Wall St tumbles on strong NFP report

2025-01-13

Summary:

Summary:

US stocks dropped Friday, with the S&P 500 wiping out 2025 gains, as a strong jobs report fueled cautious Fed rate cut expectations.

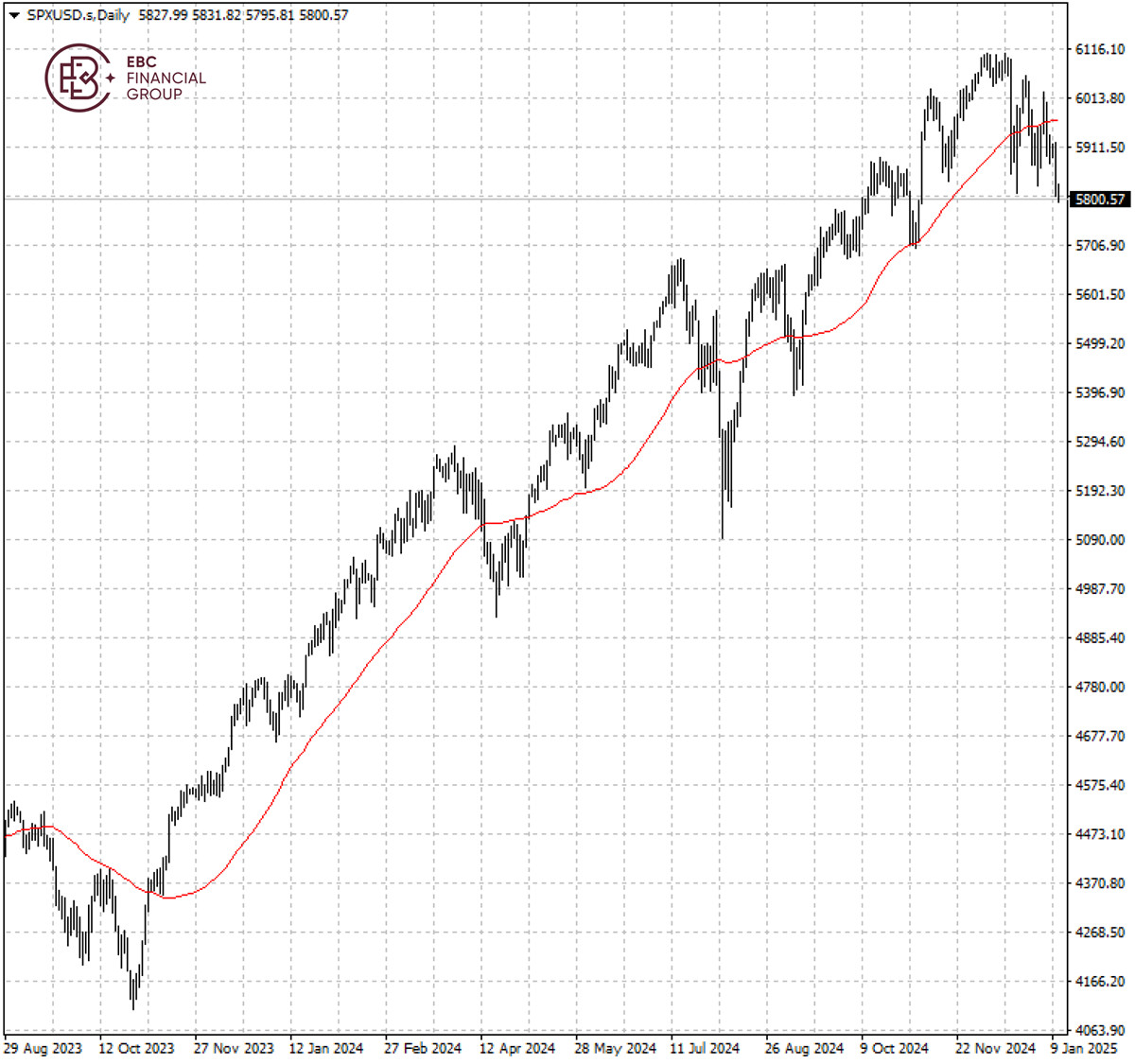

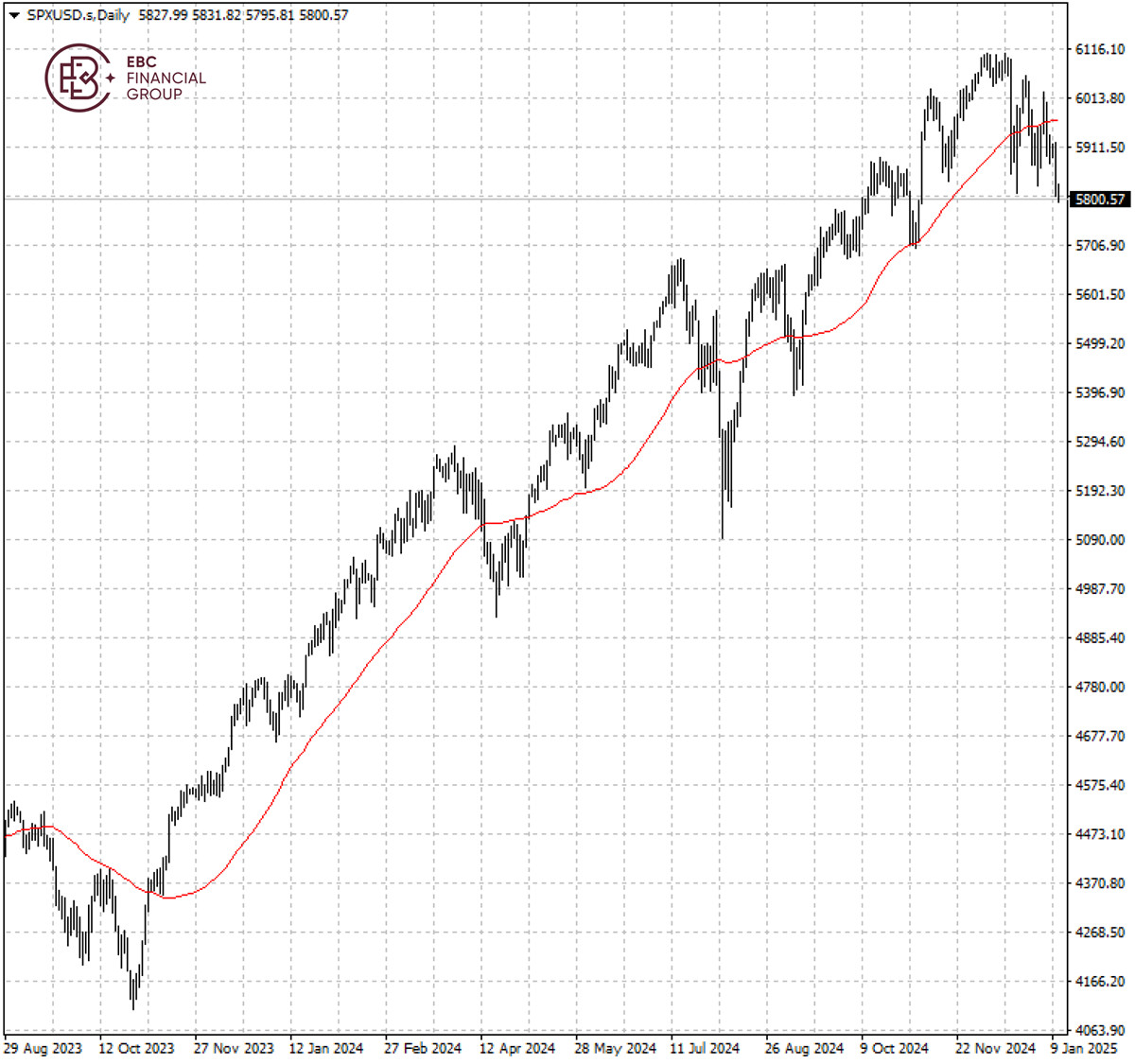

US stocks sold off on Friday, with the S&P 500 erasing its 2025 gains,

after an upbeat jobs report has reinforced bets that the Fed will be cautious in

cutting interest rates this year.

Investors were confident that the Goldilocks scenario of falling prices, a

resilient economy and gradual policy easing will prevail. But concerns remained

over how Trump's second term will unfold.

Futures options markets showed 10-year Treasury yield could head higher to 5%

in the near term. There is still room for equities to fall further as the yield

levels have been painful for them in recent years.

Magnificent Seven are expected to post a combined earnings increase of 18%

this year, down from a projected 34% for 2024, according to data compiled by BI.

And the rally will have to broaden out beyond them.

The technology behemoths will likely struggle to dominate the market in 2025

as earnings growth decelerates, said Morgan Stanley. BofA also warned growth

expectations for the group approached all-time highs.

Three of 11 sectors in the S&P 500 are poised to have seen profit growth

accelerate by double digits in Q4, including communication services and

technology, along with previously unloved groups like health care.

The benchmark index dipped below the low of 5815.8 hit on 20 December, and

the continued bearish bias indicated it could dip below 5,780 in the near term.

A trend reversal demands its break above 50 SMA.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.