As the world's largest country, the U.S. economy has been experiencing ongoing turmoil in recent years. Especially concerning is its persistent high inflation, which has not only troubled the U.S.economy but has also led to global economic issues. Therefore, people are particularly interested in U.S. CPI data for 2024, as this data will directly illustrate the inflation rate and influence global economic trends. Now, this article will list the release time and news of the U.S. CPI data for 2024 for your reference.

The Importance of U.S. CPI Data Concept.

The Consumer Price Index (CPI) is a measure of changes in the prices of a basket of goods and services. It is collected, analyzed, and published by the U.S. Bureau of Labor Statistics and is commonly used as one of the indicators to gauge the level of inflation. Additionally, it serves as a crucial tool for monitoring economic conditions and making monetary policy decisions.

CPI tracks the price changes of goods and services that consumers pay for over a certain period, typically on a monthly or yearly basis. This includes various categories such as food, housing, transportation, healthcare, and more. Each month, the Bureau of Labor Statistics releases the latest CPI data, which is used by the government, economists, investors, and the public to understand the inflationary situation and the overall health of the economy.

CPI data helps decision-makers and economists understand changes in consumer purchasing power. A rise in the inflation rate may mean consumers need to pay higher prices for the same goods and services, affecting their consumption behavior. Furthermore, inflation can impact monetary policy decisions, with central banks potentially taking measures to control inflation rates, such as adjusting interest rates.

CPI data is also used to adjust wage levels and social welfare programmes. Since wages are typically linked to the inflation rate, changes in CPI data can influence employers' adjustments to employee wages. Additionally, adjustments to social welfare programmes are often related to the inflation rate, so governments may use CPI data to ensure these programmes remain in line with inflation rates.

The release of U.S. CPI data plays a significant role in the economy. Firstly, central banks use CPI data to formulate monetary policies, such as adjusting interest rates based on inflation levels to control inflation or stimulate the economy. Secondly, the release of CPI data also impacts financial markets and consumer decisions. Investors and consumers adjust their investment portfolios and consumption behavior based on inflation expectations.

As one of the primary indicators of measuring inflation levels, U.S. CPI data plays a crucial role in central bank monetary policy decisions. When CPI rises, central banks may consider raising interest rates to curb inflation, which could result in a decline in U.S. bond prices and an increase in interest rates. Conversely, when CPI continues to decline, central banks may consider lowering interest rates to stimulate the economy, potentially leading to an increase in U.S. bond prices and a decrease in interest rates.

Therefore, the impact of CPI data on financial markets and investors is significant, and understanding and interpreting CPI fluctuations are crucial for formulating investment strategies. As a result, the release time and news surrounding U.S. CPI data have garnered widespread attention internationally and domestically, providing key insights into economic conditions in 2024.

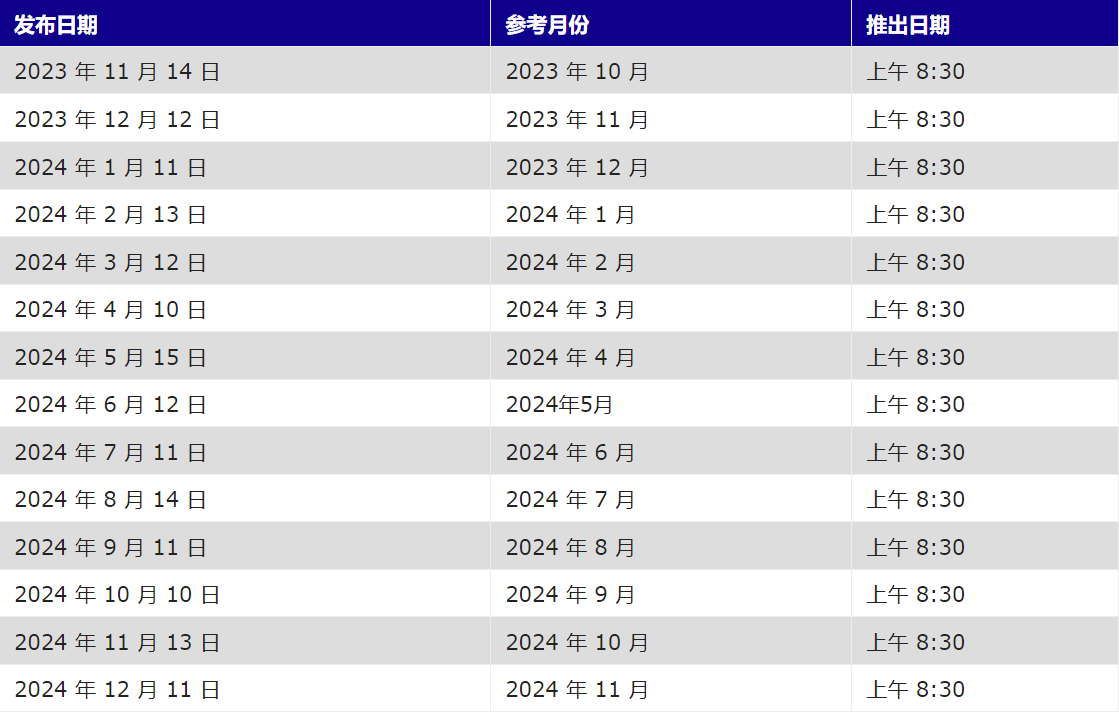

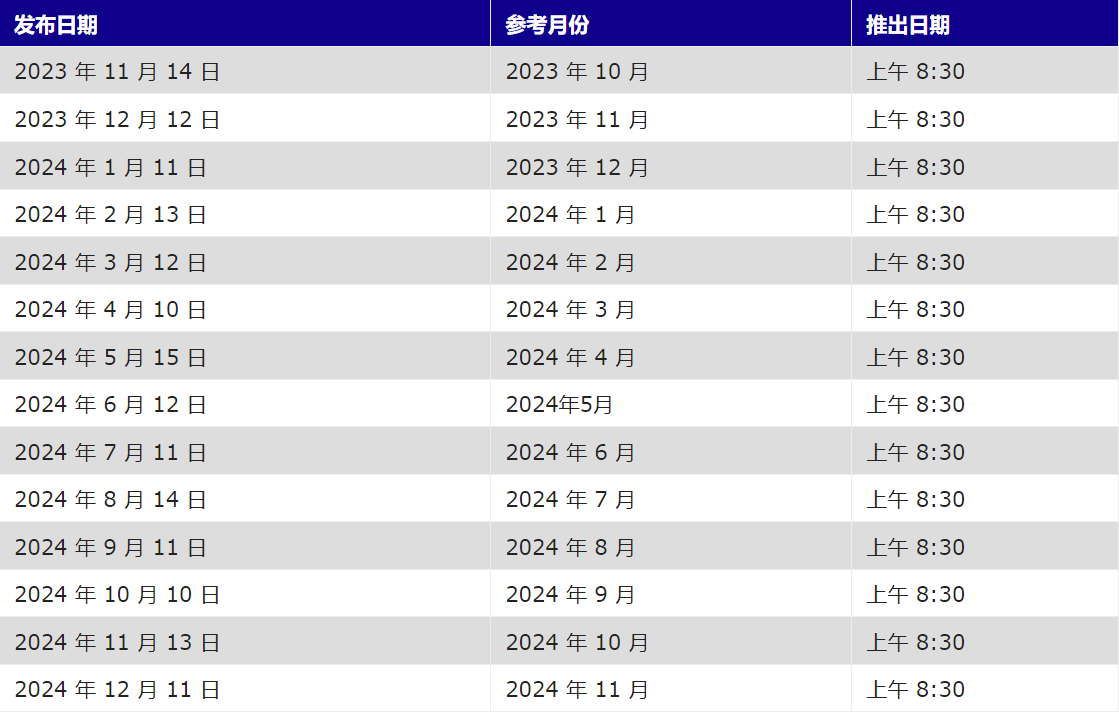

The Release Schedule for U.S. CPI Data in 2024

For the months of January to March 2024, the CPI data will be published from February to April 2024. This period covers the winter season and traditional holiday sales, prompting particular attention to the price changes of seasonal goods and services such as winter clothing and heating expenses. It may affect people's expectations of inflation for the entire year, thus garnering attention and reactions from the market and policymakers.

The specific release times for CPI data are as follows:

January 2024 CPI data will be released on February 13, 2024, at 8:30 AM Eastern Time (ET) (9:30 PM Beijing Time).

February 2024 CPI data will be released on March 12, 2024, at 8:30 AM ET (9:30 PM Beijing Time).

-

March 2024 CPI data will be released on April 10, 2024, at 8:30 AM ET (9:30 PM Beijing Time).

For the months of April to June 2024, the U.S. CPI data will be published from May to July 2024. These data reflect changes in spring economic activities and consumption trends, influenced by various factors including seasonal factors, market supply and demand conditions, and adjustments in macroeconomic policies.

The specific release times for CPI data are as follows:

April 2024 CPI data will be released on May 15, 2024, at 8:30 AM ET (9:30 PM Beijing Time).

May 2024 CPI data will be released on June 12, 2024, at 8:30 AM ET (9:30 PM Beijing Time).

June 2024 CPI data will be released on July 11, 2024, at 8:30 AM ET (9:30 PM Beijing Time).

The U.S. CPI data for July to September 2024 will be released from August to October 2024. This period provides valuable insights into summer economic activities and consumption trends. The CPI data for the third quarter may be influenced by various factors, including seasonal demand changes, labor market conditions, and the global economic situation.

The specific release times for CPI data are as follows:

July 2024 CPI data will be released on August 14, 2024, at 8:30 AM Eastern Time ET (9:30 PM Beijing Time).

August 2024 CPI data will be released on September 11, 2024, at 8:30 AM ET (9:30 PM Beijing Time).

September 2024 CPI data will be released on October 10, 2024, at 8:30 AM ET (9:30 PM Beijing Time).

The U.S. CPI data for October to December 2024 will be released from September to January 2025. This period's data will provide insights into end-of-year holiday shopping trends and inflation conditions. The CPI data for the fourth quarter is typically influenced by increased holiday shopping demand, as well as factors such as supply chain issues, labor market conditions, and the global economic situation.

The specific release times for CPI data are as follows:

October 2024 CPI data will be released on November 13, 2024, at 8:30 AM ET (9:30 PM Beijing Time).

November 2024 CPI data will be released on December 11, 2024, at 8:30 AM ET (9:30 PM Beijing Time).

The specific release date for December 2024 CPI data has not been announced yet, but it is predicted to be between January 10 and 15, 2025.

The U.S. CPI data for 2024 reflects a series of monthly and quarterly changes in the Consumer Price Index, which is crucial for assessing inflation levels, formulating monetary policy, and predicting future economic trends. Therefore, market participants and policymakers will closely monitor its fluctuations upon release.

U.S. CPI Data Updates for 2024

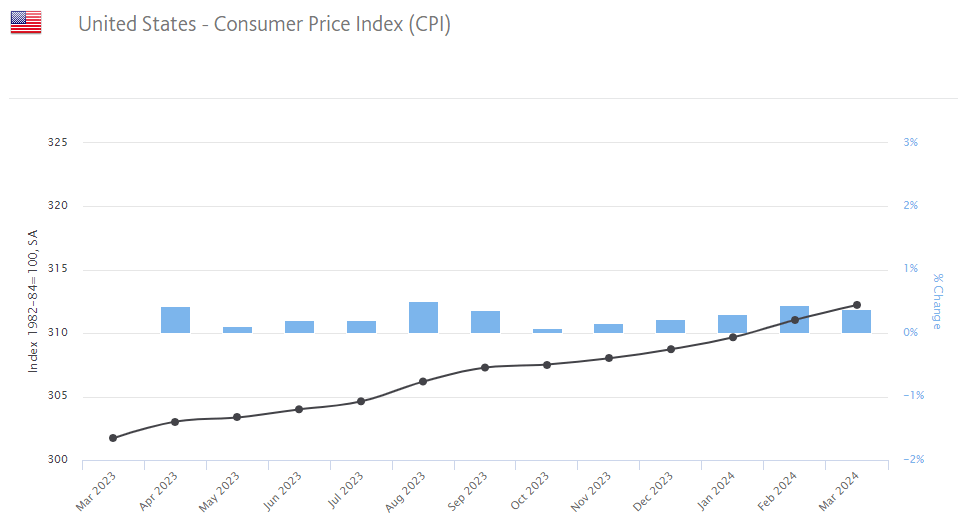

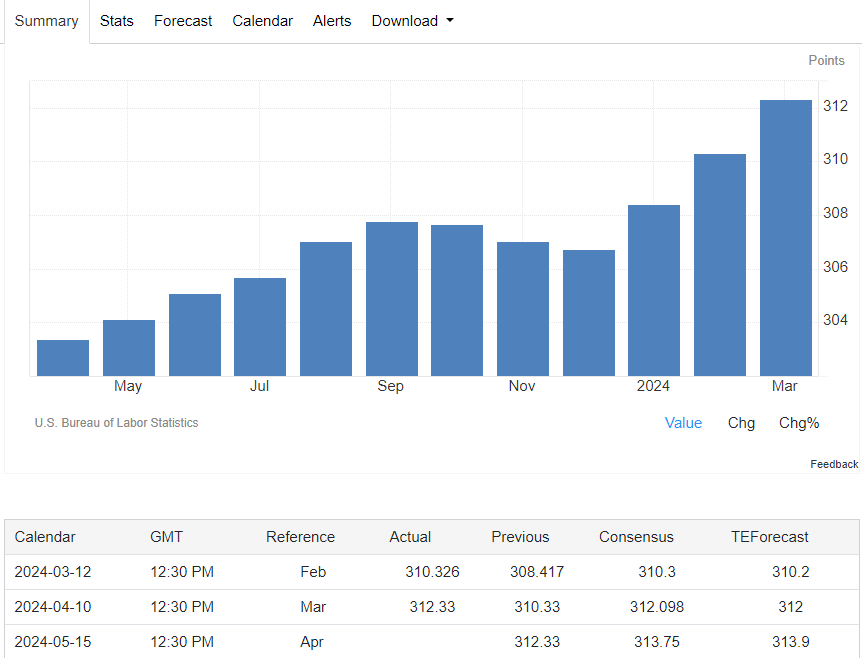

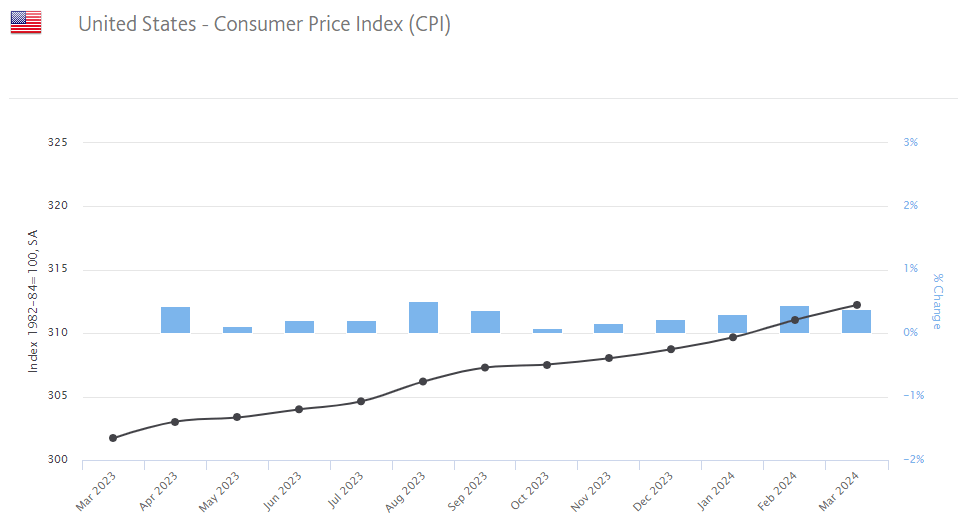

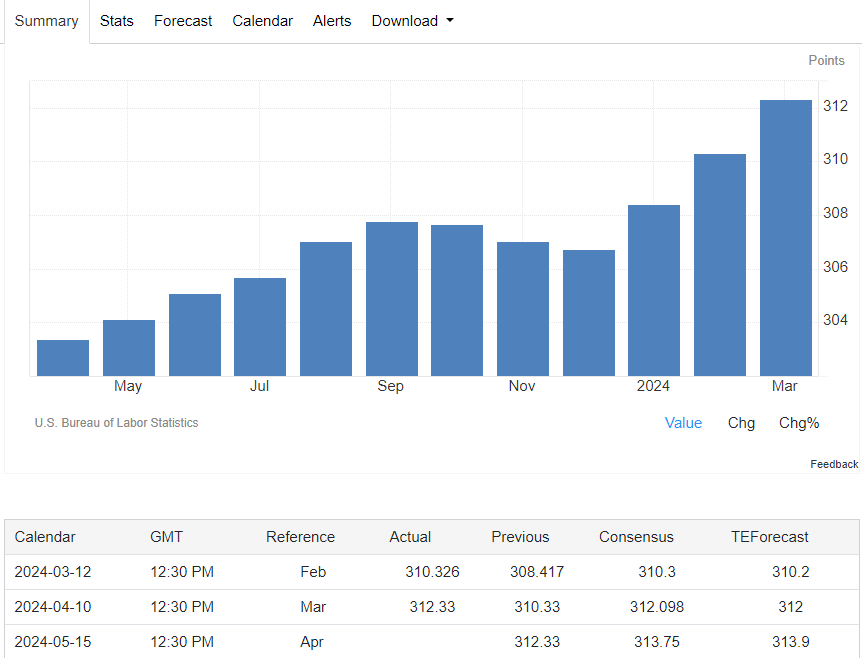

The release of U.S. CPI data for 2024 provides insights into the level and trend of inflation, which holds significant implications for monetary policy, fiscal policy, as well as decisions made by businesses and consumers. As of now, three months of CPI data for 2024 have been released, and the overall trend shows an increase.

In January 2024, the overall CPI index rose by 0.3% year-on-year, slightly higher than the market's expectation of 0.29%. The core CPI index also increased by 0.37% year-on-year, in line with market expectations. Over the past 12 months, CPI stood at 3.1%, with rent prices showing a significant increase at an annualized rate of 6%, indicating some inflationary pressure.

In February 2024, the overall CPI monthly growth rate increased to 0.4%, higher than January's 0.3%. The 12-month overall CPI growth rate, not seasonally adjusted, reached 3.2%. All items in the core CPI, excluding food and energy, also rose by 0.4% in February, remaining steady compared to January, indicating persistent inflationary pressure beyond fluctuations in food and energy prices.

Energy index rose by 2.3% in February, while the food index remained unchanged, suggesting that energy prices were a significant driver of CPI growth this month, while food prices remained relatively stable. These data indicate the existence of inflationary pressures, particularly influenced by rising energy prices.

In March 2024, the CPI year-on-year growth rate reached 3.5%, exceeding the expected 3.4% and higher than the previous month's 3.2%. In terms of month-on-month growth, CPI rose by 0.4%, slightly higher than the market's expected 0.3%, but consistent with the previous value. The focus is on more core inflation data, namely the core CPI excluding food and energy costs. Reports show that the core CPI year-on-year growth rate for March reached 3.8%, surpassing the market's expected 3.7% and remaining the same as the previous value. Month-on-month, core CPI increased by 0.4%, also slightly higher than the expected 0.3%, and consistent with the previous month.

In April 2024, the core CPI, which excludes food and energy prices, rose by 3.6% year-on-year and 0.3% month-on-month. This was slightly below the 0.4% increase that was expected. While inflation overall has eased a bit, prices remain high, especially in housing and energy sectors.

Even though inflation came in lower than expected, it's unlikely to prompt an immediate rate cut by the Federal Reserve, especially before June. Most market experts are now looking towards July or September for potential Fed action. However, the current high interest rates are still putting pressure on business costs and the overall economy.

The CPI data for May 2024 shows a modest 0.3% increase, sparking optimism about economic stability and consumer recovery. Yet, digging deeper, we see that while some food prices, like eggs and fresh fruit, have dropped, others, like pork and other essentials, remain high.

Non-food prices went up by 0.8% year-on-year, affecting crucial areas like education, healthcare, and housing. Costs for education and healthcare have risen significantly, adding financial strain on households. Even though the CPI for May dropped 0.1% from the previous month, this mainly reflects weaker consumer spending power and growing economic pressures. Slow income growth, tough job conditions, and income inequality are major issues, limiting economic growth.

In June 2024, the CPI fell by 0.1% from the previous month, which was below the expected 0.07% increase. This is the largest monthly drop since May 2020. The core CPI also rose less than expected, with a year-on-year drop to 3.27%, the lowest since April 2021.

Moreover, the core inflation rate was 3%, below the anticipated 3.1%. This suggests that the Fed's rate hikes have been effective in controlling inflation. This might influence the Fed to consider a rate cut, with September's likelihood of a rate cut now over 80%.

In July, both broad and core CPI saw a 0.2% increase month-on-month. Year-on-year, the core CPI was on target, while the broad CPI was slightly below expectations, with a 2.9% increase, the lowest since March 2021. This offers some relief as inflation trends downward.

The Fed is also watching the super-core service inflation, which excludes rent. Although it's falling year-on-year, it rose 0.21% month-on-month, slightly above pre-pandemic levels. This indicates that while year-on-year figures are improving, the month-to-month rates are still high, suggesting that a smaller rate cut in September is more likely than a larger one.

Before the next Fed meeting, another CPI report will be released, which could have a big impact on market expectations for Fed policy. The Federal Reserve is closely monitoring the CPI to adjust its policies and keep the economy stable. Investors should pay attention to this data to understand future market trends and Fed actions.

In August 2024, US CPI rose 2.5% month-on-month, slightly below the forecast of 2.6%, while core CPI increased by 2.6%. This reflects persistent inflation but hints at economic recovery.

By September, monthly CPI growth slowed to 2.4% from 2.5%, exceeding the forecast of 2.3%, marking its lowest since February 2021, driven by lower energy prices. Core CPI rose 0.3% month-on-month and 3.3% year-on-year, complicating the Fed's decisions.

October's CPI rose 2.6% month-on-month, matching expectations, with housing costs contributing heavily to inflation after six months of deceleration. November CPI rose 2.7% year-on-year and 0.3% month-on-month, the highest since April, aligning with forecasts.

In this context, traders have raised their expectations for a December rate cut by the Federal Reserve. According to the CME Group's FedWatch Tool, the likelihood increased from 86.1% before the data release to 96.4%. Although the market still anticipates no rate cut in January, the CPI figures have slightly increased the chance to approximately 23%.

US CPI data 2024 release time and news

| Reference Month |

Release Date |

Release Time

|

Actual Value |

Annual Change |

Forecasted Annual Change |

| January 2024 |

February 13, 2024 |

08:30 AM |

308.40 |

3.10% |

2.90% |

| February 2024 |

March 12, 2024 |

08:30 AM |

310.30 |

3.20% |

3.10% |

| March 2024 |

April 10, 2024 |

08:30 AM |

312.30 |

3.50% |

3.40% |

| April 2024 |

May 15, 2024 |

08:30 AM |

313.50 |

3.40% |

3.40% |

| May 2024 |

June 12, 2024 |

08:30 AM |

314.00 |

3.30% |

3.40% |

| June 2024 |

July 11, 2024 |

08:30 AM |

314.10 |

3.00% |

3.10% |

| July 2024 |

August 14, 2024 |

08:30 AM |

314.50 |

2.90% |

3.00% |

| August 2024 |

September 11, 2024 |

08:30 AM |

314.80 |

2.50% |

2.60% |

| September 2024 |

October 10, 2024 |

08:30 AM |

315.30 |

2.40% |

2.30% |

| October 2024 |

November 13, 2024 |

08:30 AM |

315.60 |

2.60% |

2.60% |

| November 2024 |

December 11, 2024 |

08:30 AM |

315.40 |

2.70% |

2.70% |

[EBC Platform Risk Disclaimer and Disclaimer Terms]: This material is provided for general reference only and is not intended to be (nor should it be construed as) reliable financial, investment, or other advice.