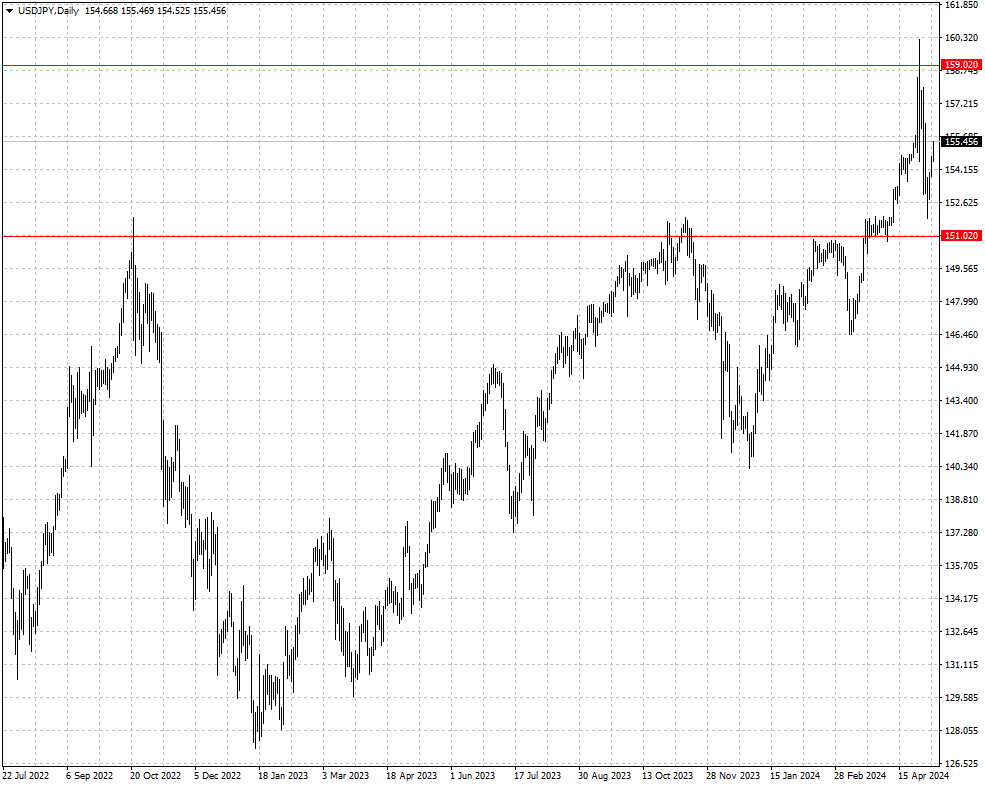

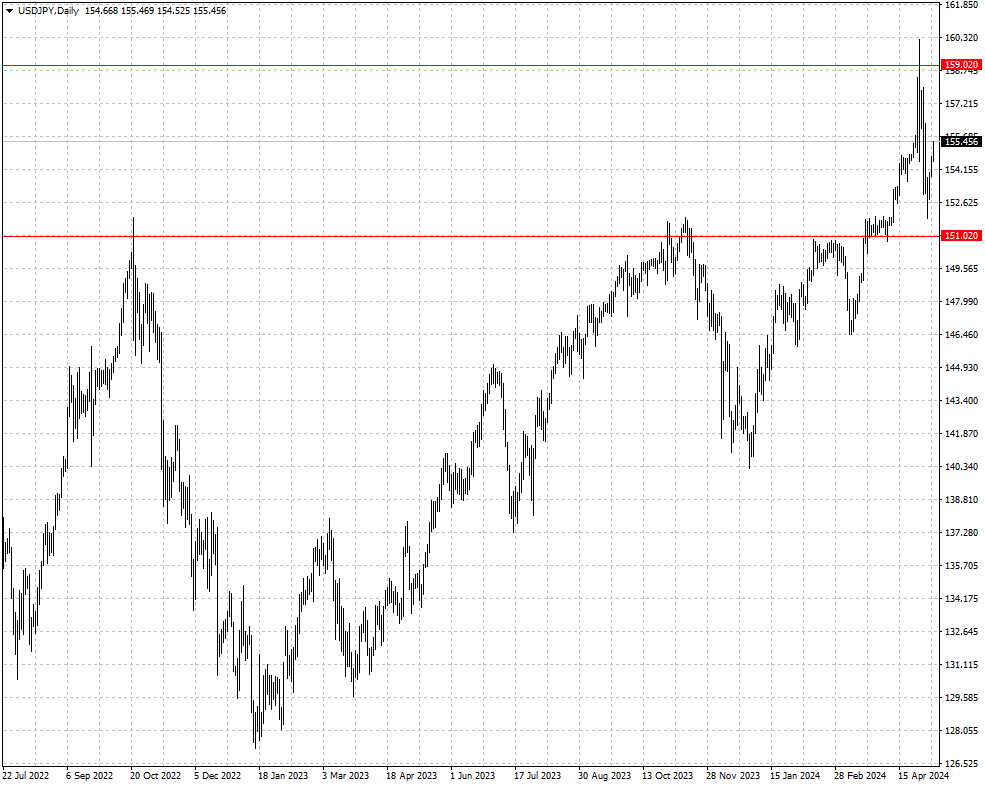

The yen was trading around 155 on Wednesday

2024-05-08

Summary:

Summary:

The dollar rose slightly on Wednesday after earlier Fed rate cut bets. The yen traded near 155 per dollar as traders anticipated market swings.

EBC Forex Snapshot, 8 May 2024

The dollar made modest gains on Wednesday after earlier losses from renewed

bets on Fed rate cuts this year. The yen was trading around 155 per dollar as

traders prepare for another round of whack-a-mole.

BOJ Kazuo Ueda said the central bank may take monetary policy action if yen

declines affect prices significantly. Finance Minister Shunichi Suzuki warned

that authorities were ready to respond to excessively volatile moves in the

currency market.

However, analysts have said that any intervention from Tokyo would only serve

as a temporary respite for the yen, given stark interest rate differentials

between the US and Japan remain.

|

Citi (as of 6 May) |

HSBC (as of 8 May) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0601 |

1.0885 |

1.0637 |

1.0840 |

| GBP/USD |

1.2300 |

1.2709 |

1.2322 |

1.2659 |

| USD/CHF |

0.8999 |

0.9244 |

0.8983 |

0.9202 |

| AUD/USD |

0.6443 |

0.6668 |

0.6422 |

0.6709 |

| USD/CAD |

1.3478 |

1.3846 |

1.3619 |

1.3815 |

| USD/JPY |

151.86 |

157.68 |

151.02 |

159.20 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.