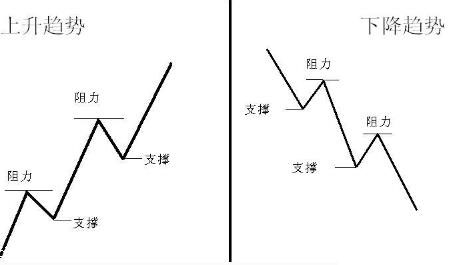

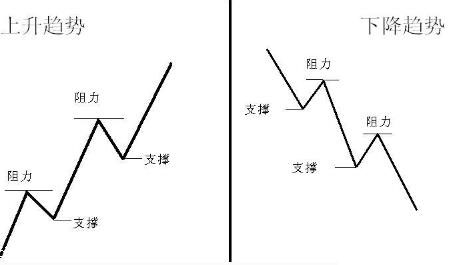

Support level is a point that traders need to pay attention to in all kind of trading. It is often used not only in forex trading, but also in stocks, futures and other trading to analyze whether it is a false trend. This requires traders to understand what support level means in order to better apply it in practical operations. Next, let's introduce what the support level is.

Support Position Concept

Support level refers to the level at which the trading market price may encounter support during a decline, thereby stopping the decline and stabilizing the price. The support line is when the stock index or stock price drops to a certain point, the stock index or stock price stops falling, and may even rebound, which is caused by multiple buying at this price.

There are generally three types of support positions:

1. Average support level;

2. High and low support levels;

3. Jumping gap support position.

The Formation of Forex Support Level

1. The Formation of Dense Trading Areas in the Market

If the dense trading area of the market is above the current price level, then that area will form resistance when the exchange rate rises; If the current price level of the market is above the historical concentration area, then the concentration area will form support when the market price drops.

2. Psychological Valence

The psychological price level is generally relative to the index.

If a significant resistance level is effectively breached during the operation of market prices, then that resistance level will become an important support level in the future.

The above is the introduction of support levels. Regardless of which investment method or trading platform investors choose, support and resistance levels are very important links in the analysis chart.

【 EBC Platform Risk Reminder and Disclaimer 】: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.