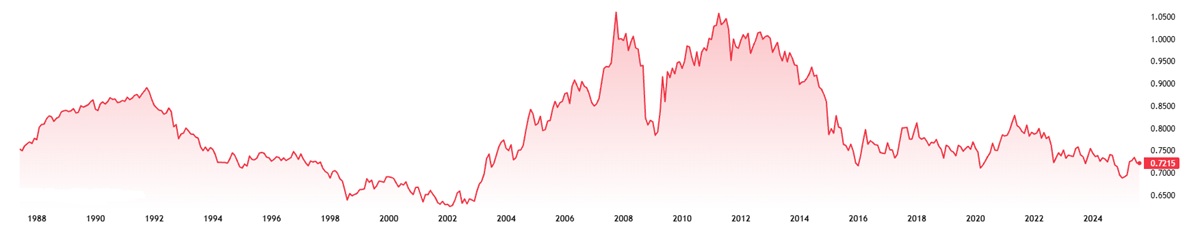

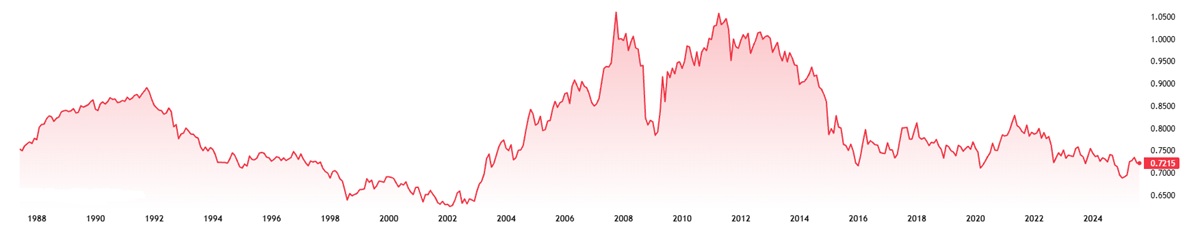

The Canadian dollar, once buoyed by strong oil exports and a stable economy, has been steadily losing ground in global currency markets. As of mid-2025. the loonie is trading near multi-year lows against the U.S. dollar, raising concerns across households, businesses, and investment firms. What's behind the slide? It's not just about oil or interest rates—it's a mix of shifting global dynamics, domestic vulnerabilities, and market sentiment working against Canada's currency. Understanding the loonie's decline requires unpacking everything from central bank policies and trade tensions to deeper structural flaws in the Canadian economy.

Oil Prices and Canada's Commodity Dependency

At the heart of the Canadian economy lies a fundamental dependence on natural resources—particularly crude oil, natural gas, and metals. Canada is one of the world's top oil exporters, and a significant portion of its GDP and government revenue stems from the energy sector. Consequently, the Canadian dollar often behaves like a "petrocurrency", closely tracking the movements of global oil prices.

In recent years, oil prices have fluctuated due to a combination of global oversupply, weaker demand from China, and uncertainty stemming from geopolitical tensions. While prices have stabilised somewhat, they remain far below their peak levels of the early 2010s. As oil revenues decline, so too does foreign demand for the Canadian dollar, leading to depreciation.

Furthermore, any weakness in global commodity demand—be it due to slowing economic growth, rising interest rates, or transitions to green energy—tends to put downward pressure on the loonie. This correlation creates a structural vulnerability for the currency, especially during periods of global economic uncertainty.

Interest Rate Gap and Diverging Central Bank Policies

Another major factor contributing to the weakness of the Canadian dollar is the divergence in interest rate policies between the Bank of Canada (BoC) and its counterparts, most notably the U.S. Federal Reserve.

As of mid-2025. the Bank of Canada has begun signalling the potential for rate cuts in response to softening domestic data and fears of a recession. Conversely, the Federal Reserve has maintained a more hawkish stance, keeping rates elevated in an effort to fully tame inflation. This creates a yield differential, whereby investors seeking higher returns on fixed-income assets prefer to park their capital in U.S. dollar-denominated instruments rather than Canadian ones.

The result is a steady outflow of investment from Canada, further weakening the loonie. In currency markets, such disparities in interest rates are critical drivers of short- to medium-term exchange rate movements.

Weak Domestic Economic Performance

Economic indicators within Canada have painted a rather uninspiring picture in recent months. GDP contracted in May 2025. and both consumer and business sentiment have weakened. Unemployment has edged upwards, and retail sales have declined. These trends point to a potential economic slowdown, if not a full-blown recession.

Adding to the concern is Canada's housing market, which has shown signs of cooling after years of rapid price growth. The real estate sector is a key pillar of Canada's economy and an important driver of household wealth. Declines in property prices could further dampen consumer spending, dragging on economic growth.

Such soft domestic fundamentals reduce investor confidence in the Canadian economy, translating into lower demand for its currency. In global markets, currencies are often viewed as proxies for national economic strength. When the outlook darkens, so too does the appeal of the loonie.

Trade Tensions and Global Risk Sentiment

Canada's close trading relationship with the United States—its largest export partner—makes it particularly sensitive to any fluctuations in trade policy. Recent developments have reintroduced uncertainty to this historically stable relationship. Tariffs on Canadian exports, especially in steel and dairy, and rhetoric around "America First" policies have led to strained cross-border dynamics.

Beyond North America, global trade tensions have also had knock-on effects. From the lingering aftershocks of the U.S.-China trade war to conflicts in Eastern Europe and the Middle East, geopolitical instability tends to spook investors. During such "risk-off"periods, market participants seek out safe-haven currencies, such as the U.S. dollar, Japanese yen, or Swiss franc—often at the expense of currencies like the Canadian dollar.

Despite being part of the G7. Canada's currency is considered more volatile and less liquid in times of crisis. As such, even if Canada is not directly involved in geopolitical strife, its currency can suffer from broad-based aversion to risk.

Structural Challenges in Canada's Economy

Beyond the cyclical issues mentioned above, the Canadian dollar also suffers from a number of long-term structural weaknesses that make it more susceptible to depreciation.

First and foremost is the lack of economic diversification. While Canada has strong institutions and a well-educated workforce, it remains heavily reliant on a narrow base of industries—particularly natural resources and real estate. Innovation, technology, and advanced manufacturing have lagged behind peers such as the United States, Germany, and even Australia in some sectors.

Secondly, Canada's twin deficits—a fiscal deficit and a current account deficit—also raise red flags. Persistent government spending and borrowing can undermine confidence in the country's long-term fiscal stability. Meanwhile, a current account deficit implies that the country is importing more than it exports, thereby creating continuous downward pressure on its currency.

Finally, unlike the U.S. dollar, the Canadian dollar is not a global reserve currency. This means that central banks and institutional investors do not hold CAD in significant quantities as part of their reserves, which limits long-term structural demand for the loonie.

Investor Sentiment, Capital Flight, and Market Forces

Investor psychology and capital flow dynamics play a substantial role in the loonie's weakness. With U.S. yields offering more attractive returns, many institutional investors are moving their capital south of the border. Domestic Canadian investors, too, are increasingly allocating their portfolios toward foreign assets—particularly U.S. equities and bonds—putting additional downward pressure on the CAD.

Speculative activity in currency markets has also amplified the loonie's decline. Traders frequently short the Canadian dollar during times of oil price volatility or economic underperformance. Additionally, algorithms and automated trading strategies often exacerbate trends once they take hold, leading to sharp moves in the exchange rate over relatively short periods.

Ultimately, perception becomes reality. As the loonie weakens, it invites more scrutiny, more negative sentiment, and further selling—creating a feedback loop that is difficult to reverse without a significant shift in economic fundamentals or monetary policy.

Conclusion

The Canadian dollar's weakness in 2025 is not the result of any single factor, but rather a confluence of global, domestic, and structural issues. From falling oil prices and interest rate divergence to weak economic data and long-standing economic vulnerabilities, the loonie is facing pressure from multiple directions.

While the Canadian dollar may eventually rebound—particularly if oil prices recover or the Bank of Canada shifts its policy stance—it is clear that significant challenges remain. For Canadians, a weak dollar has mixed implications: it makes exports more competitive but also raises the cost of imports, travel, and foreign investment.

Whether the loonie regains its strength or continues to falter will depend largely on the country's ability to adapt, diversify its economy, and navigate an increasingly volatile global landscape.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.