Markets are ready for end of rate hiking cycle

2023-07-26

Summary:

Summary:

Global equity markets and U.S. Treasury yields rose on Tuesday ahead of the Fed's expected interest rate hike and as markets awaited a stream of quarterly results from corporate heavyweights.

Global equity markets and U.S. Treasury yields rose on Tuesday ahead of the

Fed's expected interest rate hike and as markets awaited a stream of quarterly

results from corporate heavyweights.

The U.S. dollar weakened, losing earlier session gains. Most market

participants expect the Fed to deliver a 25 basis-point rate hike on

Wednesday.

Oil prices rose to three-month highs as signs of tighter supplies and pledges

by Chinese authorities lifted sentiment. Gold prices strengthened as the dollar

fell, increasing 0.5% to $1,964.34.

Commodities

China’s top leaders pledged to step up policy support for the economy,

focusing on boosting domestic demand.

The crude benchmarks have already clinched four weekly gains in a row, with

supplies expected to tighten due to output cuts from the OPEC+.

Earlier-loading Brent contracts are selling above later loadings, a price

structure known as backwardation indicating traders see tight supply, with the

six-month spread near a 2.5-month high.

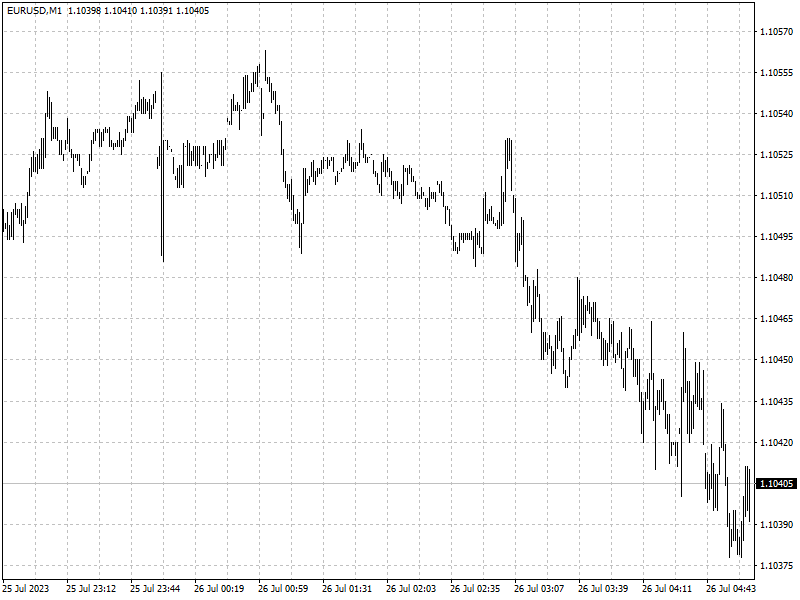

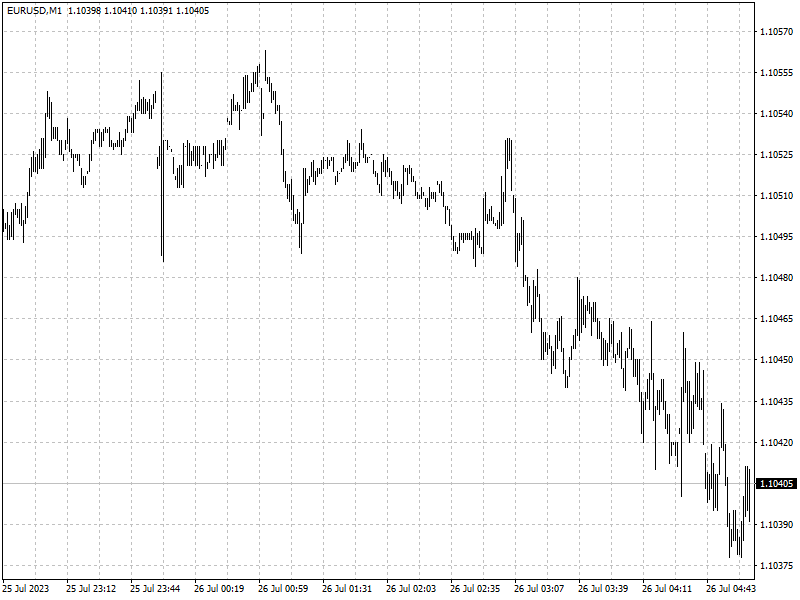

Forex

Signs of an extremely resilient U.S. economy helped the dollar recover from a

recent 15-month low, as well as persistent weakness in Europe.

Still the survey from the Conference Board offered mixed signals. Consumers

remain fearful of a recession over the next year following hefty interest-rate

hikes from the Fed.

The euro fell for a fifth successive session as evidence of a slowdown in

Europe builds after a recent survey showed demand for loans in the euro zone

hitting a record low in the second quarter.