Who can execute billions of dollars in transactions without emotional fluctuations like Bruce Kovner, like a computer?

Many people have heard of Warren Buffett, George Soros and Peter Lynch. In the past half century, these world-renowned investors have not only defeated the market, but also every well-known industry benchmark.

However, some highly successful investors manage their funds through family offices in order to avoid becoming the focus of attention. Bruce Kovner is one of them. Today, follow EBC to take a look at this mysterious bull man's secret to capturing excess trading profits.

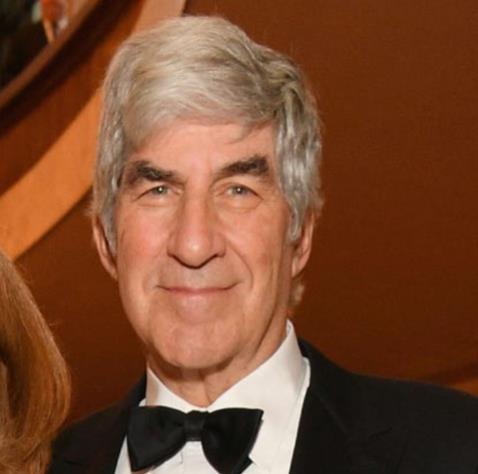

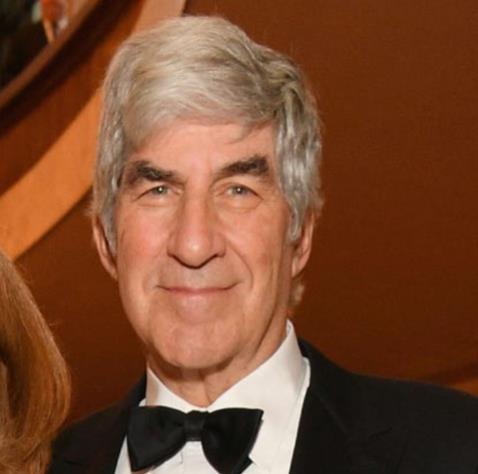

The figure picture of Bruce Kovner, taken by Dia Dipasupil and Getty Images for the Lincoln Center for the Performing Arts.

Real time net worth as of 7/5/21 $6.6

Bruce Kovner is the chairman of CAM Capital, founded in 2012, responsible for managing his personal investments and business portfolio. He is also the founder and chairman of the global macro hedge fund Caxton Associates. After running Caxton Associates for three decades, Kovner retired in 2011. He obtained a Bachelor's degree in Government from Harvard University in 1966 and resided in Quincy Prefecture during his studies. Kovner is known for his long-term support of institutions like the American Enterprise Institute and cultural organizations such as the Metropolitan Opera House, the Lincoln Center for the Performing Arts, and the Juilliard School of Music.

On Forbes List

#400 Billionaire 2021

#123 2020 Forbes 400

For decades, he has been referred to as the "Market Wizards". Thanks to its robot trading style, it has repeatedly achieved alpha excess returns.

In 1977, young Kovner purchased a soybean futures contract worth $3000 and quickly realized a return of $40000. But in the end, greed defeated reason: he refused to take profits, watched his contract fall by $17000, and finally pressed the sell button. Although he still earned a profit of $20000 in the transaction, the $17000 loss caused by his unwillingness to lock in profits made him more inclined to adopt an extremely conservative risk management approach in his future career.

During his tenure at Goldman Sachs, Kovner noticed that traders who continued to lose money were destined to fail, so he took the opposite approach by setting super strict stop losses on each trade. If a position is unfavorable to him, as long as the risk reaches 1%, he will not hesitate to sell.

Kovner considers the issue from a risk rather than an emotional perspective, and when a trade hits a stop loss, it is a signal that he has ignored the meaning given by the price itself. He takes action based on the current situation of the market, rather than how he thinks the market should go.

Risk management may seem simple, but in reality, it is difficult to maintain self-discipline. Therefore, EBC reminds traders that they must strive to overcome innate biases during trading to eliminate emotional interference.

Firstly, there is a bias of loss aversion, which may be one of the most common biases, as investors are more likely to accept profits compared to losses. Investors with this bias often are unwilling to take on the risk of specific assets within an acceptable range due to fear of loss, especially when they have had similar experiences in the past.

He will prematurely lock in profits and give up any further gains, even if the transaction is proceeding in his own way.

On the contrary, if you have already lost money, the anchoring effect will induce you to continue to insist on losing money trading. If you spend a few hours researching an idea and patiently waiting for a good entry point, but when trading goes against you, you often focus too much on the initial decision rather than the current losses. When this anchoring mentality occurs, it means that you unconsciously give too much attention to the initial information obtained. Specific manifestations include first impressions and preconceived concepts. This often leads people to make irrational choices.

Because compared to calculating absolute returns, people prefer to start from an initial price and determine whether it is "earned" or "lost". In the situation of "earning", people tend to be more conservative, avoid taking risks, and choose to fall into the bag as safety. In the case of 'losses', people instead become more inclined to take risks - just because taking risks represents the last hope of' not losing the whole body and retreating '.

When we succumb to a cognitive bias, it is a spiral decline. By default, our thinking forces us to sell too early and buy too late. Buy high and sell low, not buy low and sell high.

Although some traders are beginning to try to control their emotions, it is still very difficult to fully achieve what Kovner did. He has fully mastered the psychology of resisting loss impulses and controls the most unfavorable part of human emotions during trading. He taught himself to trade with the people around him like machines, trading from a lack of emotions.

You may ask, how could Kovner be so good at it?

He is a mentally ill person "may be an idea that comes to mind in your mind. Of course not, because mentally ill patients may feel fear but not see danger - contrary to the characteristics of skilled risk management personnel.

Perhaps trading discipline also played a role. He was trained at the Julia Conservatory and was very good at the harpsichord, a kind of unorthodox keyboard. The hours of repetition and habit formation have paid off, as reflected in his later career. In his hedge fund, Kovner fired any trader who violated his strict risk management rules.

Although there is no conclusive evidence or secret to explain why Kovner was able to consistently manage risks over time, when you study his life and career, you will find that he is a mixture of emotional maturity, discipline, and vitality.

But then again, to conquer the financial market, you need to do more than that. You need high-level fundamental analysis to predict changes in the global economy, inflation, currencies, commodities, and interest rates, among others. You also need technical analysis to measure investor sentiment, identify good entry and exit points, and effectively set trading rules. You need to have a comprehensive understanding in order to have the opportunity to make profits - let alone generate alpha excess returns.

But Kovner has already had a successful trading career, so he has elevated his trading team to a new level by hiring the best traders in the industry and implementing his robotic risk management style on them. It is precisely he who monitors their every emotional fluctuation and strictly implements risk control that makes his hedge fund stand out in the fiercely competitive financial battlefield, making him one of the wealthiest and most successful hedge fund managers in history.

【 EBC Platform Risk Reminder and Disclaimer 】: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.