The foreign exchange market, commonly known as forex or FX, is the world's largest and most liquid financial market. With an average daily trading volume exceeding $7 trillion, it plays a vital role in global finance, impacting everything from international trade to travel and investment.

But what exactly does forex mean, and how does this vast marketplace operate? Here's what every trader and investor should know.

What Does Forex Mean?

Forex is short for “foreign exchange.” It refers to the process of exchanging one currency for another, whether for business, travel, or investment purposes.

Whenever you convert your home currency to a foreign one—such as exchanging pounds for euros on holiday—you are participating in the forex market. For traders and investors, forex is also a way to speculate on changes in currency values to seek profit.

What Is the Foreign Exchange Market?

The foreign exchange market is a global, decentralised marketplace where currencies are bought, sold, and exchanged at current or determined prices. Unlike stock markets, forex has no central exchange or physical location. Instead, it operates over-the-counter (OTC) through a network of banks, brokers, financial institutions, corporations, and individual traders connected electronically around the world.

Key Features:

24/5 Trading: The market operates 24 hours a day, five days a week, across major financial centres including London, New York, Tokyo, and Sydney.

Currency Pairs: Currencies are always traded in pairs (e.g., EUR/USD, GBP/JPY). The first currency is the base; the second is the quote. The exchange rate tells you how much of the quote currency is needed to buy one unit of the base currency.

No Central Exchange: All trading is conducted electronically, allowing for seamless global participation.

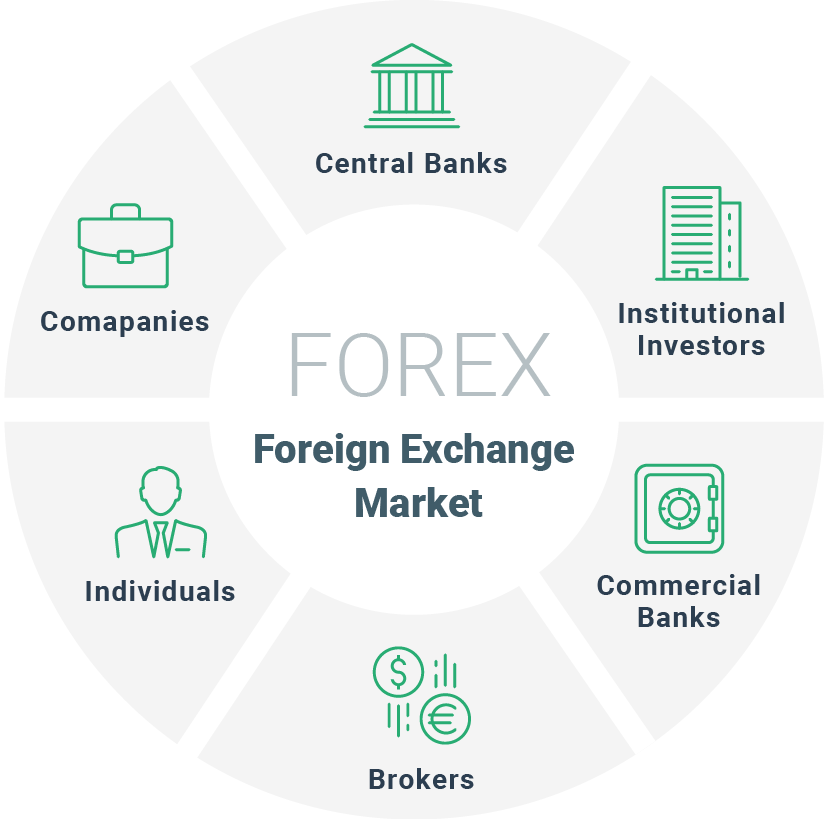

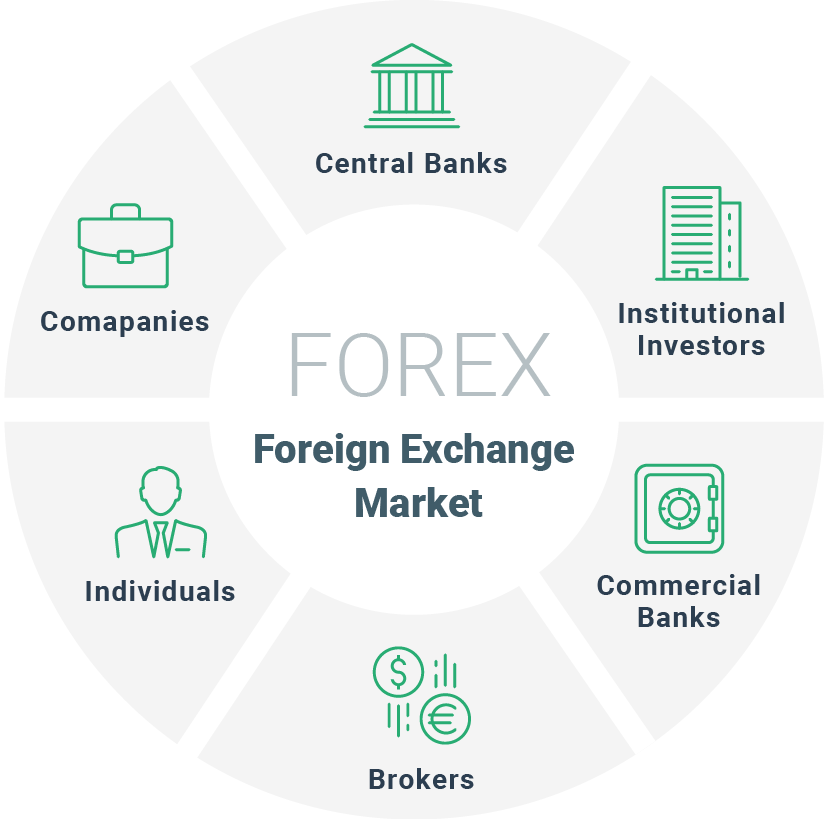

Who Participates in the Forex Market?

The forex market is made up of a diverse range of participants, including:

Commercial and Investment Banks: The largest players, responsible for the majority of trading volume.

Central Banks: Influence currency values through monetary policy and interventions.

Corporations: Engage in forex to pay for goods and services or hedge against currency risk.

Investment Managers and Hedge Funds: Trade currencies as part of global investment strategies.

Retail Traders: Individuals who speculate on currency movements, often using online platforms.

How Does Forex Trading Work?

Forex trading involves buying one currency while simultaneously selling another. For example, if you buy EUR/USD, you are buying euros and selling US dollars. The goal is to profit from changes in exchange rates—if the euro strengthens against the dollar, you can sell back at a higher price.

Types of Forex Trades:

Spot Transactions: Immediate exchange of currencies at the current rate.

Forwards and Futures: Agreements to exchange currencies at a future date and price.

Options: Contracts giving the right, but not the obligation, to exchange currency at a set rate in the future.

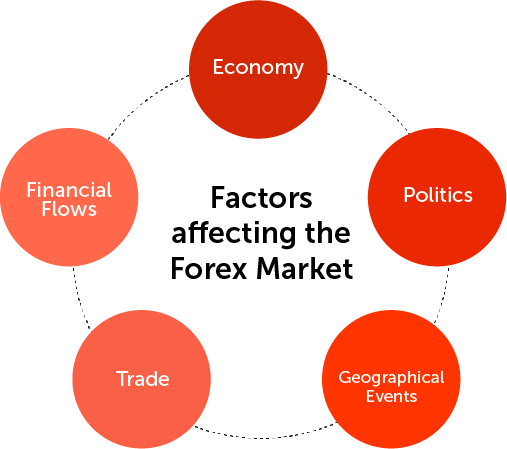

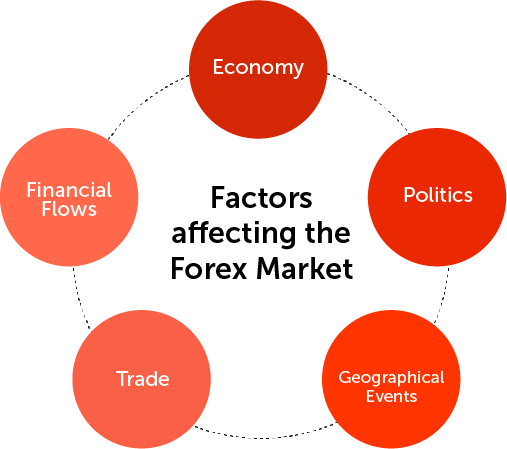

What Drives the Forex Market?

Currency values are influenced by a range of economic, political, and market factors, including:

Interest Rates: Higher rates can attract foreign capital, boosting currency value.

Economic Data: GDP growth, employment, inflation, and trade balances all impact exchange rates.

Political Stability: Uncertainty or instability can lead to currency volatility.

Market Sentiment: News, trends, and trader psychology can drive short-term price movements.

Benefits and Risks of Forex Trading

Benefits:

High Liquidity: Easy to enter and exit trades, even with large volumes.

Flexible Trading Hours: Trade any time during the week, across global markets.

Profit from Rising or Falling Markets: You can buy (go long) or sell (go short) currency pairs.

Risks:

Leverage: While it can amplify gains, leverage also increases the risk of significant losses.

Volatility: Currency prices can move rapidly, especially during major news events.

Complexity: Understanding global economics, technical analysis, and risk management is crucial for success.

Conclusion

The forex market is the backbone of international finance, enabling the exchange of currencies for trade, investment, and speculation. Understanding the meaning of forex and how the foreign exchange market operates is essential for anyone looking to participate in global markets.

Whether you're a business owner, investor, or traveller, forex touches many aspects of everyday life and offers unique opportunities and risks for those who engage with it.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.