More than 200 years ago across the ocean a man named George Washington, announced to the world the birth of an emerging country. 200 years later this young country, has grown into a global superpower. And its rise also brought the world an important currency - the dollar. It holds a special place in the global monetary system. As one of the world's leading reserve currencies, its status is widely recognized. It is also highly regarded in the investment market. Now let's take a look, what are the considerations of the dollar in foreign exchange investment?

The status of the U.S. dollar in the foreign exchange market

The status of the U.S. dollar in the foreign exchange market

It is the official currency of the United States, its currency code for the USD (United States Dollar). 1972 the United States through the minting of the bill of the United States currency was officially born, after the end of World War II, it became the core of the international monetary system. By 1973. the global currency into the era of free exchange, the U.S. currency of the day to become the past.

However, to this day it is still the world's most important currency in circulation, widely accepted in international trade and financial transactions, and is one of the world's most important reserve currency. By most countries central banks as foreign exchange reserves held for international settlements and reserves.

Its symbol is "$", which represents the unit of U.S. currency. This symbol is commonly used to represent the U.S. currency in prices, currency expressions, and finance-related texts. The design of the symbol was inspired by the letters "P" and "S", resulting in an S-like symbol that is widely accepted and used to represent U.S. currency.

Its issuance and monetary policy is the responsibility of the Federal Reserve, and the U.S. currency currently in circulation is divided into two types of bills and coins, with a total of 13 different denominations used for daily transactions. The coins of the U.S. currency usually have 1 cent, 5 cents, 10 cents, 25 cents, 50 cents and 1 U.S. dollar, while the banknotes have 1. 2. 5. 10. 20. 50 and 100 U.S. dollars and other denominations.

With the deepening of trade and economic exchanges between countries, the international market demand for foreign exchange is growing. As the world's first economic power of the United States, it is logical to become one of the world's largest foreign exchange market. At present, most of the world's commodities are priced, the vast majority of international trade with its settlement.

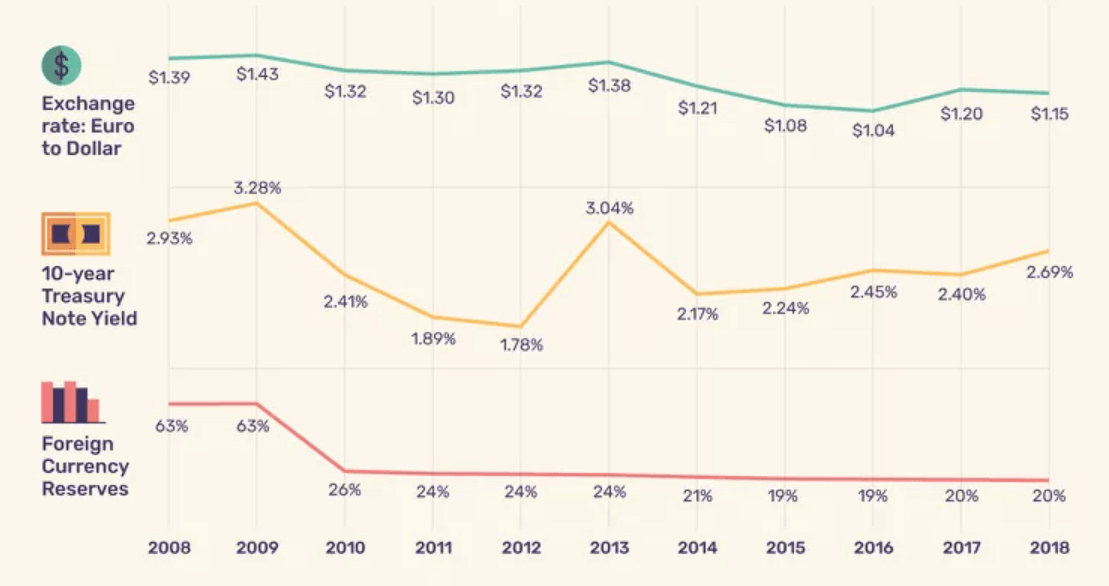

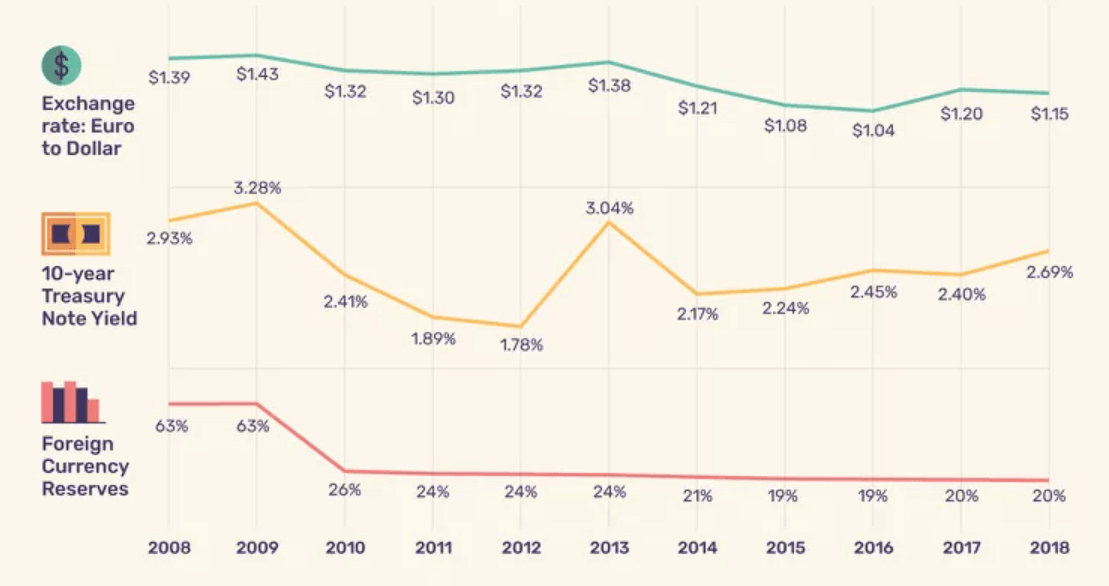

According to statistics global foreign exchange transactions in its turnover accounted for more than 80%, in the foreign exchange reserves of the central bank of each country, it is also the largest proportion of reserve assets, into the foreign exchange market deserved leader. And with other major currencies (such as the euro, the yen, the pound) to form the main currency pairs, these currency pairs in the foreign exchange market trading activity.

Its dominant position in the international financial markets, is widely used in international financing, debt issuance and other financial transactions. It is because of its superb position that the United States is strong. So when there is a crisis in the market, it becomes a better hedge currency and is favored by investors.

However, its value is affected by a variety of factors, including the U.S. economic situation, interest rate policies, inflation levels, global market demand, and so on. In the foreign exchange market, exchange rate fluctuations between it and other currencies have a significant impact on the global economy. So investors need to be cautious and sensible when speculating on the U.S. currency, and it is good to pay more attention to it.

All in all, in this era when the United States leads the way, it is still the most important and universally recognized currency in the world and still has a unique charm in the investment market. Investors and businesses can participate in the foreign exchange market to exchange and manage risk for international business and investment.

Dollar foreign exchange reserves ranking latest

| Rankings |

Country |

Foreign exchange reserves (billions of dollars) |

| 1 |

China |

31982 |

| 2 |

Japan |

14024 |

| 3 |

Switzerland |

8961 |

| 4 |

India |

4658 |

| 5 |

saudi arabia |

4358 |

| 6 |

Russia |

4357 |

| 7 |

South Korea |

4165 |

| 8 |

Brazil |

3487 |

| 9 |

Singapore |

3214 |

| 10 |

Germany |

2730 |

What supports the US dollar

Its value is supported by a variety of factors, the first of which is closely related to the overall economic strength of the United States. The U.S. is one of the largest economies in the world, with a large Gross Domestic Product (GDP) and strong development in a number of areas, including industry, technology, and finance. This economic strength usually increases confidence in the U.S. currency and supports its value.

Also the supply of U.S. currency is an important factor in determining its value. If its supply increases significantly, this could lead to inflation, which would weaken its purchasing power. Therefore, the monetary policy of the Federal Reserve (U.S. Federal Reserve System) has a direct impact on the value of the U.S. currency.

The level of interest rates is also one of the key factors affecting its exchange rate. Relatively high interest rates may attract international investors, increasing demand for it and raising its value. Therefore, the Federal Reserve's monetary policy and interest rate decisions have a significant impact on its value.

The stability of U.S. politics is also a factor that supports its value. Political uncertainty or turmoil may cause investors to worry about the U.S. currency and affect its value. In contrast, the stability of the political system helps to enhance the attractiveness of the U.S. currency.

As one of the world's leading reserve currencies, it is used by many countries and international institutions for reserves and trade. This widespread international use increases liquidity and supports its status as a global trading and reserve currency. At the same time it is widely used in international trade and a large amount of international trade and settlements are denominated in it. This makes it one of the major currencies for global transactions and supports its position in the international economy.

It is important to note that its value is not fixed and fluctuates with these factors mentioned above. To be precise, its value is based on supply and demand in the foreign exchange market. It is therefore influenced by market factors, including investor sentiment, global economic conditions, geopolitical events, etc.

A depreciation of the US dollar means a relative decrease in its value in the foreign exchange market, i.e. an increase in the cost of buying it in other currencies. This is because as it depreciates, the U.S. needs to pay more in currency to buy the same amount of foreign goods and services. This could lead to higher import costs and have an impact on U.S. import trade.

It could also lead to inflationary pressures, as the cost of imported goods rises, which could be transmitted to domestic prices. At the same time, its also likely to increase the competitiveness of U.S. products in international markets, as U.S. products are relatively less expensive in foreign markets, helping exports.

For international investors holding U.S. currency, its depreciation may reduce the real value of their assets. This may prompt some investors to move their funds to other relatively stronger currencies or assets, leading to an increase in the prices of other assets, such as equities and commodities. There is also a risk of triggering a global reallocation of funds, as investors may look for more attractive investment opportunities. This would allow for a realignment of global capital flows that would affect financial markets in other countries and regions.

It could also increase the debt burden of the United States in international markets. If the U.S. government or corporations hold foreign debt, the cost of paying interest and principal with it will rise, increasing the pressure to service the debt. In turn, this makes U.S. assets more attractive internationally because foreign investors can buy U.S. assets, such as real estate or corporate equity, at a lower cost in their own currencies.

It is important to note that a depreciation of the U.S. currency does not always have negative effects, but rather depends on the economic environment and other relevant factors. Some degree of devaluation may also be one of the objectives of national policies to promote economic growth and enhance export competitiveness. However, if the devaluation is too large or too fast, it may trigger some negative effects that need to be carefully monitored and adjusted.

Risk Prevention in US Dollar Forex Trading

Risk Prevention in US Dollar Forex Trading

In forex trading, the U.S. currency is often used as one of the currencies in a trading pair. The foreign exchange market is the world's largest financial market, which includes a large number of currency pairs, and the U.S. dollar is usually used as one of the major currencies. There are major currency pairs and cross currency pairs in the Forex Market. Major currency pairs are pairs that contain the US currency, such as EUR/USD, USD/JPY, GBP/USD, and so on. In these currency pairs, its usually the denominated currency.

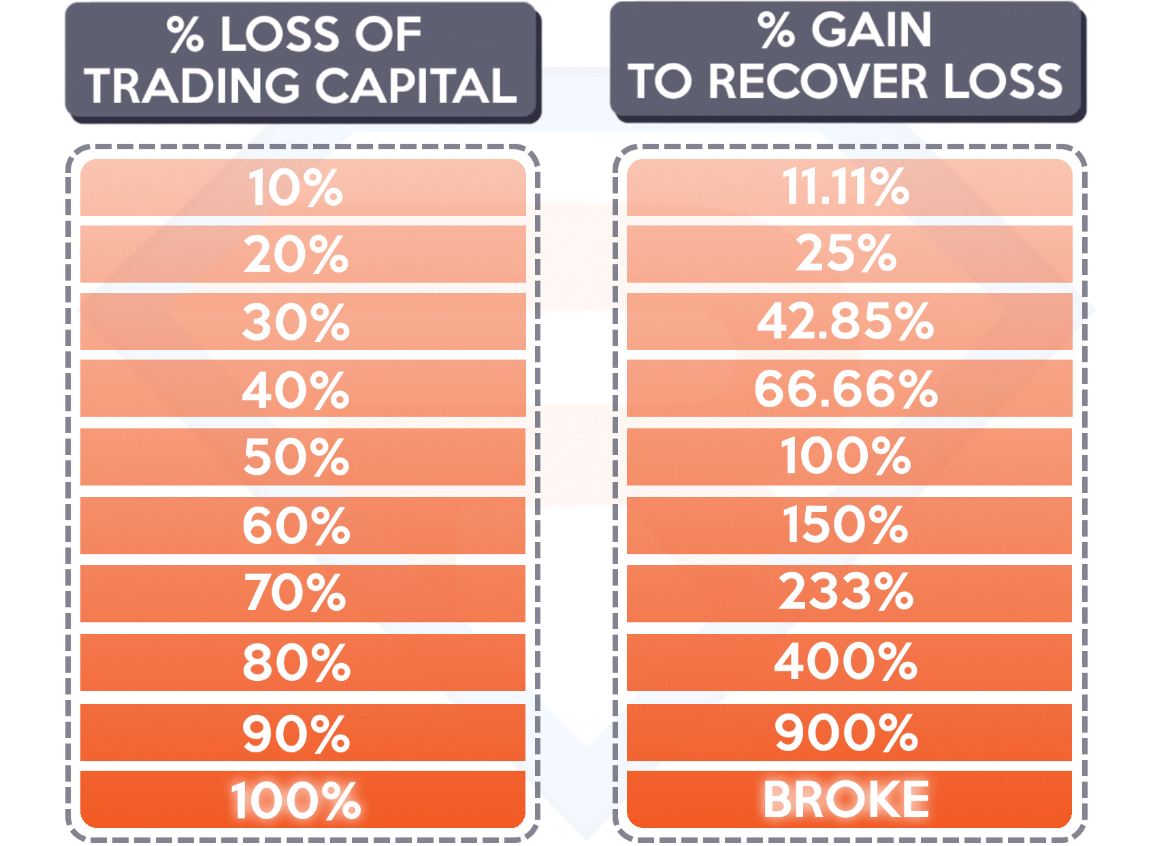

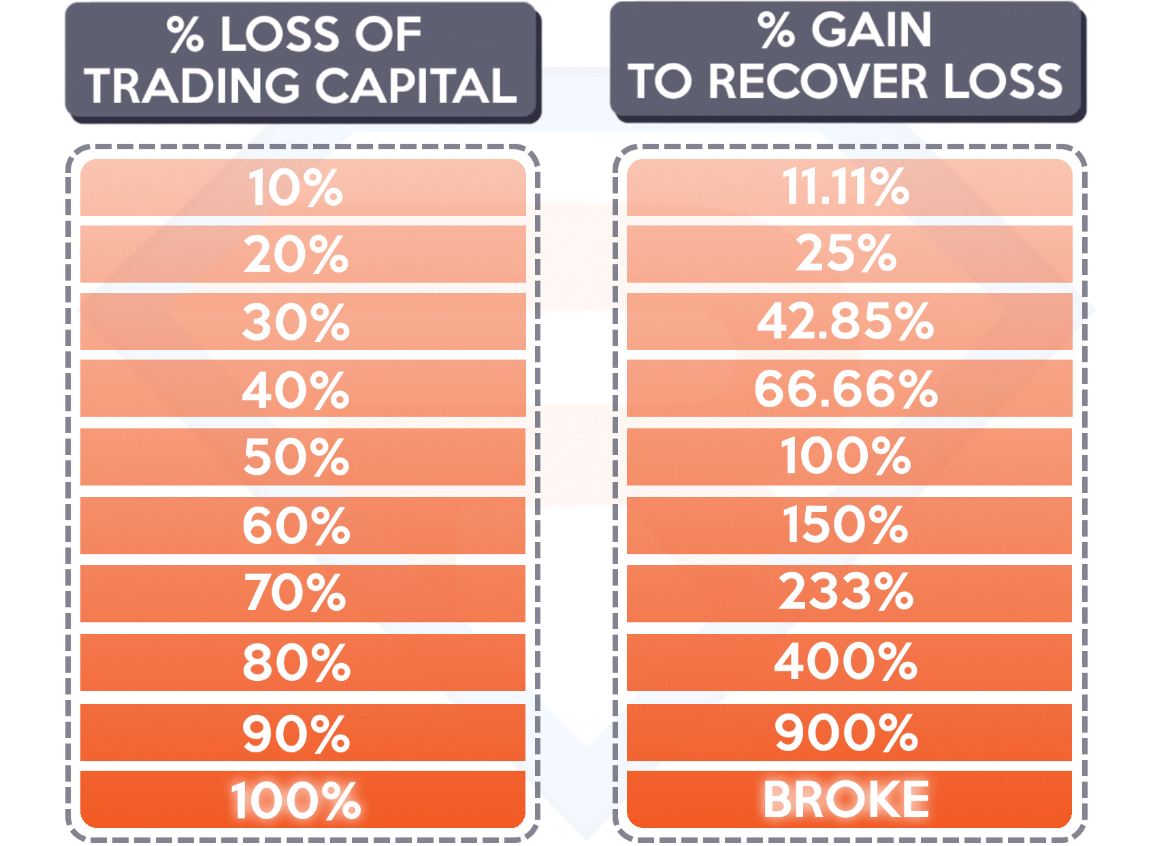

When trading the US dollar in the foreign exchange market, it is important to guard against the risk of trading. If you lose a certain percentage of your account, then you need to achieve a larger percentage of gain to break even, as shown below.

So the first step is to choose a reputable and well-regulated forex trading platform. Ensure that the platform provides a safe and stable trading environment and understand its fee structure. Then develop a clear Trading plan, including entry points, stop loss points and take profit points. Strictly implement the trading plan and avoid trading based on feelings or emotions.

Because of the volatility of the foreign exchange market, investors need to remain calm, not be disturbed by market emotions, and make rational decisions. Do not trade frequently because of market volatility, excessive trading may lead to increased transaction costs and increase the risk of loss. Also when making decisions, conduct careful technical and fundamental analysis to understand market trends, rather than relying solely on short-term market noise.

Establish a sound risk management system, including risk assessment, position management and position size control. Make sure you keep enough money in your trading to withstand potential losses. And set a reasonable level of stop loss, which means that the position will be automatically closed when the loss reaches a certain level. to limit potential losses. Do not blindly expand your stop loss due to market volatility, stay calm and rational.

If using leverage for foreign exchange trading, be careful to control the leverage multiplier. Leverage can magnify trading profits, but it also increases the risk of loss. Use leverage carefully to ensure that foreign exchange transactions within an acceptable range. Also avoid avoid concentrating all of your money into one trade and reduce overall risk by diversifying your investments.

Please note that foreign exchange trading is a high risk investment. It is necessary to keep an eye on the market and keep abreast of important factors affecting the foreign exchange market, such as economic data, international events and political unrest. You should also review the performance of your foreign exchange transactions on a regular basis, adjust your investment portfolio in a timely manner, and manage your risk according to market conditions.

Considerations

Considerations

There are many things to be aware of when it comes to the U.S. dollar in forex trading today. For example, the monetary policy of the Federal Reserve (U.S. Federal Reserve System) has a significant impact on it, so investors need to pay attention to the Fed's interest rate resolutions, statements and press conferences, as well as its assessment of the economy, which may trigger fluctuations in its exchange rate.

At the same time it serves as a global reserve currency and its value is directly affected by global economic conditions. Therefore, close attention should be paid to economic indicators, policy changes in major global economies, and global trade movements that are critical to its investment.

Technical and fundamental analysis can also be utilized to understand market trends and possible price movements. technical analysis focuses on price charts and technical indicators, while fundamental analysis focuses on economic data and policy factors. Using a combination of both types of analysis allows for a more comprehensive assessment of market conditions.

Leverage is a tool in forex trading that can magnify profits, but it also carries a higher level of risk. Investors should use leverage with caution, making sure they understand how it works and avoiding risks caused by excessive leverage. And since the foreign exchange market is volatile, investors should adopt effective risk management strategies. Set reasonable stop-loss levels, diversify your investments, and avoid concentrating too much of the money you use for trading on a particular position in order to reduce potential losses.

Because the foreign exchange market is more sensitive to news and events, timely access to and analysis of market news related to it can help investors better grasp the pulse of the market. Meanwhile the U.S. Dollar Index is a measure of its value relative to a basket of other major currencies. Investors should pay attention to its movements as it provides information about the overall performance of the US currency and helps in making trading decisions.

The Forex market is global and trades 24 hours a day, but market activity varies from session to session. Choosing to trade during the most active periods of the market can increase transaction efficiency and reduce slippage.

Asian markets contribute to foreign exchange trading mainly from the Tokyo and Singapore markets, whose active hours are usually in the early hours of Greenwich Mean Time (GMT). In particular, the Asian markets overlap with the Australian market, and the major currency pairs in this session include USD/JPY and others.

The European market is an important market for forex trading, with London being the largest forex trading center in the world. The active session in the European market is usually in the morning to afternoon GMT. During this session, pairs involving EUR/USD, GBP/USD and other currencies related to the US currency are more actively traded.

The North American market, centered in New York, is the last major market in the global forex market. The active session is usually in the afternoon to late night GMT. During this session, trading involving currency pairs such as USD/CAD, USD/CHF, etc. is more active.

US Dollar Forex Trading Hours

| Timeframe |

Market activity |

| Asian markets (early morning GMT) |

Major participating markets: Tokyo and Singapore |

| European Market (GMT AM) |

Major Participating Markets: London |

| North American Market (GMT PM) |

Major participating market: New York |

| Asia-Europe Crossover |

Asian markets closed, European markets active, liquidity increasing |

| Europe-North America Crossover |

European and North American markets open simultaneously, peak liquidity. |

| Asia-North America Crossover |

Asian markets have some overlap with North American markets, higher liquidity |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The status of the U.S. dollar in the foreign exchange market

The status of the U.S. dollar in the foreign exchange market Risk Prevention in US Dollar Forex Trading

Risk Prevention in US Dollar Forex Trading Considerations

Considerations