Insider trading is a term that often makes headlines, conjuring images of secret deals and unfair profits. But what exactly is insider trading, how does the law define it, and why is ethical behaviour so crucial in this area?

Understanding these questions is essential for anyone active in the financial markets, whether you're an investor, trader, or corporate insider.

What Is Insider Trading?

Insider trading refers to the buying or selling of a company's securities—such as shares or bonds—by individuals who possess material, nonpublic information about that company.

This information is not available to the general public and could significantly affect the company's share price if it were widely known. Examples include knowledge of upcoming mergers, financial results, new product launches, or changes in senior management.

Who Is Considered an Insider?

The definition of an "insider" is broad. It includes:

Corporate insiders: Officers, directors, and employees of a company.

Significant shareholders: Those owning more than 10% of a company's securities.

Temporary insiders: Professionals such as lawyers, accountants, or consultants who gain access to confidential information through their work.

Tippees: Individuals who receive material, nonpublic information from an insider and trade on it, knowing it's confidential.

Material, Nonpublic Information

Material information is any fact that could influence an investor's decision to buy or sell a security. For example, news of a pending acquisition, regulatory approval, or a major financial loss would be considered material.

Nonpublic information means it has not been released to the general public and cannot be discovered through ordinary research or analysis.

Legal vs Illegal Insider Trading

Not all insider trading is illegal. Legal insider trading occurs when insiders buy or sell shares of their own company and properly disclose these transactions to regulators, such as through public filings. For example, a CEO buying company shares after a public earnings report is legal if it follows all reporting rules.

Illegal insider trading happens when someone trades based on material, nonpublic information in breach of a duty of trust or confidence. This includes trading by insiders themselves or by outsiders who have received a “tip” from an insider. Both the person who leaks the information (the tipper) and the person who uses it (the tippee) can be held liable.

How Is Insider Trading Detected and Prosecuted?

Regulators like the Securities and Exchange Commission (SEC) and the Department of Justice (DOJ) monitor trading activity for signs of insider trading. Unusual trading volumes or patterns ahead of major company announcements often trigger investigations. If found guilty, individuals can face severe civil and criminal penalties, including:

Fines up to three times the profit gained or loss avoided

Disgorgement of profits

Injunctions barring them from serving as company officers or directors

Imprisonment for up to 20 years

Real-World Examples

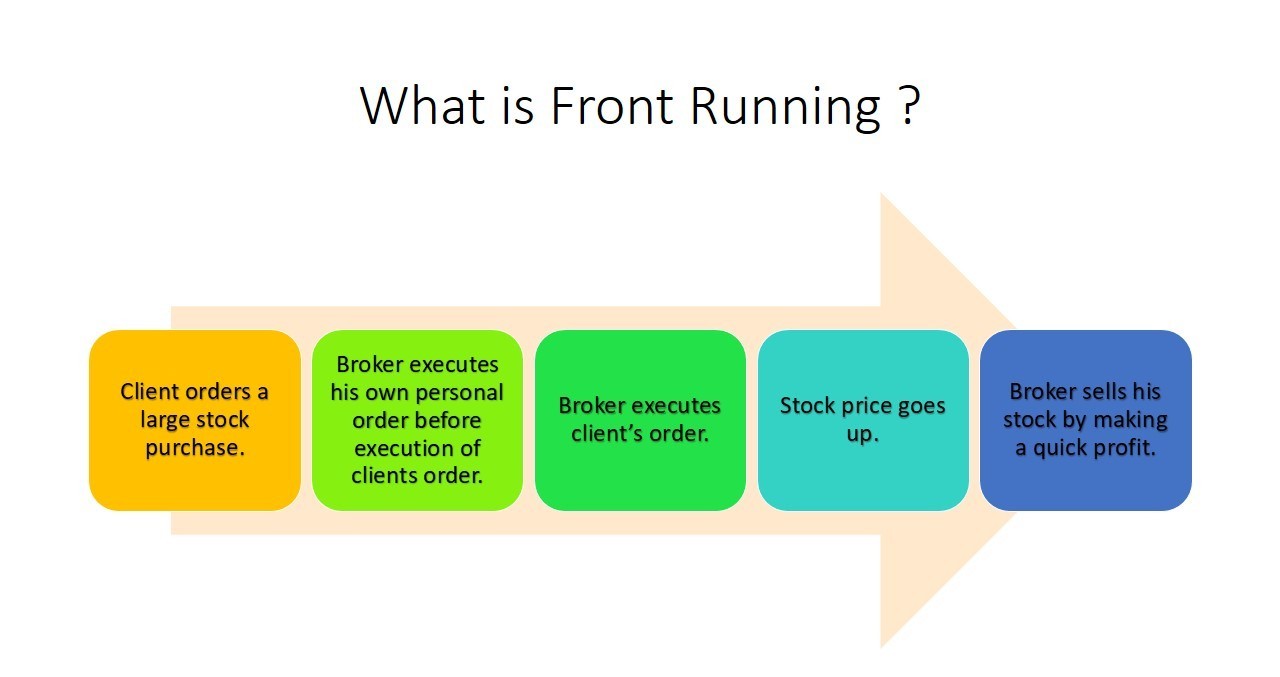

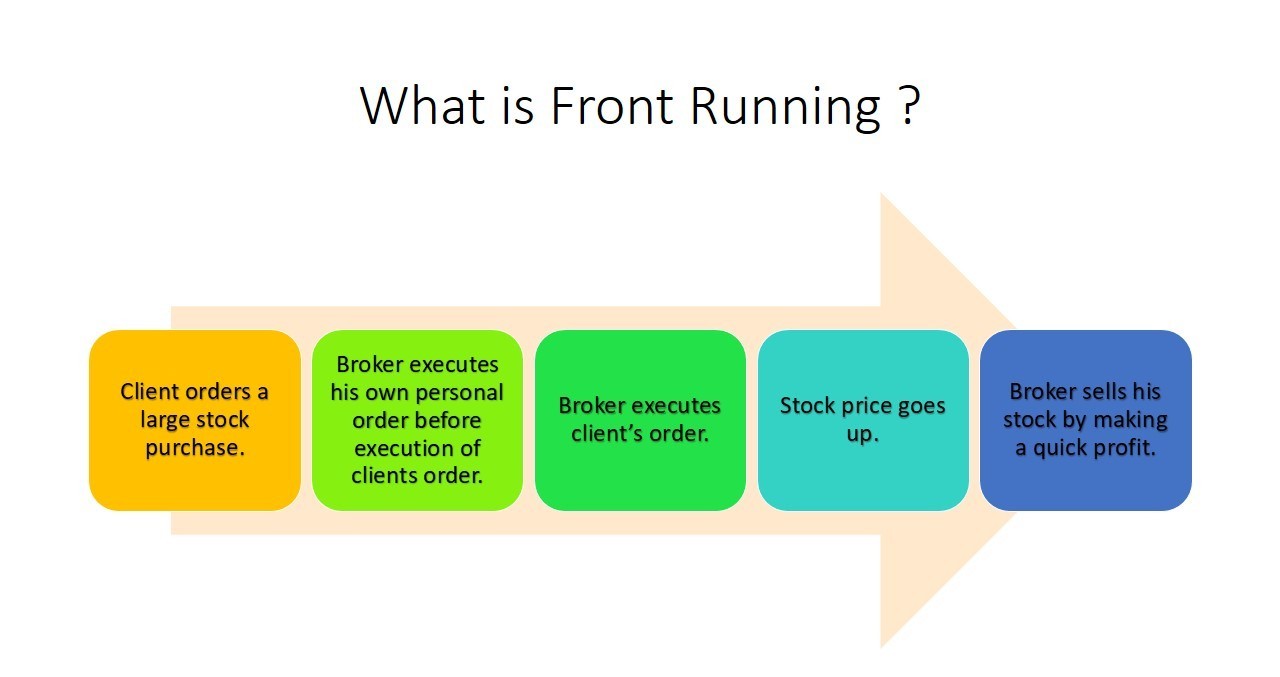

Front-running: A broker learns of a large client order and trades for their own benefit before executing the client's trade. This is both unethical and illegal.

Tipping: An executive shares confidential information about a merger with a friend, who then trades on that knowledge. Both can be prosecuted.

Misappropriation: A consultant working on a confidential project uses inside information to trade the company's shares.

The Ethics of Insider Trading

Insider trading raises important ethical questions. Markets are built on trust and the principle of a level playing field. When insiders use privileged information for personal gain, it undermines confidence in the fairness and transparency of financial markets. Other investors, lacking access to the same information, are put at a disadvantage, which can erode public trust and damage the integrity of the entire market.

While some argue that not all insider trading is inherently unethical, most legal systems penalise it because of the potential harm to other stakeholders and the broader market. The ethical standard is clear: those with access to confidential information have a duty not to exploit it for personal benefit.

Why Law and Ethics Matter

Robust insider trading laws and ethical standards are essential for protecting investors and ensuring that markets function efficiently and fairly. By enforcing strict rules and penalties, regulators aim to deter misconduct and maintain public confidence in the financial system.

Conclusion

Insider trading sits at the intersection of law and ethics in finance. Understanding what constitutes insider trading, the legal boundaries, and the ethical implications is vital for anyone participating in the markets. By respecting both the letter and the spirit of insider trading laws, market participants help uphold transparency, fairness, and trust in financial markets.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.