MSCI's global equity index closed slightly higher on Wednesday while the

dollar ended lower even the Fed signalled that it could raise rates by another

half percentage point by year-end.

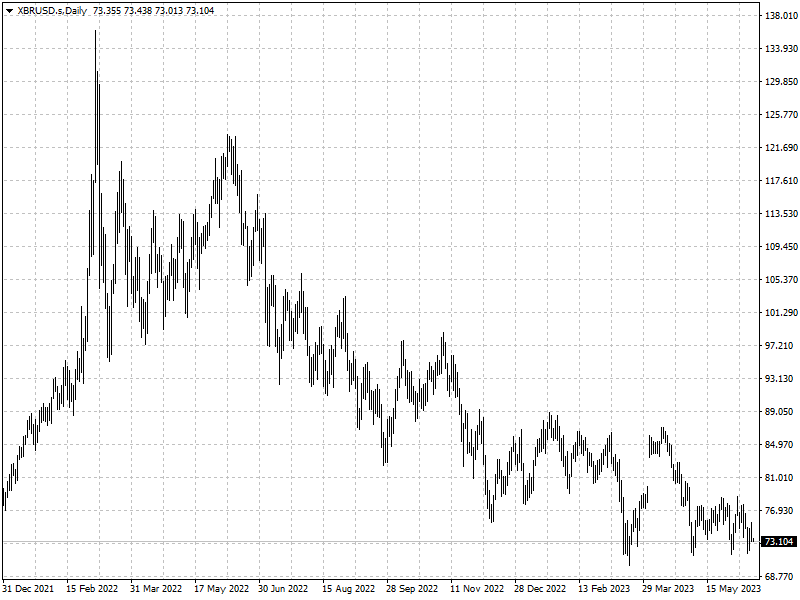

Gold prices steadied despite rising yield. Oil prices pared back its earlier

gains, giving up earlier gains as traders weighed an unexpectedly large build in

U.S. Crude Oil.

Fed Chair Jerome Powell said it is too soon to say inflation will continue to

retreat even as officials expect price pressure to stay on a cooling trend.

Commodities

Traders are now pricing in a 70% chance of Fed rate hike in July, up from 60%

earlier, according to the CME Fedwatch tool.

U.S. crude oil stocks rose by about 8 million barrels in the week ended June

9, according to data from the EIA. Analysts had estimated a 500,000-barrel

decline.

The IEA, meanwhile, increased its oil demand growth forecast for this year by

200,000 bpd to 2.4 million bpd, lifting the projected total to 102.3 million

bpd.

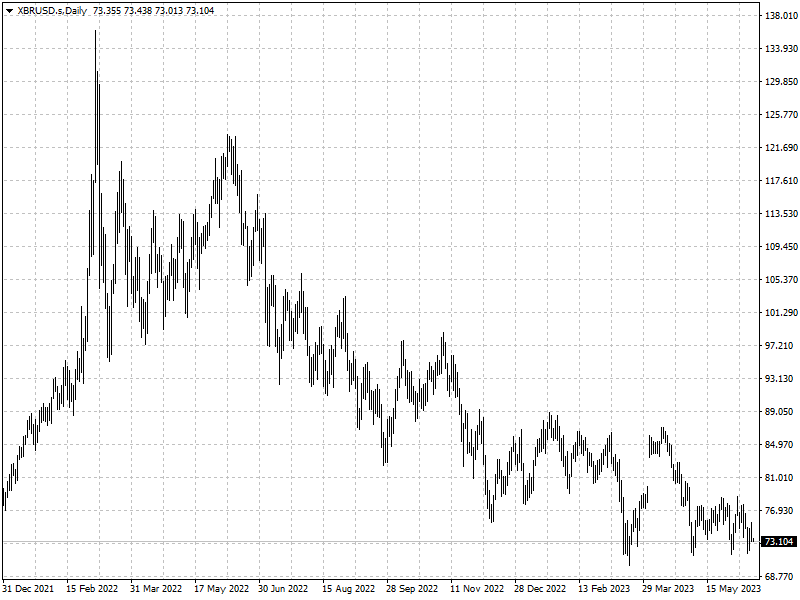

Forex

U.S. producer prices fell more than expected in May, with the annual increase

in producer inflation being the smallest in nearly 2.5 years. It’s viewed as a

potential leading indicator of how prices could eventually behave at the store

level.

The ECB's rate decision is up next on Thursday, with markets pricing in a 25

basis-point hike and another in July before a pause for the rest of the

year.