Yen stabilizes after losses on Wednesday

2024-03-13

Summary:

Summary:

The US dollar steadies as inflation surpasses expectations, prompting doubts about the Fed's ability to justify multiple rate cuts this year.

EBC Forex Snapshot, 13 Mar 2024

The US dollar held steady against its major peers on Wednesday, as

hotter-than-expected inflation left analysts wondering whether the Fed will have

sufficient data to justify more than a couple of rate cuts all year.

The yen firmed following its biggest loss in a month. The BOJ governor Kazuo

Ueda said on Tuesday that the economy was recovering but also showing some signs

of weakness.

Expectations are for bumper pay raises, with a number of Japan's biggest

companies already saying they had agreed to fully meet union demands for pay

increases at annual wage negotiations.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 4 Mar) |

HSBC (as of 13 Mar) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0695 |

1.1017 |

1.0819 |

1.1005 |

| GBP/USD |

1.2476 |

1.2827 |

1.2628 |

1.2924 |

| USD/CHF |

0.8551 |

0.9013 |

0.8701 |

0.8865 |

| AUD/USD |

0.6443 |

0.6624 |

0.6498 |

0.6689 |

| USD/CAD |

1.3359 |

1.3606 |

1.3402 |

1.3590 |

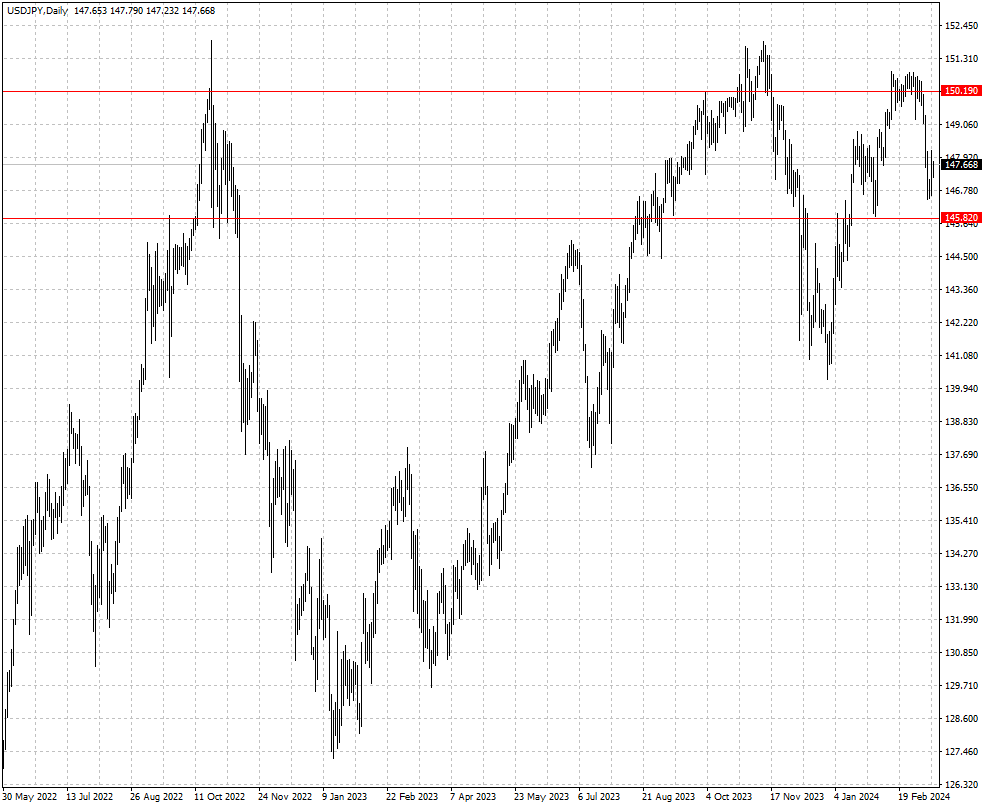

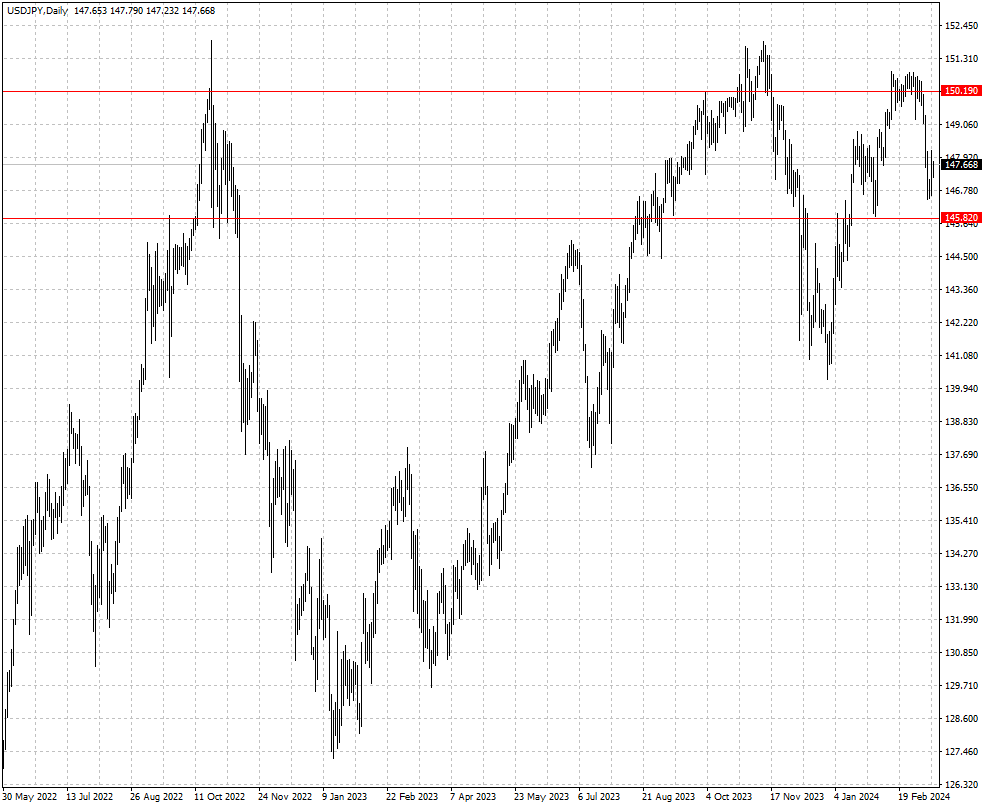

| USD/JPY |

146.68 |

151.91 |

145.82 |

150.19 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.