The Fed's July meeting

2023-07-21

Summary:

Summary:

The Fed will raise its benchmark overnight interest rate by 25 basis points to the 5.25%-5.50% range on July 26, according to all 106 economists polled by Reuters, with a majority still saying that will be the last increase of the current tightening cycle.

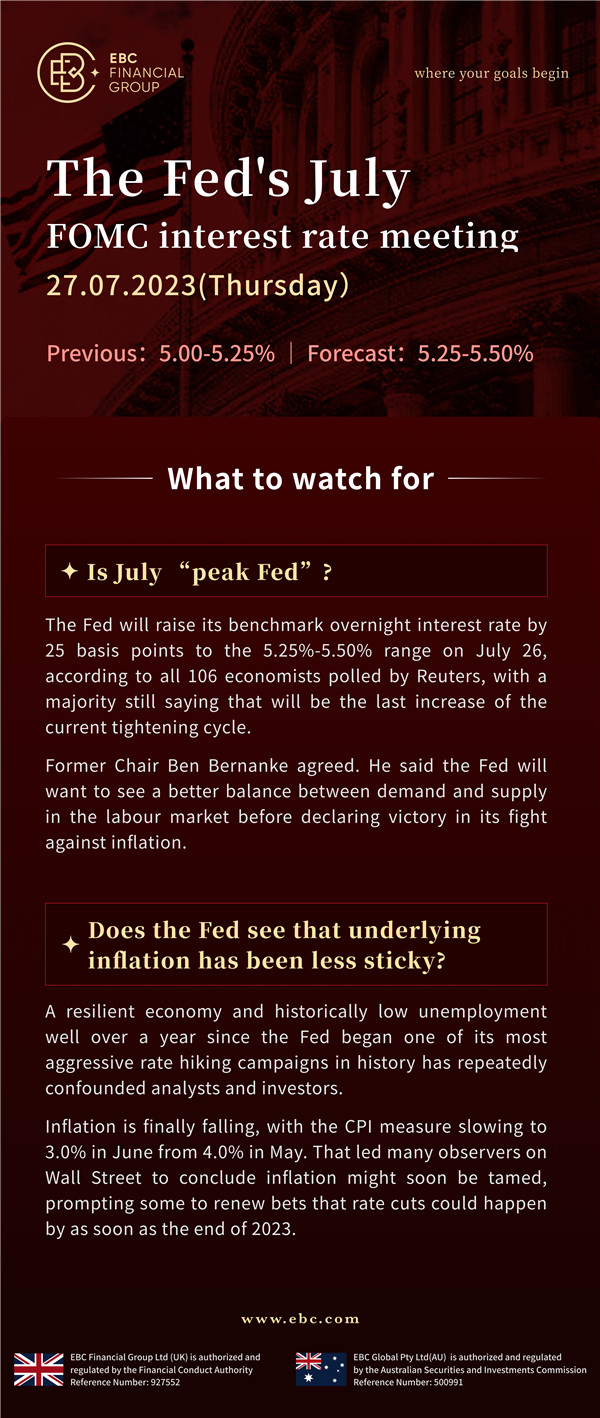

The Fed's July meeting

2023.7.27(Thursday)02:00

Previous (June): 5.00-5.25% Forecast: 5.25-5.50%

What to watch for:

Is July ‘peak Fed’?

The Fed will raise its benchmark overnight interest rate by 25 basis points

to the 5.25%-5.50% range on July 26, according to all 106 economists polled by

Reuters, with a majority still saying that will be the last increase of the

current tightening cycle.

Former Chair Ben Bernanke agreed. He said the Fed will want to see a better

balance between demand and supply in the labour market before declaring victory

in its fight against inflation.

Does the Fed see that underlying inflation has been less sticky?

A resilient economy and historically low unemployment well over a year since

the Fed began one of its most aggressive rate hiking campaigns in history has

repeatedly confounded analysts and investors.

Inflation is finally falling, with the CPI measure slowing to 3.0% in June

from 4.0% in May. That led many observers on Wall Street to conclude inflation

might soon be tamed, prompting some to renew bets that rate cuts could happen by

as soon as the end of 2023.