The yen fell sharply on Tuesday

2024-03-19

Summary:

Summary:

BOJ's end to negative rates caused the yen's sharp fall. The Australian dollar slipped too, as local rates remained steady.

EBC Forex Snapshot, 19 Mar 2024

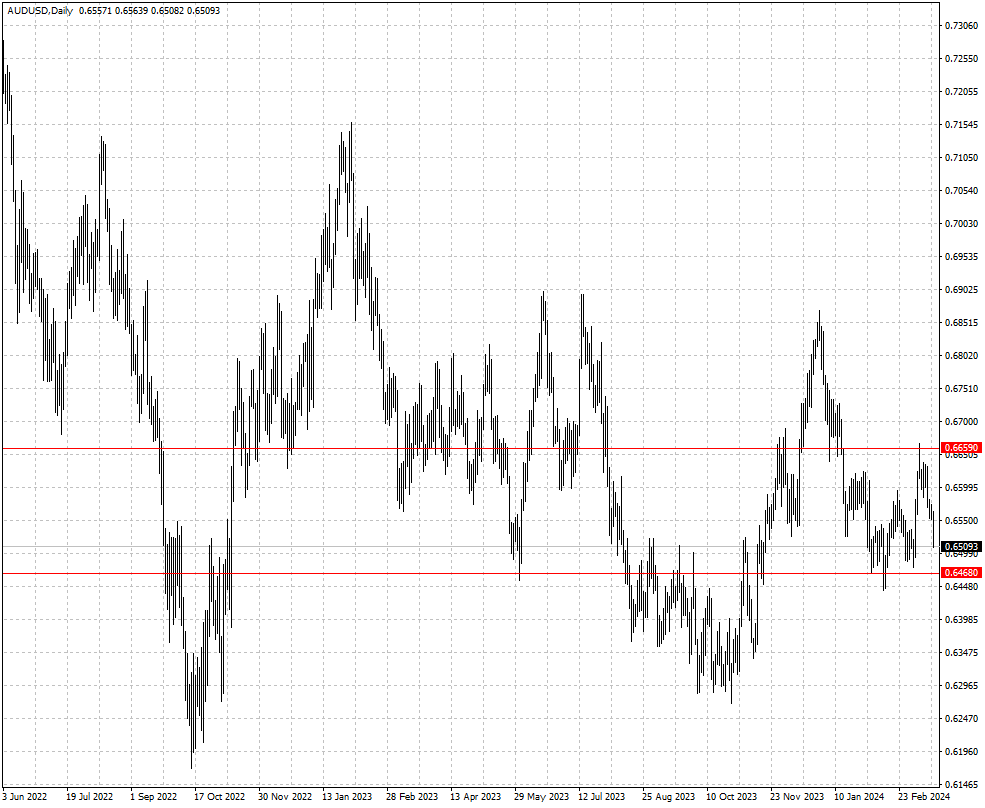

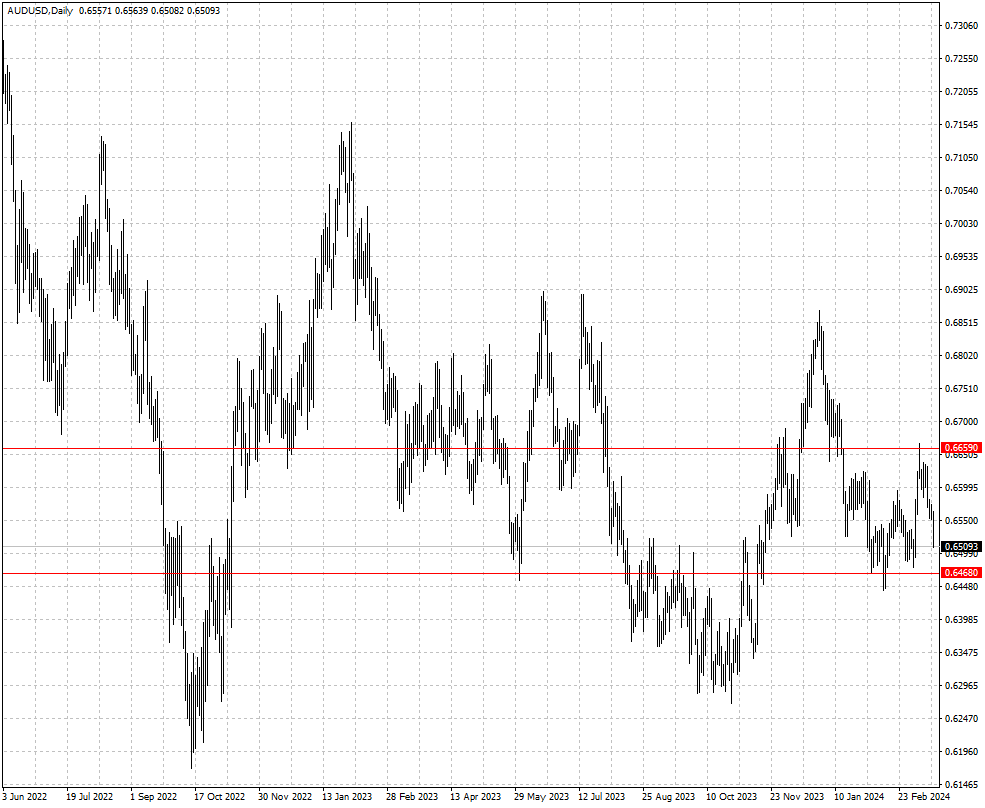

The yen fell sharply on Tuesday after the BOJ ended its negative interest

rate policy in a highly anticipated decision, while the Australian dollar also

slid after domestic rates were kept steady.

Governor Michele Bullock said more rate hikes cannot be ruled out but the

risks to the outlook are “finely balanced.” Her comments implied the central

bank did not consider a rate cut at the meeting.

GDP expanded just 0.2% in the last quarter. Excluding population growth,

economic activity per person contracted 1% from a year earlier, the worst result

outside the Covid pandemic period since the 1990s.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 11 Mar) |

HSBC (as of 18 Mar) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0695 |

1.1017 |

1.0794 |

1.098 |

| GBP/USD |

1.2503 |

1.2896 |

1.2593 |

1.2889 |

| USD/CHF |

0.8551 |

0.9000 |

0.8745 |

0.8909 |

| AUD/USD |

0.6443 |

0.6691 |

0.6468 |

0.6659 |

| USD/CAD |

1.3359 |

1.3607 |

1.3437 |

1.3625 |

| USD/JPY |

146.68 |

150.89 |

146.71 |

151.08 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.