The yen was slightly lower on Monday

2024-08-12

Summary:

Summary:

The yen weakened slightly on Monday in thin trading due to a Japanese holiday as markets remain uncertain about a significant Fed rate cut next month.

EBC Forex Snapshot, 12 Aug 2024

The yen was a tad softer in trading thinned by a Japanese holiday on Monday,

with market participants still ambivalent about the odds of a big Fed rate cut

next month.

Leveraged funds' position on the Japanese yen shrank to the smallest net

short stance since February 2023 in the latest week, CFTC showed. The weekly

change marked the largest since Mar 2011.

The dollar eked out slight gains. JP Morgan analysts revised their forecast

for the yen to 144 per dollar by the second quarter of next year, and they see

reason to be optimistic on the dollar's medium-term prospects.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 5 Aug) |

HSBC (as of 12 Aug) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0796 |

1.0948 |

1.0791 |

1.1024 |

| GBP/USD |

1.2613 |

1.2894 |

1.2635 |

1.2910 |

| USD/CHF |

0.8551 |

0.8827 |

0.8414 |

0.8907 |

| AUD/USD |

0.6466 |

0.6653 |

0.6397 |

0.6696 |

| USD/CAD |

1.3590 |

1.3899 |

1.3648 |

1.3878 |

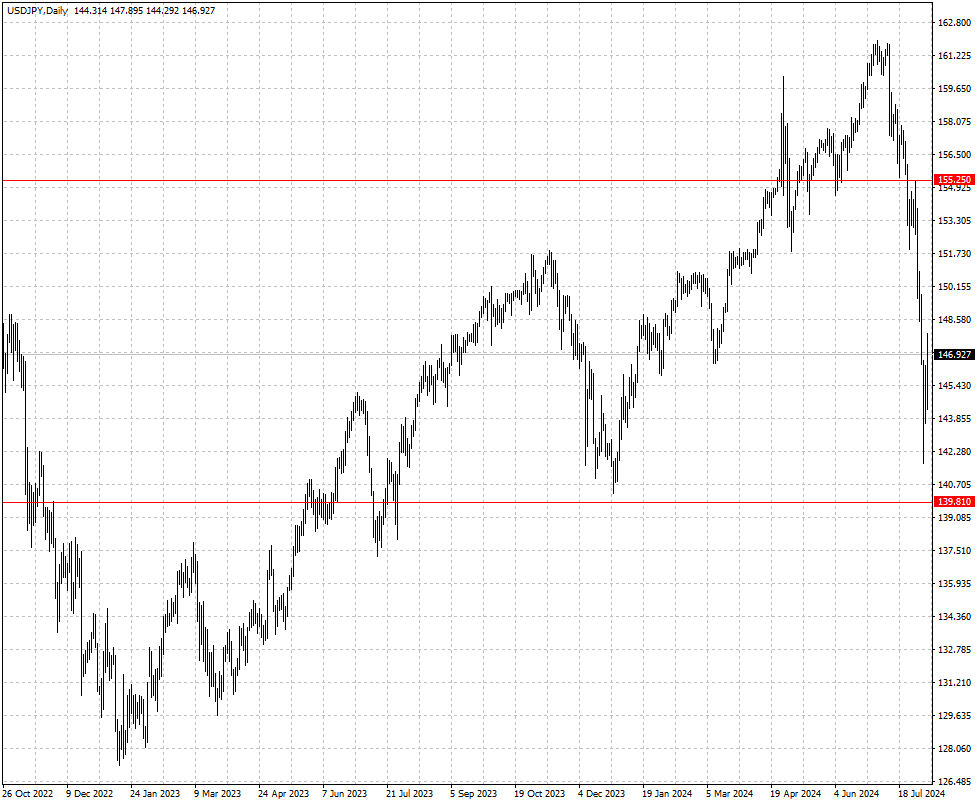

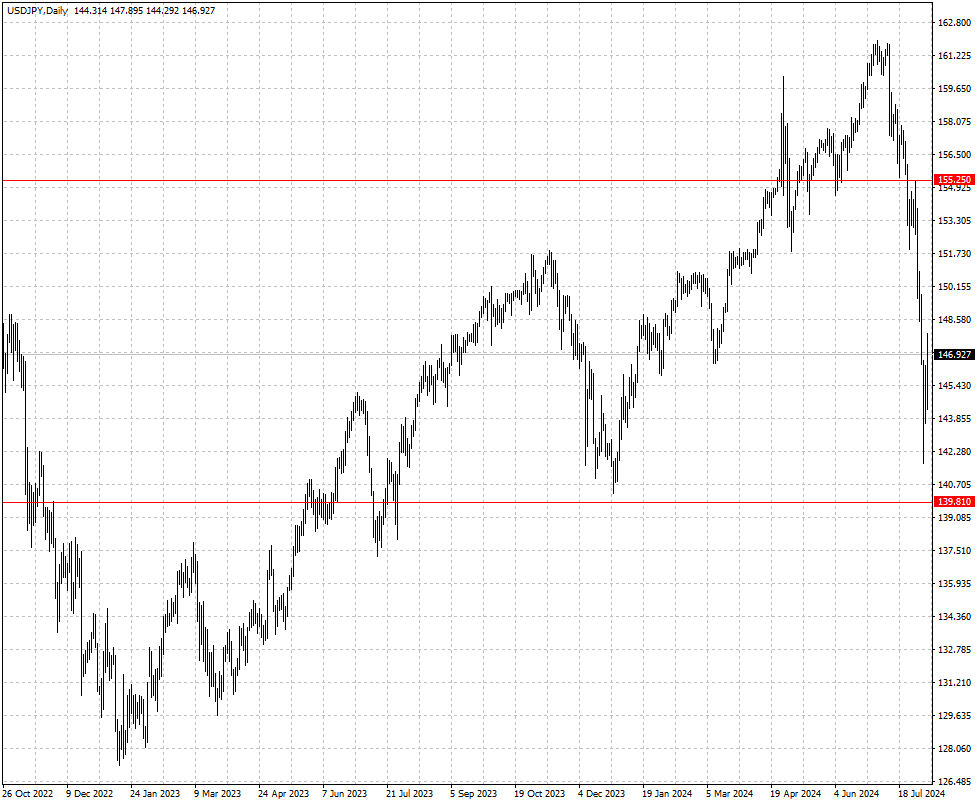

| USD/JPY |

145.37 |

150.00 |

139.81 |

155.25 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.