2023 Fed Rate Hike Schedule's Impact on Capital Markets

2023-08-09

Summary:

Summary:

The announcement of the 2023 Federal Reserve's interest rate hike schedule has had a significant impact on the capital market. It is expected that the Federal Reserve will gradually start raising interest rates at the beginning of the year and carry out a series of rate hikes before the end of the year.

The Federal Reserve's interest rate hike refers to a monetary policy adopted

by the Federal Reserve System to regulate economic development and inflation by

raising short-term interest rates. Simply put, raising interest rates means

raising the interest rates of bank loans, credit cards, and other short-term

borrowing methods. So let's take a closer look at the schedule for the Federal

Reserve to raise interest rates in 2023.

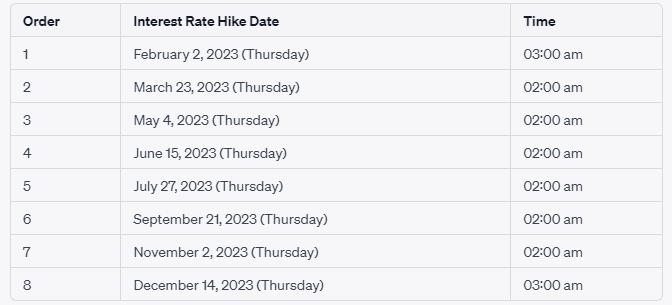

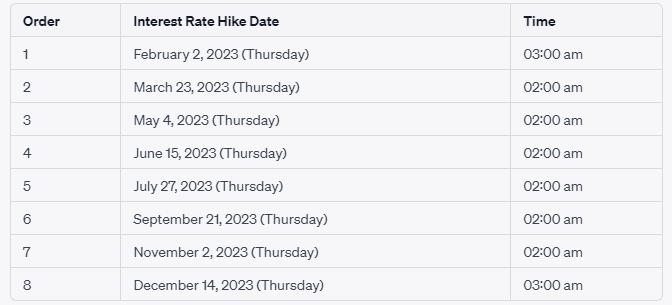

2023 Schedule for Fed Rate Hikes

The specific time still needs market validation.

The Impact of the Federal Reserve's Interest Rate Hike on the Capital Market

Market interest rates rise: The Federal Reserve's interest rate hike will

cause interest rates on bank loans, credit cards, and other short-term borrowing

methods to rise, thereby increasing the yield of fixed-income investment

vehicles. As a result, market interest rates have generally risen, and investors

may also be more willing to hold fixed-income investment instruments with higher

interest rates than non-interest-rate assets. This may lead to a decline in the

prices of non-interest-rate assets.

Economic slowdown: Interest rate hikes may suppress consumption and

investment demand, leading to a slowdown in economic growth. In addition,

raising interest rates will increase borrowing costs and may have a negative

impact on consumer and business spending.

Strong currency value: Raising interest rates usually causes the country's

currency exchange rate to strengthen. Due to the fact that the US dollar is the

global reserve currency, raising interest rates by the Federal Reserve will

attract global market attention. If the interest rate hike exceeds market

expectations, it may lead to the appreciation of the US dollar and affect the

import and export trade of other countries and regions.

Disclaimer: Investment involves risk. The content of this article is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product.