Since the end of 2022, global financial markets have had a quite turbulent ending and beginning. Firstly, the Federal Reserve slowed down interest rate hikes, and then the liquidity crisis in the banking industry swept across the world, causing Credit Suisse to fall silent on the historical stage in a wave of shocks.

On the asset side, AT1 has been hit by thunderstorms one after another, resulting in a sharp drop in investment value; The hedging nature of gold is prominent, but the high price makes people feel a bit aloof and cold; The exposure of liquid assets to high inflation will also be constrained by the business cycle.

In the current market environment, it is difficult to have a stable investment target, so investment diversification has become the main tone of the market.

As the most active trading market in the world, the forex market is naturally welcomed by more investors. With the continuous innovation and changes in the financial industry, what new changes will happen to the forex market in the next two years?

1、 Firstly, forex margin trading will be further opened up

A few years ago, Bank of China and China Construction Bank had already laid out the forex market in advance and obtained a full regulatory license from the UK FCA.

In 2023, the Zhengzhou Commodity Exchange launched the first shot in domestic forex margin trading, and now you can directly search for Guotai Jun'an's servers on MT4.

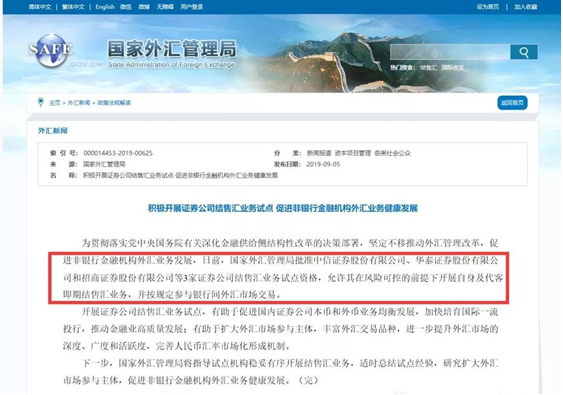

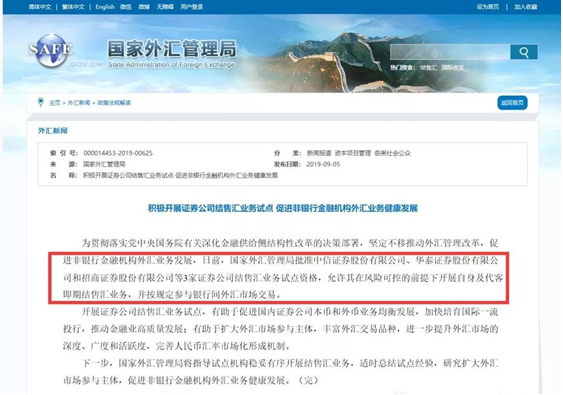

At the same time, the State Administration of Forex has approved the pilot qualifications for forex settlement and sales business for four Securities companies, including CITIC, Huatai, Zhongtai, and China Merchants Securities. Next, the State Administration of Forex will guide pilot institutions to steadily and orderly carry out forex settlement and sales business, timely summarize pilot experience, study and expand the participation of forex market participants, and promote the healthy development of forex business of non-bank financial institutions.

With the further opening up of China's forex market, there will be more high-quality securities firms and banks in China, which will layout the forex market in advance and provide us with more diverse channels to participate in forex trading.

2、 More high-quality overseas trading securities firms will be introduced

As early as 2019, the China Securities Regulatory Commission approved the establishment of JPMorgan Chase Securities (China) Co., Ltd. and Nomura Oriental International Securities Co., Ltd. in accordance with the law. Next, the China Securities Regulatory Commission will continue to firmly implement China's overall plan for opening up to the outside world.

In addition to introducing overseas trading securities firms, Chinese enterprises have also accelerated the pace of overseas mergers and acquisitions. For example, in 2015, CITIC Securities acquired 60% of the equity of KVB Kunlun International Finance and became its controlling shareholder; Geely Group also acquired a 30% stake in Shengbao Bank in 2017 and stated that it will continue to expand the scale of its share acquisition in the future, making up for its shortcomings in the financial services field through the advantages of Shengbao Bank's diversified asset platform.

Whether it is the introduction or acquisition of forex trading securities firms, it is a solid step forward in the development of China's forex market. However, for us ordinary investors, when choosing trading securities firms to participate in trading, we must pay attention to regulatory qualifications to prevent encountering some platforms that are confusing.

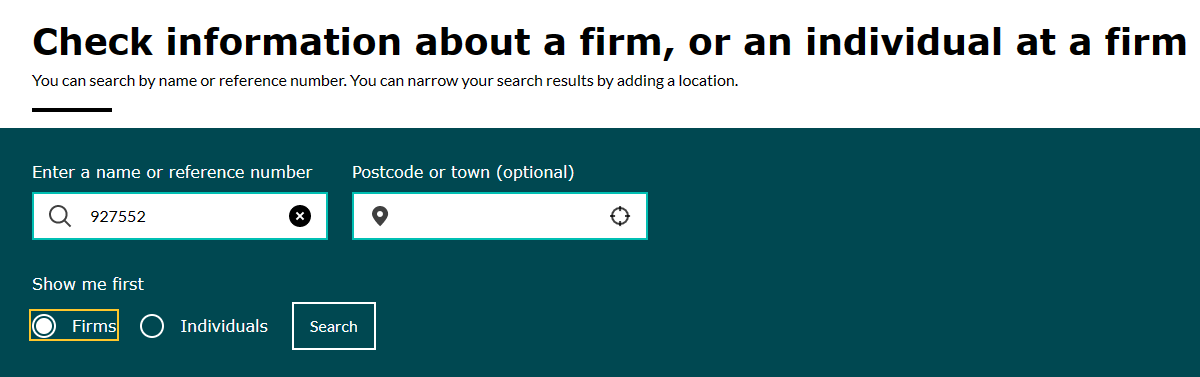

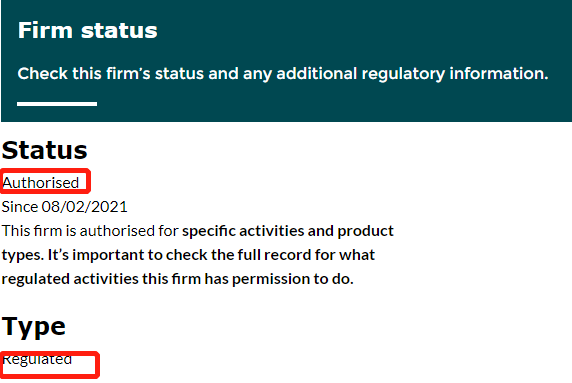

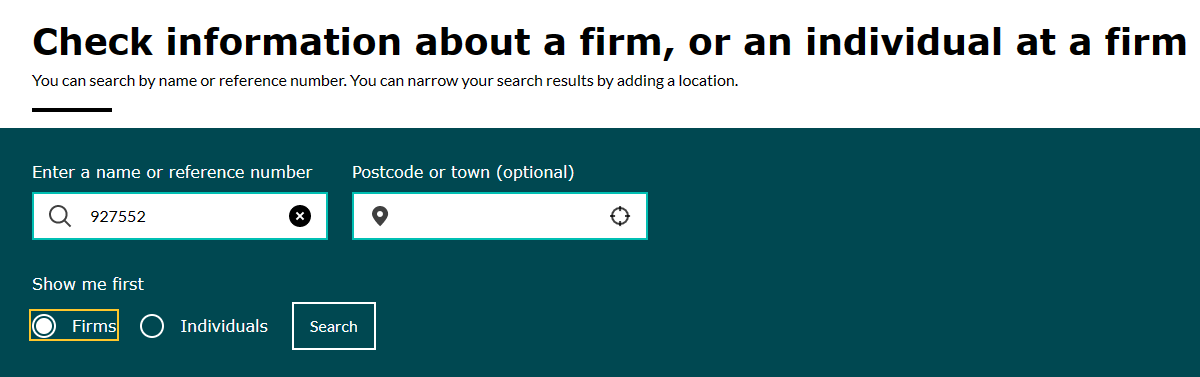

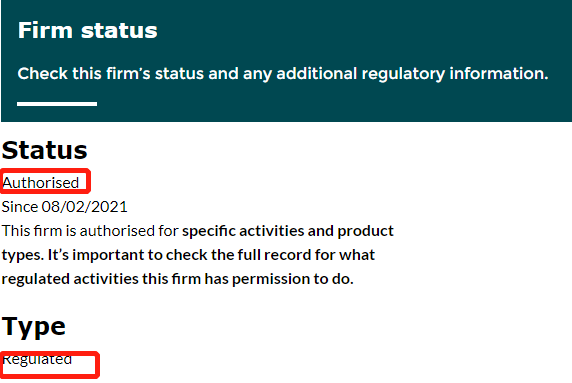

At this stage, it is recommended to prioritize the selection of FCA licensed institutions, which must be fully licensed. Specific screening methods, using EBCGroup as an example: Open the FCA query website: https://register.fca.org.uk/ Enter the regulatory number 927552 of EBC in the search bar and click on firms to search, then we can see all the detailed information about EBC.

Authorized and Regulated are displayed in the Status and Type columns respectively, indicating that the company is under effective FCA supervision and is fully licensed.

However, it should be noted that if it is EEA Authorized or other words, it is not fully regulated by FCA, and attention must be maintained.

3、 EA transactions are becoming increasingly popular

When China established a stock exchange in 1990, foreign countries still adopted the model of electronic disk and quotation personnel; No one would have expected that by 1994, China had become the first country in the world to enter the era of electronic trading.

With the rapid changes in the global financial industry and the launch of EA trading by Nasdaq, programmed trading has become popular worldwide and has given birth to many technological genres.

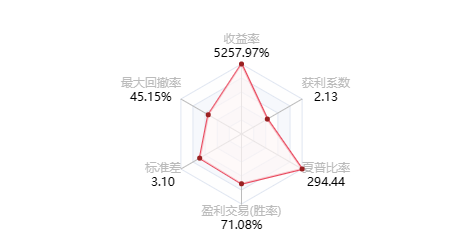

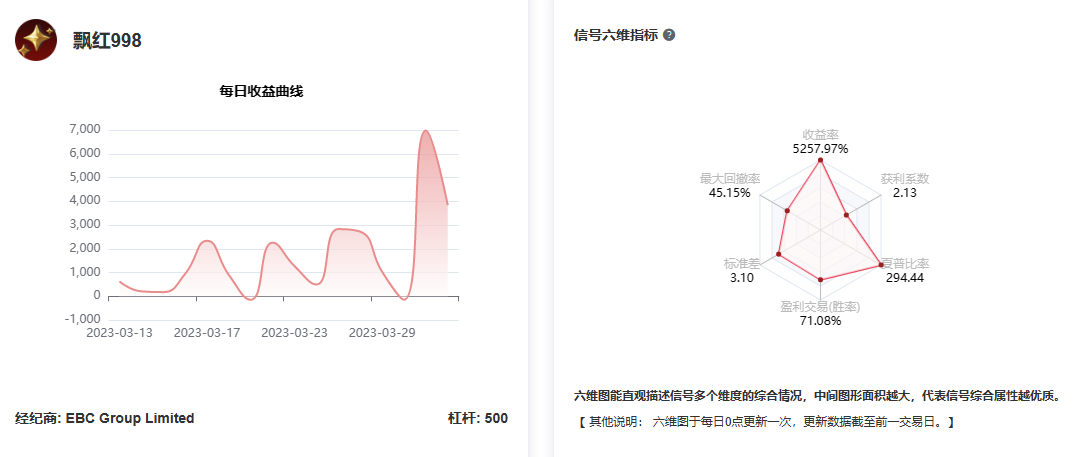

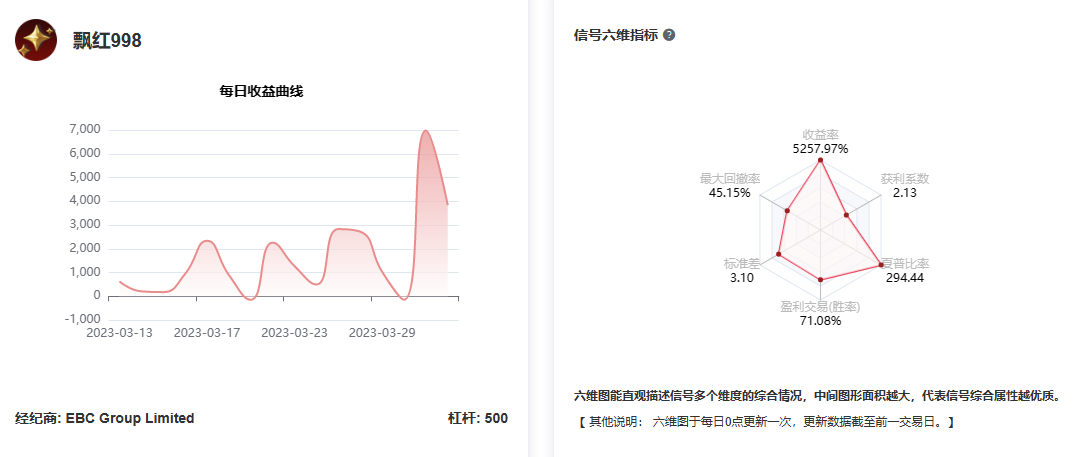

When I was watching the EBC trading competition recently, I noticed that the first player was an EA trader. In the past 17 trading days, he has placed a total of 41140 orders, with an average of 2420 trade per day, and his cumulative revenue performance has reached 55 times.

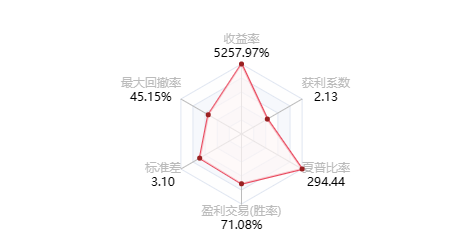

Although it is a fast forward and fast out high-frequency trade, his position control is very small, and the overall profit is also very stable. The Sharpe ratio is as high as 294.44%, close to 3, which is almost the level that top fund managers can reach.

In fact, this is not difficult to understand, because EA trading is a programmatic trading, as long as your algorithm is good enough to avoid some irrational factors and the impact of human nature on trading, it is not surprising that you can run stably and well.

In addition to the above advantages, MT4 has already formed a very stable EA communication community, providing over 2000 paid tools and over 700 free tools, which can assist in better tradeexecution. So, EA trading is an inevitable trend for future development. Even if you don't like high-frequency trading, there are various types of EA such as trend trading and volatility trading that can assist you in judging the trend.

Some platforms have also launched the same order flow tool as Wall Street, which is simply connected to the data end of the exchange and can grasp the flow of every order in the market through trading analysis. This tool, combined with EA, basically focuses directly on the entire market liquidity trading. But the general fee is also relatively high, so it is rarely used by retail investors.

However, there are exceptions, as EBC Group is one of the few platforms on the market that offers free order flow tools.

Although it is provided for free, the EBC order flow tool is comparable to the ones on the market that charge fees. Firstly, it is the most important source of data. The partners of the EBC order flow tool include CME and the London Metal Exchange, which carry a considerable portion of the world's trade, so the data provided is more authoritative.

Secondly, the EBC order flow tool incorporates the trading behavior of large institutional market participants. According to the official website explanation, in simple terms, it means analyzing the behavior of the main funds in the market, such as fundraising and distribution, and EA users can conduct follow-up trade based on this data. -

If you are interested in the EBC order flow tool, you can go to the official website to obtain free collection information.

4、 Forex documentary and forex custody will be more favored

The forex market will never lack excellent traders. For investors who have just entered the market, if they can imitate or even replicate their trading, they can enjoy the fun of trading and gain additional returns. So, the forex custody and forex tracking models were born.

Forex custody

Just like a fund, you hand over your funds to a dedicated custodian team, who invest and earn returns.

Forex documentary

Forex tracking refers to traders displaying their signals in the tracking community. Investors can choose the signal that suits them based on the trader's earnings performance, trading variety, and trading style, and then follow it with one click to copy the returns.

With the deepening of professional investment, more and more investors are choosing to hand over their funds to professional traders. In the rapidly changing forex industry, forex custody and forex tracking undoubtedly provide a very good window for beginners to participate.

However, by comparison, forex documentary trading is still a more common method at present. Firstly, small capital investors may find it difficult to participate in forex custody; In addition, the forex custody team may also have trading lows and other situations where they perform poorly, and investors are unable to adjust their investment direction. In contrast, forex documentary trading does not limit the amount of funds and can switch signals at any time to maintain optimal trading status.

Taking the EBC tracking community as an example, EBC Sync provides investors with a six dimensional evaluation system and can view every order of a trader in real-time.

Through the six dimensional evaluation system, investors can accurately grasp the trading style, return performance, and pullback situation of traders, in order to distinguish whether they are stable traders or aggressive traders, and thus determine their tracking style.

By viewing each order in real-time, one can understand the trader's trading ideas, observe and learn, and improve their trading skills. At the appropriate time, it is also possible to follow orders with one click and synchronize profits.

Overall, in the past few years, we have seen many very encouraging changes in the forexe industry.

With the further opening of China's financial market, a more dynamic forex trading market will become a part of our diversified investment portfolio. More importantly, a fair and transparent trading mechanism in the forex market will become a powerful tool for us to hedge market risks and suppress market fluctuations.