Euro Surges on Monday

2024-07-01

Summary:

Summary:

The euro jumped Monday after the French far right's election win fell short, leaving the final result dependent on party deals.

EBC Forex Snapshot, 1 Jul 2024

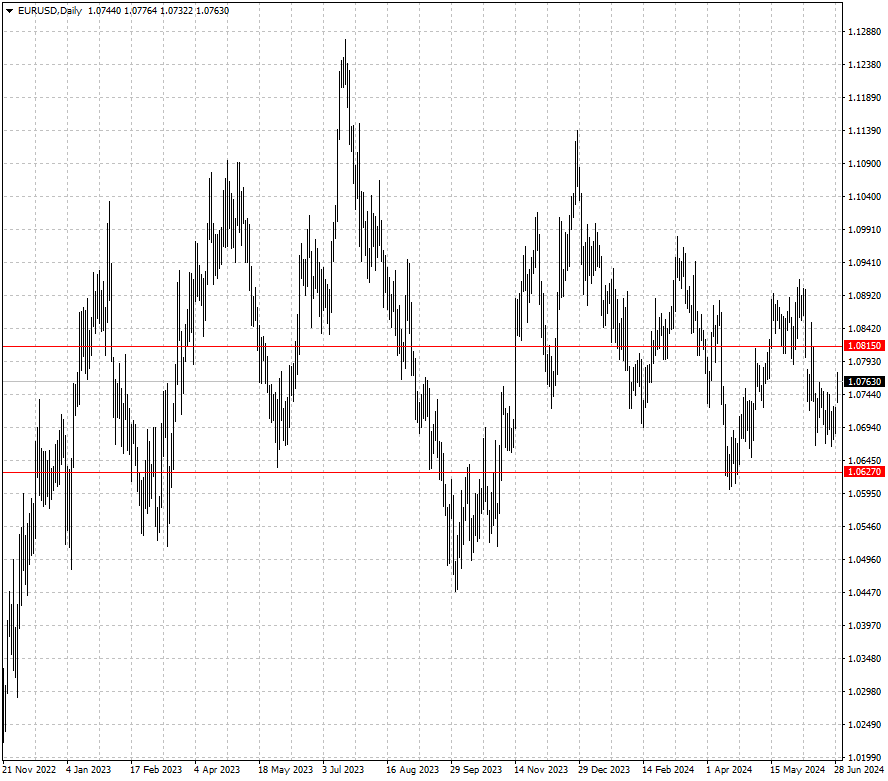

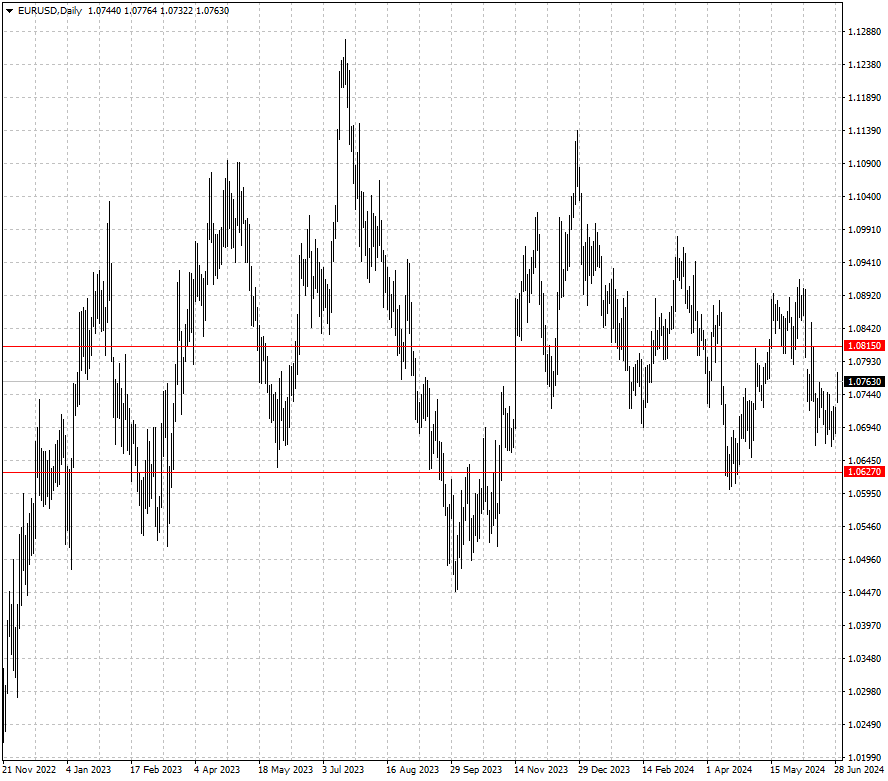

The euro jumped on Monday after a convincing win by the French far right in

the first round of parliamentary elections fell short of some expectations,

leaving the final result dependent on party deals before next weekend.

The RN could come to power through "cohabitation" with Macron and push a

high-spending and euro-sceptic agenda though European financial markets breathed

a sigh of relief for now.

The rise in the euro sent the dollar a touch lower after data showing US

inflation cooled in May. Market pricing now points to about a 63% chance of a

Fed cut in September, according to the CME FedWatch tool.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 24 Jun) |

HSBC (as of 28 Jun) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0668 |

1.0916 |

1.0627 |

1.0815 |

| GBP/USD |

1.2619 |

1.2860 |

1.2545 |

1.2795 |

| USD/CHF |

0.8827 |

0.9158 |

0.8875 |

0.9044 |

| AUD/USD |

0.6564 |

0.6729 |

0.6578 |

0.6708 |

| USD/CAD |

1.3577 |

1.3846 |

1.3621 |

1.3786 |

| USD/JPY |

153.60 |

160.00 |

157.35 |

162.50 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.