Forex resistance level refers to the highest price level that prices will encounter when the exchange rate is predicted to rise in technical analysis. That is to say, when the exchange rate rises to a specific price, the market will engage in selling behavior, resulting in the inability of the exchange rate to continue to rise.

The resistance level is a predicted value calculated based on historical price data, reflecting the bearish sentiment of the market towards the currency and the pressure point for investors to sell. Usually, traders can determine multiple resistance levels based on historical price trends and use them as one of the important reference factors for trading decisions. If the exchange rate can break through the resistance level, it may mean that the market has increased bullish sentiment towards the currency, further driving the exchange rate up; If the exchange rate cannot break through the resistance level, it may cause prices to fall back.

Traders can use resistance levels to develop trading strategies, such as setting a stop profit position or opening a short position. It should be noted that the resistance level is only a reference, and the actual exchange rate trend will be influenced by various factors, including macroeconomic data, situation, international trade, etc. Traders should comprehensively consider these factors and develop corresponding risk management strategies.

Is the Resistance Level a Pressure Level?

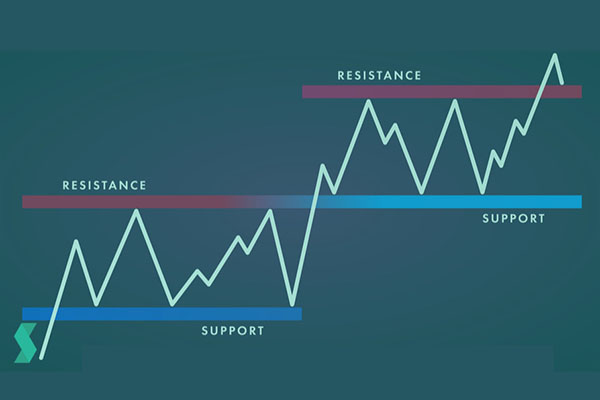

Resistance level, also known as pressure level, refers to the situation where prices stop rising or even fall when they rise near a certain price level. The resistance level is the tangent between the highest points of each peak on the K-line graph of price movement. The resistance level plays a role in preventing prices from continuing to rise, while the opposite is the support level. Resistance and support can be exchanged with the strength of the market.

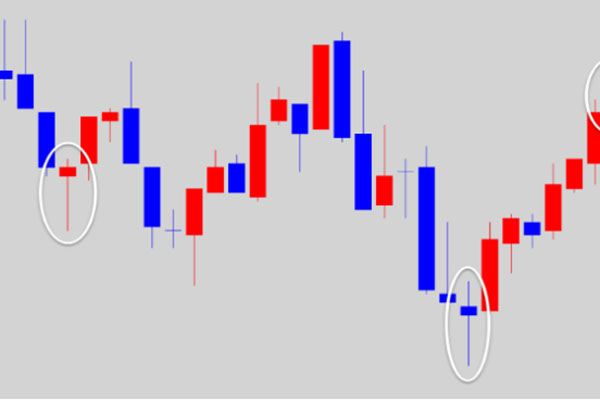

The resistance level indicates that the current supply has no power to continue rising prices. The main reason for this is that when prices continue to rise near resistance levels, sellers are more willing to sell, but buyers do not buy because the price is too high, which greatly weakens the force of price increase. After the exchange rate reaches the resistance level, the supply relationship in the market changes, which will prevent the price from rising.

Resistance levels can also be broken. If a resistance level is broken, it means that the strength of the many sides in the market is much stronger than the short side. The higher the price is compared to the resistance level, the stronger the buying intention is and the investor is willing to buy at a higher price. After the resistance level is broken, a new resistance level will also be established. A price level that cannot be broken when the price of a security rises. A price level at which the stock price may encounter pressure when rising and reverses down if it fails to break through.

EBC Platform Risk Reminder and Disclaimer: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.