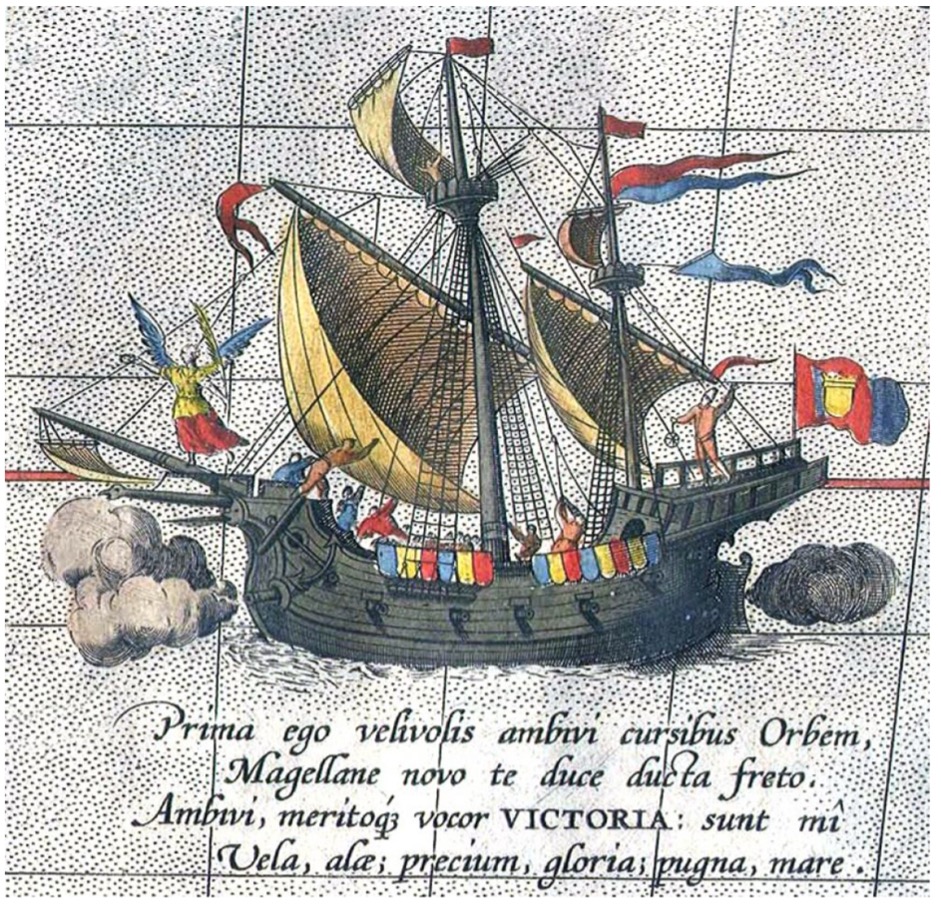

Ferdinand Magellan's Sailboat Victoria

1494

Double entry bookkeeping method

In the late 13th century, the double entry accounting system emerged in Venice and Florence, hence its original name was the Venetian accounting system. Italian monk and mathematician Luca Pacioli in 1494In a book published in, the details of the Venetian method were compiled and introduced in a language that everyone could understand. This method has hardly developed for centuries, despite significant changes in organizational accounting techniques and valuation.

Luca Pachaulli and his student Guidobaldo da Montefeltro I (1495); By Jacopo de 'Barbari filmed "Portrait of Luca Pachaulli" - Source: Naples Capodimont Museum

16th to 17th centuries

The Implementation of Mercantilism in Several European Countries

Represented by French politician Colbert. He sees exports as the main source of wealth for a country, especially due to the precious metals produced by exports.

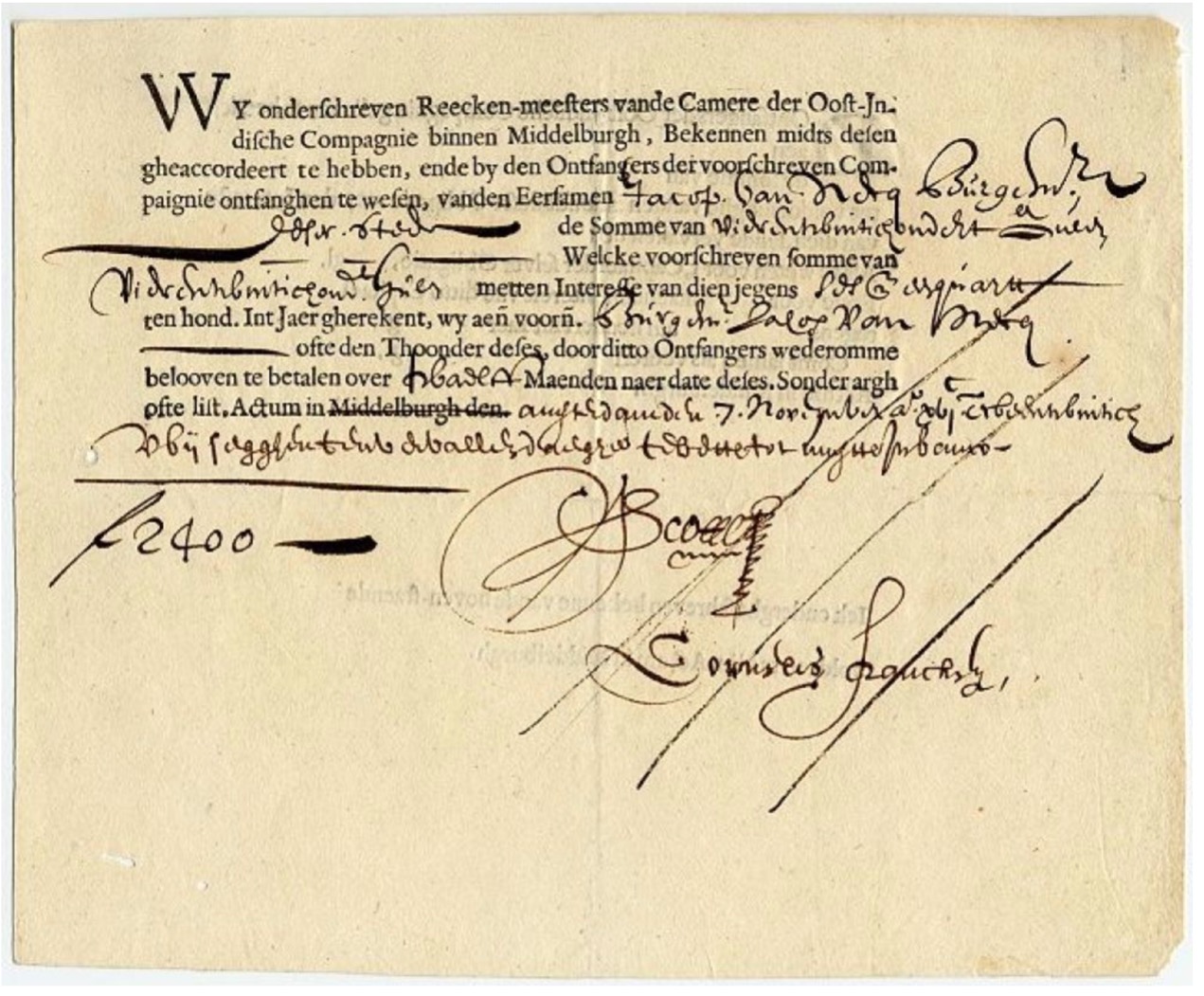

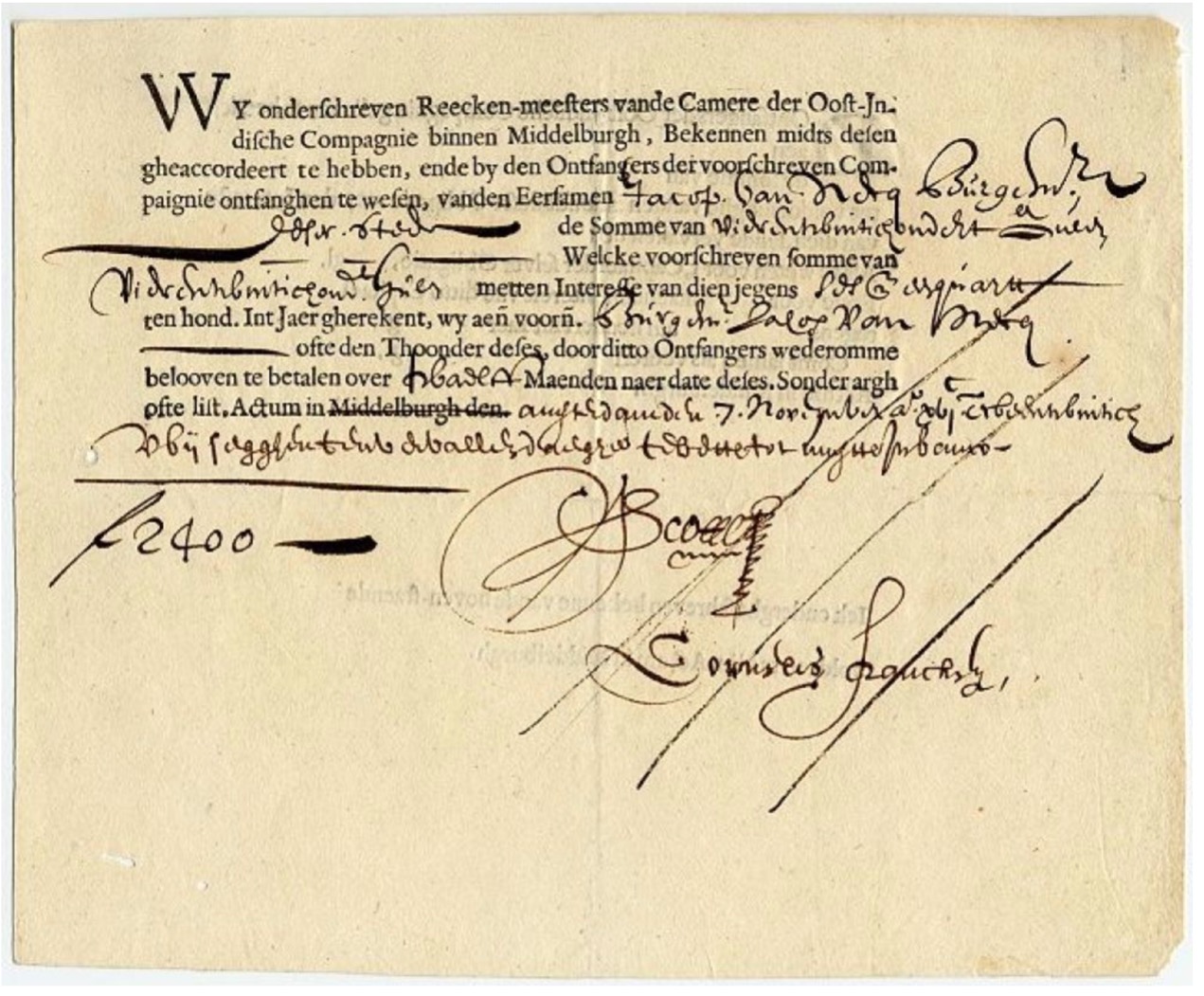

Vereenigde OostingischeCompagnie) on November 7, 1622 in the amount of 2400 florin. Written and authorized in Middleburg, but signed in Amsterdam - source. Wikimedia Commons

1517

The Economic Principles of Protestantism

The Protestant Reformation can be traced back to 1517, when Martin Luther condemned the Pope's indulgence. Luther believed that it was impossible to donate money to the church as a substitute for the usual redemption during pardons.

Sociologist Max WeberWeber, 1864-1920) and other scholars believe that there is a connection between some branches of Protestantism, especially the ethics of Calvinism, and the rise of capitalism in some countries. Protestantism emphasizes the value of work as a way to fully utilize and thus glorify God's creations; Career success is seen as a sign of divine selection. As Puritanism also proposed to adopt a frugal lifestyle and reject luxury, this work ethic was regarded as the ideal basis for developing means of production and economic growth. It subsequently spread outside the Protestant community.

Luther supported the traditional interest bearing loan ban. However, John Calvin believes that they are legal, depending on the interest rate provided (which should not be too high) and the purpose of the loan (encouraging production loans but not stimulating consumer loans).

Around 1520, a banker in Tournai, France was issuing loans, silk, and wool tapestries. Source: Tarker/The Bridgeman Art Library

one thousand five hundred and forty

The first commodity exchange in France was established

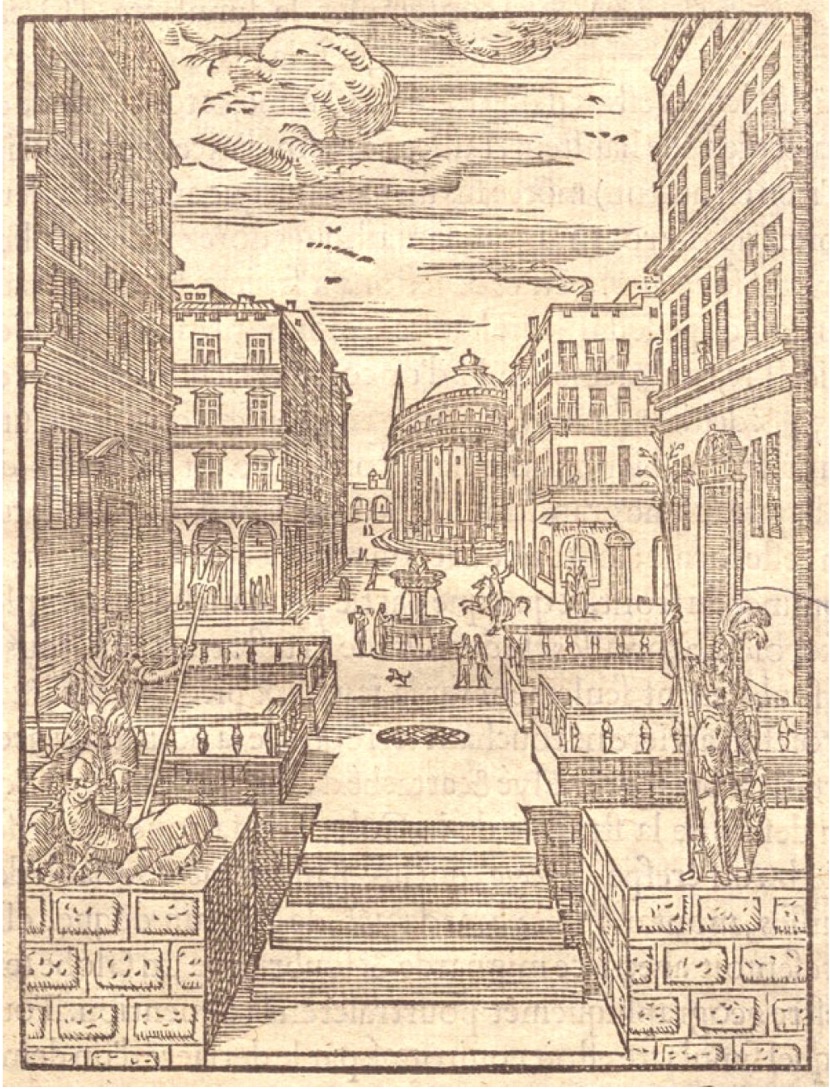

In France, the first commodity exchange was established in Lyon around 1540. Its success mainly stems from bills of exchange and discounting. It competes with the Antwerp Exchange.

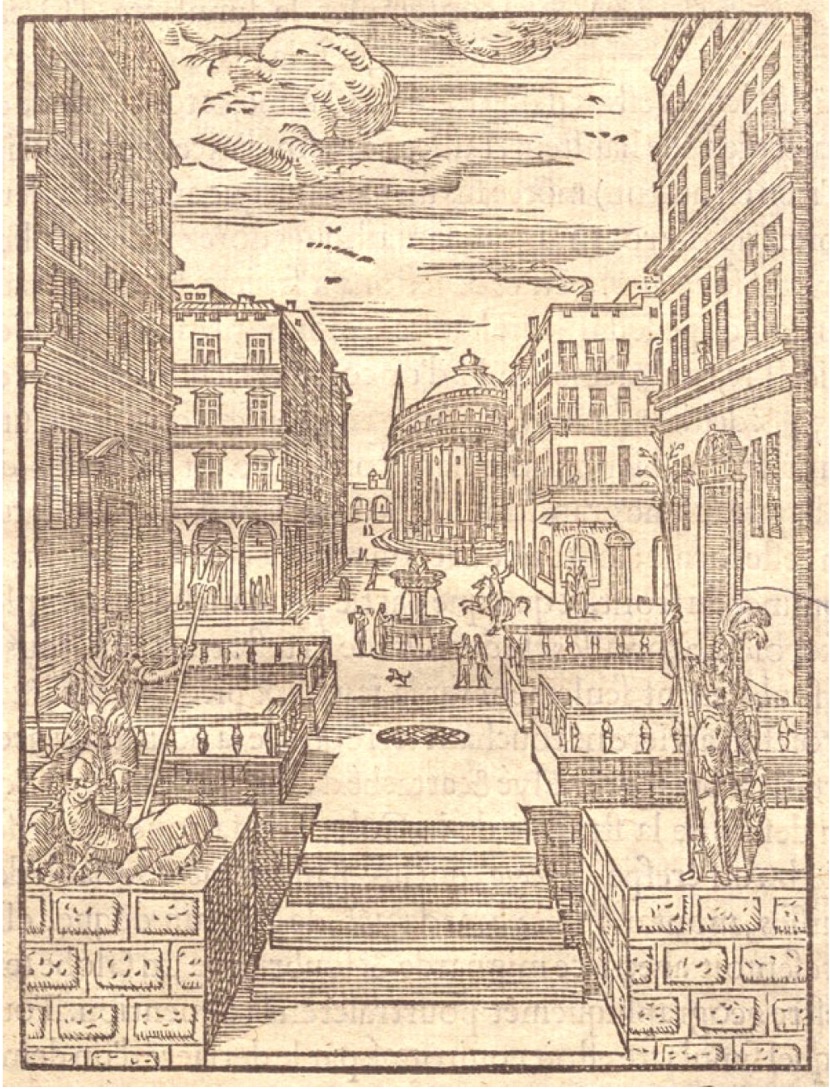

The bank transaction took place in Lyon, France. Bernard Salomon's (1506-1561) printmaking source: Clich é Biblioth è que UrbanDe Lyon

1545

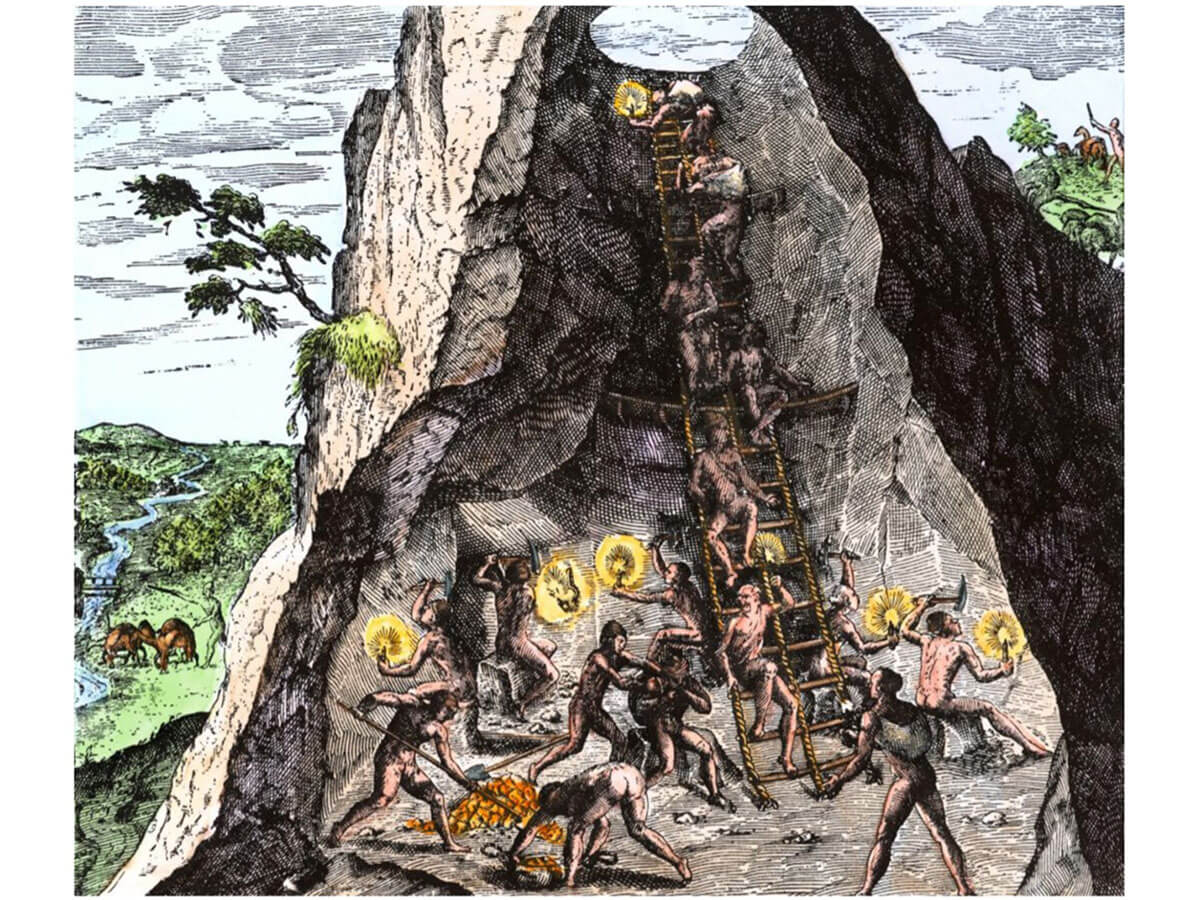

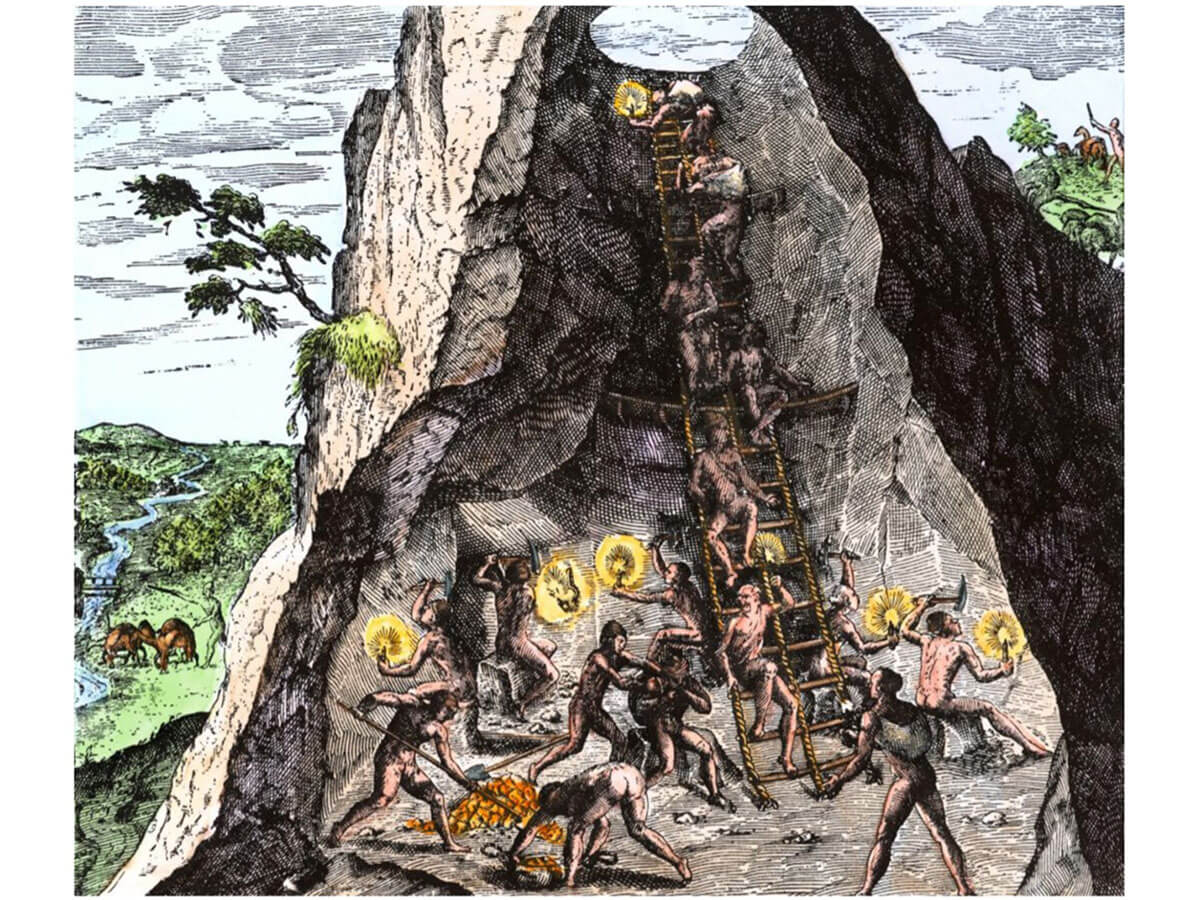

Spain began extracting silver from mines in Potosi

Mining in Bolivia and other 'New World' mines has led to the influx of precious metals into Europe and Asia.

The mining of silver mines. Native Americans, as Spanish slaves, mined silver mines in Potosi (16th century). From Theodor deBry (1527-1598) during the colonial period, from De Bree - Source: North Wind Pictures/Leemage

1568

The Debate between Bodin and Mallestro in France

one thousand five hundred and sixty-sixIn, the King's advisor and Chairman of the French Public Accounts Committee, Marquistrot, conducted an investigation into the widespread rise in prices and currency depreciation. He defended the concept that inflation is just an illusion: the precious metal content and value of coins have decreased, but food prices measured by precious metals have not increased.

In 1568, Jean BodinBodin responded that the price increase since the South American cash silver mine was mainly due to the large influx of precious metals into Europe. Therefore, he was one of the earliest to propose what economists later referred to as the quantitative monetary theory.

Jean Bodin (1530-1596) French philosopher and judge. His paper The Republic (1576) developed the principles of monarchy in various countries. Engraving source: Rue desArchives/Tallandier

17th to 18th centuries

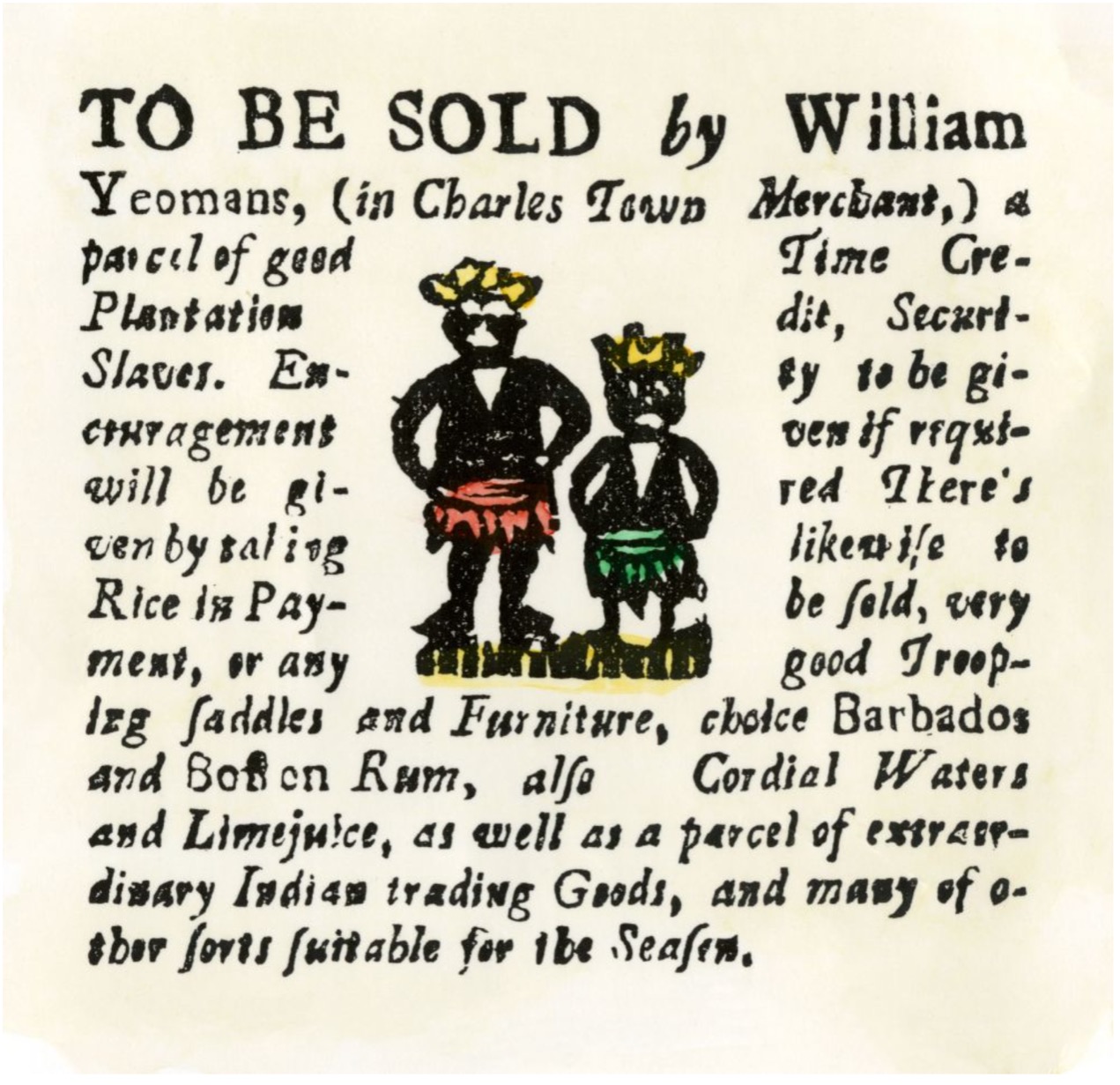

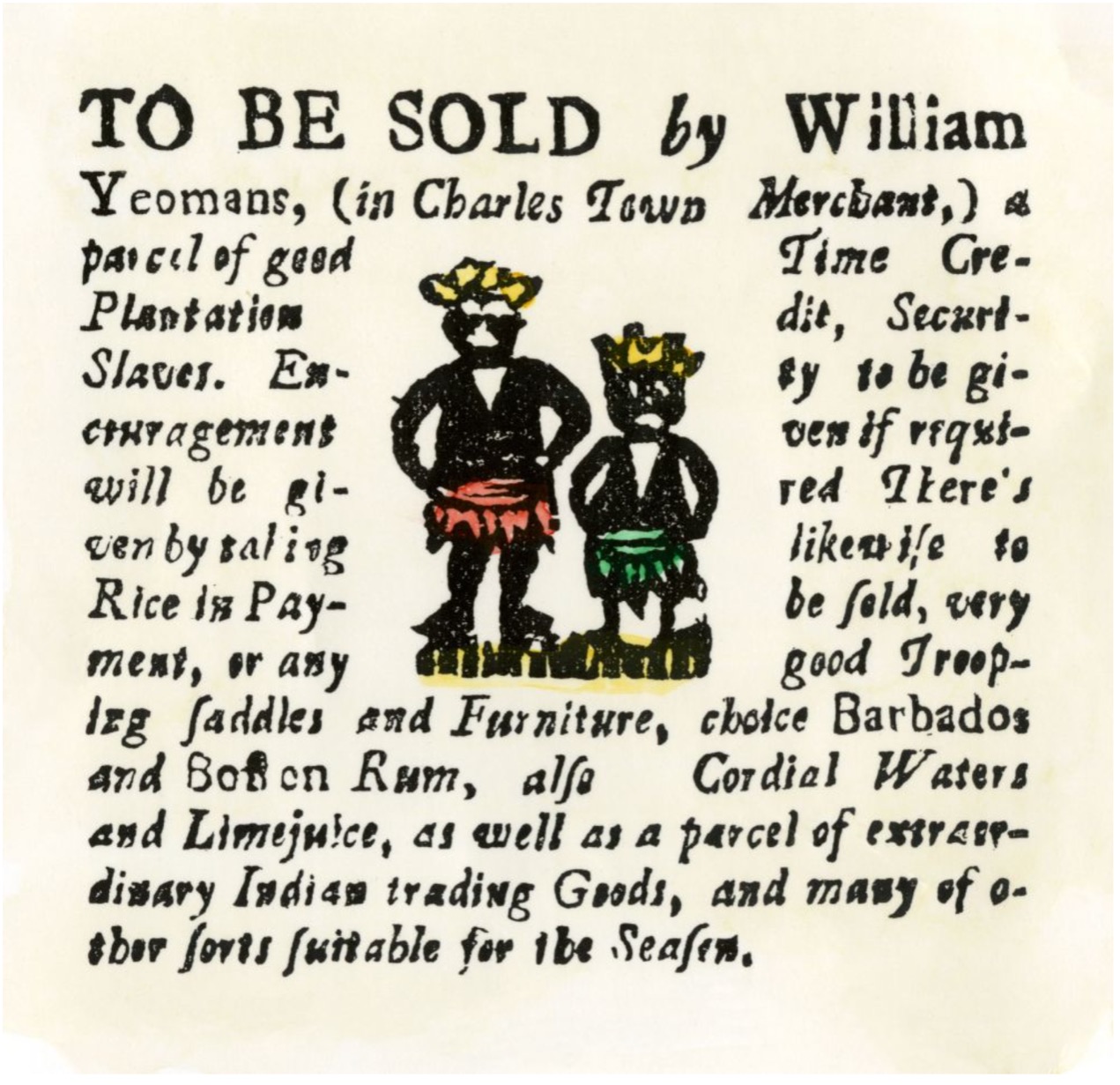

The heyday of the European African American triangular trade

European ships arrived in Africa loaded with weapons and fabric, sailed with slaves to the United States, and then returned to Europe loaded with tropical goods.

In 1744, an advertisement for slave sales and trade in goods was published in the Charleston Gazette of South Carolina. 19th Century Colorful Engraving - Source: North WindPictures/Leemage

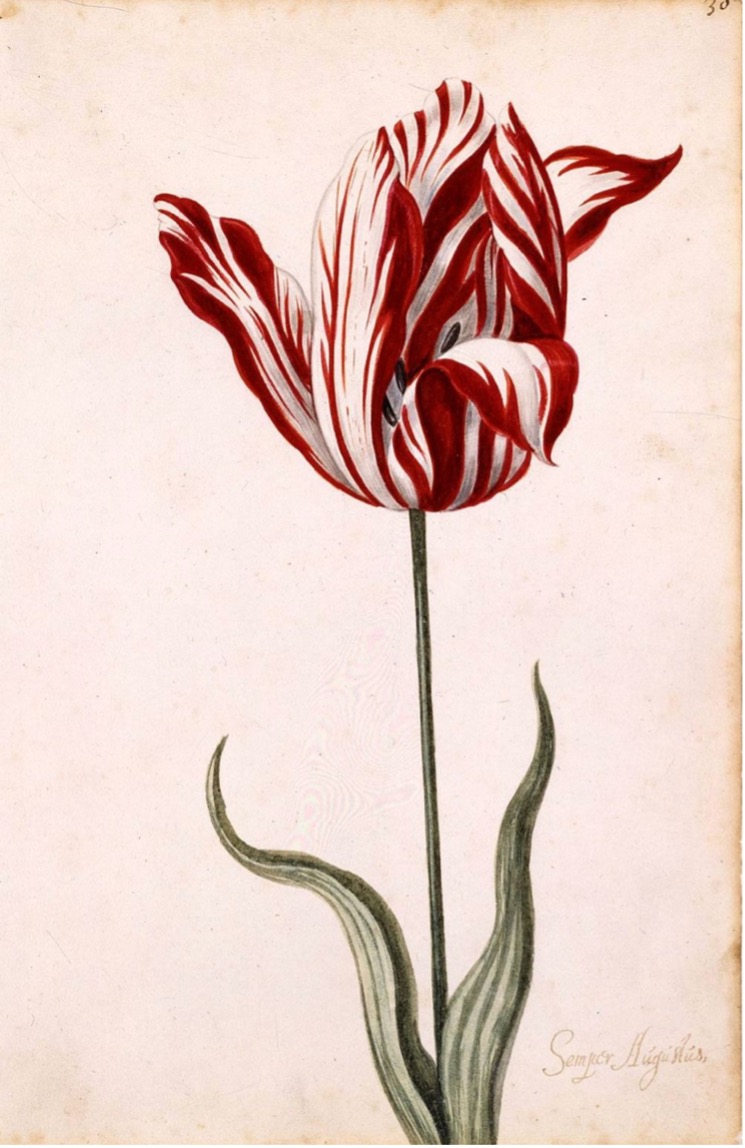

1636-1637

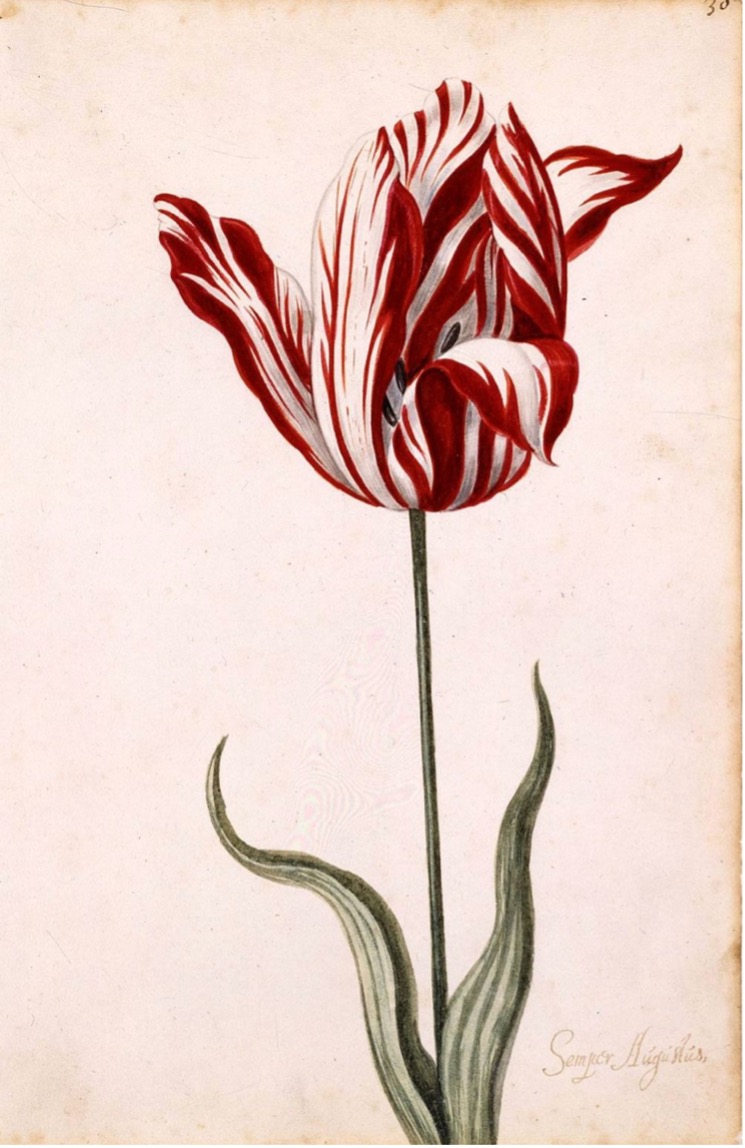

The first speculative foam in the tulip bulb market

In the 17th century Netherlands, tulips rose in price due to their rarity and novelty. In the 1630s, they became objects of speculation. This hype continued until 1637At that time, a sudden price reversal caused buyers to panic and sell off.

The most expensive variety of tulips during the 17th century Dutch tulip craze - Sempell Augustus tulips

Source: Norton Simon Art Foundation

1661

Sweden's first convertible cash bearer note

Johan Palmstruch, a Swedish businessman, banker, and founder of Stockholm Bank, proposed the issuance of this paper currency (1656).

1666, Stockholm, Sweden, Credityf Zedels, Texte Imprente Signature and Seal

Source: Uppsala University Coin Cabinet

1668

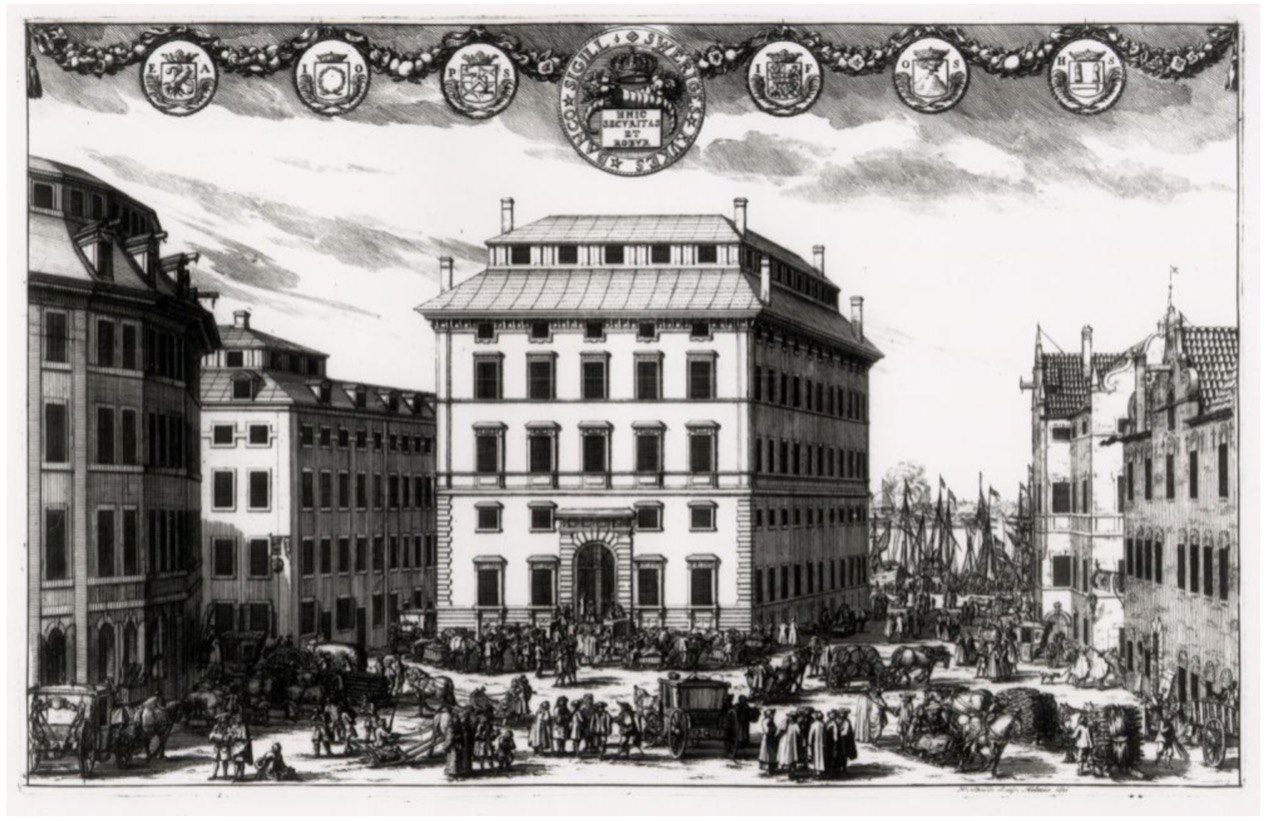

Create the first central bank

After the collapse of the Stockholm Bank managed by Johan Palmstruch, the Kingdom Estate Bank (now the Swedish Bank) was established in 1668.

The Bank of England was founded in 1694, and the Bank of France was founded in 1800Year. These early central banks gradually distinguished themselves from other banks (now known as' secondary banks' or 'commercial banks') by gradually acquiring a monopoly on paper currency issuance in specific regions.

The first building of Riksens St ä nders Bank, formerly Sveriges Riksbank. ErikDahlberg, Suecia Antiqua, and Hodierna (1698-1701); Willem Swide Carving

Source: Gabriel Hildebrand/Kungliga Myntkabinette