Oil prices higher on peace deal uncertainty

2025-04-25

Summary:

Summary:

Oil prices rose slightly on Friday but were set for a weekly loss as OPEC+ output hikes and a potential Russia-Ukraine ceasefire may boost supply.

Oil prices edged higher on Friday but were on track for a weekly loss as a

potential OPEC+ output increase and a possible ceasefire in the Russia-Ukraine

war may raise supply.

The US and Russia are moving in the right direction to end the war in

Ukraine, but some specific elements of a deal remain to be agreed, Russian

Foreign Minister Sergey Lavrov said in an interview with CBS News.

Iran Foreign Minister was ready to travel to Europe for talks on Tehran's

nuclear programme. The US could likely lift of sanctions on Iranian oil exports

if some progress is made.

Reuters reported on Wednesday that several OPEC+ members had suggested the

group accelerate oil output increases for a second month in June despite cloudy

demand outlook.

US crude oil stockpiles rose unexpectedly last week as imports jumped, while

both gasoline and distillate inventories fell more than expected, the EIA

said.

Goldman Sachs expects Brent and WTI oil prices to edge down, averaging $63

and $59 a barrel, respectively, for the remainder of 2025, and $58 and $55 in

2026.

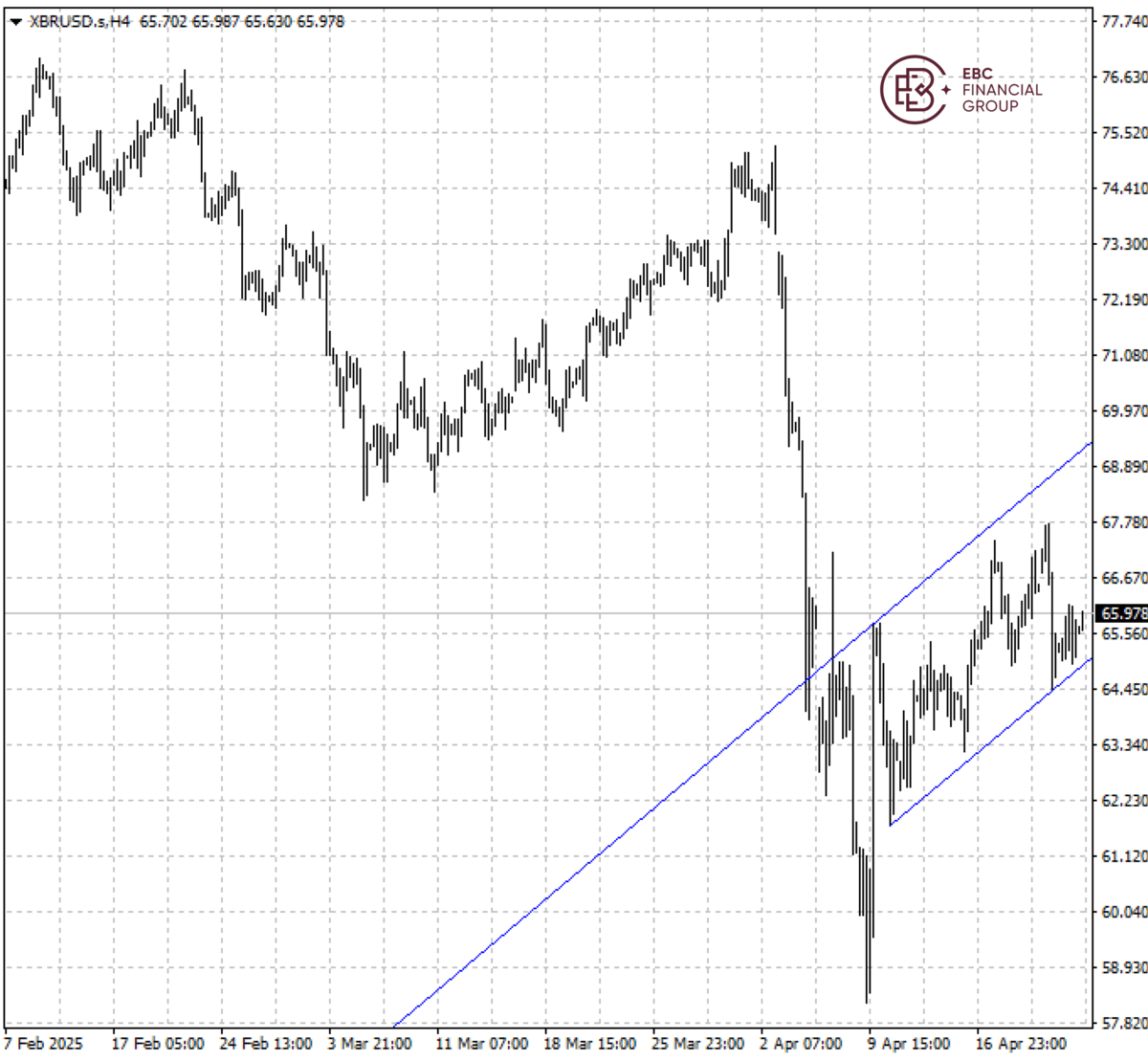

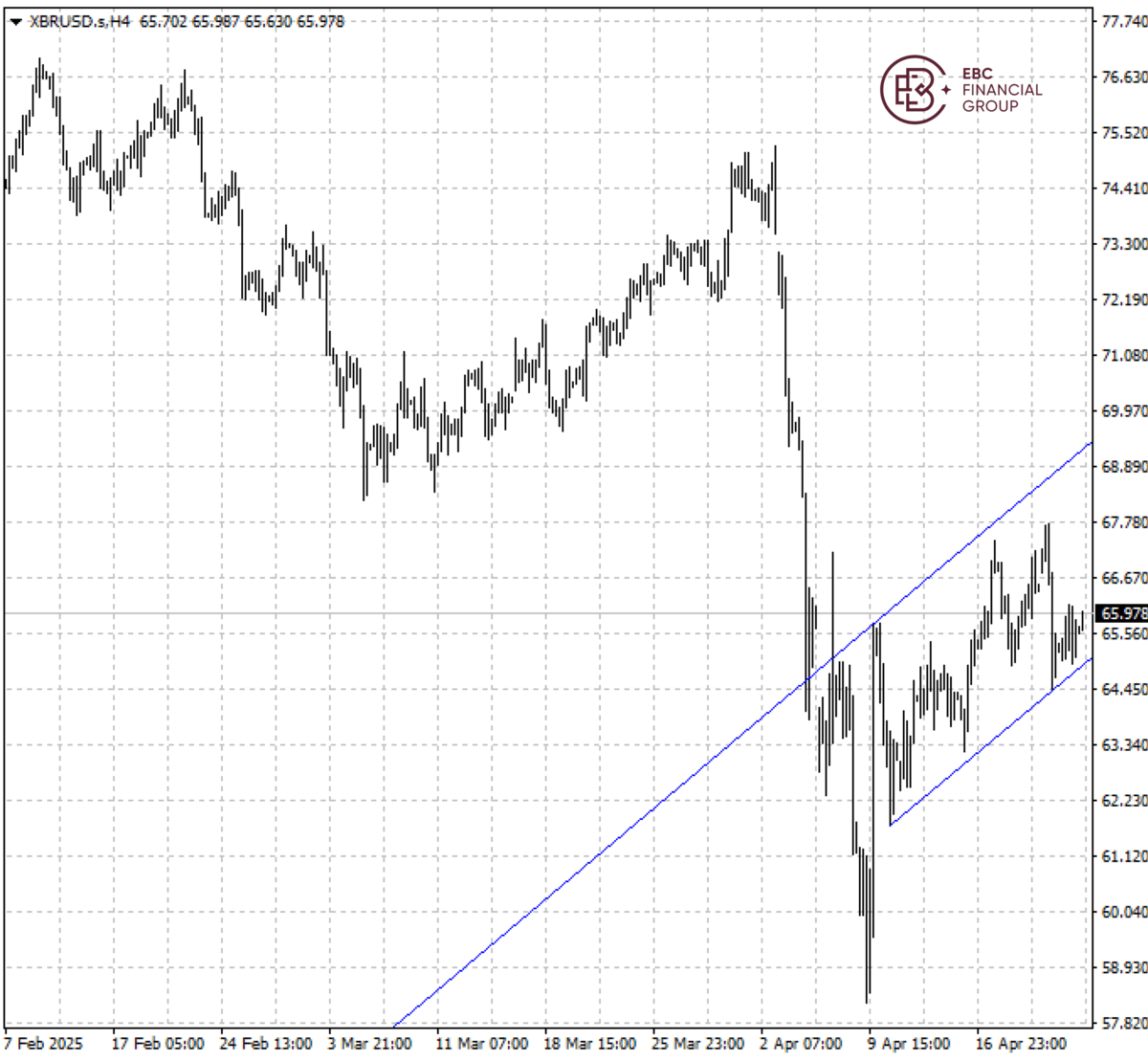

Brent crude is set to rise further as the upside channel remains intact. The

resistance lies around $68.2.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.