The Euro Hovers Near Lows on Monday

2024-06-17

Summary:

Summary:

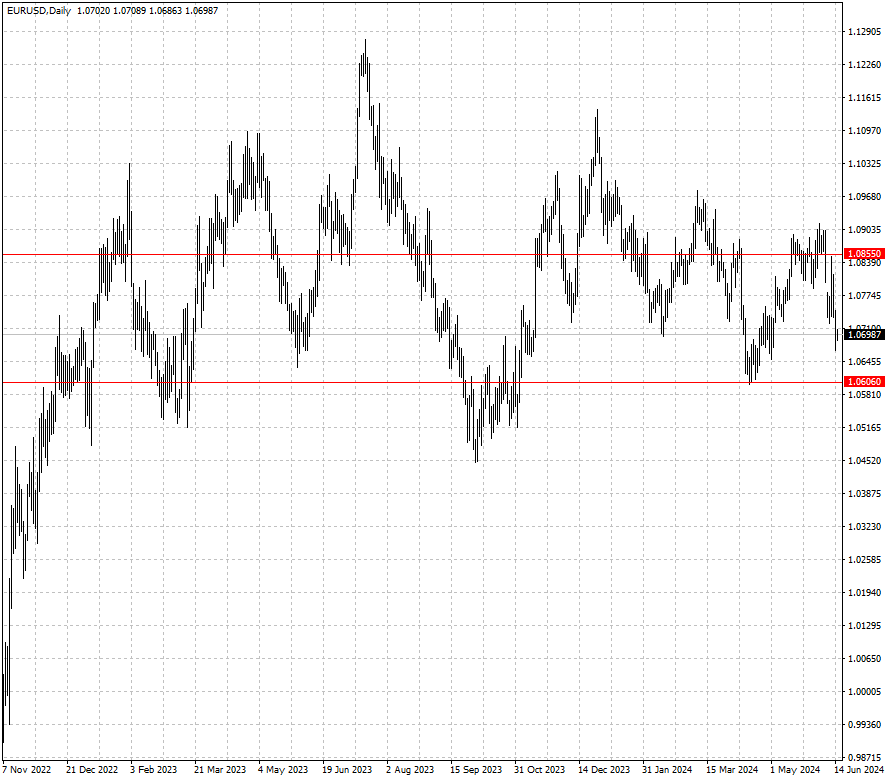

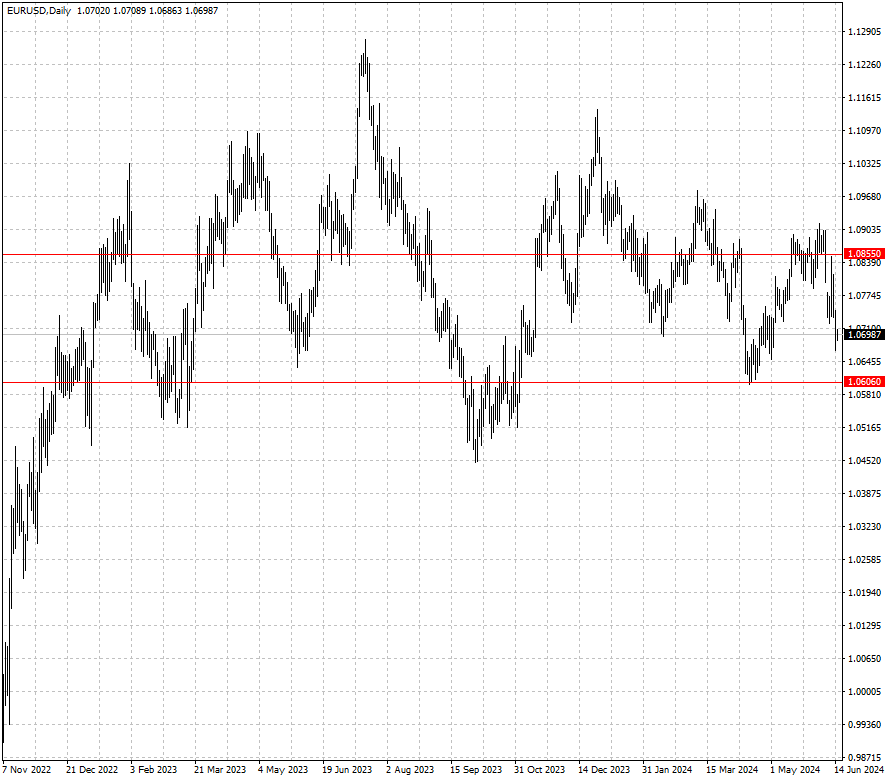

The dollar stayed firm Monday as investors awaited US economic signals. The euro hovered near a one-month low amid Europe's political turmoil.

EBC Forex Snapshot, 17 Jun 2024

The dollar was firm on Monday as investors awaited fresh clues on the

strength of the US economy. The euro hovered near a more than one-month low amid

political turmoil in Europe.

Even after the French financial markets endured a brutal sell-off late last

week, European Central Bank policymakers have no plans to discuss emergency

purchases of French bonds, five sources told Reuters.

The international trade surplus in goods in the Eurozone was estimated at €15

billion in April, standing higher than the figure seen during the corresponding

month last year, Eurostat said last week.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 11 Jun) |

HSBC (as of 17 Jun) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0700 |

1.0981 |

1.0606 |

1.0855 |

| GBP/USD |

1.2300 |

1.2827 |

1.2604 |

1.2810 |

| USD/CHF |

0.8885 |

0.9158 |

0.8806 |

0.9070 |

| AUD/USD |

0.6562 |

0.6729 |

0.6557 |

0.6687 |

| USD/CAD |

1.3577 |

1.3846 |

1.3626 |

1.3817 |

| USD/JPY |

151.86 |

157.71 |

155.18 |

158.90 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.