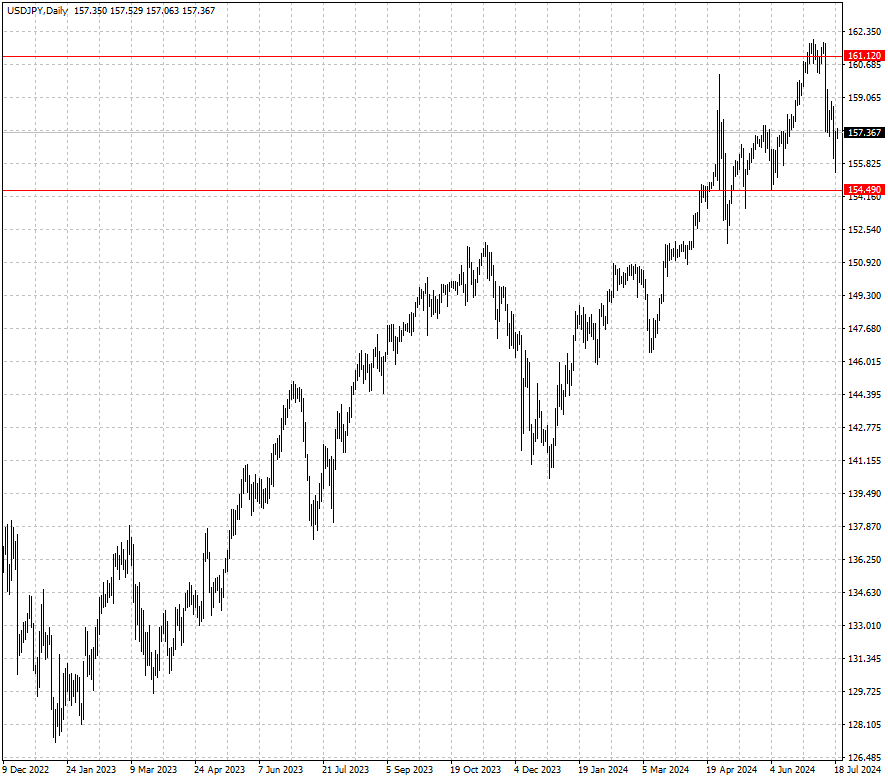

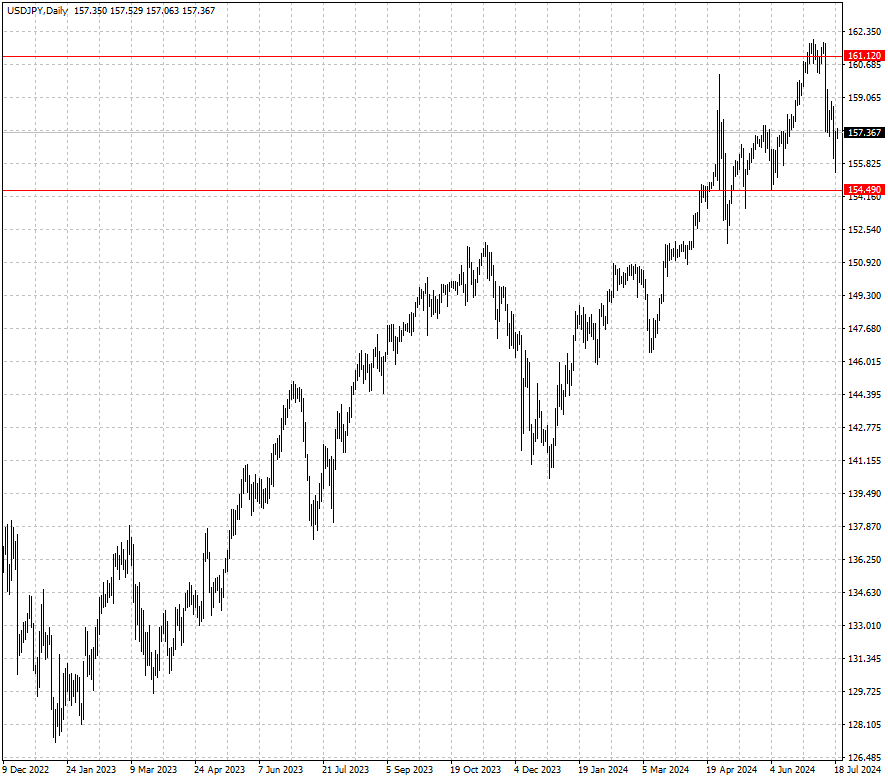

Yen Pulls Back from Six-Week High

2024-07-19

Summary:

Summary:

The dollar steadied on Friday, poised to end a two-week decline, as US data fueled speculation on the timing and scale of Fed rate cuts.

EBC Forex Snapshot, 19 Jul 2024

The dollar was steady and poised to snap a two-week losing run on Friday as

US labour and manufacturing data kept traders pondering on when and by how much

the Fed would cut rates this year.

The number of Americans filing new applications for unemployment benefits

rose more than expected last week. The yen pared some of its earlier losses

after hitting a sex-week high on Thursday.

Data showed core consumer prices in Japan accelerated for a second straight

month in June, keeping alive market expectations that the central bank could

soon raise interest rates.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 15 Jul) |

HSBC (as of 18 Jul) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0796 |

1.0916 |

1.0754 |

1.0993 |

| GBP/USD |

1.2860 |

1.2996 |

1.2687 |

1.3119 |

| USD/CHF |

0.8832 |

0.9158 |

0.8779 |

0.9011 |

| AUD/USD |

0.6647 |

0.6871 |

0.6625 |

0.6791 |

| USD/CAD |

1.3577 |

1.3846 |

1.3608 |

1.3777 |

| USD/JPY |

157.51 |

160.21 |

154.49 |

161.12 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.