Global shares and U.S. Treasury yields rose on Friday following

stronger-than-expected job growth data that raised investor expectations that

the Federal Reserve could retain its interest rate hikes.

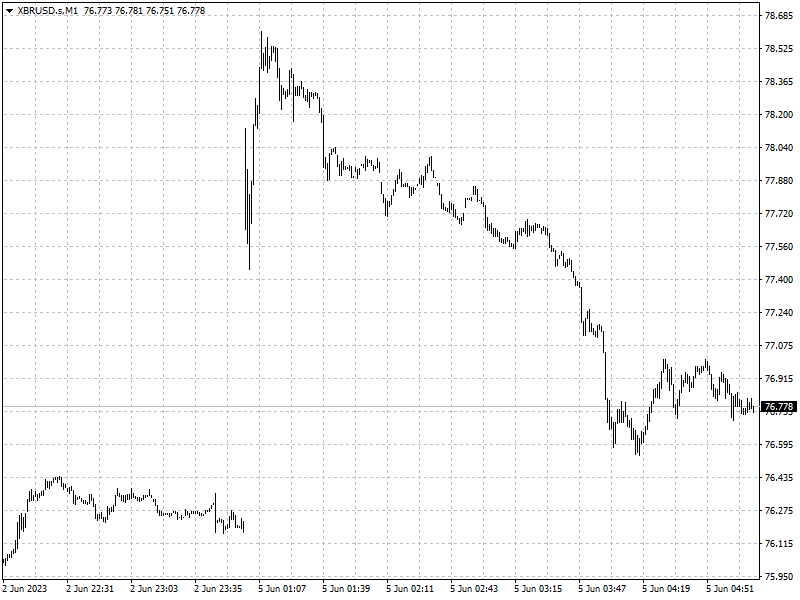

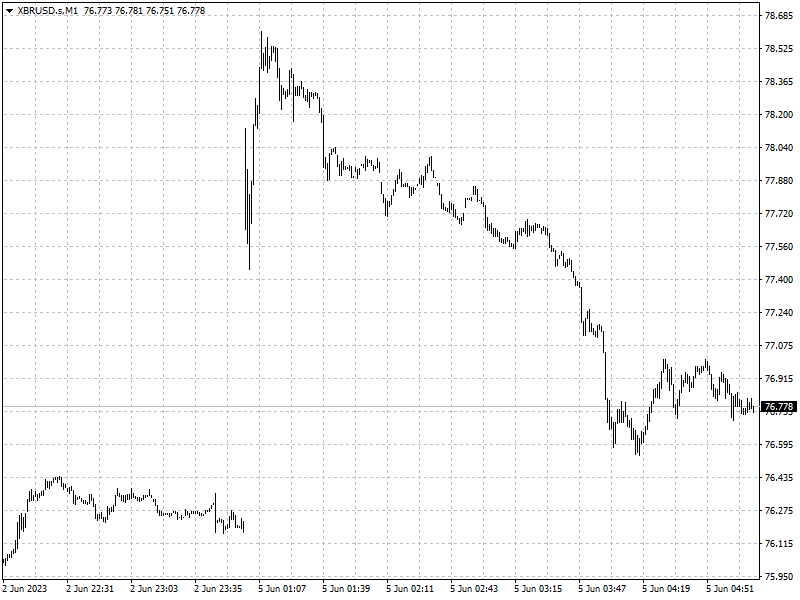

Gold prices slipped more than 1% as the dollar jumped. U.S. nonfarm payrolls

grew by 339,000 in May, beating expectations for an increase of 190,000, but the

unemployment rate rose to 3.7% from a 53-year low of 3.4% in April.

Oil prices rose over 2% after the U.S. Congress passed a debt ceiling deal

that averted a government default. The closes were the highest since May 26 for

WTI and May 29 for Brent.

Commodities

In the U.S., energy firms last week slashed the number of oil rigs operating

by the most since September 2021, reducing the overall count for a fifth week in

a row, energy services firm Baker Hughes Co said.

U.S. drillers have been cutting back on drilling for months due to an 11%

drop in U.S. crude prices and a 51% drop in natural gas futures since the start

of the year.

China is suffering from early heatwaves, expected to persist through June,

putting power grids under strain as consumers in mega-cities like Shanghai and

Shenzhen crank up air conditioners.

Forex

money markets are pricing in a roughly 29% chance of a June hike, down from

near 70% earlier in the week.

Fitch Ratings said the United States ‘AAA’ credit rating will remain on

negative watch, despite the debt limit agreement, citing repeated political

standoffs and last-minute suspensions of the ceiling before the deadline.

The australian dollar surged after Australia's independent wage-setting body

announced that it would raise the minimum wage by 5.75% from July 1.

Ahead of the FWC statement, ANZ head of Australia economics Adam Boyton said

in a note he now expects the RBA to raise rates two more times this year,

bringing the cash rate to a peak of 4.35%, in part due to rising labor

costs.