When I was young, I used to firmly believe that as long as I mastered the investment secrets of trading masters, I could have a successful investment market. After all, 'standing on the shoulders of giants is the only way to see further'.

At that time, I read "Memoirs of Stock Traders" and worked hard to learn Gann's theory, while also trying to discover the true trajectory of the market from Elliott's wave theory. But in the end, reality managed to knock me out of the speculation of becoming famous in World War I.

For a long time, I never touched trading again. It's not about fear, it's about instinctively moving away from things I think I can't control. It wasn't until I communicated with a friend who had achieved some success in trading that I realized that trading is really the simplest path. You may not have fancy techniques, but you must learn to stop profits and losses, especially stops.

1、 Learning to stop losses is the first step in trading

In fact, looking back at the trading history of the past century, when facing positions with losses, top international trading masters almost unanimously believe that it is necessary to quickly recognize losses and exit.

1. Livermore:

Livermore, the trading master known as the "big bear" and "the greatest stock trader of all time," once said: before deciding to buy a stock, one must first plan a clear goal of "once the development of the stock after buying does not meet expectations, one must leave the market" and must execute it accurately.

He also mentioned multiple times that it is inappropriate or even incorrect to add extra weight to positions that are losing money.

2. Wells Wilder:

Wells Wilder, known as the "greatest master of technical analysis in the 20th century," believes that trading should "stop losses at the right time and continue to make profits".

He once said, "Don't worry about profitable positions. What you need to worry about is the losing positions. As long as you handle the losing positions well, the profitable positions will naturally help you make money

Jiang En:

Jiang En, known as the "father of technical analysis," also mentioned in his later years that many investors suffered huge losses because they did not set appropriate stop loss points, resulting in unlimited errors and increasing losses.

In fact, trading masters place stop losses in a crucial position because they see human weaknesses in long-term trading.

Most people always fall into the misconception of ensuring that every order is profitable when trading. So when the profit order sees small profits, it runs away, but when the loss order remains calm, the situation often becomes more and more biased, and ultimately can only leave the market with a big loss, or even liquidate the position.

Even Livermore has stated that when faced with loss orders, it is still inevitable for him to make such foolish actions, and in the end, the situation often develops to an uncontrollable extent.

Master, if ordinary people can strictly follow the trading discipline of stop loss in trading, they have already achieved half of the success.

2、 How to stop loss will directly affect the outcome of the transaction

For ordinary investors, whether to do a good job of stopping losses may lead to completely different trading outcomes.

Recently, I was watching the EBC Million Dollar Trading Competition. With a million dollar prize pool and an ultra-low entry threshold, the EBC Trading Competition has attracted widespread participation from global investors, which has spawned many outstanding traders.

Just about a month into the competition, the first 40x trader was born, with a cumulative yield of up to 4300%.

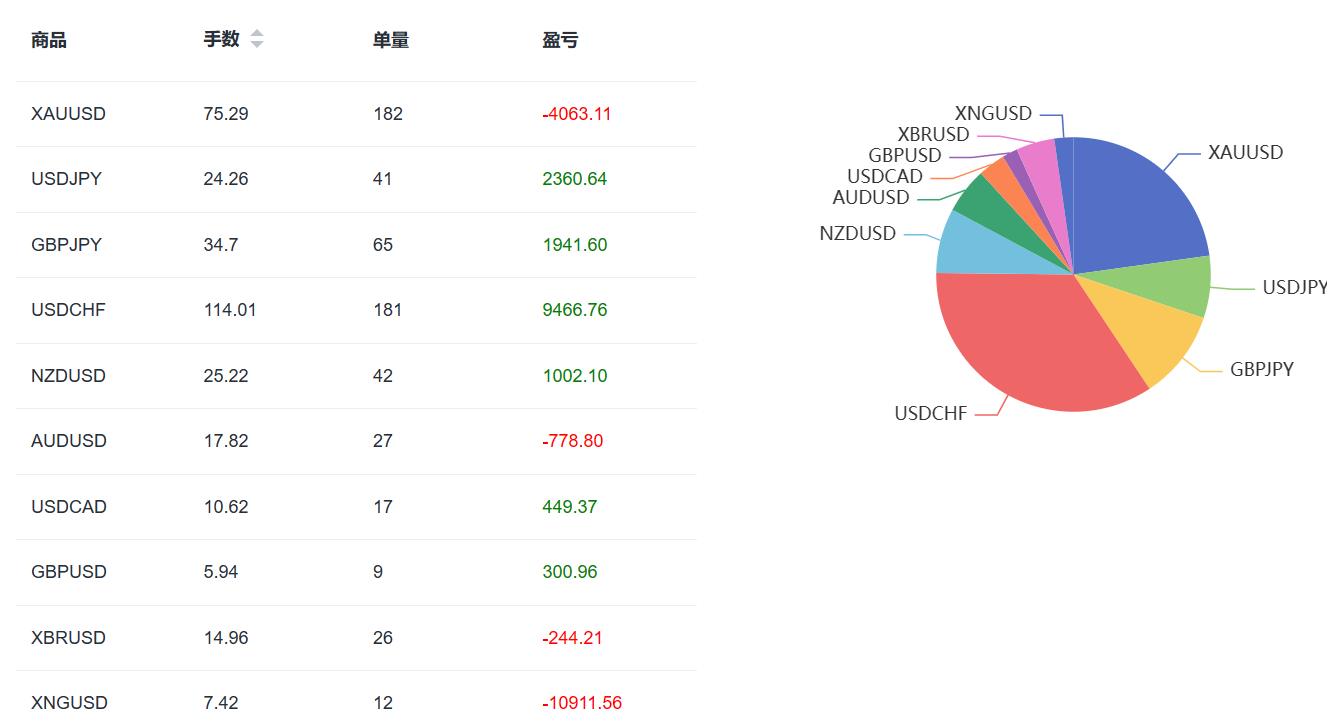

Even if you look at his Trading Account now, you will feel that he is a very stylish trader. His selection logic is very smooth. In the early stages of trading, he would choose some varieties that are in the trend channel and repeatedly sell high and buy low, which helped him accumulate a lot of profits. Even if there is a reverse market trend, as it is a trading trend, the order can be smoothly lifted and lifted.

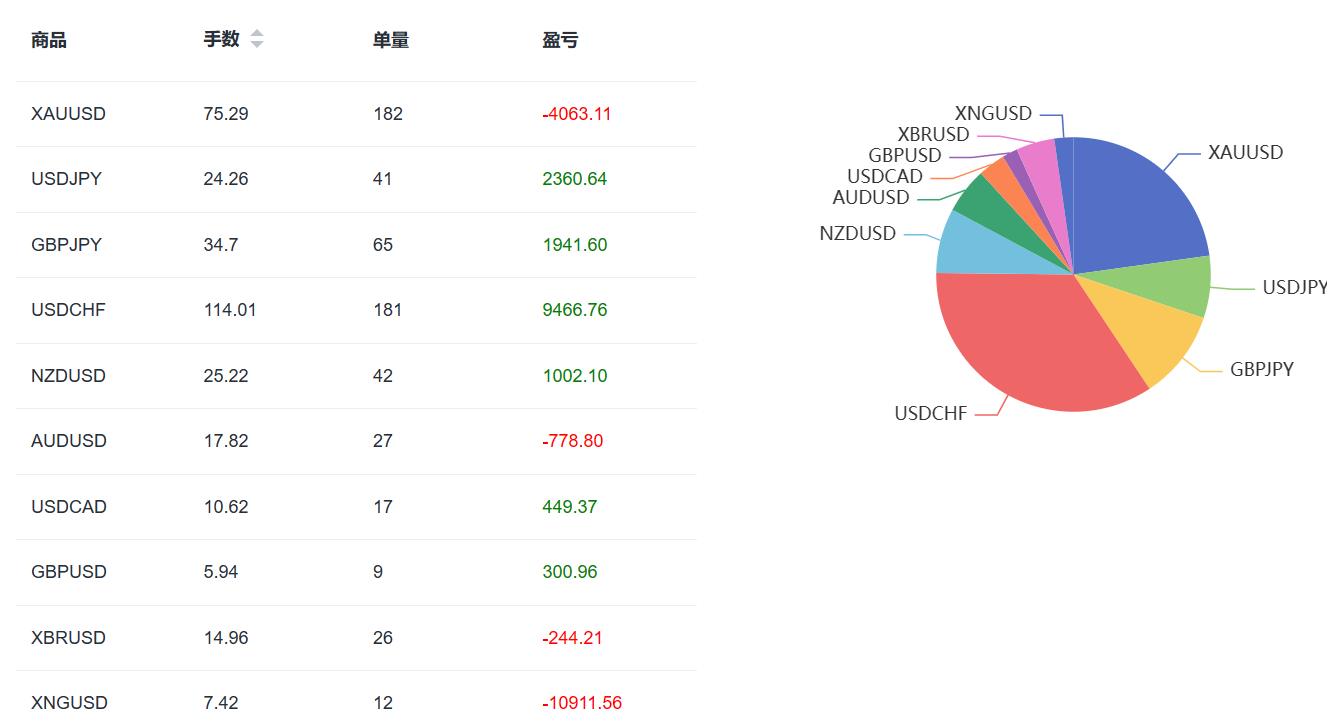

So when the account was at its peak, his USDCHF and XAUUSD both accumulated profits of nearly ten thousand US dollars.

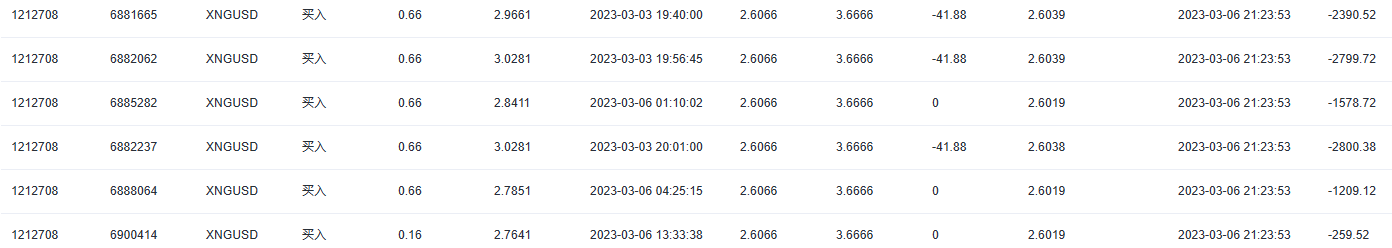

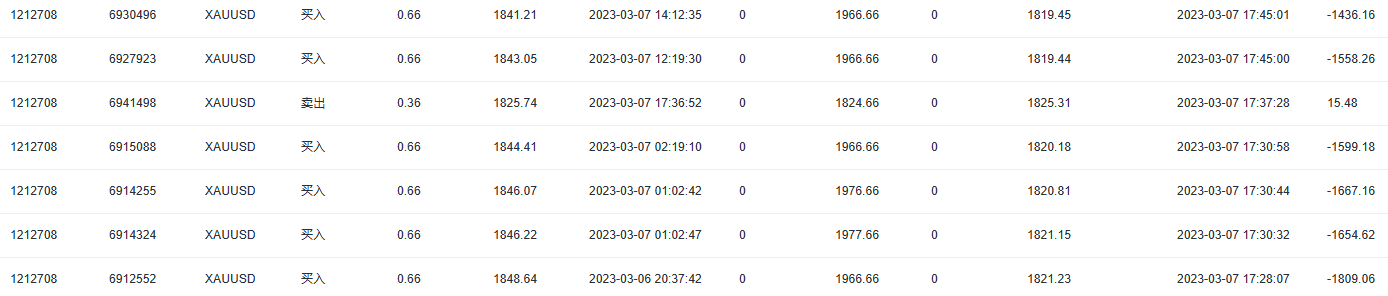

However, the collapse of a large building often occurs in the blink of an eye, due to misjudgment of the trends of XAUUSD and XNGUSD, coupled with overweight positions and failure to leave the market in a timely manner, his account was directly reset to zero in just two trading days and two waves of market conditions.

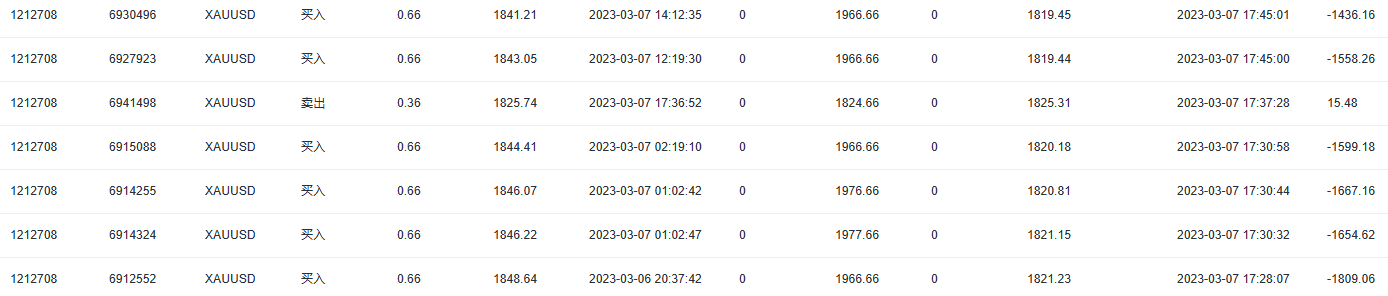

Gold loss orders that triggered the explosion of positions

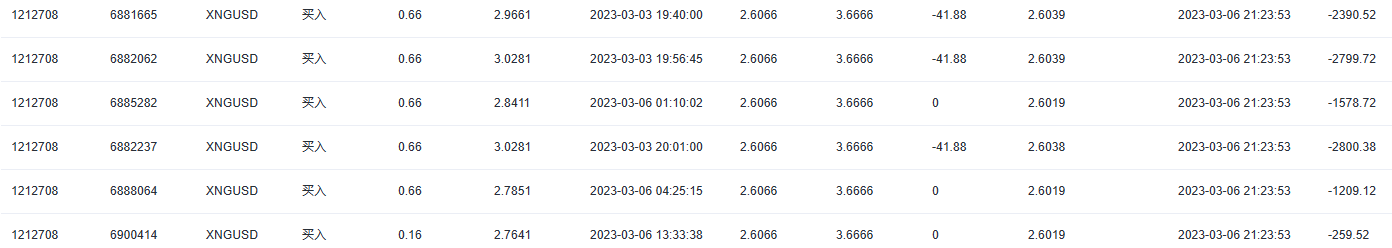

XNGUSD loss order that triggered a position explosion

In fact, in the two trading days approaching the end of his position, he has a good chance to cut his meat and leave the market. Even if he temporarily loses his ranking advantage, he can still ensure a profit of around 20 times to prepare for a comeback. However, his previous experience of successfully carrying orders has temporarily paralyzed his ability to stop losses in a timely manner, leading to the failure of his previous efforts.

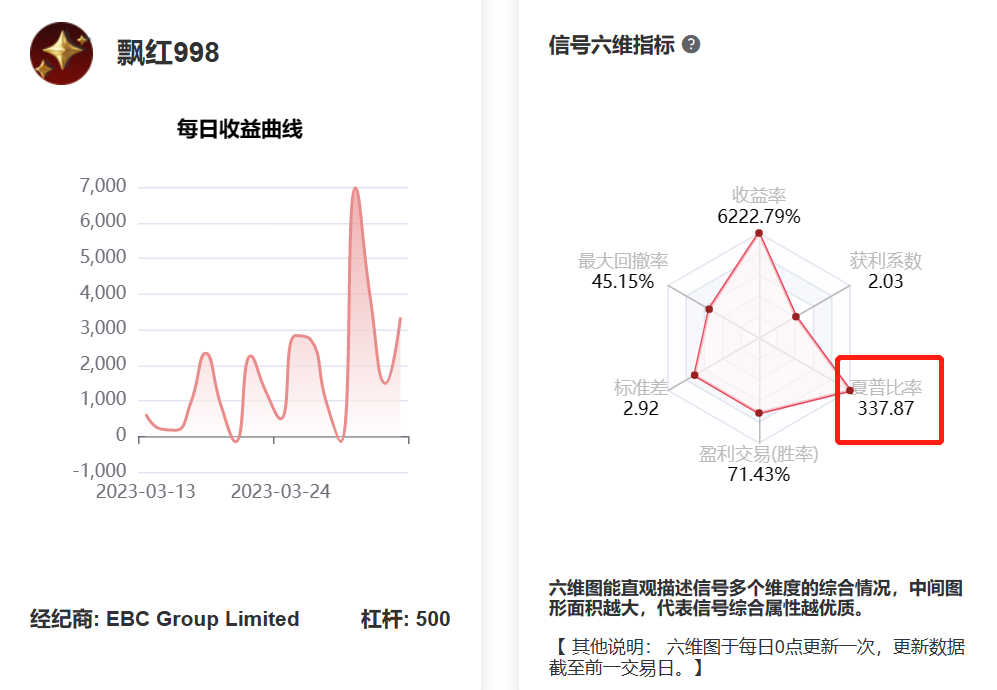

However, as the competition progresses, there is currently a trading dark horse on the field that I believe is very stable.

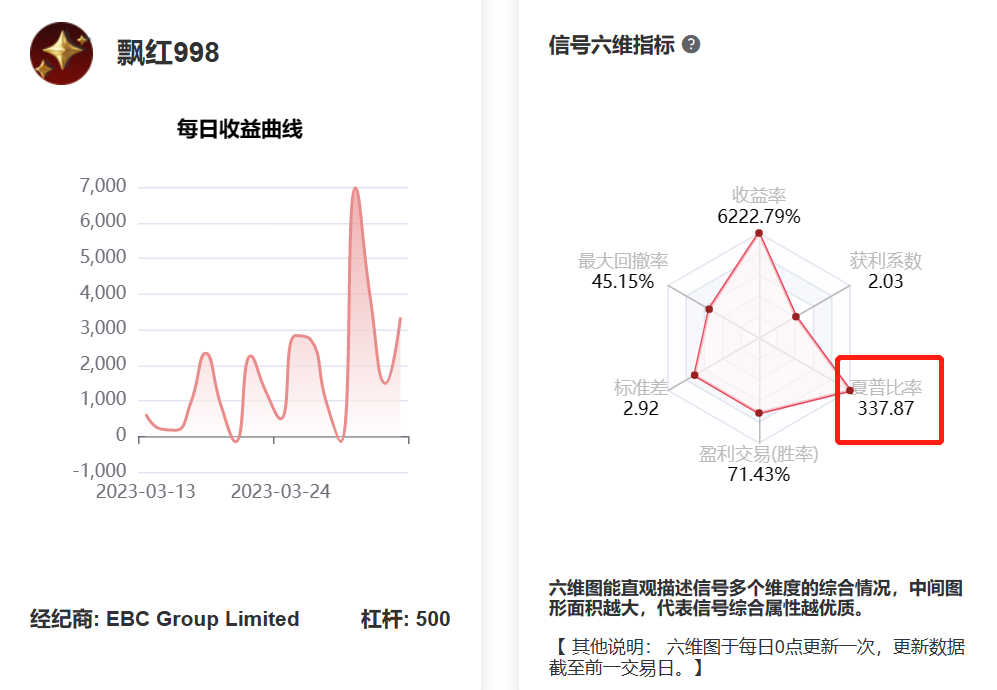

Interestingly, he is a high-frequency EA trader. Since participating on March 13th, a total of 47262 orders have been placed. But it was also EA trading that broke free from human weaknesses and strictly followed the trading principles of small positions, fast forward and fast out, and timely stop gains and losses.

Reviewing his trading account, his orders did not pursue a high winning rate, but maintained an overall breakeven ratio of 2.5:1, allowing for 2 loss orders out of every 7 orders. Once the order reaches the threshold set for loss, it is decisively closed and opportunities for entry are sought again, keeping the average loss on his order at around $2.23.

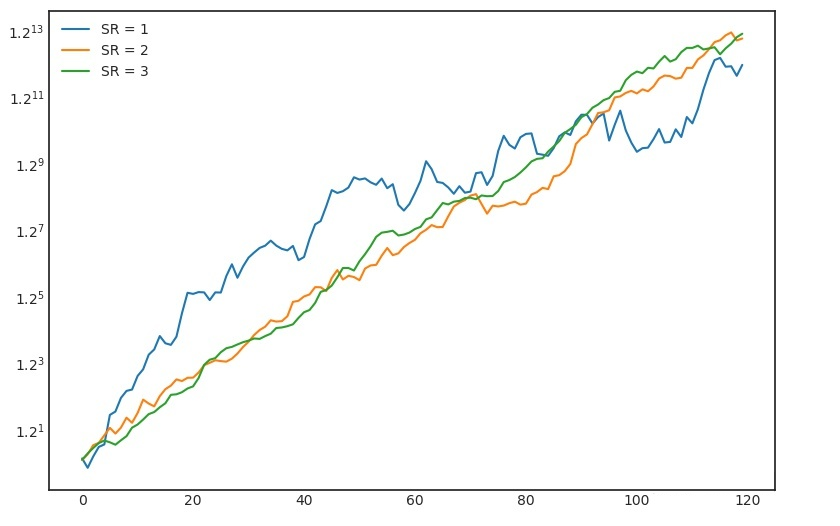

So, his account profitability is very stable, with almost no significant fluctuations. In recent months, compared to his gold deposit standard of $500, his profit has steadily increased by 3.5 times a day, showing a completely opposite profit trend compared to the previous champion.

These clues can actually be found in the six dimensional evaluation system provided by EBC.

In order to facilitate the observation of traders' operation performance, in addition to real-time viewing of orders, the EBC Group also introduced a six dimensional evaluation system, including profitability, withdrawal and Sharpe ratio.

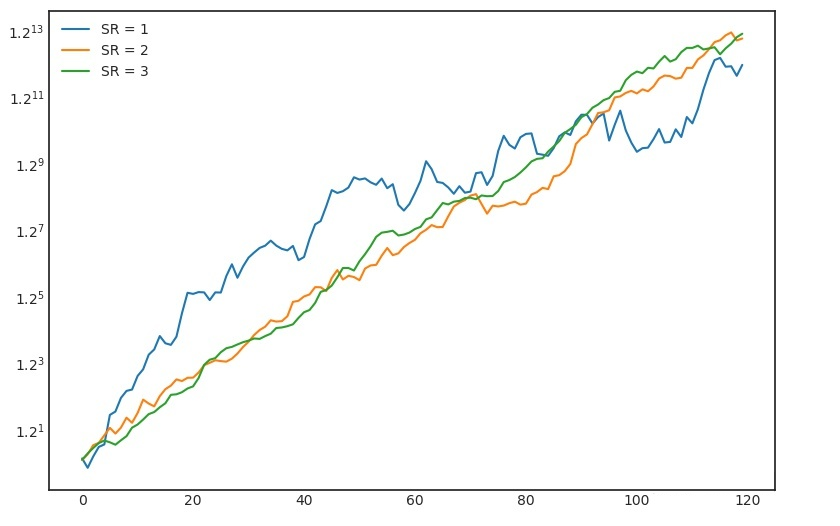

In the fund industry, the Sharpe ratio is a core investment indicator to weigh risks and returns. Generally, when the Sharpe ratio is greater than 1, it has investment value; If it exceeds 2, it is very noteworthy; If it reaches 3, it is basically one in a hundred with indicators. If the Sharpe ratio is 3 (SR=3), the net worth curve is basically a straight line, representing a very stable return.

第二位选手的夏普比率高达337.87%,超过了3,基本可以媲美顶级基金经理的盈利水平了。

So, I believe that 'fast in and fast out will lead to losses' is a false proposition.

As long as we strictly adhere to trading discipline and control stop losses, we can fully accumulate profits in the midst of fluctuations. On the contrary, if you don't know how to stop losses, it will become chasing gains and killing losses, which is the fundamental reason for fast forward and fast out losses.

3、 How to set a good stop loss

In fact, whether it is manual trading or future EA's Automated Trading, learning to stop losses is a necessary factor to become a qualified investor.

In recent years, I have also been in contact with and accepting EA transactions. In the process of understanding, I found that when investment leaders in the EA field design an EA, the core control variable is also to set a stop loss.

For example, legendary trader EdSeykota, who has been writing trend trading systems since the modern 1970s, earned $15 million from clients' $5000 accounts over 16 years, a 2500 fold increase in revenue. When it comes to success, Seykota attributes it to good fund management, the ability to stop losses in a timely manner, and its own developed technical analysis system.

Compared to manual trading, although EA can overcome human weaknesses in order execution, how to use stop loss effectively remains an eternal challenge and has become a key variable affecting trading. I think we can do this:

Set protective stop loss points while entering and move stop loss to lock in profits

No one can control the market, so the larger the stop loss, the better. Protecting profits with stop loss always comes first.

2. Before entering, set a stop loss for the worst-case scenario that may occur

Based on your trading system, where do you think the trend will reverse? Set the stop loss. Don't be afraid to make mistakes, it is necessary to try and make mistakes while controlling losses.

3. Find a platform with fast order execution speed and strong liquidity

Don't overestimate your judgment on the market, especially when it comes to the early stages of trading. If there is a flash market, the platform's order execution speed and liquidity will determine whether your order can be cleared at the point you set, thereby minimizing losses.

Generally, high-quality platforms have at least 3 or even dozens of servers, such as EBCThe Group has nearly 30 ultra high speed dedicated line servers worldwide, which can achieve up to 1000 aggregated orders per second and provide 98.75% data transmission stability.

As for the liquidity of the platform, it mainly depends on the liquidity of the platform's access. For example, EBC connects to the liquidity fund pools of over 20 top banks through the fix interface, including JPMorgan Chase, Barclays Bank, and UBS Group, providing customers with direct market access to primary liquidity venues.

Trading is not an overnight process.

Only by gradually improving our skills while controlling risks can we continuously broaden our trading path. Learning to stop losses is crucial in this process.