Global equities rose on Thursday after the U.S. House of Representatives

passed a bill to raise the federal debt ceiling, while U.S. Treasury yields fell

as data reflected a cooling labor market.

Oil prices were buoyed by optimism from the passage of the debt ceiling bill

that could underpin consumer demand despite reports that U.S. crude inventories

rose last week.

The dollar was on track for its worst daily loss in nearly a month as U.S.

manufacturing data and Fed officials make case for a pause. Gold gained nearly

1% to a more than one-week peak.

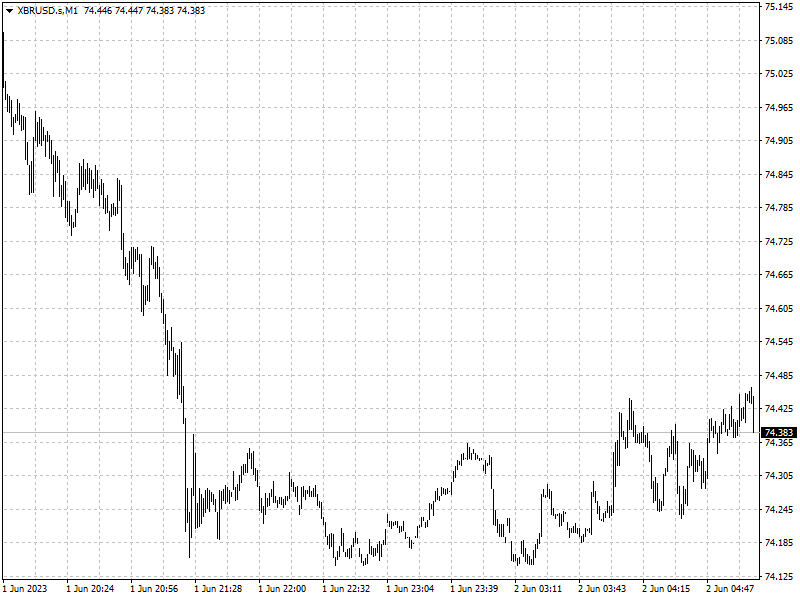

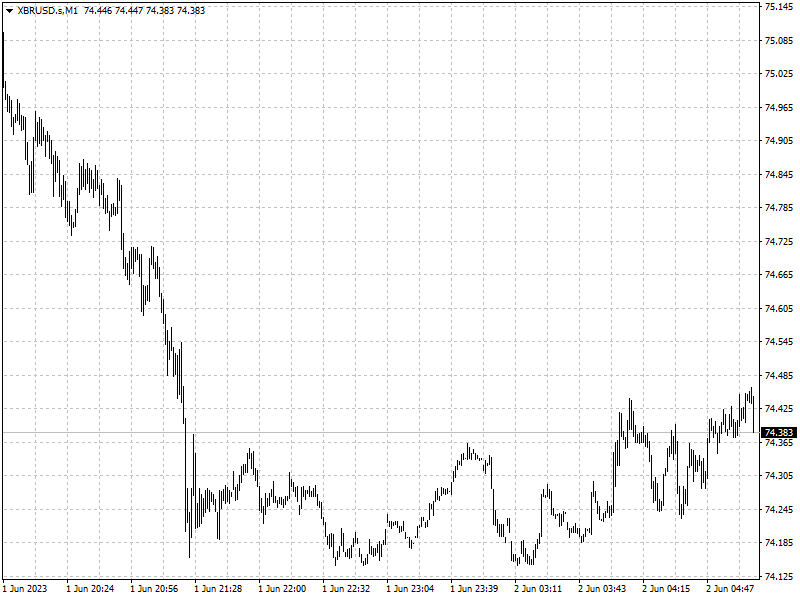

Commodities

Oil prices rose by the most in two weeks ahead of an OPEC+ meeting on Sunday.

Four sources from OPEC+ told Reuters that the alliance is unlikely to deepen

supply cuts.

U.S. Crude Oil stockpiles rose unexpectedly last week, as imports jumped and

strategic reserves dropped to their lowest since Sept. 1983, according to data

from the EIA.

The U.S. Senate will stay in session until it passes the bill, Democratic

Majority Leader Chuck Schumer said, with just four days left to pass the measure

and avert a catastrophic default.

‘There’s some kind of safe-haven demand supporting gold because of

uncertainty regarding the debt ceiling bill,’ said Commerzbank analyst Carsten

Fritsch.

Forex

Fed officials pointed toward a rate hike "skip" at its June 13-14 meeting,

giving time for the central bank to assess the impact of its tightening cycle

thus far against still-strong inflation data.

U.S. manufacturing contracted for a seventh straight month in May as new

orders continued to plummet, while the number of new U.S. jobless claims

increased modestly last week.

The euro recovered from a two-month low after ECB President Christine Lagarde

said further policy tightening was necessary and the dollar skid.

money markets are pricing in an 85% chance of a 25 basis point hike when the

ECB meets on June 15. Another 25 basis point hike is expected in July, according

to Refinitiv.