Today, EBC Finance shares with investors the top 1% from the global pyramidThe thoughts and ideas of successful individuals on how to manage wealth and establish business. It does not constitute investment advice, and we hope to work together with EBC's close friends on the path of improvement in life.

We often hear big shots such as Warren Buffett and Ray Dario publicly speaking on various social media platforms. Interestingly, when you carefully examine them, you will find that they often say the same thing.

Even though the speech scenes and content are different, they have obvious commonalities in their thinking, which is:

I am not smart enough to know this or that.

I don't know much yet.

Would you be surprised?

They are renowned for their wisdom, perseverance, and wealth, yet they are so humble and openly admit their mistakes and ignorance.

Ignorance is a blessing

A while ago, I heard Warren Buffett deliver a speech at the University of Chicago in 2012, mentioning "Ignorance is aBlending He regards ignorance as a blessing.

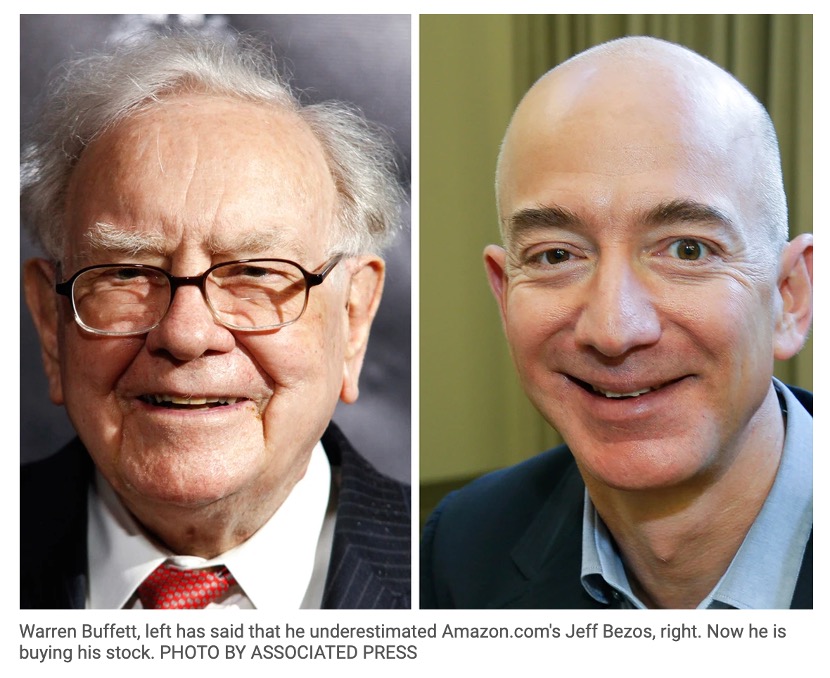

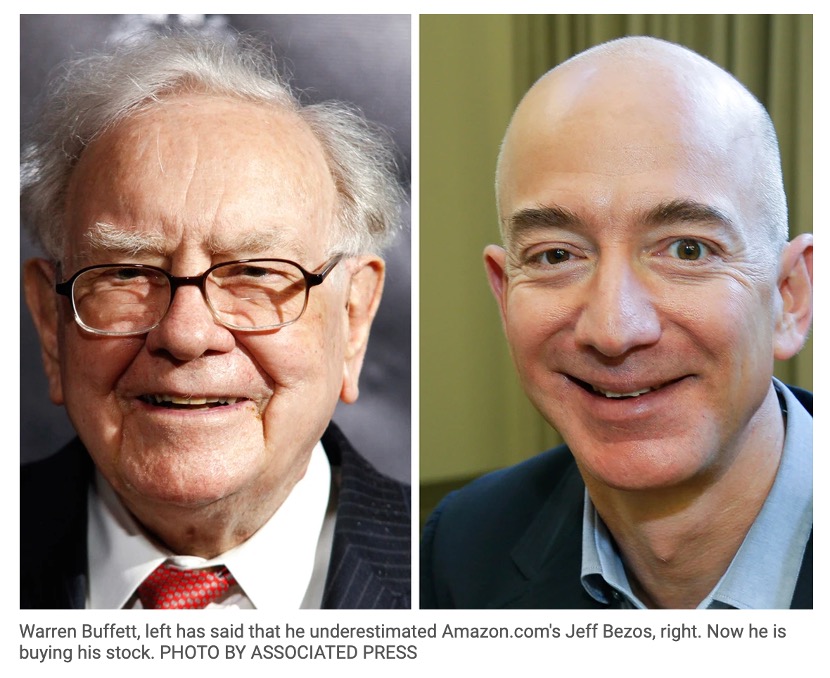

In that speech, he also paid tribute to Jeff Bezos and publicly shared how he measured the intrinsic value of Coca Cola.

In a 2019 interview with CNBC, Buffett publicly acknowledged his "foolish" actions:

Buffett is accepting CNBCDuring the interview, he stated that he had always been a "fan" and "fool" of the online retail giant (Amazon founded by Bezos) who did not buy Amazon stocks... Over the years, Buffett has often chosen to avoid technology stocks, saying he does not understand whether the product and market are good enough.

Warren Buffett acknowledges his ignorance and did not purchase Amazon stocks earlier. Buffett has stated that he underestimated Amazon's Jeff Bezos.

As Chairman and CEO, Buffett previously accepted CNBCDuring the interview, he stated that although he underestimated Amazon through his foolishness, a funding researcher at Berkshire Hathaway has been investing in Amazon for the company, so the credit should be attributed to him. Buffett referred to him as investment managers Todd Combs and Ted Weischler.

Buffett also attributed some of his conglomerate's purchases of aviation stocks and Apple to this deputy, and pointed out that their involvement exceeded their stock selection responsibilities.

As of August 5, 2021, Buffett has become the 10th member of the $100 billion club. According to the Bloomberg Billionaires Index, the wealth of Berkshire Hathaway Chairman Warren Buffett has jumped to101 billion US dollars. The club also includes Jeff Bezos, Elon Musk, and his friend Bill Gates.

Buffett often talks about the "20 SLOT PUNCH CARD" investment decision in his life, which makes him critically think about every investment he makes.

Buffett has an analogy:

Imagine that you have only 20 investment opportunities in your lifetime. In this way, every investment decision you make will be carefully considered. For example, if you go to a cocktail party and hear people talking about a company, they don't know what the company is doing or even the company name, but they made money from the same type of company last week. At this point, if you understand clearly that you only have 20 Chances are, you won't buy stocks in this company.

People are always tempted to try something, especially now stock trading has become very convenient. You just need to click online, and perhaps the stock price will rise in the next moment. You feel excited and continue to do so the next day. But when you repeatedly operate like this, you can imagine that you cannot make money.

Returning to the assumption of 20 times, this limits your ability to consider and select the best and most important opportunities. It's also possible that you won't be able to use up these 20 opportunities in your lifetime, but it's not important

EBC Finance | We need to be like Buffett,

Believe in thoughtful decisions

Utilize one's strengths

Admit our ignorance in things we are not good at

Prepare for the unknown

Ray Dalio's investment thinking process is also second to none, especially in risk management, how to achieve portfolio diversification through a 24/7 strategy.

In his all-weather strategy, Dario talked about the certainty and uncertainty of the economic environment:

There are only four different possible environments:

inflation

deflation

Higher than expected economic growth

Lower than expected economic growth

Dario said that you should take 25% risk in each of these four categories - rather than investing 25% of your wealth. Because there are four possible cycles in the financial world, no one really knows what the next cycle will be.

Dario also candidly described what he knew and what he didn't know. Because he doesn't know what will happen next, he is prepared not to take this risk.

EBC Finance | We need to be like Ray Dario,

Be prepared for the unknown

Admit one's' knowledge 'and' ignorance 'and learn as much as possible

Always consider reducing risk, rather than making hasty bets

Captain Pioneer

Jack Bogle is often mistaken for a retired person who drinks American coffee at Starbucks.

He is actually the founder of Pioneer Fund, the world's largest mutual fund company, and a pioneer in low-cost investment and Index Funds. He is known as the "father of index funds" and is often able to choose suitable financial assets at the right time and price.

He believes that the feeling is right:

For Bogle, becoming an investment master has nothing to do with the exact composition of his investment portfolio; This is the result of tailoring and adhering to his feelings.

He used to have a very basic portfolio, which followed the asset allocation called 60-40 rule - the U.S. stock index fund accounted for 60%, and the U.S. bond index fund accounted for 60%40%, for many years, he has kept this allocation for himself.

Later, he adjusted his strategy to 50/50, which made his investment portfolio more conservative.

He only follows these four investment rules and ignores the other rules.

Not rebalancing asset portfolios - if necessary, once a year is sufficient.

Not investing in overseas markets outside of the United States - at least not directly.

Diversification means using bonds to diversify stock risks in their investment portfolio.

If you make a 'simple' investment portfolio, you will spend less time worrying.

He has received many interviews and answered questions about market timing and buying suitable stocks. He is always honest, he always says he doesn't know.

But he provided a solution. Buy the entire market through an index.

Smart investors will not try to beat the market, "he said. They will make long-term investments by purchasing index funds and choose diversified investment methods

EBC Finance | We need to be like Jack Bogle,

Persist in what you know

Focusing on the Long Term

What we gained from the previous 1% of people: always remain humble.

In the world of social media, people seem to know everything. Influential people try to get traders to write viral posts and shoot provocative videos.

And these giants are exactly the opposite:

They tell you what they know.

They will also tell you things they don't know.

They acknowledge their ignorance in certain aspects.

They exert their power.

So, we must think. Warren Buffett, Ray Dario, and Jack Bogle can all openly acknowledge their ignorance, so let alone us ordinary people, who always need to maintain a cautious attitude towards products and fields we are not familiar with.