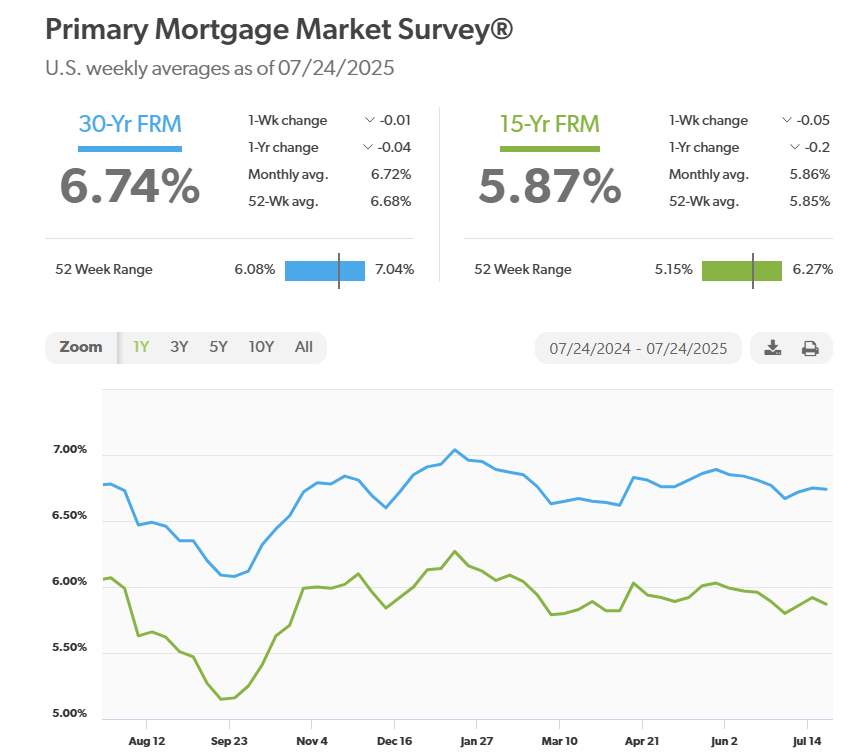

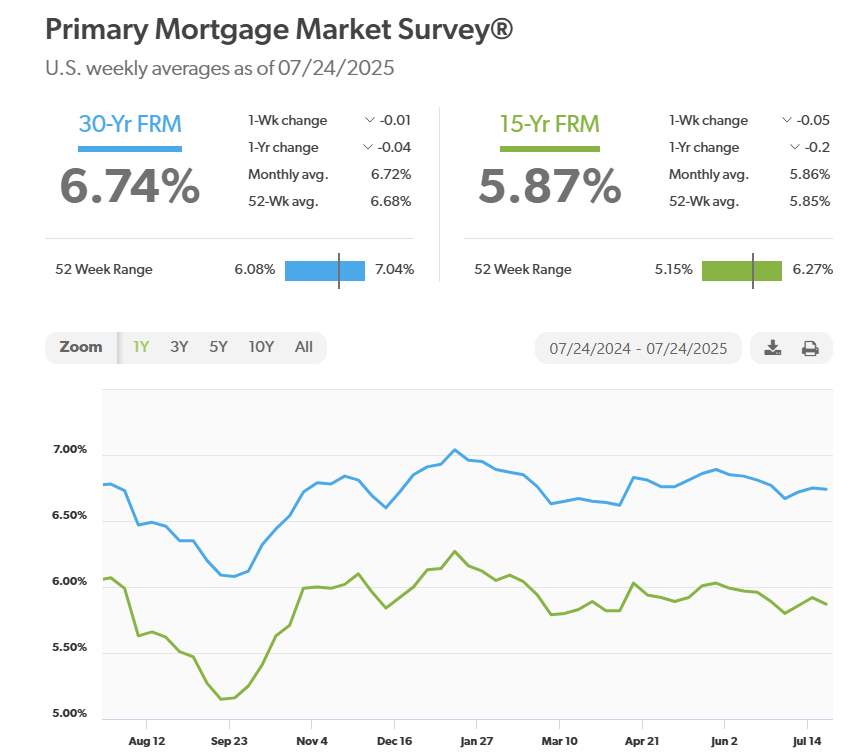

As of July 2025, U.S. 30‑year fixed mortgage rates sit stubbornly high at 6.74%, while 15‑year rates hover near 5.87%, according to Freddie Mac's most recent survey.

Homebuyers, refinancers, and economists are asking: Will this year deliver any relief, or are high borrowing costs here to stay? Below, we break down expert forecasts, contextual drivers, risks, and strategies for navigating uncertain mortgage markets in 2025.

Current Mortgage Rate Landscape

This summer, 30‑year fixed mortgage rates have remained in a narrow range between 6.67% and 6.84%, reaching 6.74% in the week ending July 24. While this marks a modest dip from earlier highs, rates remain well above the long-term average.

Trends in the housing market emphasise affordability challenges: The supply of new homes hit its peak since 2007, causing listings to rise by 28.9% year-over-year and resulting in a drop in the median price to around $402,000 in June.

Buyers are experiencing elevated rates close to 7%, which continue to dampen demand, leading to slower sales and extended listing durations in areas such as San Antonio and throughout the U.S.

Why Rates May Not Fall Soon: Monetary & Market Dynamics

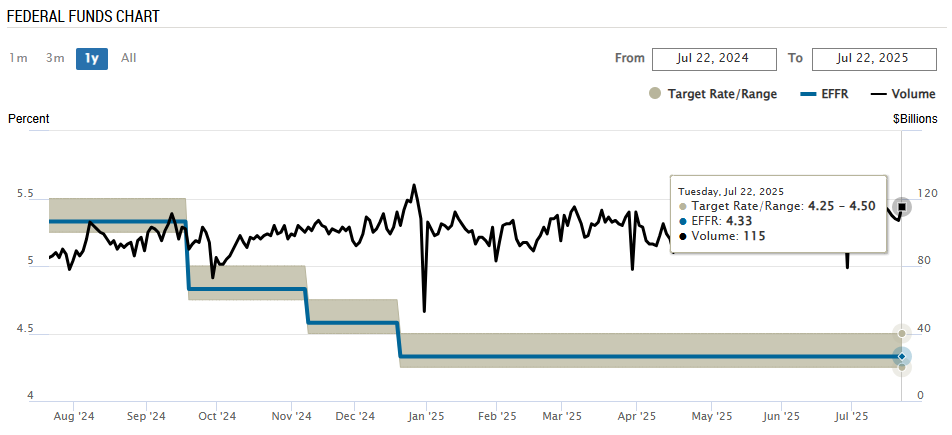

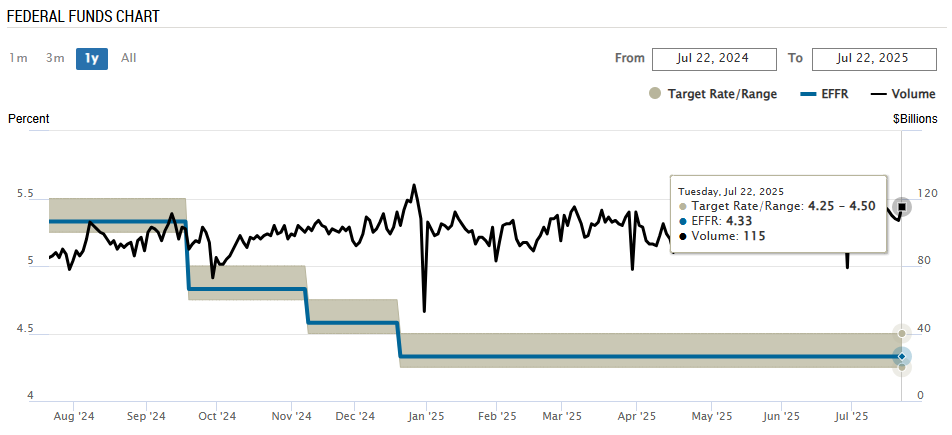

Federal Reserve's Cautious Approach

The Fed is holding its benchmark rate firmly at 4.25%–4.50% through mid‑2025, reflecting worries about inflation tied to trade policies and limited downside data.

Fed Chair Powell has noted early, though still uncertain, tariff-related inflation pressures, underlining the central bank's reluctance to signal cuts until late 2025 at the earliest.

Bond Market & Treasury Yields

Mortgage rates closely follow the 10‑year Treasury yield, which remains elevated around 4.4%. Despite some bond market jitters causing fleeting rate dips, any pause could reverse swiftly in response to rising term premiums or fiscal pressures.

Will Mortgage Rates Go Down Before 2025 Ends? Expert Forecasts

Advisor forecasts 30-year fixed rates will average 6.8% in Q3 2025, finishing the year around 6.7%.

A consensus of 14 research groups expects rates to average 6.34% by year-end, assuming moderate economic cooling.

Experts collated warn that even after the Fed cuts, mortgage rates may not fall immediately, given lagging transmission from policy to loan pricing.

In general, the majority of forecasts anticipate that rates will gradually decrease by late 2025 or early 2026, but not collapse.

What Could Trigger Rate Cuts Or Prevent Them?

| Factors Likely to Push Rates Lower |

Drivers Keeping Rates Elevated |

| A recession or noticeable economic slowdown |

Persistent inflation above 3% |

| Global economic turmoil calming and safe‑haven demand easing |

Continued tariff or fiscal-induced supply disruptions |

| Diminished term premiums if political interference subsides |

Strong housing demand buoying long-run yields |

When Could Rates Fall Significantly?

Late 2025 to early 2026: Should inflation persist in its decline and economic growth decelerate, bond yields might adjust, leading to lower mortgage rates. Predictions suggest a 6.5% or less by the middle of 2026.

Still, only one or two Fed rate cuts are anticipated in 2025, limiting the potential for sharp declines.

External volatility, like trade tensions or large Treasury supply, could derail rate retreats despite weak growth signals.

Should Buyers Wait or Act?

If you're considering buying a home, holding out for a slight drop in rates could lead to disappointment, particularly with slow predictions for rate relief and the risk of missing current prices or deals in spring or early summer of 2025.

Strategy guidance:

Lock a rate now if you find a favourable mortgage (e.g., ≤6.75%) and expect rising rates, or markets correct upward.

If conditions soften in Q4 or 2026, consider refinancing when possible.

Base decisions on personal readiness, job security, credit profile, and long-term plans.

Final Verdict: Will Mortgage Rates Go Down in 2025

Short answer: Not much.

Current levels (~6.7%) are expected to persist through 2025.

Slight decreases to around 6.5–6.3% could occur by late 2025 or 2026, influenced by inflation and economic deceleration.

A rapid drop to under 6% rates is unlikely unless macro conditions deteriorate dramatically.

Buyers with access to favourable rates today may face better value than waiting for slow, incremental improvements.

Conclusion

In conclusion, while no one can predict mortgage rates with complete certainty, expert forecasts for 2025 suggest a gradual decline, assuming inflation continues to ease and the Federal Reserve begins cutting interest rates later this year.

Lastly, economists and housing market analysts generally expect average 30-year fixed rates to fall into the mid-6% to low-6% range by the end of 2025, though volatility may persist along the way.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.