Australian dollar firms near 5-month peak

2025-05-06

Summary:

Summary:

The dollar struggled on Tuesday due to a new 100% tariff on films made outside the US, while the Australian dollar rose to a five-month high.

The dollar struggled to make headway on Tuesday, weighed down by new 100%

tariff on films made outside the US. The australian dollar benefited from the

fallout, hovering near five-month high.

Australian financial markets on Monday largely welcomed a historic win by the

centre-left Labour Party as it strengthens the government's hand in dealing with

any serious threat to the economy from global trade war.

Goldman Sachs left its forecasts for fiscal spending, GDP growth and RBA

policy rates unchanged as the recent policy announcement from Labour is unlikely

to have a material economic impact in the near term.

The worry for Canberra is that an escalation in tensions between Washington,

Australia's main security ally, and Beijing, its largest trading partner, could

dent demand for commodities.

China's manufacturing activity fell more than expected to a 16-month low,

sliding into contractionary territory in April. Exporters front-loaded outbound

shipments to avoid higher duties in the previous month.

Trump said he is willing to lower tariffs on China at some point because the

levies now are so high that the two economies have essentially stopped doing

business with each other.

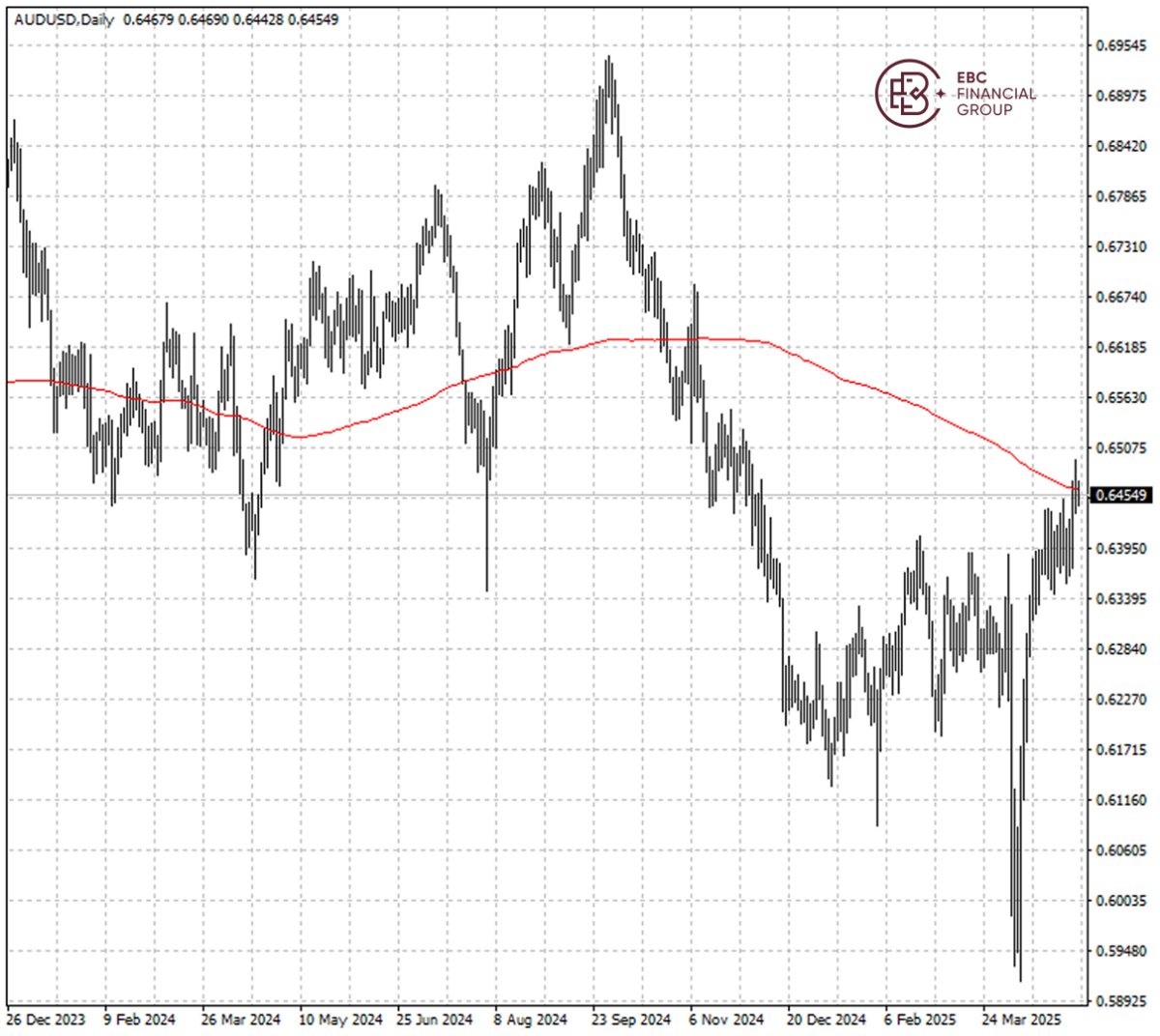

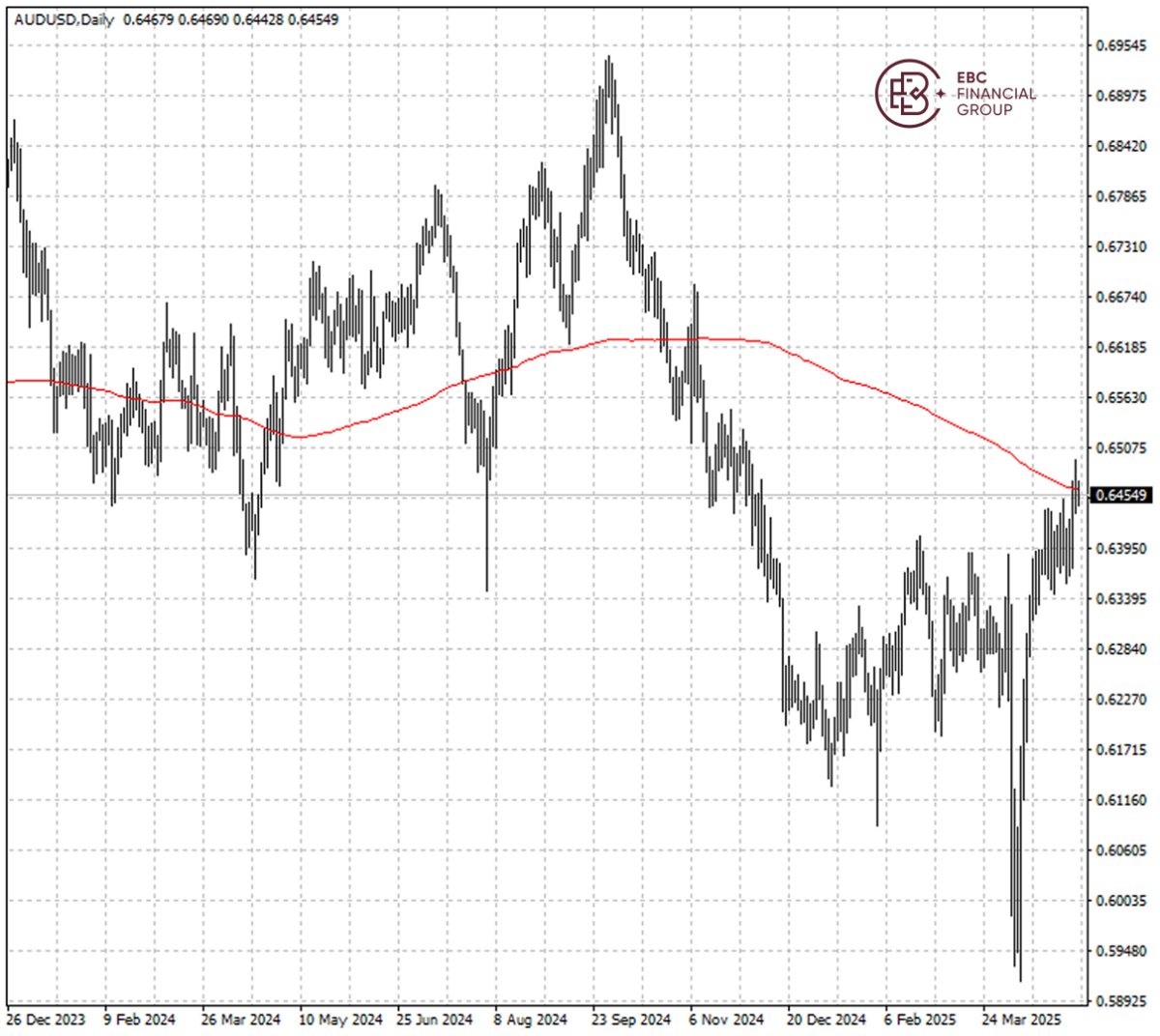

The Aussie dollar has breached its 200 SMA, extending the uptrend from last

month. The initial resistance lies around 0.6500, which is followed by

0.6550.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.