World shares rose while U.S. Treasury yields fell on Friday as markets

digested the BOJ's decision to tweak its ultra-loose monetary policy as well as

data showing a continuing moderation in annual U.S. inflation.

The BOJ adjusted its yield curve control scheme, offering to buy 10-year

Japanese government bonds beyond the previous 0.5% target rate while keeping

unchanged its benchmark short-term rate at -0.1% and long-term bond yields at

zero.

Oil prices settled higher, reaching the fifth straight week of gains as

investors were optimistic that healthy demand and supply cuts will keep prices

buoyant. Brent crude settled 75 cents higher to $84.99, while WTI crude gained

49 cents to $80.58.

Commodities

Saudi Arabia is expected to extend a voluntary oil output cut of 1 million

bpd for another month to include September, analysts said.

In the U.S., energy firms in July cut the number of oil rigs for an eighth

straight month by one to 529, Baker Hughes said in its weekly report.

‘Oil prices are up 18% since mid-June as record high demand and Saudi supply

cuts have brought back deficits, and as the market has abandoned its growth

pessimism,’ Goldman Sachs analysts said in a July 30 note.

The bank maintained its Brent forecast at $86 a barrel for December and

expects prices to rise to $93 in the second quarter of 2024.

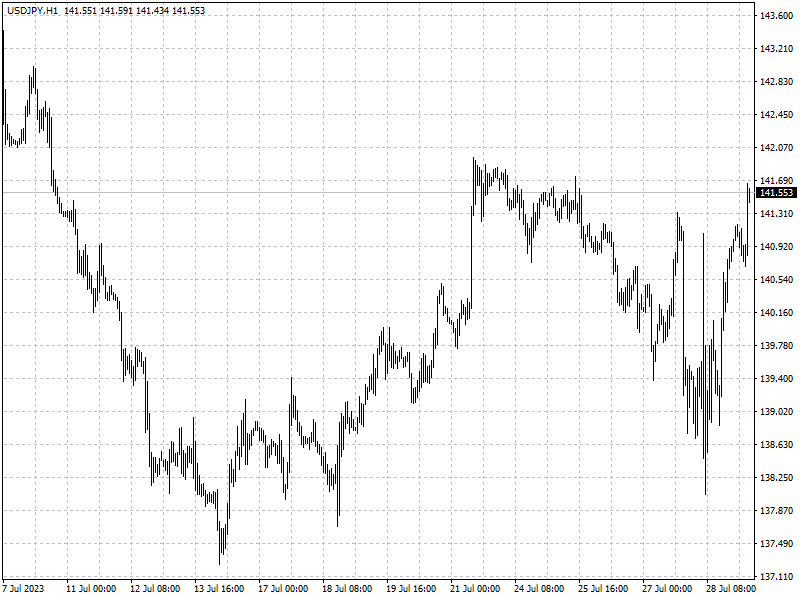

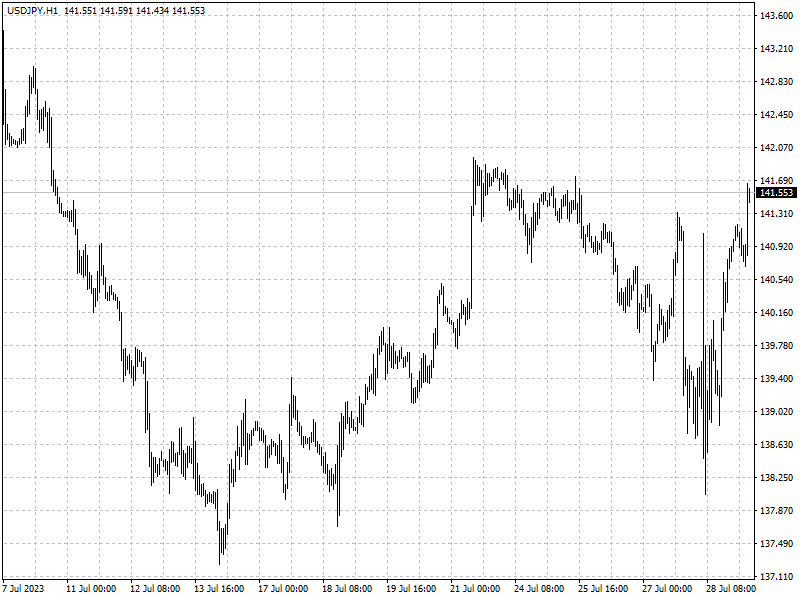

Forex

U.S. inflation slowed considerably in the 12 months to June, with the

personal consumption expenditures price index rising by 3%, the smallest annual

gain since March 2021, data from the Commerce Department showed.

The yen whipsawed in its most volatile trading session in months following

the BOJ's move while the dollar fell against a basket of its major peers. The

yen weakened 1.18% versus the greenback at 141.08 per dollar.

Disclaimer: Investment involves risk. The content of this article is not an

investment advice and does not constitute any offer or solicitation to offer or

recommendation of any investment product.