The US dollar opened lower this week

2023-12-18

Summary:

Summary:

The US dollar opened lower, continuing its decline post-Fed meeting, signaling potential 2023 rate cuts. The yen stabilized after last week's 2% rise.

EBC Forex Snapshot

18 Dec 2023

The US dollar opened lower this week, extending is fall following the Fed’s

meeting that signalled potential rate cuts next year. The yen steadied after

rising around 2% last week.

The market mood stayed with futures pricing in a roughly 75% chance the first

cut could come as early as March, according to the CME FedWatch tool. The BOJ’s

policy meeting is now in focus.

Traders are seeking further clarity on how soon policymakers could phase out

its negative interest rate policy. More than 80% of economists in a Reuters poll

said the BOJ will begin rate hikes by the end of 2024

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 11 Dec) |

HSBC (as of 18 Dec) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0756 |

1.1017 |

1.0738 |

1.1033 |

| GBP/USD |

1.2326 |

1.2733 |

1.2517 |

1.2814 |

| USD/CHF |

0.8667 |

0.8957 |

0.8613 |

0.8805 |

| AUD/USD |

0.6522 |

0.6750 |

0.6570 |

0.6775 |

| USD/CAD |

1.3417 |

1.3695 |

1.3277 |

1.3556 |

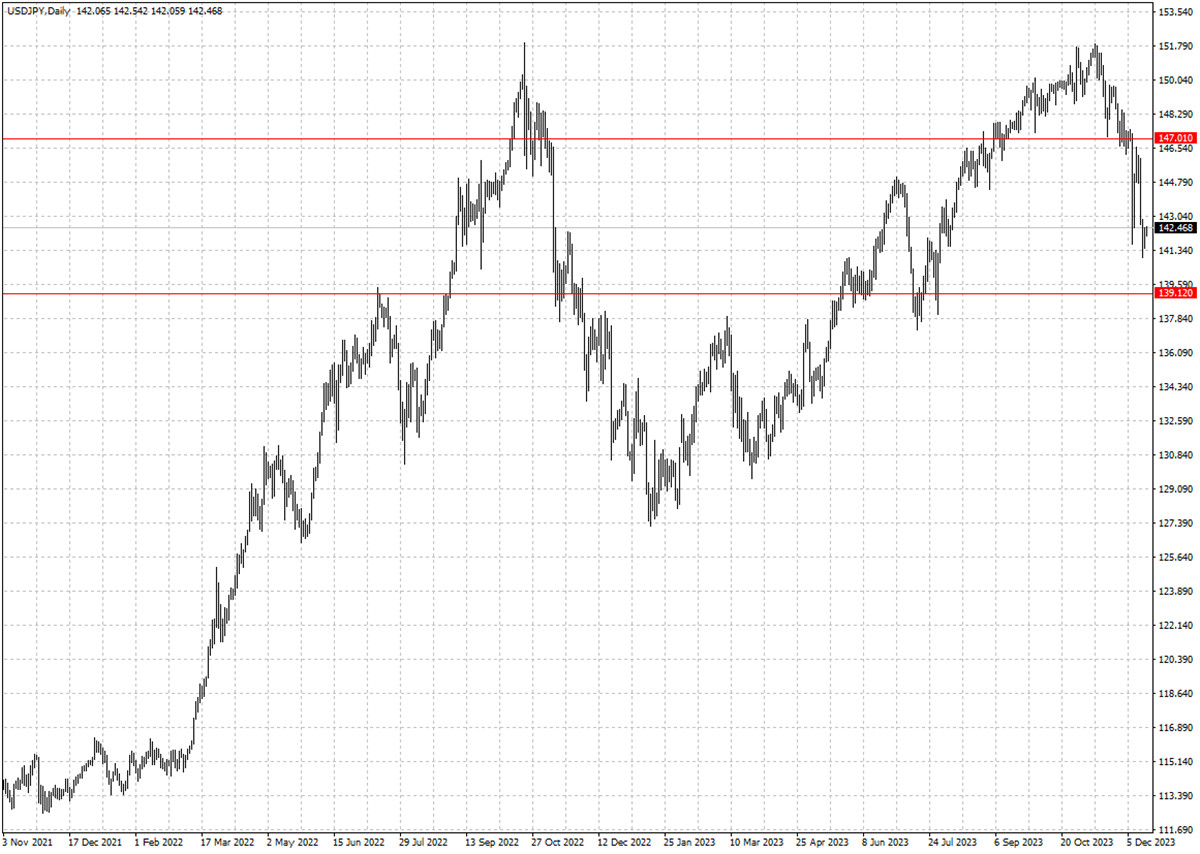

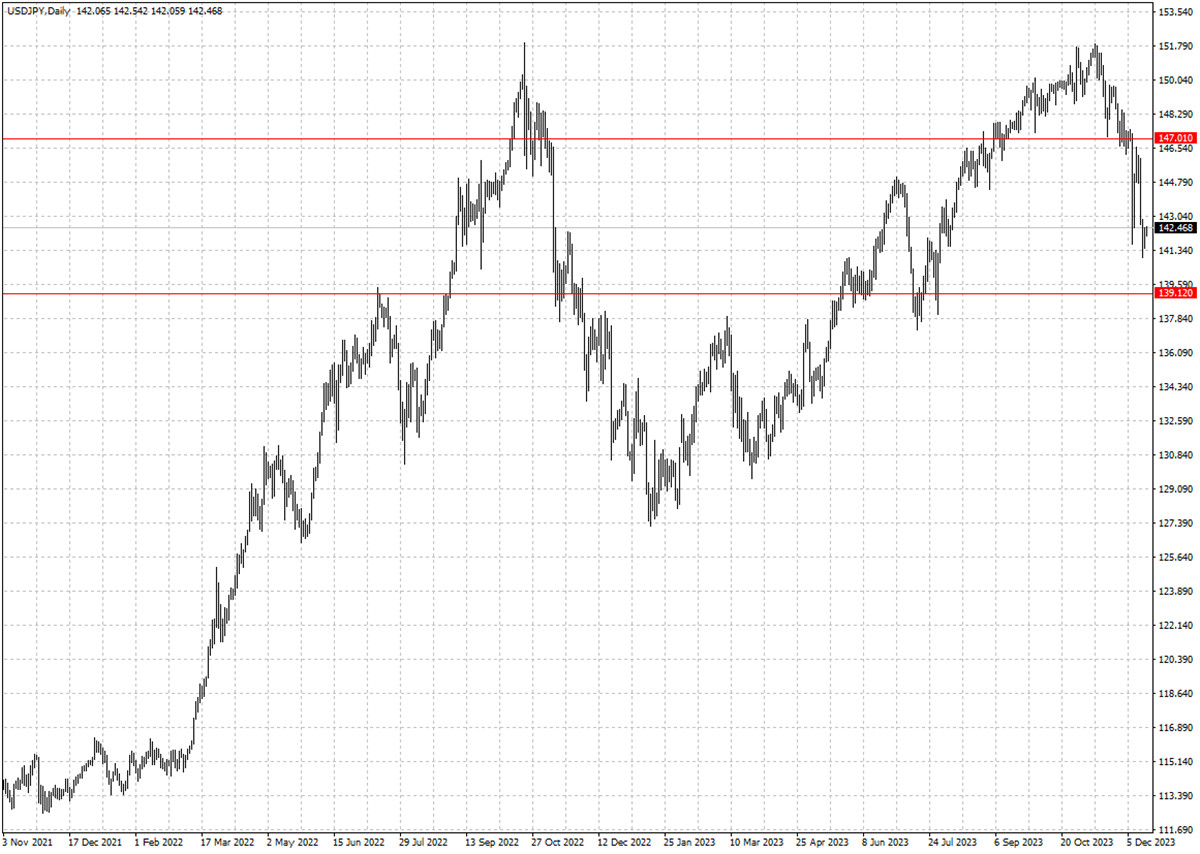

| USD/JPY |

142.34 |

147.50 |

139.12 |

147.01 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.