Novice traders are often repeatedly defeated due to not establishing their own rational understanding of the market and their own trading logic. However, the dilemma for deep trading players lies in overemphasizing algorithm design and reliance on trading technology analysis, while neglecting the limitations of dynamic equilibrium and quantitative analysis in trading.

How to find the best state in a transaction? EBC Finance takes you into the world of diverse traders around the world, reexamining trading with a speculative spirit.

The author shared today is Steve RoehlingA professional system developer and software engineer. The development of trading systems is his research and interest, including the technical and psychological aspects of system development.

SteveRoehling tells us that traders can find their own niche market through specific systems, but they need to have a quantifiable strategy, a complete and balanced overall trading system, and good psychological qualities.

The following are trading insights from Steve Roehling. After patiently reading them, you will definitely gain something.

My professional background is system development and software engineering. Over the years, I have accumulated experience in writing computer models, developing large-scale systems, and analyzing big datasets.

When I first started trading a few years ago, this engineering background gave me transferable skills to test and validate trading strategies. For example, using NinjaTrader and AmibrokerProgramming and backtesting strategies using tools such as.

However, it took me several years to understand and identify higher-level concerns in trading, such as market dynamics, supply and demand, and trading psychology. These usually require continuous research to discover new trading concepts or improve existing strategies.

I strongly agree that traders are an indispensable part of the entire system. Even if traders completely adopt automated systems for execution, they will at least develop some custom workflows around the system. In this regard, there is always room for further development in the system to accommodate individual traders.

In addition, if traders do not have the correct skills, discipline, or psychology to effectively execute the system, an otherwise profitable system may fail; In other words, traders may also be the weakest link in the system.

Don't overly focus on algorithm design and technical analysis

Based on my own experience and background, I initially tended to focus too much on the underlying logic of the system, but lacked a more comprehensive, top-down approach. There are several drawbacks to developing overly technical trading systems:

Law of the instrumentThe Law of the Tool/Hammer is a form of cognitive bias: excessive reliance on the same tools and methods, ignoring and underestimating alternative options. There is a saying that goes, "If you have a hammer, everything you see is a nail

Especially for engineers and programmers, there is a strong tendency to view transactions as engineering, programming, or mathematical problems. When I first started trading, this was indeed the case, and I found that many programmers, engineers, or data scientists around me were almost completely focused on backtesting, machine learning, artificial intelligence, trading robots, and other aspects when researching trading.

Overuse or misuse of computerized backtesting: Backtesting is a very powerful tool, but it also has its limitations. For example, backtesting tools revolve around information that can be easily represented by computer algorithms, such as moving averages and other technical indicators. Without more advanced programming, it is difficult to incorporate fundamental analysis or other "non backtesting friendly" information.

In fact, backtesting only supports a portion of the strategies. In addition, to a certain extent, automated strategies are built on the same type of tools as backtesting, and many traders use these same tools. Trading backtesting strategies in real-time markets may lead to trading failures.

Overreliance on financial charts and technical indicators: As a retail trader, what do you first see when logging into trading websites? Usually there are some type of news feed, information about your open positions, and some basic charts with technical indicators.

I am very grateful to my agent for providing me with these tools, but I believe it will bring unexpected trading biases. Brokers generally provide tools that support the "minimum common denominator" type that can be used by all customers. I believe retail traders tend to use ready-made tools, whether they are truly effective or not.

A mature and professional trading system includes more advanced and advanced concepts, such as Confluence ConvergenceIt is the combination of multiple strategies and ideas into a complete strategy. By viewing charts with multiple indicators or overlay layers and developing different combinations of indicators to help identify trading opportunities]

The transaction catalyst [about the events that triggered the rapid and significant changes in market prices], and multiple time frames or relative intensity; These higher-level concepts can play a more important role than chart analysis and technical indicators.

Over time, I gradually approach transactions from a more creative and observational perspective. Although I appreciate the technical and analytical aspects of trading, I now view trading as an art and science.

On the limitations of backtesting, algorithmic trading and technical analysis, Michael HarrisA technical paper I once wrote also strengthened my view that trading is a creative and scientific approach.

Pay full attention to fundamentals, market dynamics, and other trading disciplines

As an engineer, I was initially happy to focus on backtesting, technical indicators, and analysis of transaction results. But it also requires perseverance, time, and experience to balance my trading with other important knowledge and skills:

Continuous learning and research:Have you ever walked into a professor's office and noticed a pile of journal articles or bookshelves filled with books? This is because professors cast a wide net and constantly learn to generate new research ideas. Continuous research and learning are also absolutely applicable to traders.

For example, traders can research and learn by reading books, listening to podcasts, watching instructional videos, participating in forums, or talking and collaborating with others. For my own trading style, some of the best ideas are actually inspired by traders trading different assets or time frames.

Understanding market fundamentals and dynamics: Traders do not necessarily need an economics degree, but having a basic theoretical understanding of market dynamics, supply and demand, and catalysts that can trigger price changes is helpful. My own background:The study of system dynamics and system thinking involves feedback loops, causality and nonlinear system behavior. In the past few years, it has been very interesting to understand how systems work in financial markets.

For example, a dynamic in the market is reflexivity, which means that demand and the resulting price changes sometimes form a self reinforcing feedback loop.

Fundamental analysis: Strategies are primarily technical in nature, and fundamental analysis can also be used to further confirm transaction settings or assist in selecting between two other similar transactions.

Transaction log: Transaction log is very important. Can capture detailed information about entry and exit, and over time, new patterns may appear in these log entries; These models can help further refine strategies or serve as the basis for new trading concepts.

General log: Separate from personal transaction logs, I keep a log that includes general observations on the market, patterns I see, trading ideas, and more. So far, I have nearly 2000Log entries. This is a very unstructured activity, but it is enough to prove that it can hone my observation ability.

Manual backtesting: Computer backtesting is very powerful, but it also has its limitations. By manual backtesting, I mean gradually browsing historical prices and other transaction related information, and visually examining this information to obtain transaction signals. Then record the results in a spreadsheet, with one row for each transaction.

Manual backtesting is a laborious process, but it is very useful for improving existing strategies or for backtesting strategies that are difficult to represent in computer algorithms. This type of backtesting can also be performed by non programmer traders.

Screen time and chart analysis: In addition to transaction logs and general logs, I categorize screen time as an important tool for honing observation skills. By screen time, I mean observing real-time markets to observe patterns, possible trading signals, etc. A major component of screen time is chart analysis; Visual inspection of price behavior and technical indicators to analyze supply and demand relationships.

A common feature of many disciplines mentioned above is the lack of automation and the need to continuously invest time in observing markets, acquiring new knowledge, and adapting to new market conditions.

Some of these activities may seem monotonous and tedious, far less intellectual stimulation than trading in real-time markets or developing new trading algorithms. Nevertheless, it is important not to avoid these important disciplines.

Finding Balance

Based on my own experience mentioned above, a common lesson I have learned is that focusing too little or too much on any element of a transaction can lead to failure. For example, traders from engineering backgrounds may focus too much on technology trading and overlook important market fundamentals or psychology. Similarly, traders from a financial background may not have the skills to test and validate their trading strategies.

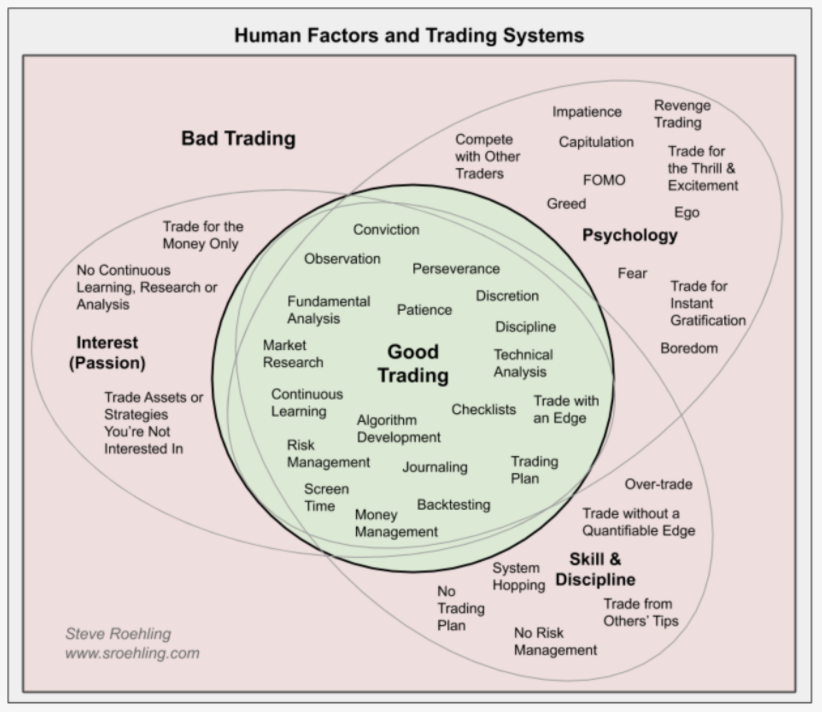

Human Factors and Trading Systems

Traders must have the correct combination of overlapping skills, disciplines, psychology, and interests in order to successfully develop and/or trade a given system. The above Venn figure symbolizes this important point.

To some extent, each element shown in the center of the Venn diagram really needs to overlap and consider the three surrounding issues. For example, the development of trading algorithms naturally requires programming skills. However, even if the resulting strategy looks good during simulation, it may still cause the system to fail. In addition, if the quality of an algorithm depends on the person who designed it, the algorithm design process requires creative investment from people with a higher level of understanding of the market.

In my opinion, psychological and interest levels are more important than the technical skills of traders. Without sustained interest, traders will not have the skills and discipline required to develop their trading system through self motivation. If there is no correct psychology, traders may be attracted by systems that are not suitable for their temperament or skill level.

For example, new traders may try to replicate the strategies of more experienced professional traders, but fail due to a lack of patience or discipline. Similarly, many new traders may be attracted by the excitement and excitement of cryptoCurrency Trading or intraday trading. In fact, this type of trading may not be suitable for the experience level, psychology, or risk tolerance of new traders.

Matching Individuals with Trading Systems

There are several methods to match individual traders with trading systems, especially:

Adapt existing systems to traders: Find an existing system that already matches your skill level, psychology, and interests. Many times, existing systems are flexible enough to be modified for individual traders. For example, the rules for exiting positions can be adjusted based on the patient level of individual traders.

However, there are some issues with this method. Firstly, people can find trading systems on books or websites, such as those based on Moving Average crossing; These are very useful for learning purposes, but without extensive modifications, these 'textbook' systems are unlikely to provide any significant advantages.

For new traders, it is also difficult to know which type of system is suitable for them; There may be some repeated experiments and system jumps to find the appropriate system.

Design a new system: The last method is to design a new system while taking into account the unique interests, skills, and psychology of traders. This is the method I ultimately adopted. Although I have adopted some building blocks from other systems, it has proven to be the best way to build the system around my core trading methods, professional interest in the market, and unique skill combinations.

This can be said to be the most difficult method, as people need a wide range of skills and knowledge to know which building blocks are included in the system.

Unfortunately, there is no clear path or fixed schedule to cultivate necessary trading skills, establish core methods, and match oneself with a suitable trading system. This challenging and frustrating development process may take several years and involve extensive trial and error. Completing this development process requires sustained interest and perseverance in the market.

What is Useful for Me?

As far as I am concerned, it took me over five years to fill the knowledge gap and develop some trading systems that are suitable for me. For me, this is a process of continuous learning, experimentation, and trial and error with different systems, as well as the issue of sticking to trading no matter what.

Over time, I have accumulated more and more knowledge and practical skills that can be applied to any trading style. The same accumulation of knowledge provides me with a knowledge foundation from which I can draw ideas for developing new systems or improving existing systems.

In order to develop strategies, I selected from many sources. I have some core methodologies that will affect the types of trading strategies I set, including those based on momentum and volatility. Some of the building blocks of my strategy come from my own observations.

Although I try to be systematic, I maintain an open attitude. My trading strategy has a relatively strict process. However, my process is not fully automated, including manual checklists and a somewhat disconnected set of tracking spreadsheets, scripts, filtering tools, and chart packages.

I believe that 'observational power' can search for new and unique market models, correlations, catalysts, etc. Diary and screen time play an important role here. This includes some methods that help me observe new patterns, find new trading ideas, and think about improving existing strategies.

Quantitative analysis is part of my trading system development process, including backtesting (automatic and manual) and algorithm development. My system includes some technical analysis; I even developed some technical indicators myself, including momentum and oscillation indicators based on volatility.

However, ultimately, I believe that price itself is the ultimate technical indicator and the most direct manifestation of supply and demand. In this regard, I believe it is wrong to use technical indicators or trading algorithms that are far from the price itself.

I won't spend a lot of time conducting fundamental analysis, but I will closely monitor the company's financial statements to understand information on revenue growth or potential danger signals.

Another field that I have been delving into is psychology, especially studying how to be more patient. I use multiple strategies to become more patient, but this is an ongoing task. When I first started trading, I didn't realize that psychological factors were an important factor. I now believe that psychology is an indispensable part of the success or failure of the entire trading system.

For many years, I have maintained a strong interest in the market. This gives me the self motivation to constantly learn and discover new ideas. This also gave me some perseverance, even though the transaction itself did not gain much attraction. I believe that my skills and discipline are sufficient to meet my current trading style, but this is also an ongoing task.

Treat Trading Systems as Recipes

To connect these concepts together, people can consider trading systems as recipes. The recipe includes each ingredient, quantity, or portion size, as well as a step-by-step procedure for preparing the recipe. Furthermore, traders and chefs are no different. Almost anyone can learn how to follow a recipe, but the chef knows how to balance the ingredients of the recipe and mix and match the correct ingredients to create a new recipe.

Similarly, trading systems have any number of elements or components. The list of elements and their relative importance vary depending on the trading system. Compared to food recipes, the error margin of the trading system is very small. If a trading system lacks an element, or if a single element loses balance, the entire system will collapse.

A new and inexperienced trader may be able to follow trading plans and strategies, but lacks the knowledge and skills to develop new systems or improve existing systems. However, experienced traders can utilize their accumulated experience and knowledge to build and improve trading systems.

The chef also focuses on different types of food, such as Italian cuisine or pastries. Similarly, based on their skills and interests, traders can also avoid overly focusing on certain types of assets, time frames, and procedural trading systems.

The development of trading systems is a very challenging task, full of pitfalls and complexity. The entire trading system requires multiple elements, including but not limited to trading plans, risk management rules, backtesting strategies, and a list of execution strategies. Although strategies must have advantages and positive expectations, if anything is missing or out of balance, the entire system may fail.

Additionally, the given trading system may or may not be suitable for individual traders. To successfully trade a given system, it is necessary to correctly integrate human factors, including psychology, technical skills, discipline, and sustained interest. It may also be necessary to make some adjustments to the system to accommodate traders, and vice versa. The development of new trading systems must also take into account these human factors. In this regard, individual traders are largely an integral part of the entire system.

Each trading system is unique, but fortunately, developing and trading these systems requires a relatively universal set of tools, building blocks, and technologies. Although it may take years for traders to gain some positive impact, the accumulation of knowledge is useful regardless of which system they trade in. This accumulated knowledge helps to develop new systems and strategies, or adapt to existing systems and strategies. In addition, even if the trader initially did not make a profit, trading experience can help improve psychology and discipline.