The Yen Strengthens as a Safe Haven

2024-09-05

Summary:

Summary:

The dollar fell Thursday on US economic worries, with the yen rising on safe-haven demand. Traders see a 44% chance of a 50-bp cut this month.

EBC Forex Snapshot, 5 Sep 2024

The dollar dipped on Thursday as concerns over the US economy's growth

resurfaced, with the yen a notable outperformer on safe-haven demand. Traders

are now pricing in a 44% chance of a 50-bp cut this month.

Data released showed US job openings dropped to a more than 3-year low in

July, suggesting the labour market was losing steam, in line with Tuesday's ISM

manufacturing survey which remained in contraction territory.

The BOJ must be vigilant to the fallout from recent market turbulence but

stay on course to raise interest rates, its board member Hajime Takata said,

reinforcing market expectations for further hikes in borrowing costs.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 26 Aug) |

HSBC (as of 5 Sep) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0819 |

1.1276 |

1.0967 |

1.1199 |

| GBP/USD |

1.2860 |

1.3230 |

1.2905 |

1.3322 |

| USD/CHF |

0.8333 |

0.8827 |

0.8331 |

0.8664 |

| AUD/USD |

0.6615 |

0.6799 |

0.6612 |

0.6829 |

| USD/CAD |

1.3478 |

1.3792 |

1.3384 |

1.3683 |

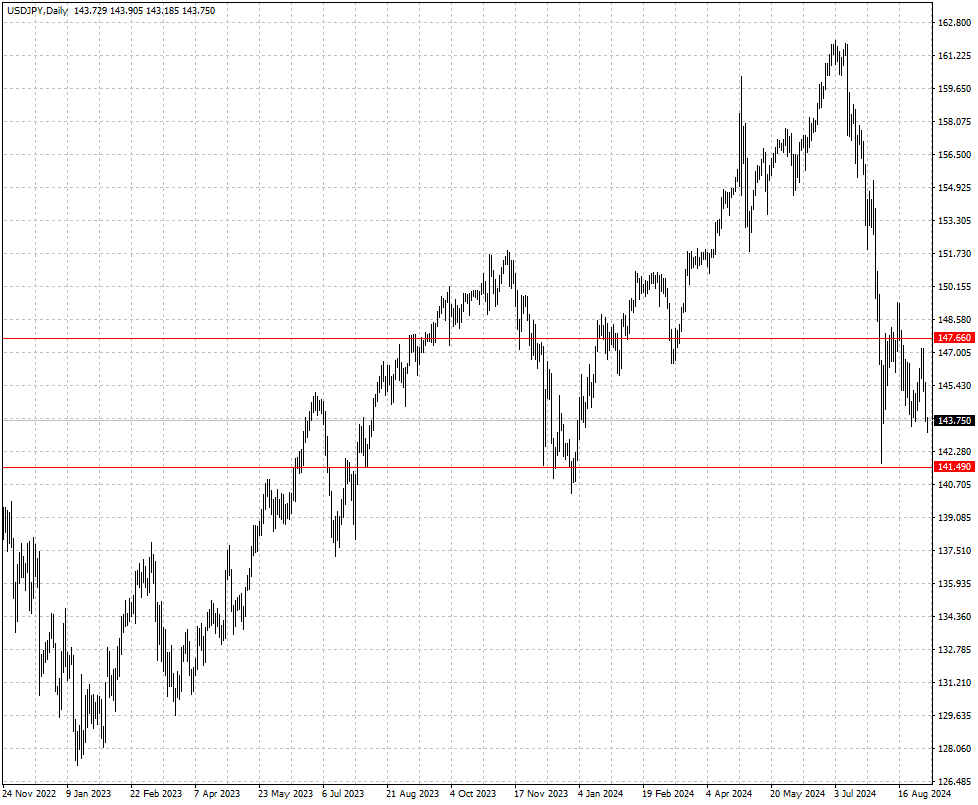

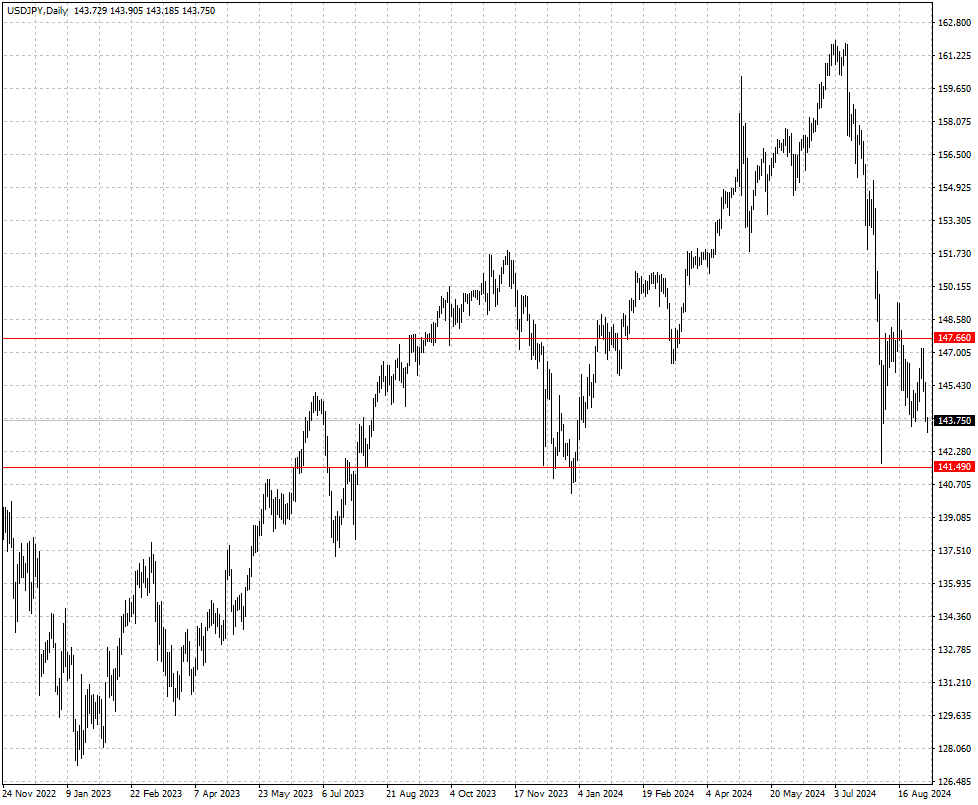

| USD/JPY |

141.70 |

149.35 |

141.49 |

147.66 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.