Global share markets edged lower on Friday as most U.S. megacap stocks

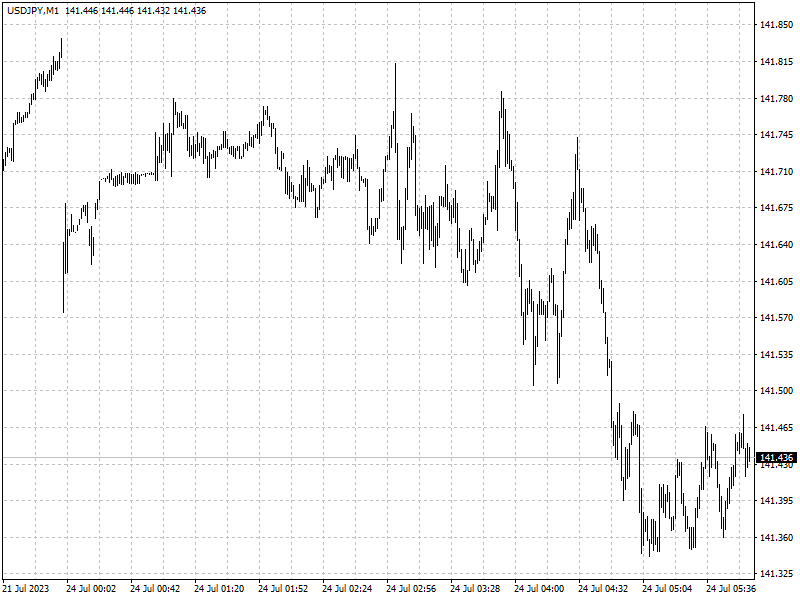

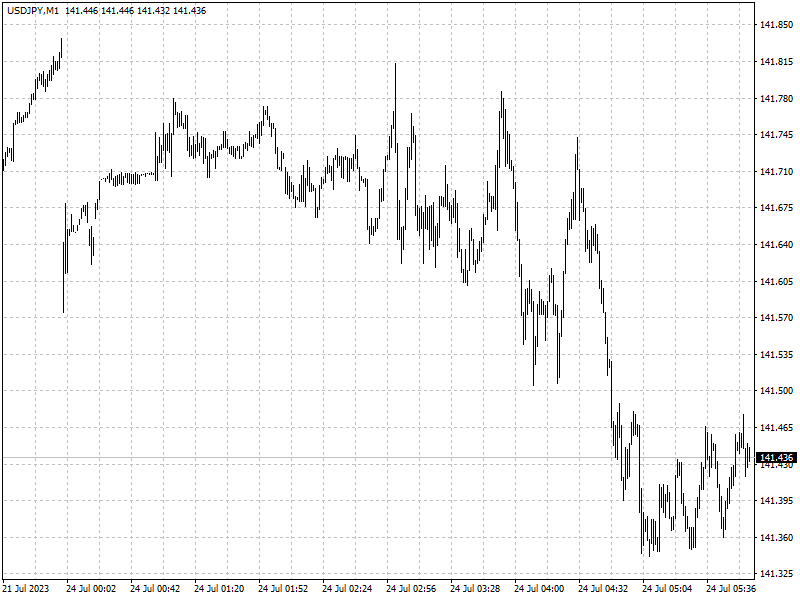

slipped, while the dollar soared against the yen after Reuters reported the BOJ

is leaning toward keeping its dovish monetary policy next week.

Gold prices fell as the dollar rebounded to its highest in more than a week.

Oil prices edged higher, buoyed by evidence of tightening supplies and economic

stimulus in slow-recovering China.

More investors are now embracing the probability of a soft landing, with many

companies well financed at lower interest rates so that higher rates - the Fed's

terminal rate is expected to rise to 5.25%-5.5% next week - will not cause a

credit crunch as in the past.

Commodities

Oil prices rose nearly 2% to record a fourth consecutive weekly gain, buoyed

by growing evidence of supply shortages in the coming months and rising tensions

between Russia and Ukraine that could further hit supplies.

Meanwhile, U.S. energy firms last week reduced the number of oil rigs by

seven, their biggest cut since early June, energy services firm Baker Hughes

said. At 530, the U.S. oil rig count, an early indicator of future output, is at

its lowest since March 2022.

UAE Energy Minister Suhail al-Mazrouei told Reuters that current actions by

OPEC+ to support the oil market were sufficient for now and the group was "only

a phone call away" if any further stEPS were needed.

Forex

BOJ policymakers prefer to scrutinize more data to ensure wages and inflation

keep rising before changing the policy, five sources familiar with the matter

said. The report added there was no consensus within the central bank and the

decision could still be a close call.

‘All expectations are for them to keep yield curve control as is and no

changes to rates, but maybe a little upgrade on their inflation outlook,’ said

Edward Moya, senior market analyst at OANDA in New York.

However, ‘the chances that we could get a surprise should remain on the

table,’ Moya added. ‘The BOJ is potentially going to be a major market-moving

event because time’s running out on the BOJ to really set up a policy

shift.’

Fed funds futures traders are pricing in 33 basis points of additional

tightening this year with rates expected to peak at 5.41% in November. The pound

fell for a sixth day versus the dollar - its longest stretch of daily losses

since last September.