Dollar was on the Back Foot on Thursday

2024-07-04

Summary:

Summary:

Thursday saw the dollar weaken after ADP reported fewer job gains in June, aligning with increased initial unemployment claims last week.

EBC Forex Snapshot, 4 Jul 2024

The dollar was on the back foot on Thursday after ADP employment report

showed a less-than-expected job gains in June in line with an increase in

initial applications for unemployment benefits last week.

Minutes of the Fed's meeting acknowledged the economy is slowing and price

pressures were diminishing. Markets are pricing in about a 68% chance of a rate

cut in September, according to the CME FedWatch tool.

Sterling held steady after gaining on the dollar overnight. Britain appears poised to elect Labour Party leader Keir Starmer as its next prime minister when voters go to the polls.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 24 Jun) |

HSBC (as of 4 Jul) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0668 |

1.0916 |

1.0695 |

1.0847 |

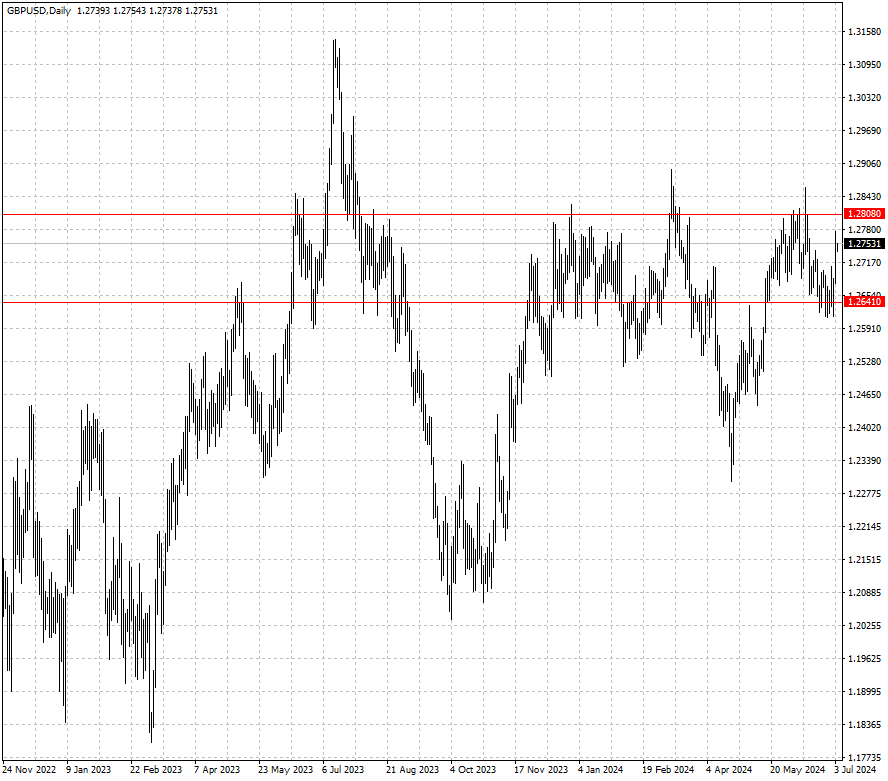

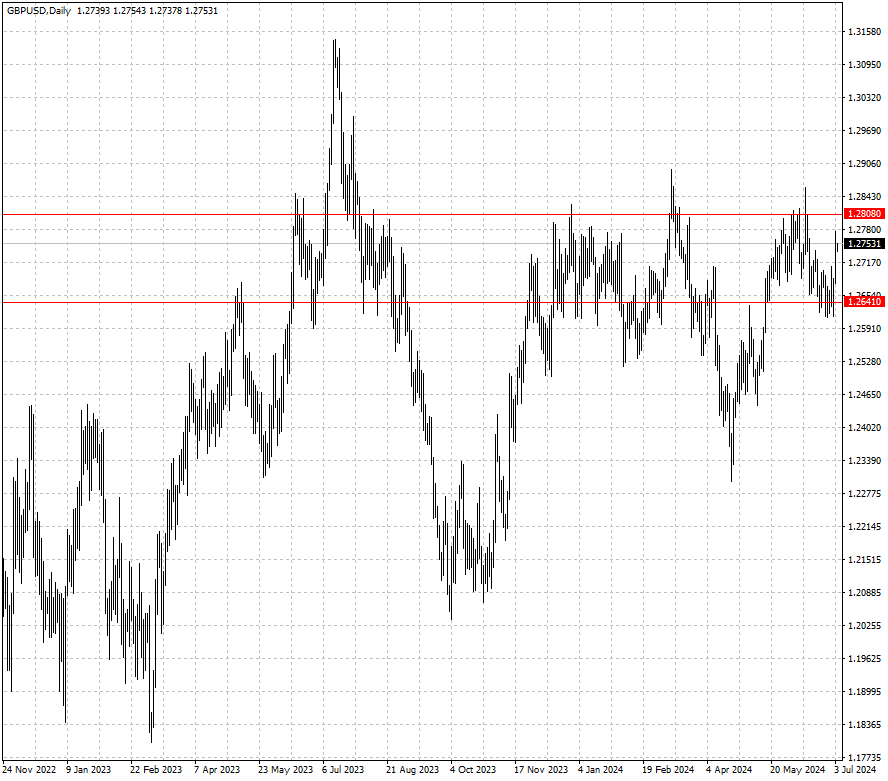

| GBP/USD |

1.2619 |

1.2860 |

1.2641 |

1.2808 |

| USD/CHF |

0.8827 |

0.9158 |

0.8875 |

0.9101 |

| AUD/USD |

0.6564 |

0.6729 |

0.6614 |

0.6764 |

| USD/CAD |

1.3577 |

1.3846 |

1.3576 |

1.3739 |

| USD/JPY |

153.60 |

160.00 |

158.37 |

163.49 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.