What Is a Double Bottom Pattern?

A double bottom pattern is a technical analysis chart formation that signals a potential reversal from a downtrend to an uptrend.

It occurs when the price of a security or index drops to a certain level, rebounds, and then declines again to approximately the same level before making another recovery.

The double bottom pattern resembles the letter "W", with the two low points forming a significant support level. If the price holds at these lows and then begins to rise, it suggests the potential for an uptrend.

Understanding the Structure of the Double Bottom Pattern

As mentioned above, the double bottom pattern consists of three key components that define its structure: two distinct lows (initial downtrend and retest of support), an intermediate high (neckline), and a breakout. It visually resembles the letter "W" and signals a potential reversal from a downtrend to an uptrend.

The double bottom pattern always follows a downtrend and consists of two distinct troughs separated by an intermediate peak. For example, the two bottoms form a strong support zone where demand is higher than supply, preventing further decline.

If the price breaks above the intermediate peak (the high between the two lows), it confirms a potential trend reversal.

History of the Double Bottom Pattern

The double bottom pattern has been a fundamental part of technical analysis for over a century. It was first widely recognised and documented by Charles Dow, the father of Dow Theory, in the late 19th and early 20th centuries.

Over time, early traders and analysts, including Richard W. Schabacker and later Edwards & Magee, refined Dow's work, identifying repeating formations in stock price movements. By the mid-20th century, the double bottom pattern was fully integrated into classical charting techniques, appearing in books as a reliable reversal pattern.

As we dwell on the rise of computerised trading and quantitative analysis in the late 20th century, traders could analyse massive amounts of historical price data. It allowed the testing of double bottom patterns across different markets, asset classes, and timeframes with apparent effectiveness in stocks, commodities, and forex.

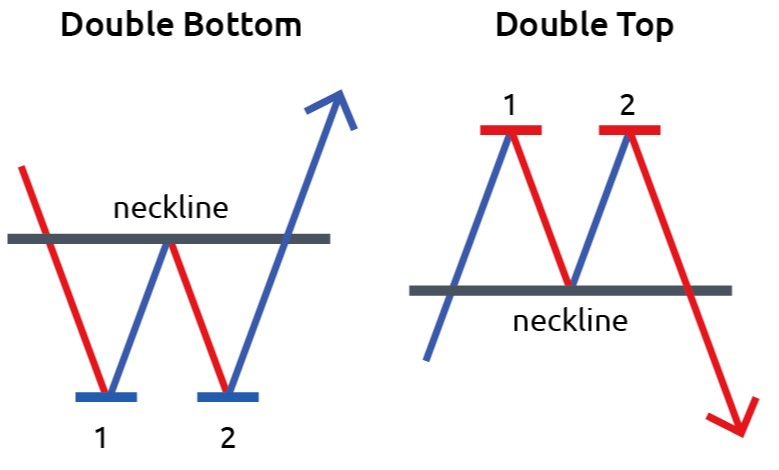

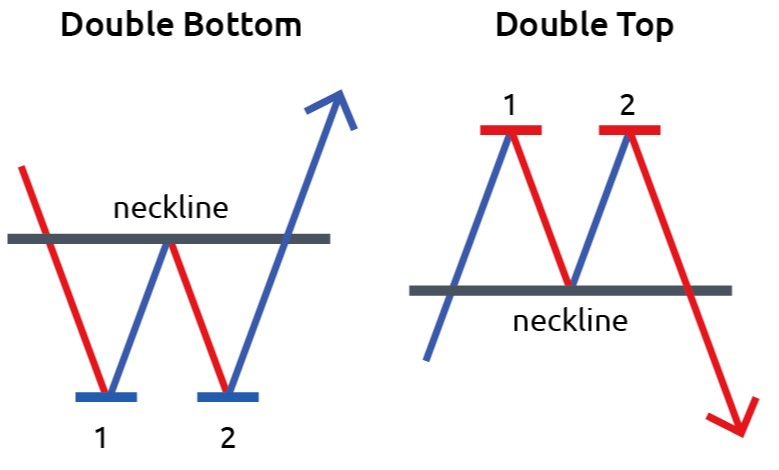

Double Bottom vs Double Top

A double bottom is the opposite of a double top pattern. While the double bottom signals a bullish reversal, the double top indicates a bearish reversal.

Feature

|

Double Bottom |

Double Top |

Shape

|

"W" |

"M" |

| Trend Reversal |

Downtrend > Uptrend |

Uptrend > Downtrend |

| Entry Point |

Break above neckline |

Break below neckline

|

Please refer to our double top pattern article for additional information.

How to Trade Double Bottom Pattern

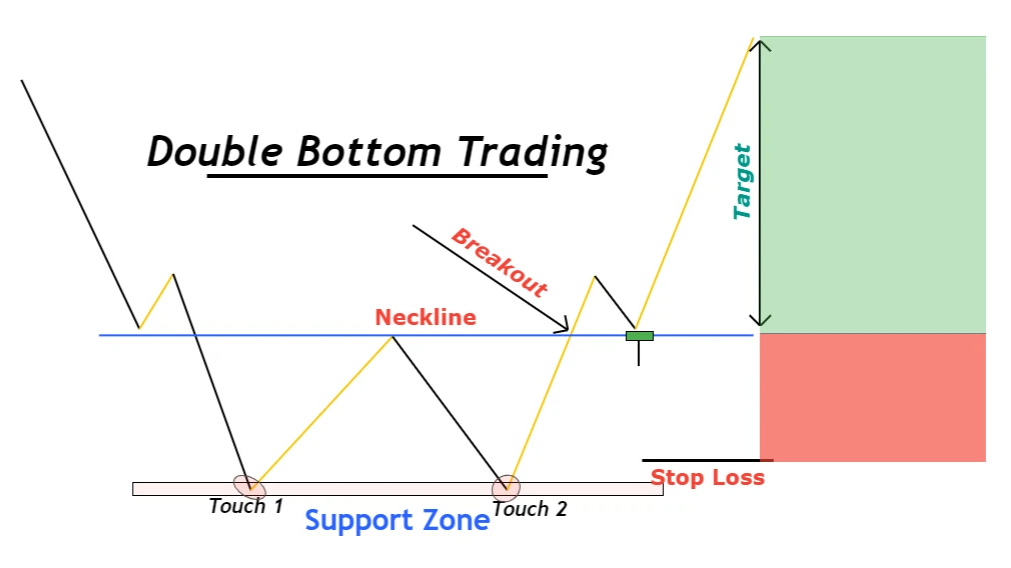

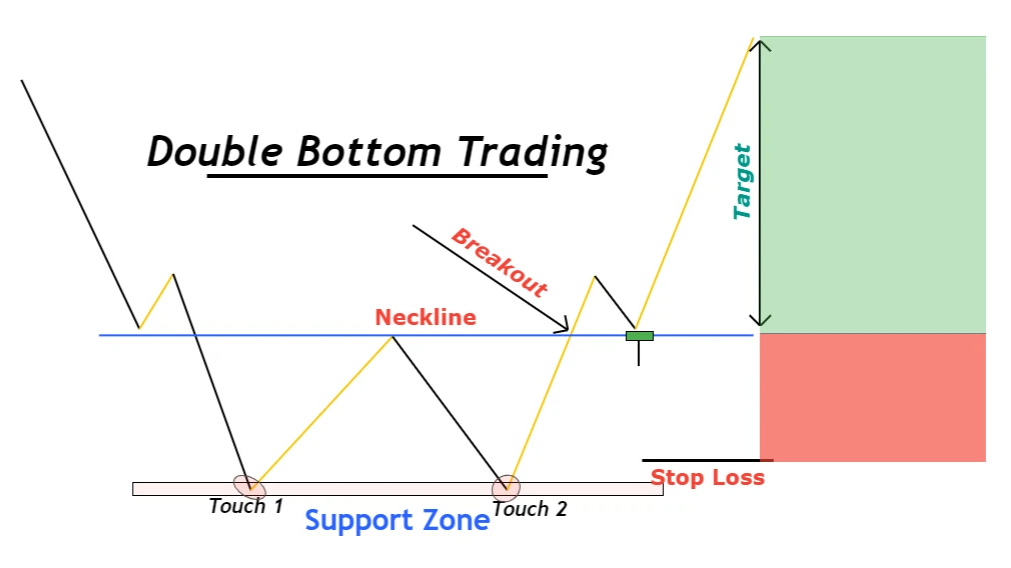

Traders use the double bottom pattern to identify potential entry points for long positions. The strategy involves:

Confirmation of the Pattern: A valid pattern requires the second bottom to be within 3% to 4% of the first bottom.

Breakout Entry: Once the price surpasses the intermediate peak (the middle of the "W"), a breakout occurs, which signals a buying opportunity.

Stop-Loss Placement: Setting a stop-loss slightly below the second bottom helps manage risk.

Profit Targets: A conservative target equals the distance between the two lows and the intermediate peak. More aggressive traders aim for a price movement twice this distance.

Timeframe Considerations: The longer the duration between the two lows, the more reliable the pattern is. A pattern that develops over weeks or months carries greater significance than one forming in just a few hours.

Real-World Example of Trading the Double Bottom Pattern

A historical case of the double bottom pattern occurred with Advanced Micro Devices (AMD).

The stock formed two significant lows within 3% to 4% of each other, followed by a bullish rebound. Then, the price broke above the neckline with increased volume, confirming the reversal.

It resulted in a rally of nearly 10%, illustrating the pattern's predictive power when correctly identified.

Double Bottom pattern trading Is a Test of Patience

The double bottom pattern is a strong bullish reversal signal, but success depends on proper identification, confirmation, and risk management. Many traders rush into trades too early or exit too soon out of fear, but the best double bottom trades come from patience and disciplined execution.

Tips for A Successful Trade

Identify a Clear Downtrend First: Ensure the stock or forex pair is in a clear downtrend before the double bottom forms.

Use Volume as a Confirmation Tool: A valid double bottom breakout should follow a strong volume. If it is low, the breakout may lack strength and fail.

Use Longer Timeframes for Accuracy: Double bottoms in daily and weekly charts are more reliable than those in short-term (hourly) charts due to reduced noise and stronger trend shifts.

Manage Risk with Proper Position Sizing: Never risk too much on a single trade. Professional traders use the 1-2% rule, meaning they risk only 1-2% of their total capital on a single trade.

Parting Notes

The double bottom pattern is a powerful tool in technical analysis, signalling potential trend reversals when properly identified and confirmed.

While it provides significant profit opportunities, traders should combine technical and fundamental analysis while using appropriate risk management strategies to maximise success and avoid pitfalls.

By understanding the nuances of this pattern, investors can make informed decisions and capitalise on emerging bullish trends.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.