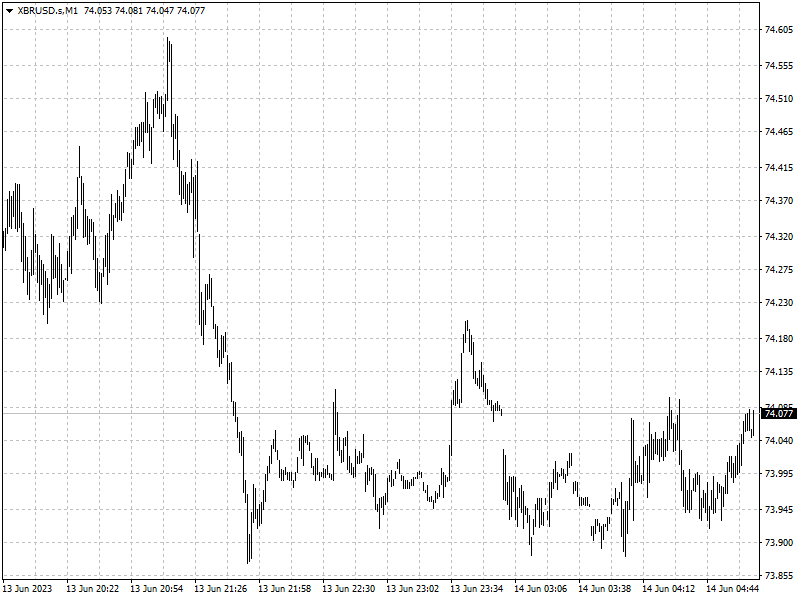

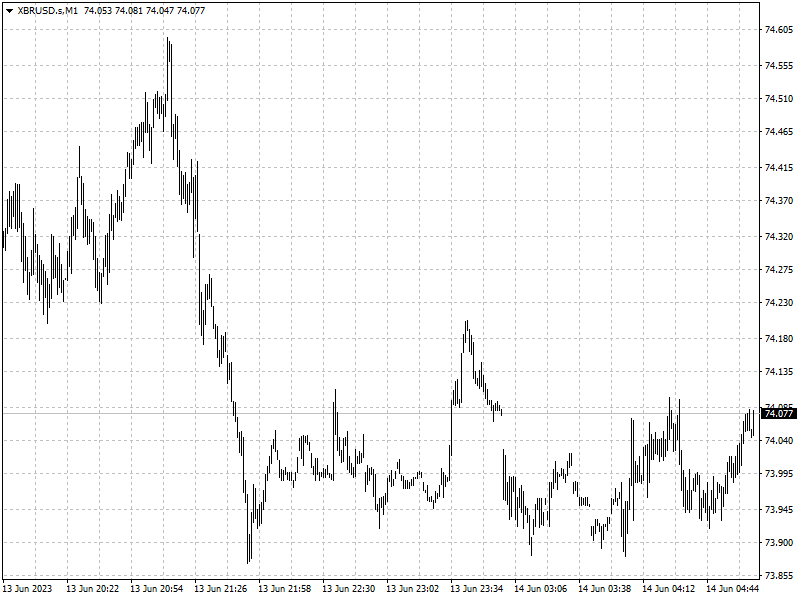

Oil rallies on China’s surprise rate cut

2023-06-14

Summary:

Summary:

Global shares rallied and the dollar eased on Tuesday after U.S. consumer price data showed inflation barely rose in May, increasing expectations the Fed will pause in June.

Global shares rallied and the dollar eased on Tuesday after U.S. consumer

price data showed inflation barely rose in May, increasing expectations the Fed

will pause in June.

Oil prices climbed over 3% on hopes for growing fuel demand after China's

central bank lowered a short-term lending rate for the first time in 10

months.

The annual increase in the consumer price index was the smallest in more than

two years but underlying price pressures are still strong.

Commodities

Brent's six-month backwardation fell to its lowest since March at around

$1.10, indicating faltering confidence that demand will exceed supply over the

year.

‘For market participants to start building up long positions again, they

likely need to see larger inventory declines,’ said UBS strategist Giovanni

Staunovo, adding he expected this to happen within weeks.

The OPEC kept its forecast for 2023 global oil demand growth steady for a

fourth month on Tuesday, slightly increasing expectations of Chinese demand

growth.

Forex

The dollar dropped to a three-week low on news of the smallest annual

increase in inflation last month in more than two years.

Traders of futures tied to the Fed's policy rate now expect a roughly 93%

chance the Fed will keep the benchmark rate at 5.00% to 5.25% this week.

Elsewhere, sterling jumped after employment data came in much stronger than

expected, with wages rising sharply, adding to inflation concerns.

The pound hit a five-week high of $1.2625 against the dollar as traders bet

the BoE would have to raise rates further than previously expected.