The hedge fund industry has shown sustained growth and achieved remarkable performance in the past few years. Due to their openness, they are also different from private equity. Hedge funds have shown strong performance over the past decade, and investors now see them not only as a means of diversification, but also with excellent returns.

According to alternative investment data and data from BarclayHedge, an index company, the five-year net annualized return of the top 50 funds is 14.81%, slightly lower than that of the S&P 500 index15.22%. In addition, from early 2016 to 2020, the annualized standard deviation of hedge funds was 11.17%, while the market level was 15.13%.

The market crash in early 2020 demonstrated the importance of hedging. The pandemic has caused some changes in investor preferences, and this trend may continue until 2021After the year. Currently, hedge funds are gradually shifting from their main long short stock strategies to fixed income strategies or CTAs.

EBC has compiled a list of key statistical data on the hedge fund market. These statistical data also show constantly changing industry trends and investor preferences.

Whether you are a market or industry researcher or an investor, you can take a look at this latest list of hedge fund statistics.

Market Statistics

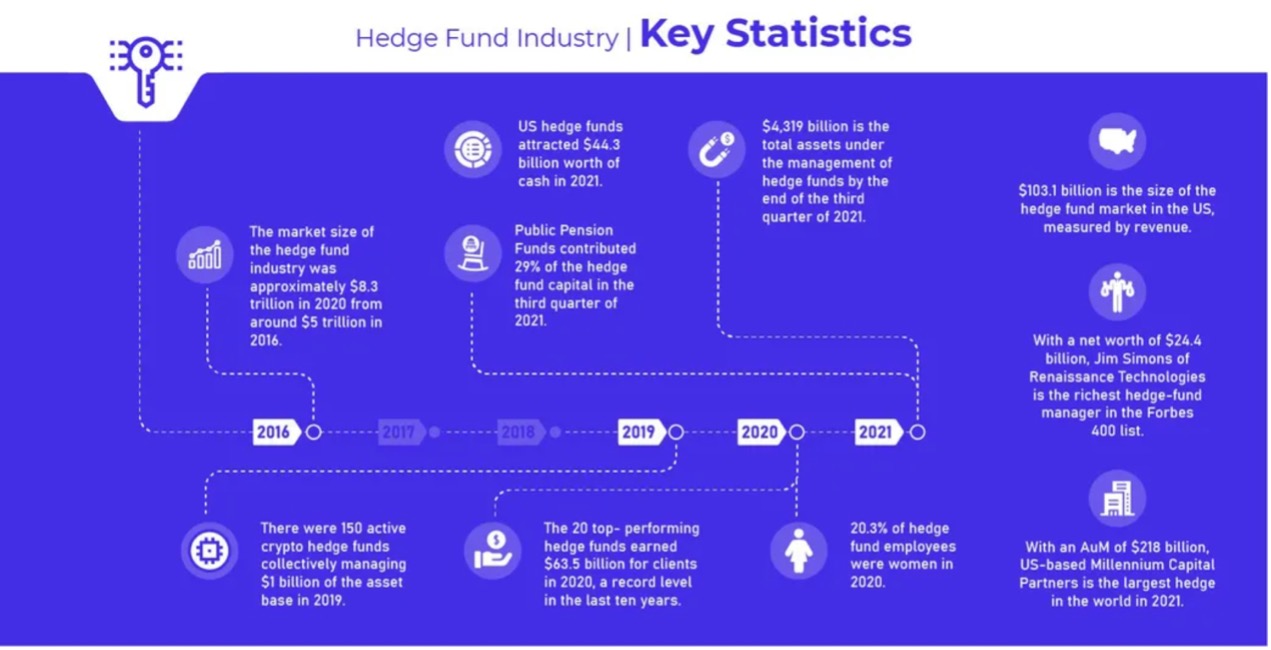

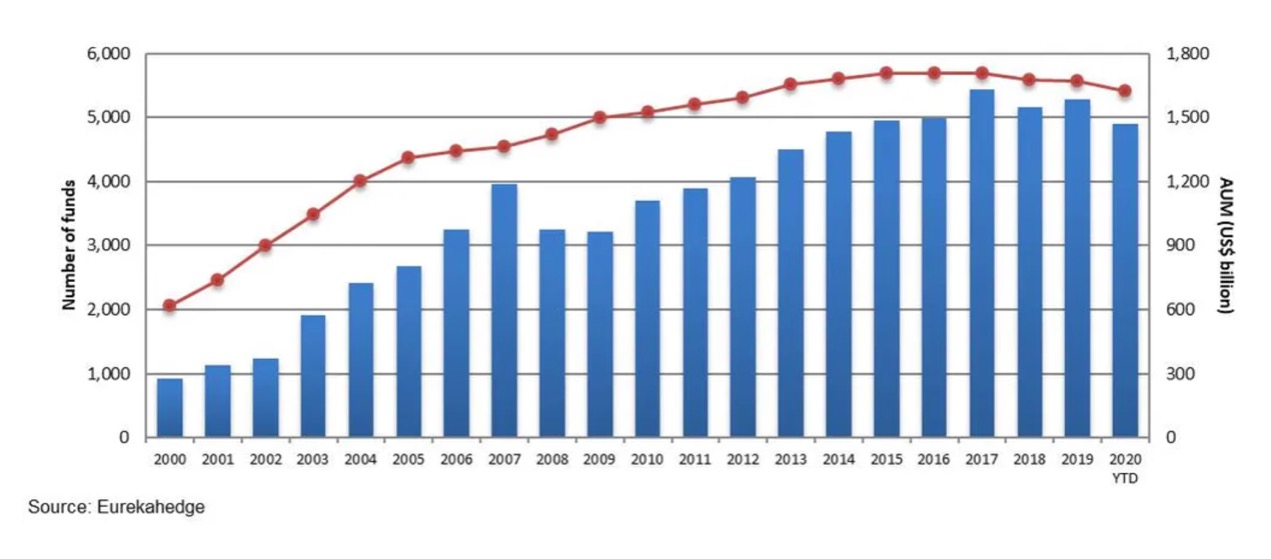

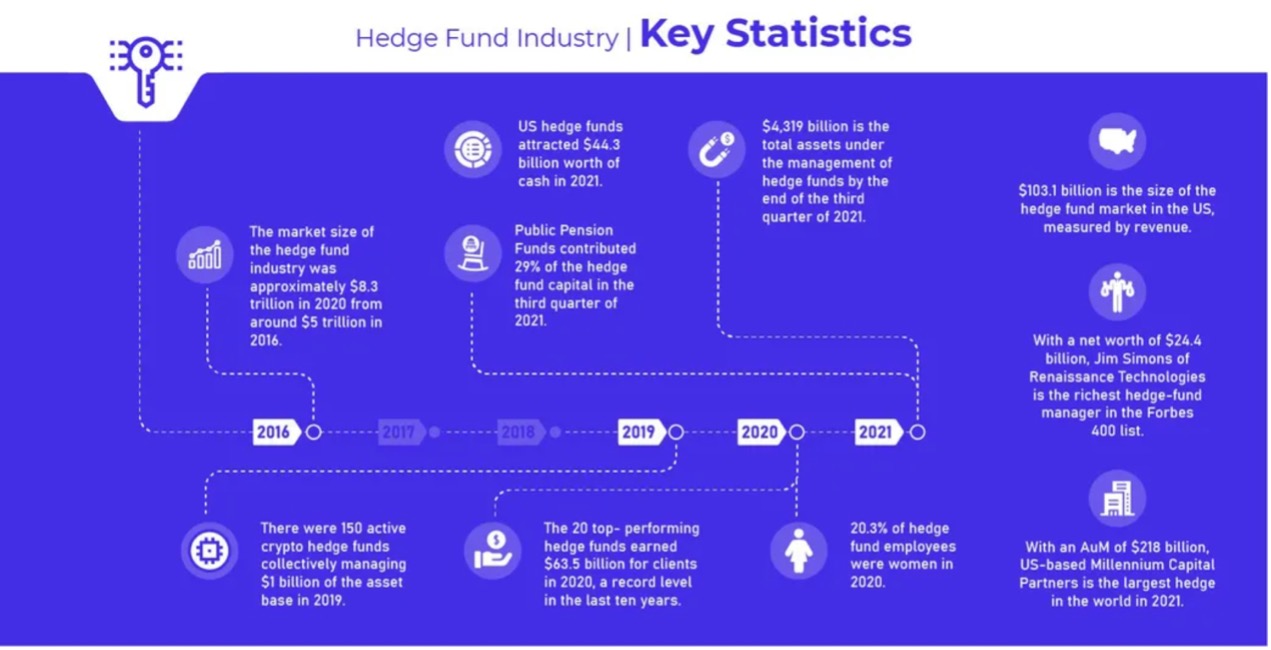

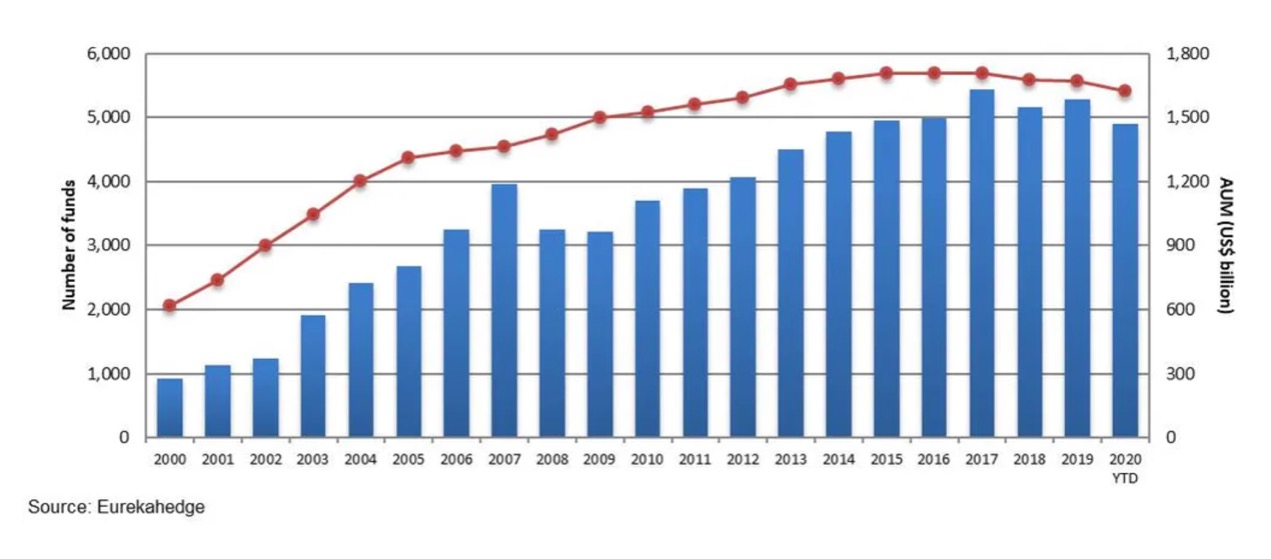

According to data from financial research institutions, the market size of the hedge fund industry has increased from approximately $5 trillion in 2016 to approximately $8 trillion in 2020Trillion US dollars. We can attribute the success of hedge funds to their complex trading strategies and advanced risk management.

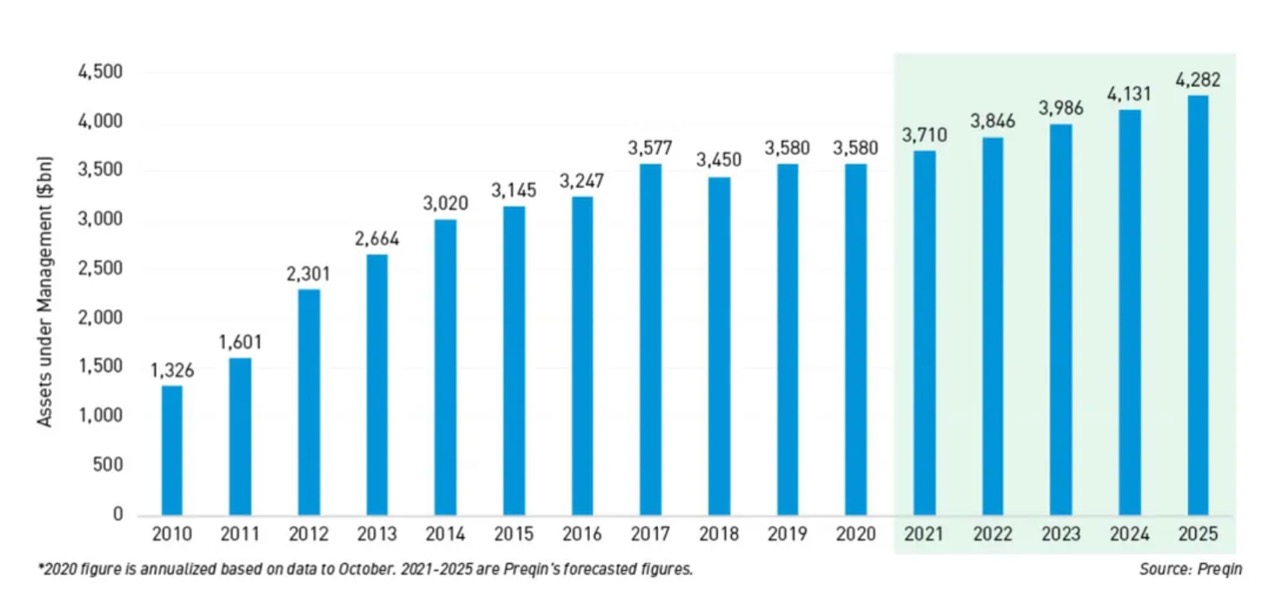

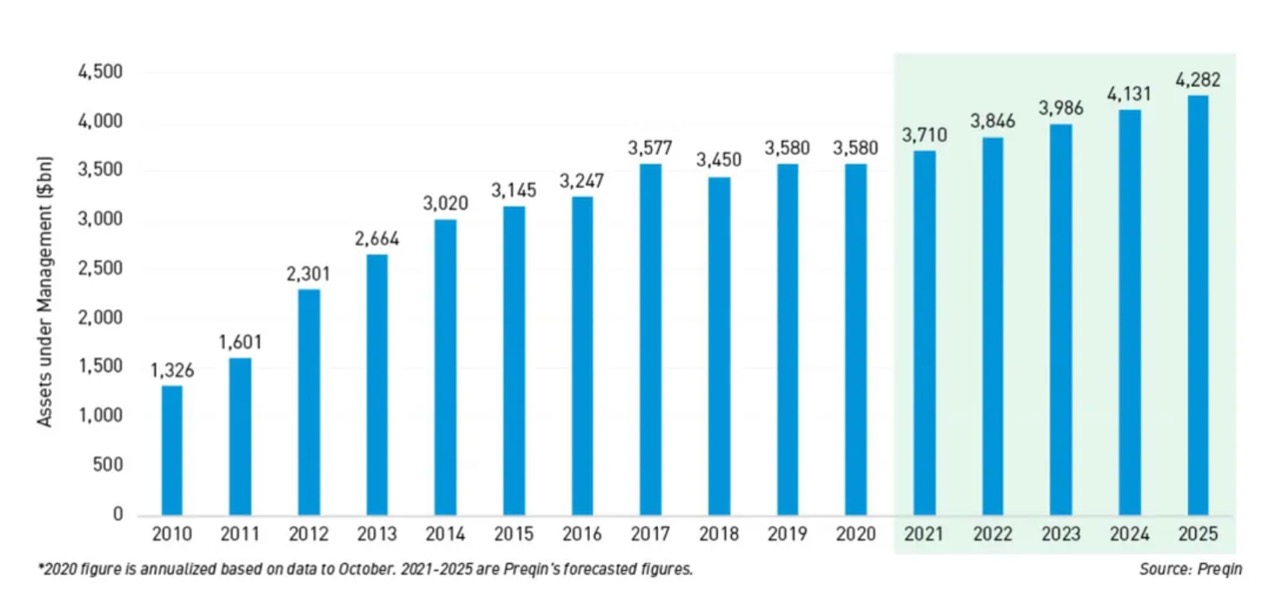

From 2020 to 2025, managed hedge fund assets may grow by 19.6% to $4.28 trillion, with a compound annual growth rate of 3.6%.

The total amount of funds flowing into hedge funds in the first three quarters of 2021 was $900 million

The total outflow of hedge fund funds in 2019 was $97.2 billion.

The total outflow of hedge funds in 2020 was $44.5 billion.

The average growth rate of global hedge funds from January to November 2021 was 13.9%.

The return rate of macro strategy funds in the first 11 months of 2021 was 7%.

The return rate of macro strategy funds in the first 11 months of 2021 exceeded 14%.

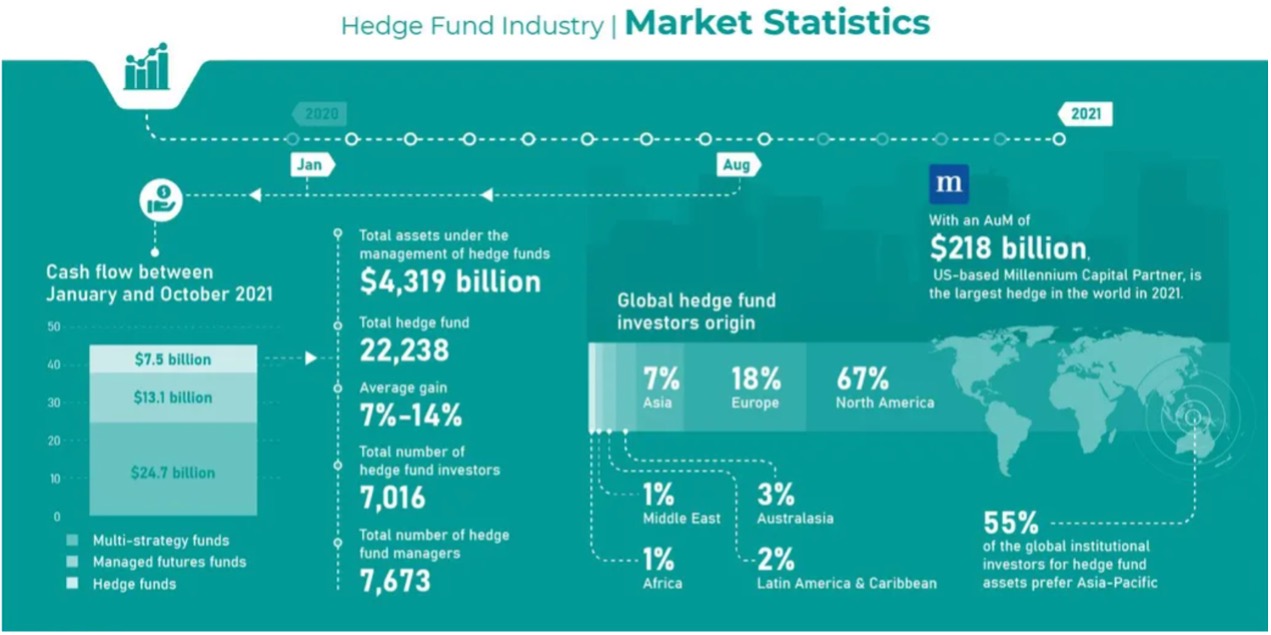

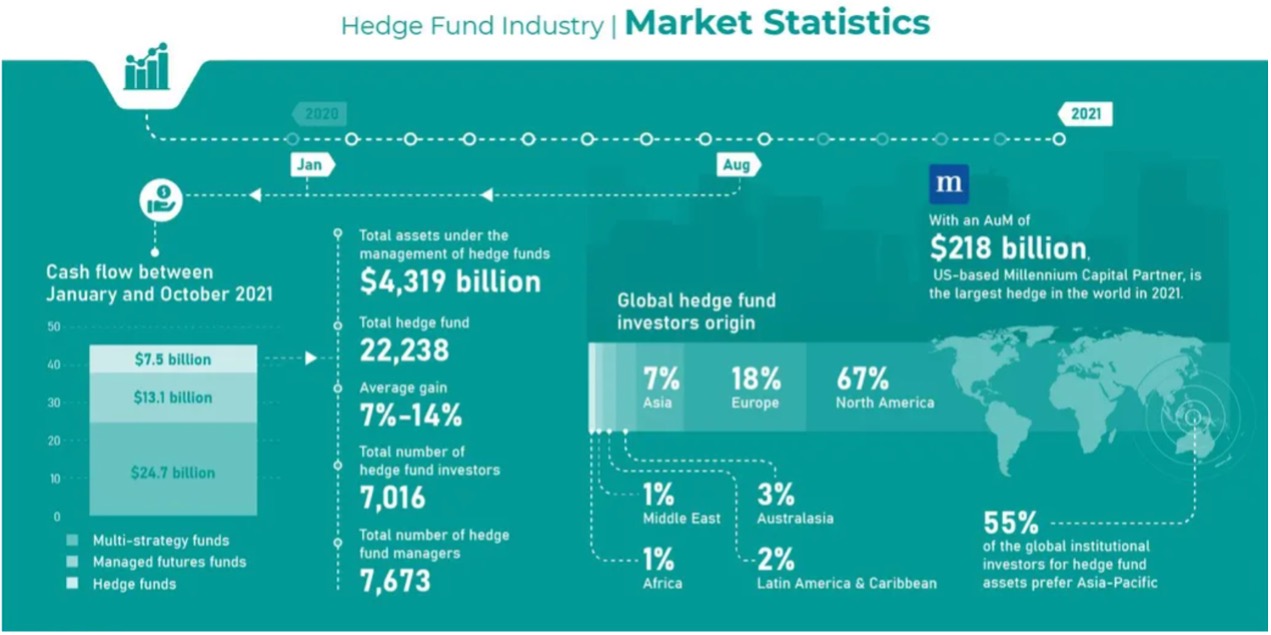

From January 2021 to October 2021, cash flows worth $24.7 billion flowed into multi strategy funds.

From January 2021 to October 2021, $13.1 billion worth of cash flowed into the managed futures fund.

In 2021, cash worth $2.95 billion and $2.34 billion flowed into European and Asian funds, respectively.

The total outflow of long/short equity funds in 2021 was $12.6 billion.

The total number of hedge fund investors as of the end of the third quarter of 2021 was 7016.

The total number of hedge fund managers as of the end of the third quarter of 2021 was 7673.

As of the end of the third quarter of 2021, the total number of hedge funds was 22238.

As of the end of the third quarter of 2021, the total assets managed by hedge funds were $4319 billion.

As of the end of the third quarter of 2021, the Asia Pacific region managed $174 billion in hedge fund assets.

The total amount of funds flowing into hedge funds in the third quarter of 2021 was $7.5 billion.

Hedge funds received a return of 0.21% in the third quarter of 2021.

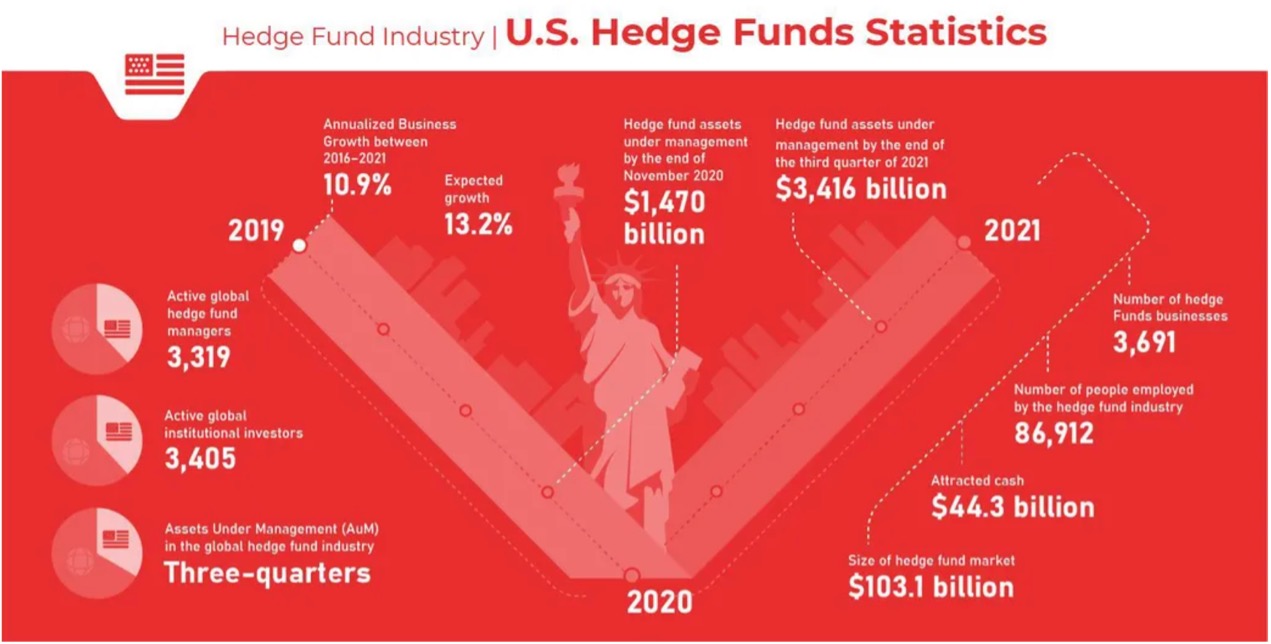

The revenue of the hedge fund industry is expected to grow by 13.2% in 2021.

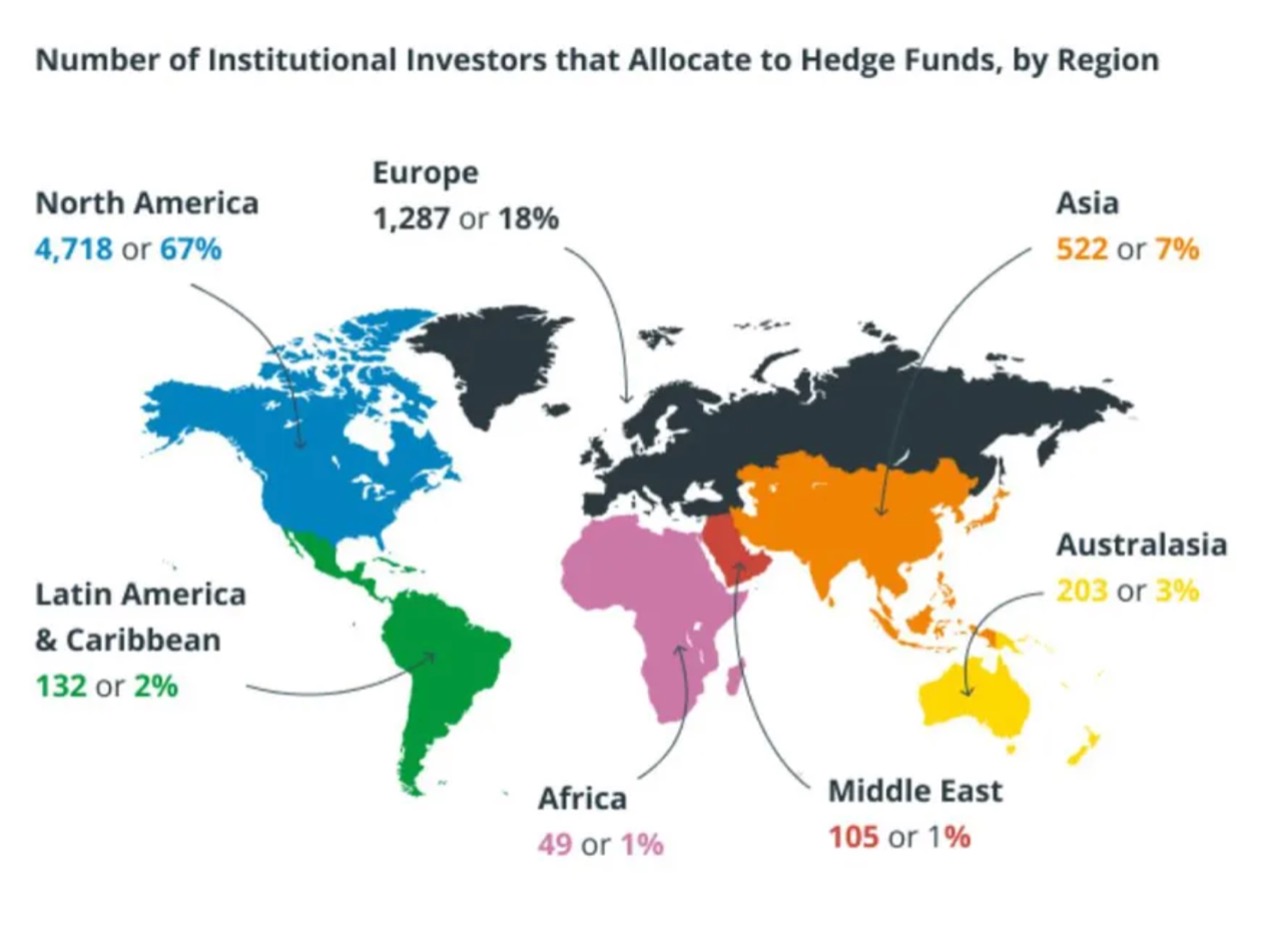

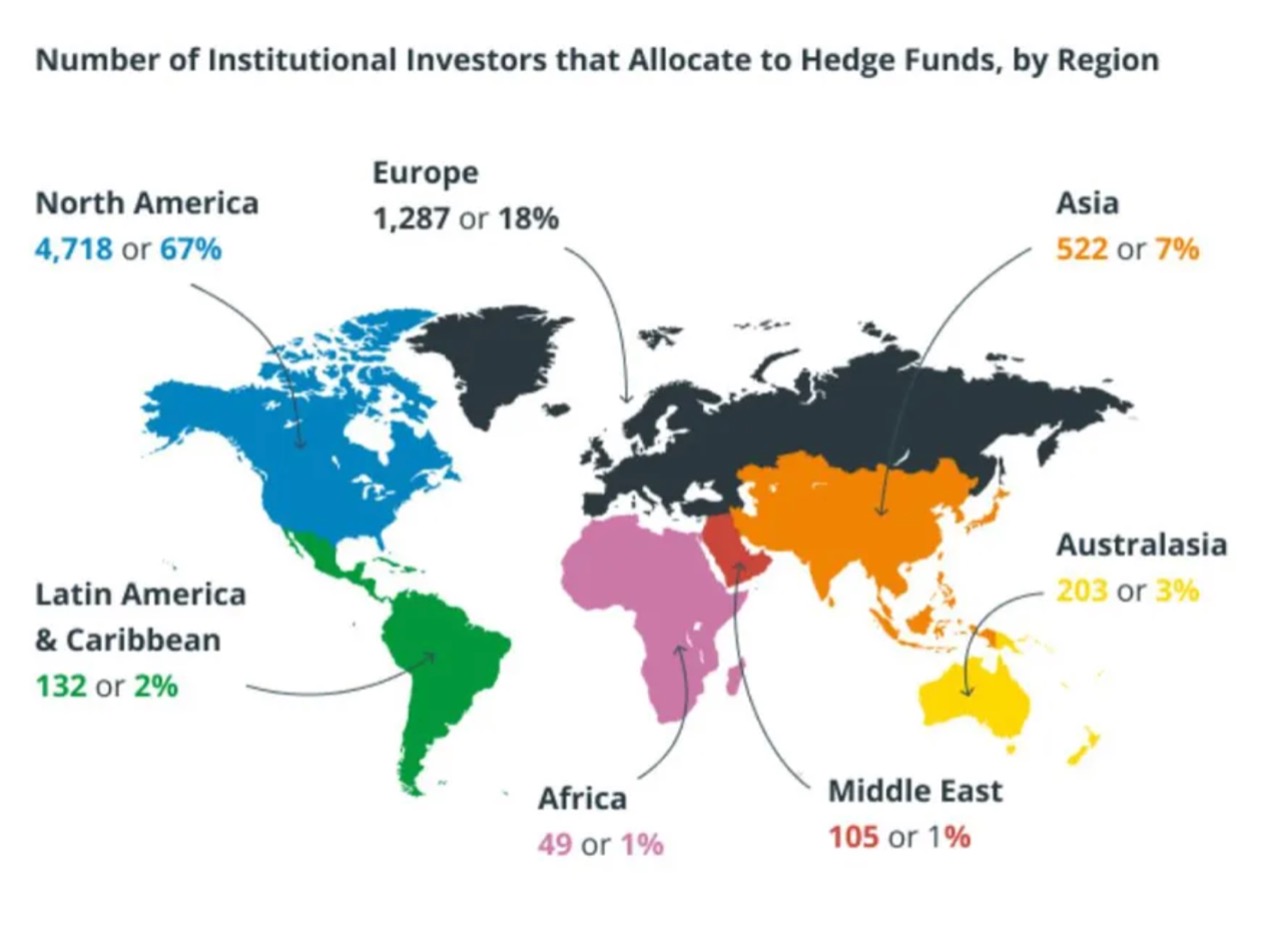

In the third quarter of 2021, 67% of hedge fund investors worldwide came from North America.

In the third quarter of 2021, 18% of hedge fund investors worldwide came from Europe.

In the third quarter of 2021, 7% of global hedge fund investors came from Asia.

In the third quarter of 2021, 2% of global hedge fund investors came from Latin America and the Caribbean region.

In the third quarter of 2021, 3% of global hedge fund investors are from Australasia.

In the third quarter of 2021, 1% of global hedge fund investors came from Africa.

1% of global hedge fund investors in the third quarter of 2021 came from the Middle East.

Millennium Capital Partner, headquartered in the United States, has $218 billion in assets under management and is the world's largest hedging company in 2021.

Huili Group Limited, headquartered in Hong Kong, has $216.314 billion in asset management and is the world's second largest hedge fund in 2021.

Fortress Investment Group, headquartered in the United States, has $110.894 billion in assets under management and is the world's third largest hedge fund in 2021.

Capula Investment Management, headquartered in London, has assets under management of $105.951 billion, which is 2021The world's fifth largest hedge fund in.

Over the past three years, the total outflow of funds from hedge funds has been approximately $140 billion.

As of November 2019, investors had withdrawn $82 billion from hedge funds.

In 2019, only 529 hedge funds were launched, compared to 1169 in 2018.

Due to the number of liquidations exceeding the number of new funds, the number of active funds in the industry has been reduced to 16256.

In 2019, the largest participant in the hedge fund industry was Bridgewater Associates, with assets under management of $162.9 billion.

According to a survey by Credit Suisse Group, 55% of global hedge fund asset institutional investors prefer the Asia Pacific region.

A study by Credit Suisse Group shows that 2% of international institutional investors in hedge fund assets prefer North America.

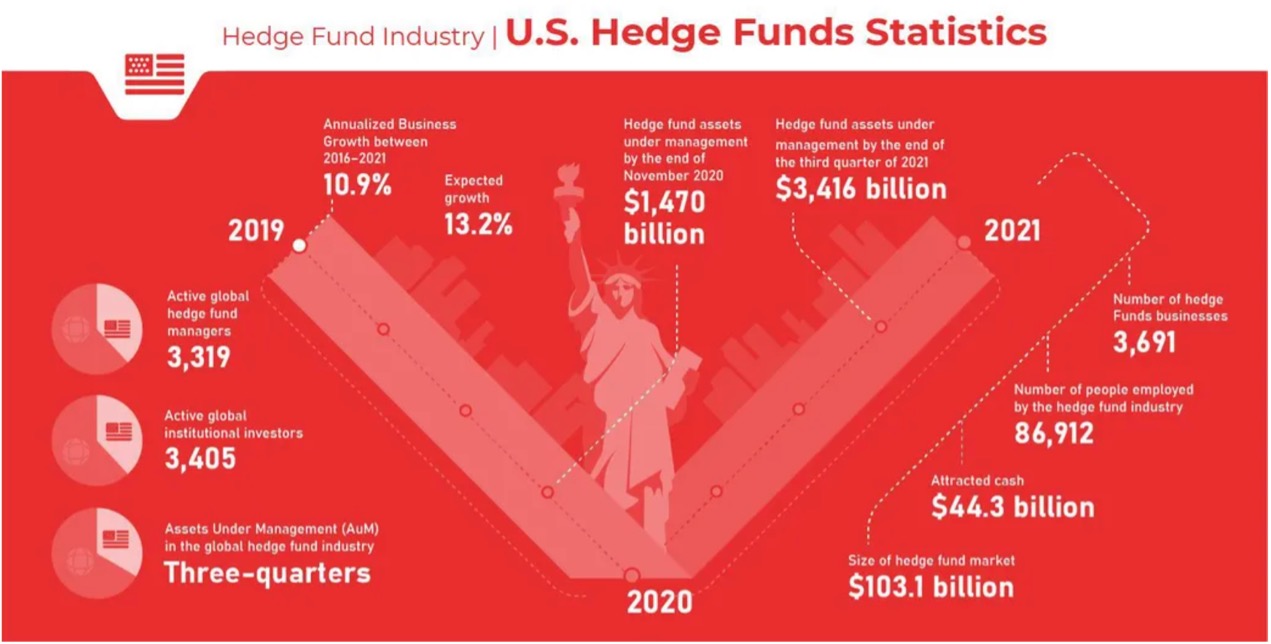

The size of the US hedge fund market is $103.1 billion.

The number of employees in the US hedge fund industry in 2021 was 86912.

The expected growth of the US hedge fund business in 2021 is 13.2%.

The annualized business growth of hedge funds in the United States between 2016 and 2021 was 10.9%.

As of 2021, there were 3691 hedge fund businesses in the United States, an increase of 2.8% compared to 2020.

In 2019, the United States accounted for three-quarters of the global hedge fund industry's managed assets (AuM).

Of the 5523 global institutional investors active in hedge funds in 2019, 3405 were in the United States.

In 2019, among 5383 active global hedge fund managers, 3319 were in the United States.

US hedge funds attracted $44.3 billion worth of funds in 2021.

As of the end of the third quarter of 2021, North America managed $3416 billion worth of hedge fund assets.

As of November 2020, North America managed hedge fund assets worth $1.47 trillion.

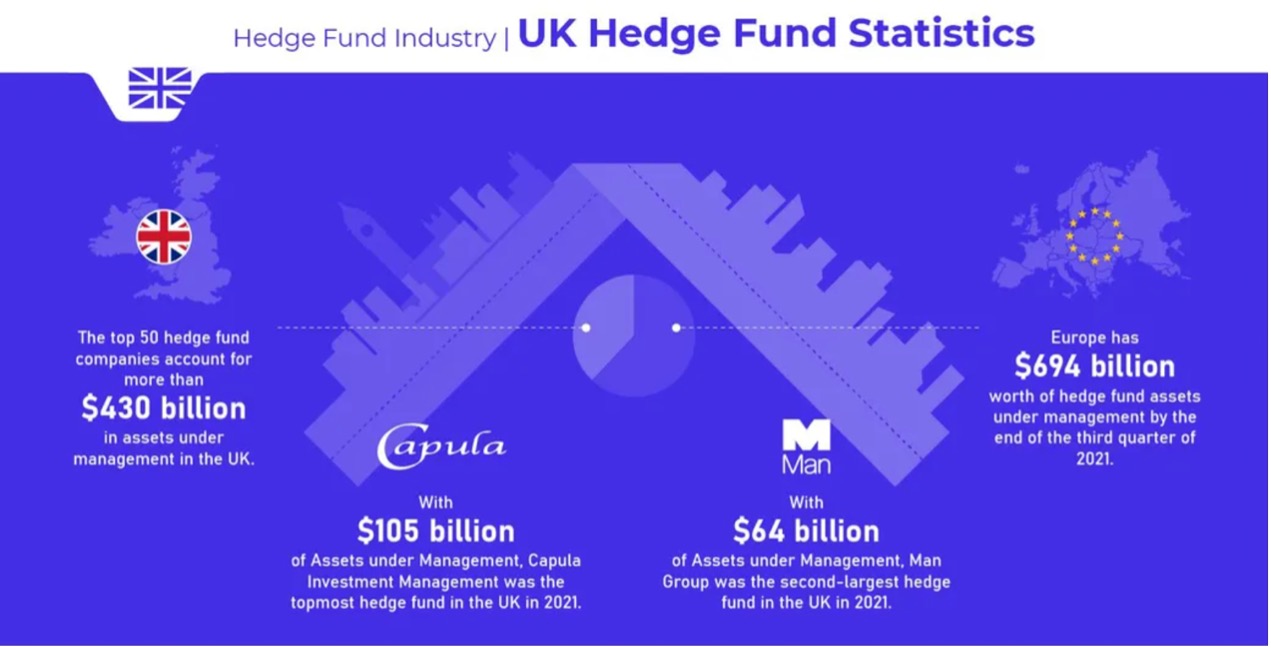

UK Hedge Fund Statistics

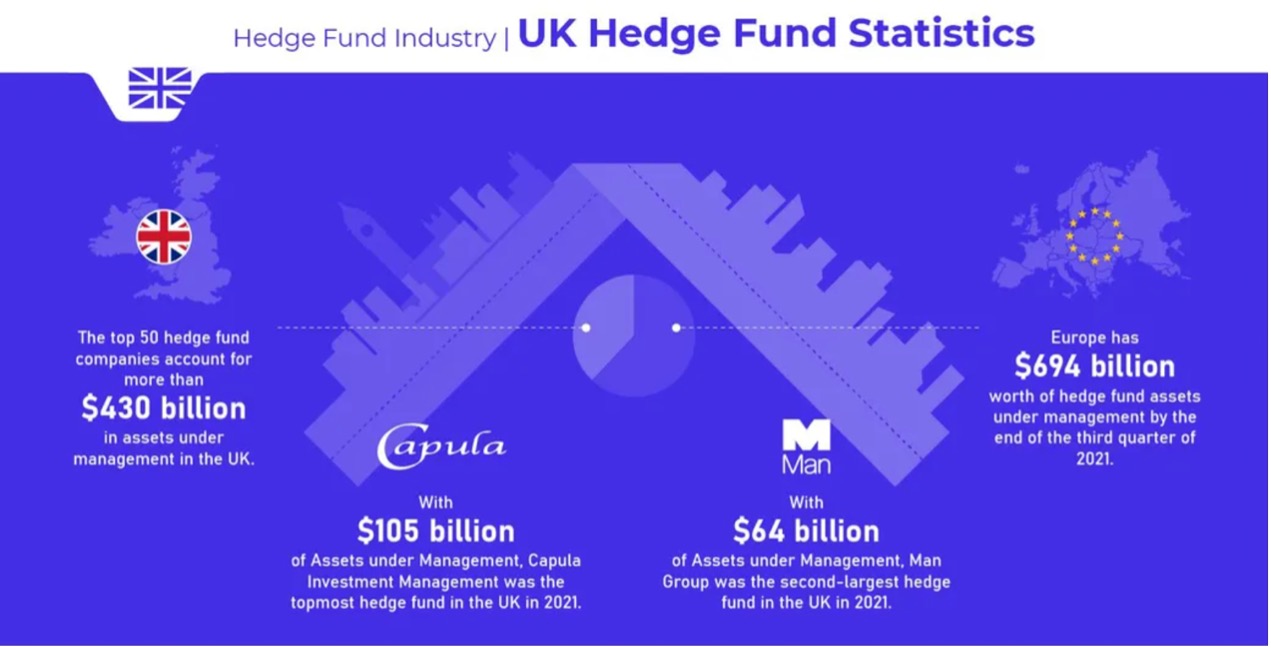

The top 50 hedge fund companies in the UK manage over $430 billion in assets.

Capula Investment Management manages $105 billion in assets and is the largest hedge fund in the UK in 2021.

Man Group manages $64 billion in assets and is the second largest hedge fund in the UK in 2021.

As of the end of the third quarter of 2021, Europe is managing hedge fund assets worth $694 billion.

Hedge fund statistics from other regions of the world

Pictet Alternative Investments, headquartered in Geneva, owns 317.15With $100 million in managed assets, it is the largest hedge fund in other parts of Europe.

Danske Capital, headquartered in Copenhagen, has $15 billion in managed assets and is the second largest hedge fund in other parts of Europe.

Brummer and Partners, headquartered in Stockholm, has $14.2 billion in managed assets and is the third largest hedge fund in the rest of Europe.

By the end of the third quarter of 2021, hedge fund assets managed in other regions of the world were worth $35 billion.

The total outflow of funds from emerging market funds in 2021 was $4.86 billion.

Hedge Fund Performance Statistics

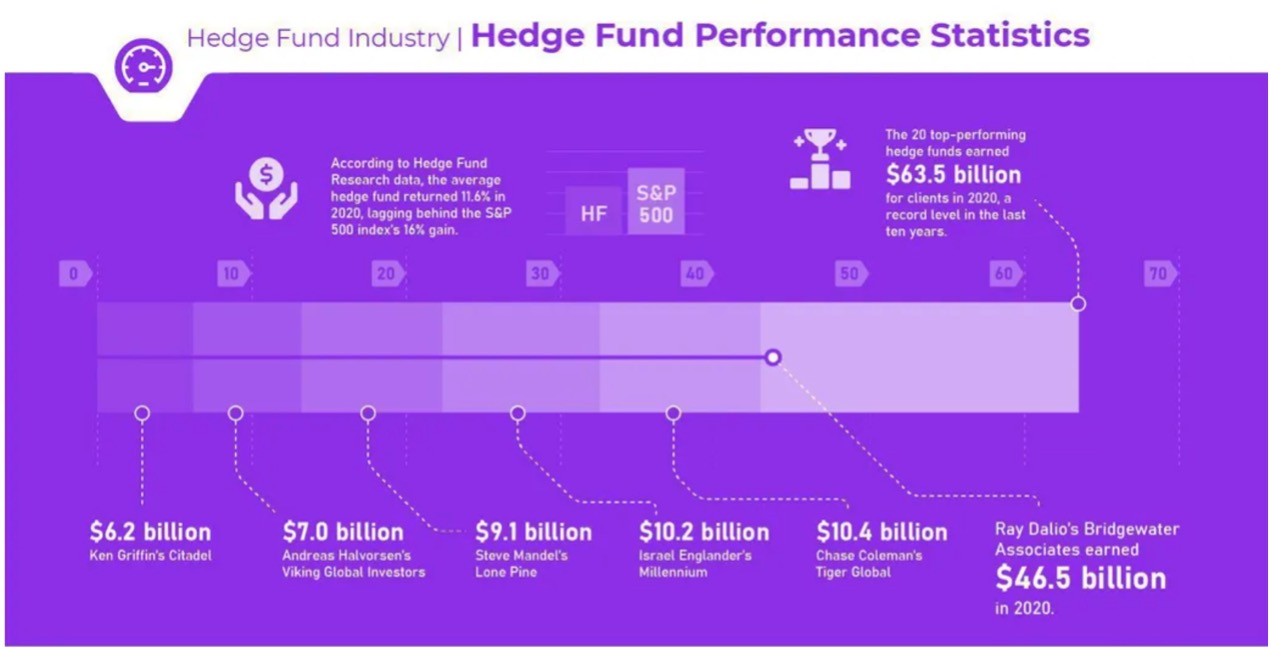

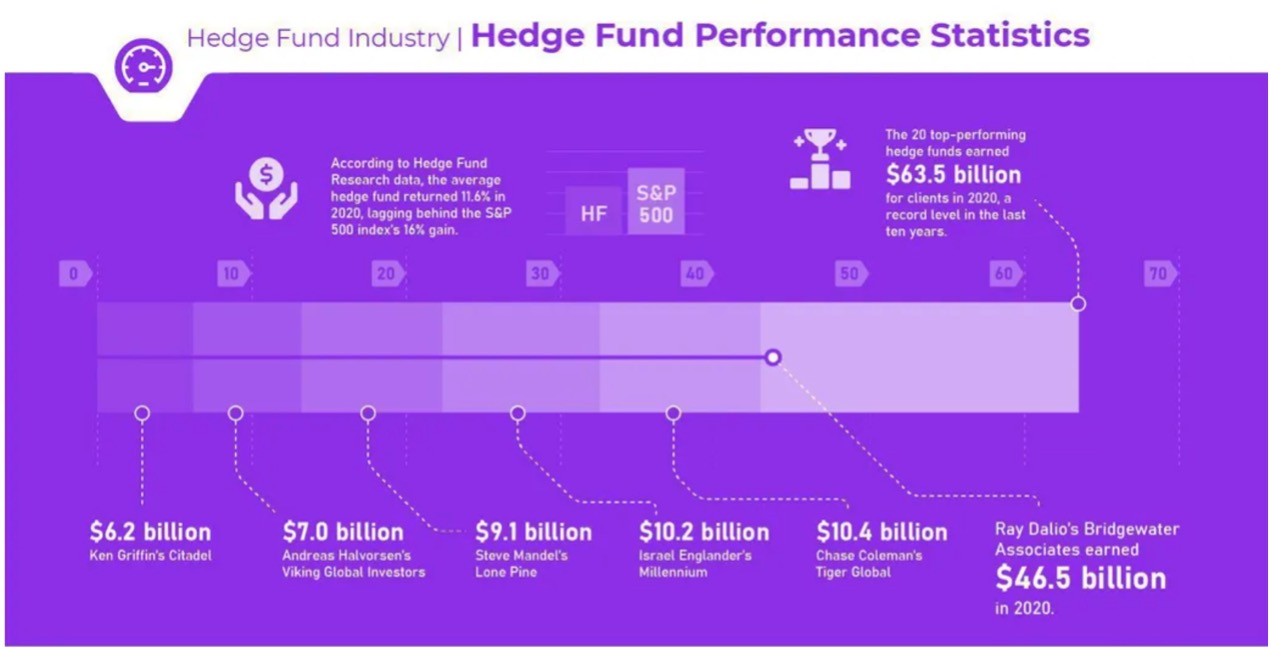

The 20 best performing hedge funds earned $63.5 billion for clients in 2020, setting a new high in the past decade.

According to hedge fund research data, the average return of hedge funds in 2020 was 11.6%, lower than the 16% increase in the S&P 500 Index.

Chase Coleman's Tiger Global earned $10.4 billion in 2020.

Steve Mandel's Lone Pine earned $9.1 billion in 2020.

Andreas Halvorsen's Viking Global Investors earned $7 billion in 2020.

Ken Griffin's Citadel earned $6.2 billion in 2020.

Ray Dalio's Bridgewater Associates earned $46.5 billion in 2020.

The hedge fund industry has a wider range of job categories, such as investment, trading, risk management, marketing, accounting, legal and compliance, and support and management. Except for the last two, everyone else is a financial player in a hedge fund.

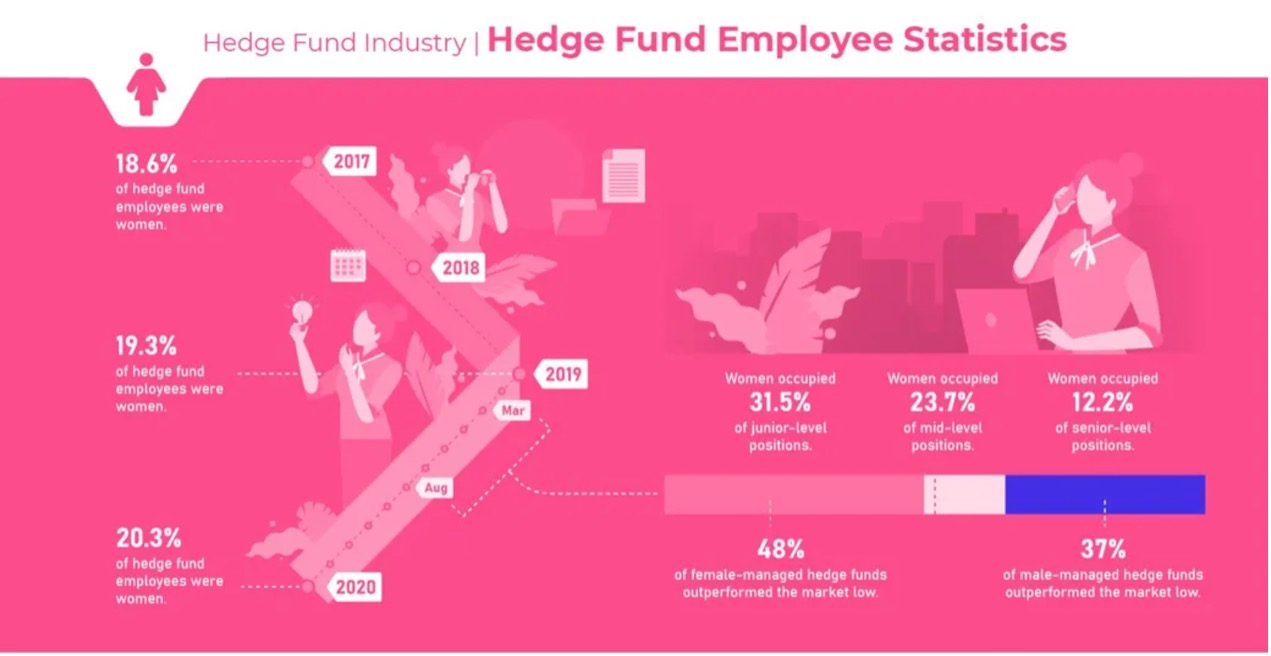

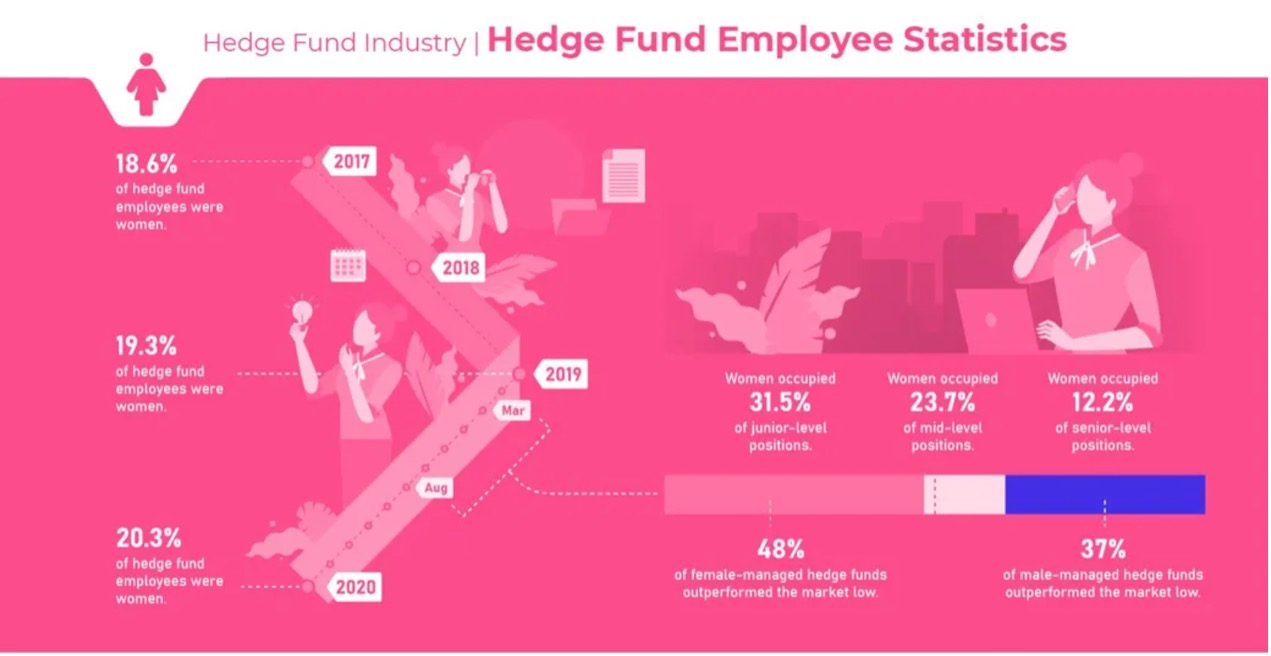

During this period, the proportion of women in hedge funds has increased, with most investor relationship roles held by women. According to Prequin, since 2017Since then, the number of female employees in Asian hedge funds has exceeded that of North America or Europe.

In 2020, 20.3% of hedge fund employees were women.

In February 2019, 19.3% of hedge fund employees were women.

In October 2017, 18.6% of hedge fund employees were women.

In 2020, women held 31.5% of entry-level positions in hedge fund companies.

In 2020, women accounted for 23.7% of middle-level positions in hedge fund companies.

In 2020, women accounted for 12.2% of senior positions in hedge fund companies.

48% of hedge funds managed by women outperformed the market low point of Goldman Sachs between March and August 2020.

Between March and August 2020, 37% of male managed hedge funds outperformed the market's low point, Goldman Sachs.

Hedge fund manager statistics

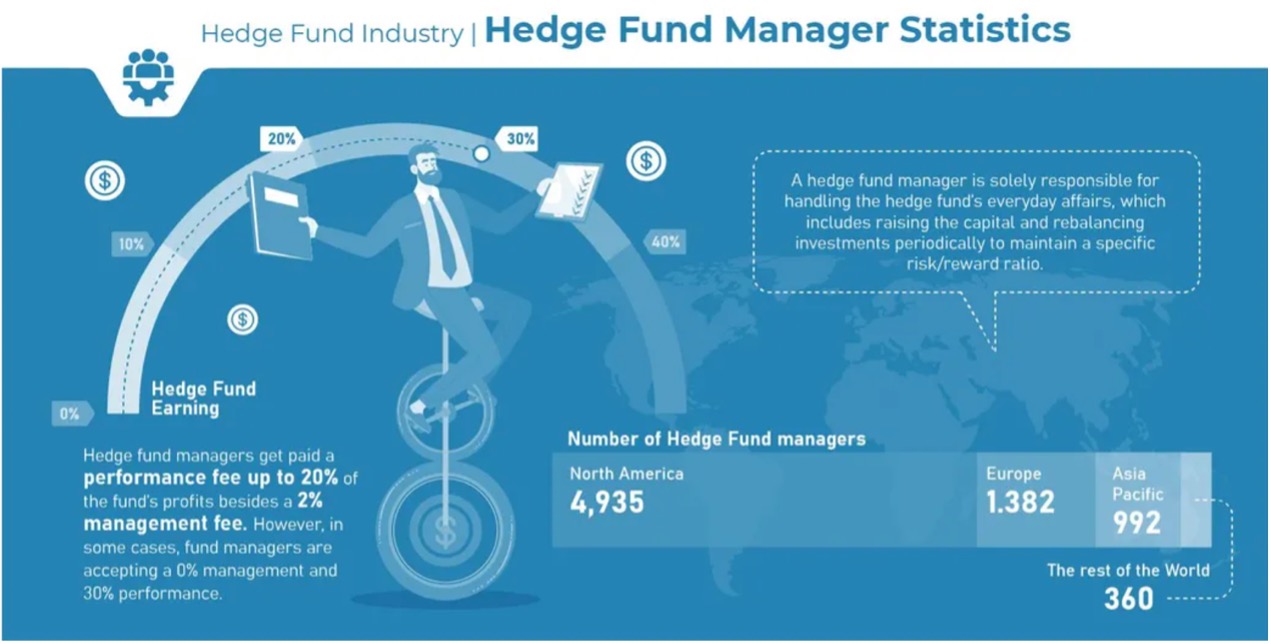

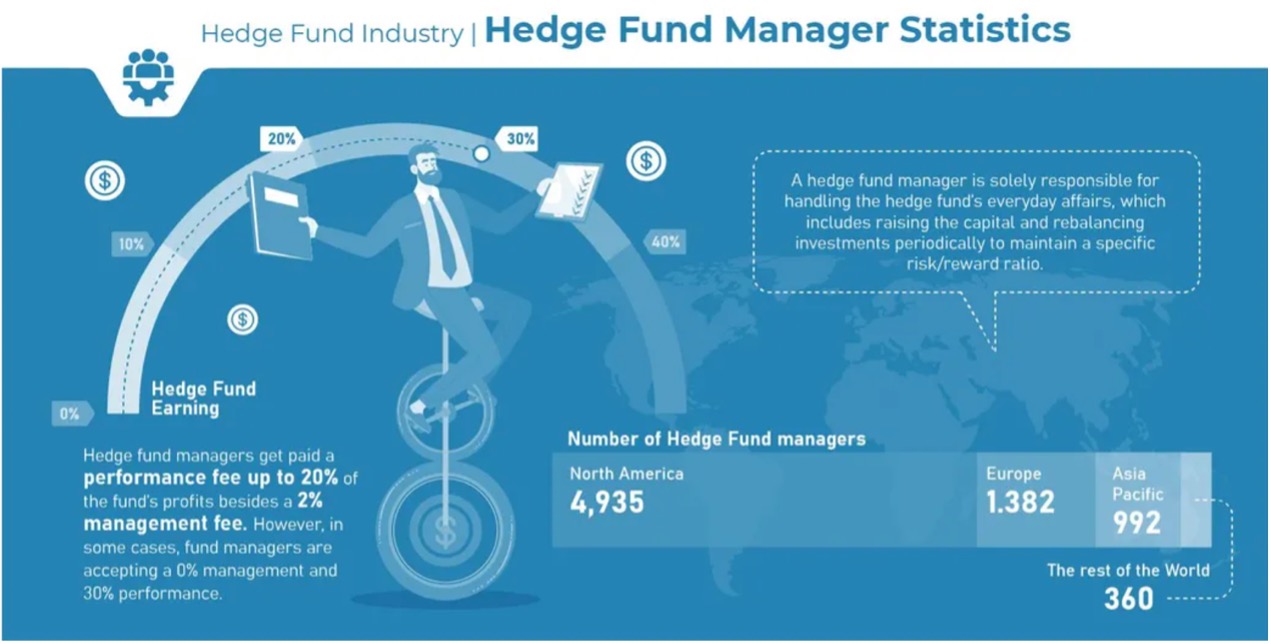

Hedge fund managers are fully responsible for handling the daily affairs of hedge funds, including regularly raising funds and rebalancing investments to maintain specific risk/return rates.

Hedge fund managers typically earn considerable income. They receive performance fees as rewards, with a maximum of 20% of the fund's profits in addition to a 2% management fee. However, in some cases, fund managers accept 0% management and30% performance, instead of the traditional 2-20 fee structure.

Not all hedge fund managers have the same income, as the above interest rates are approximate and vary depending on the situation.

There are 4935 hedge fund managers in North America.

There are 1382 hedge fund managers in Europe.

There are 992 hedge fund managers in the Asia Pacific region.

There are 360 hedge fund managers in other regions of the world.

Jim Simons of Renaissance Technologies has a net asset of $24.4 billion, which is Forbes 400The wealthiest hedge fund manager in the strong.

Ray Dalio of Bridgewater Associates has a net asset of $20 billion and is the second wealthiest hedge fund manager among the Forbes 400.

Hedge Fund Capital Statistics

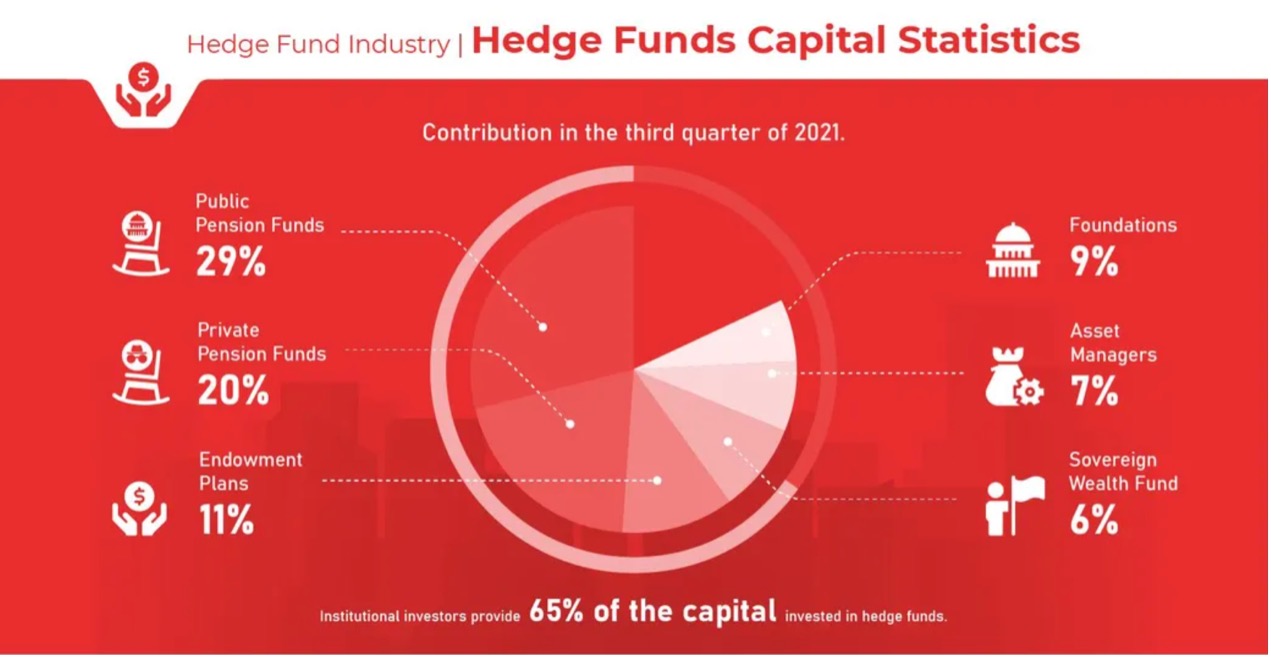

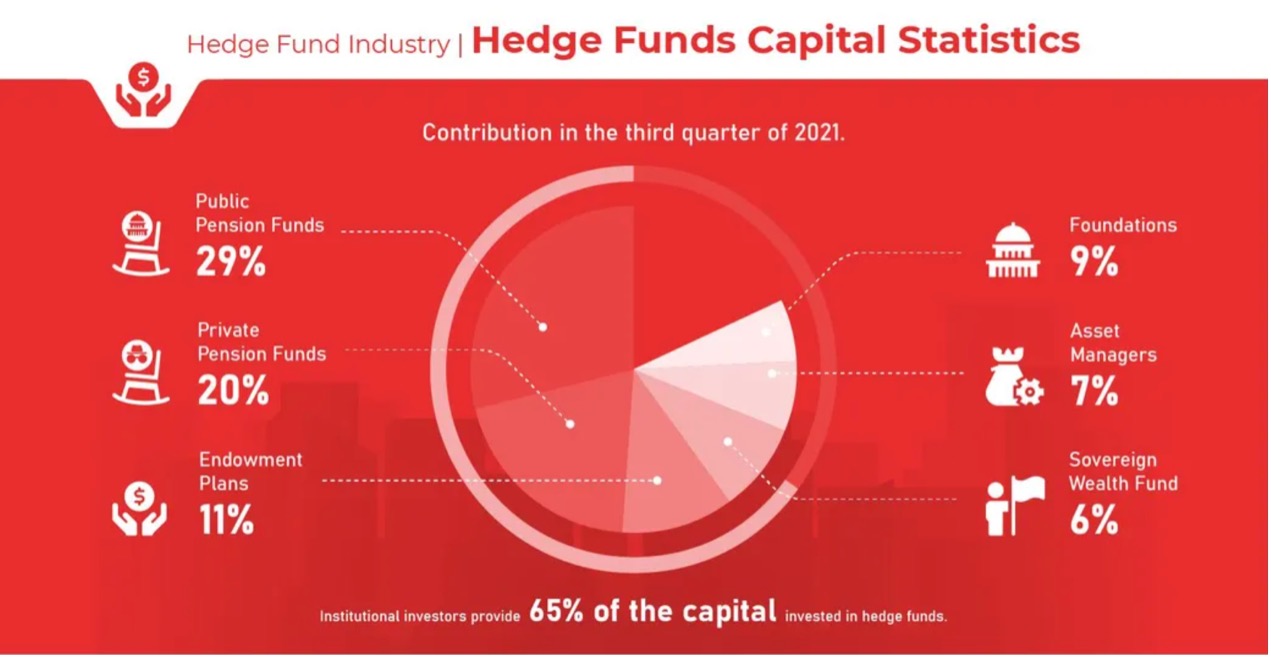

Hedge funds typically have greater risk than most other investments and require a significant amount of capital. That's why the main investors of hedge funds are institutional investors, who are professionals who manage large amounts of funds. Institutional investors provide hedge fund investments65%.

Public pension funds contributed 29% of hedge fund capital in the third quarter of 2021.

Private pension funds contributed 20% of hedge fund capital in the third quarter of 2021.

The donation program contributed 11% of hedge fund capital in the third quarter of 2021.

The foundation contributed 9% of hedge fund capital in the third quarter of 2021.

Asset management companies contributed 7% of hedge fund capital in the third quarter of 2021.

Sovereign Wealth Fund contributed 6% of hedge fund capital in the third quarter of 2021.

Hedge funds and digital assets

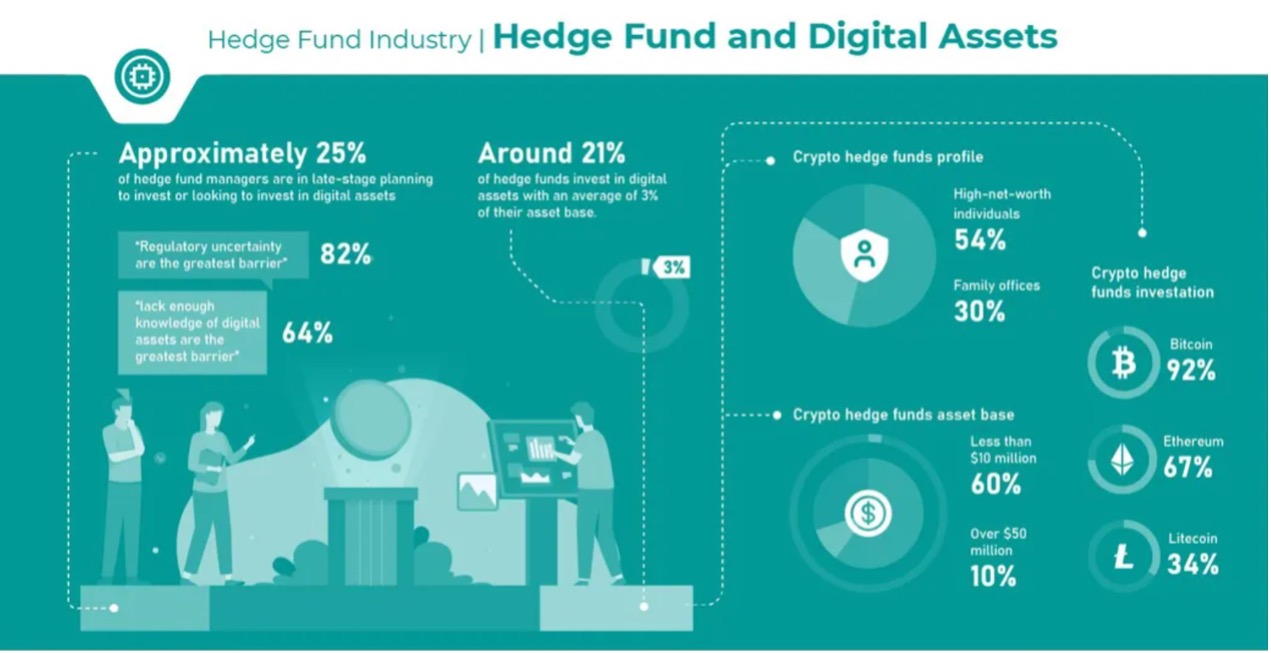

Hedge funds are increasing their allocation of digital assets. These assets include cryptocurrency, blockchain, and DeFi technology. In some cases, it may also have irreplaceable tokens (NFTs). AIMACEO Jack Inglis stated that diversification and exposure to new value driven assets may be key reasons for investing in digital assets.

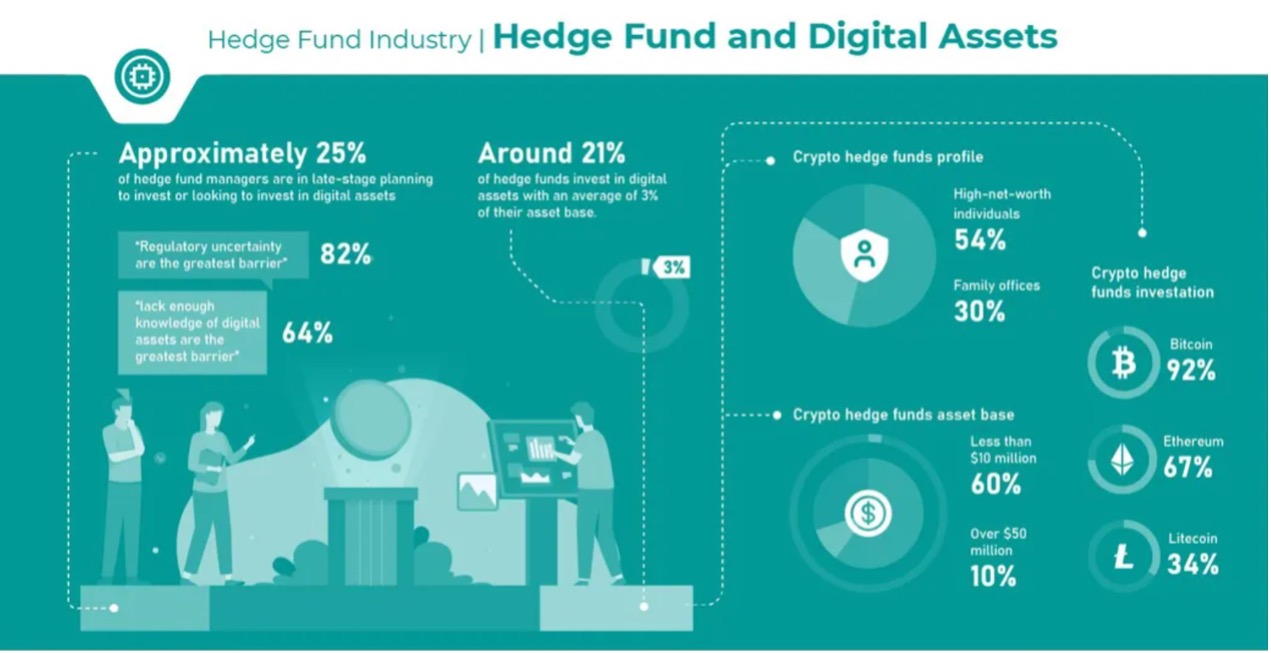

Approximately 21% of hedge funds invest in digital assets, accounting for an average of 3% of their asset base.

About 25% of hedge fund managers are in the later stages of planning or seeking to invest in digital assets.

82% of respondents believe that the main obstacle to investment, regulatory uncertainty, is the biggest obstacle.

64% of respondents stated that they lack sufficient understanding of digital assets.

As of October 2020, the total assets managed by crypto hedge funds reached $6.6 billion.

In 2019, there were a total of 150 active crypto hedge funds managing a $1 billion asset base. This does not include crypto Index Funds and crypto venture capital funds.

More than 60% of crypto hedge funds have an asset base of less than $10 million.

Less than 10% of crypto hedge funds manage assets exceeding $50 million.

54% of Crypto Hedge Funds investors are high net worth individuals, while 30% are family offices.

In 2020, 92% of crypto hedge funds invested in Bitcoin.

In 2020, 67% of crypto hedge funds invested in Ethereum.

In 2020, 34% of crypto hedge funds will invest in Litecoin.

In 2020, 34% of crypto hedge funds were registered in the Cayman Islands.

In 2020, 33% of crypto hedge funds were registered in the United States.

In 2020, 9% of crypto hedge funds were registered in Gibraltar.