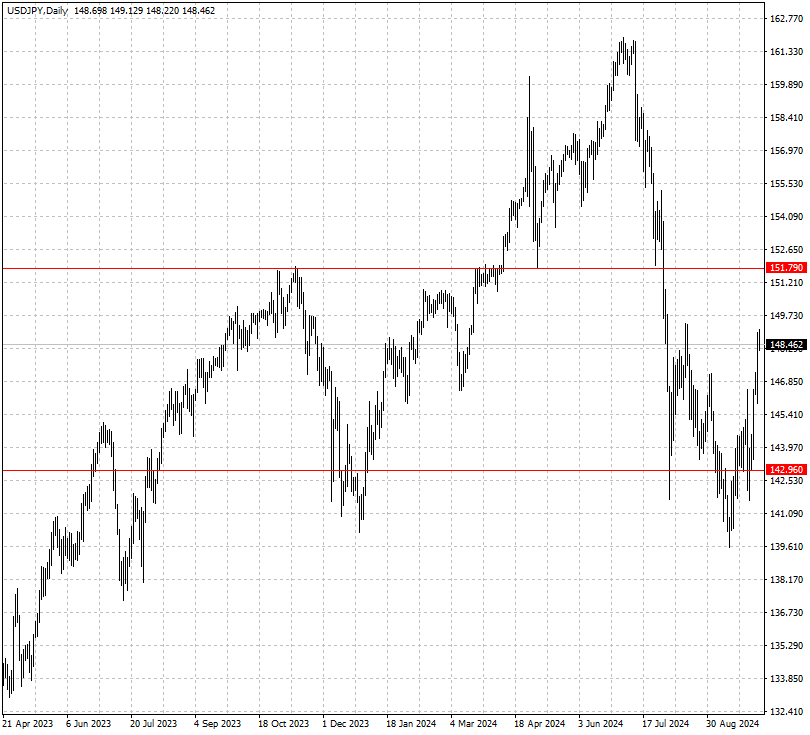

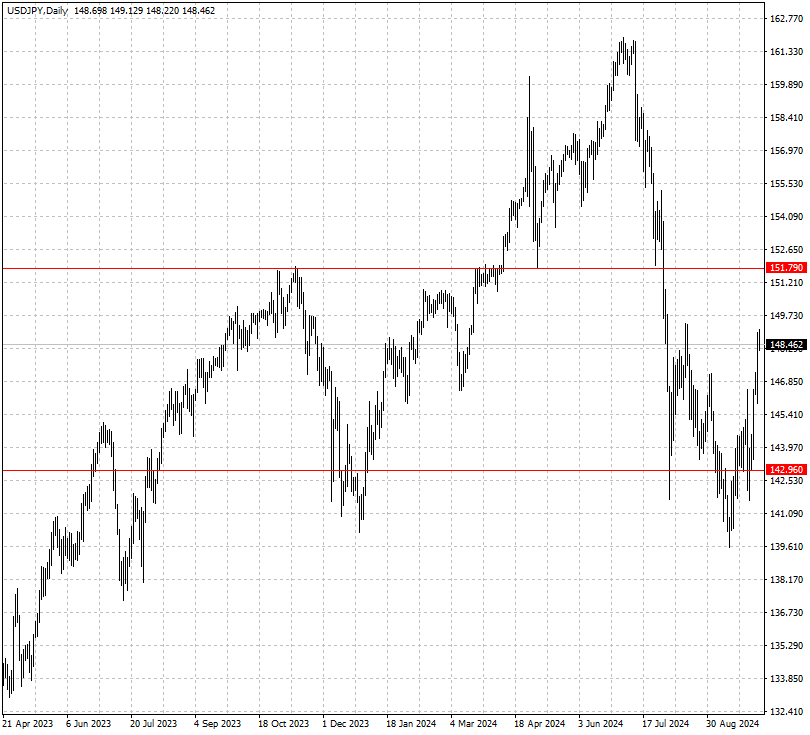

The Yen Dipped to its Lowest Level in Nearly Two Months

2024-10-07

Summary:

Summary:

The dollar rallied on strong US jobs data and escalating Middle East conflict, while the yen fell to its lowest level in nearly two months.

EBC Forex Snapshot, 7 Oct 2024

The US dollar extended its rally following strong US jobs data and rising tensions in the Middle East. In contrast, the yen weakened, hitting its lowest point in nearly two months. Last month, the US saw the largest increase in job creation in six months, alongside a drop in the unemployment rate and steady wage growth. These signs of a robust economy have prompted markets to scale back expectations of Federal Reserve rate cuts.

Japan's top currency diplomat, Atsushi Mimura, issued a warning against

speculative moves on the forex market. Shigeru Ishiba said last week

the economy was not ready for further rate hikes.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 30 Sep) |

HSBC (as of 7 Oct) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.1002 |

1.1214 |

1.0880 |

1.1143 |

| GBP/USD |

1.3002 |

1.3482 |

1.2977 |

1.3345 |

| USD/CHF |

0.8375 |

0.8749 |

0.8444 |

0.8662 |

| AUD/USD |

0.6757 |

0.6950 |

0.6705 |

0.6912 |

| USD/CAD |

1.3420 |

1.3792 |

1.3444 |

1.3673 |

| USD/JPY |

139.50 |

147.13 |

142.96 |

151.79 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.