The dollar was firm on Friday

2024-03-15

Summary:

Summary:

Friday saw a resilient dollar, poised to end a three-week slide fueled by inflation data suggesting prolonged Fed rate stability, sparking concerns.

EBC Forex Snapshot, 15 Mar 2024

The dollar was firm on Friday and set to snap a three-week losing streak as

another hotter-than-expected inflation data stoked worries that the Fed could

keep interest rates unchanged for longer than expected.

The PPI for final demand increased rose 1.6% from a year earlier, the largest

annual advance since September. Markets now price in 60% chance of rate cuts in

June, according to the CME FedWatch tool.

The yen was on course for its worst weekly performance since January. The BOJ

will ditch its negative interest rate policy in April, according to just under

two-thirds of economists polled by Reuters.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 11 Mar) |

HSBC (as of 15 Mar) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0695 |

1.1017 |

1.0790 |

1.0976 |

| GBP/USD |

1.2503 |

1.2896 |

1.2601 |

1.2897 |

| USD/CHF |

0.8551 |

0.9000 |

0.8747 |

0.8911 |

| AUD/USD |

0.6443 |

0.6691 |

0.6482 |

0.6673 |

| USD/CAD |

1.3359 |

1.3607 |

1.3431 |

1.3619 |

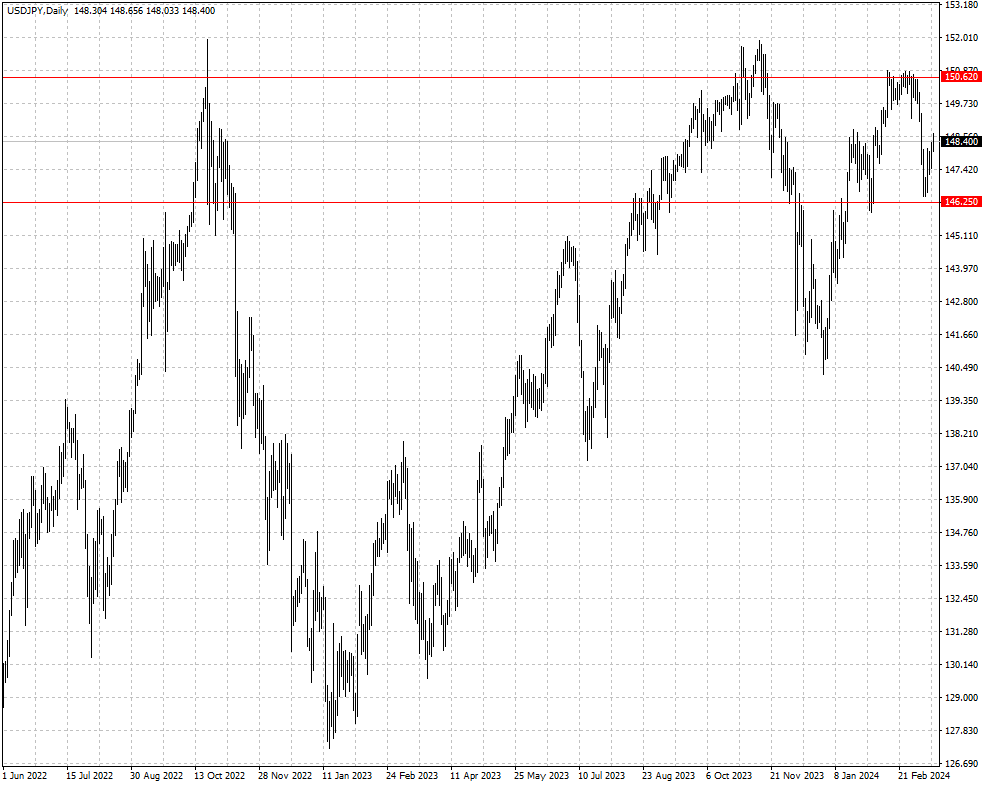

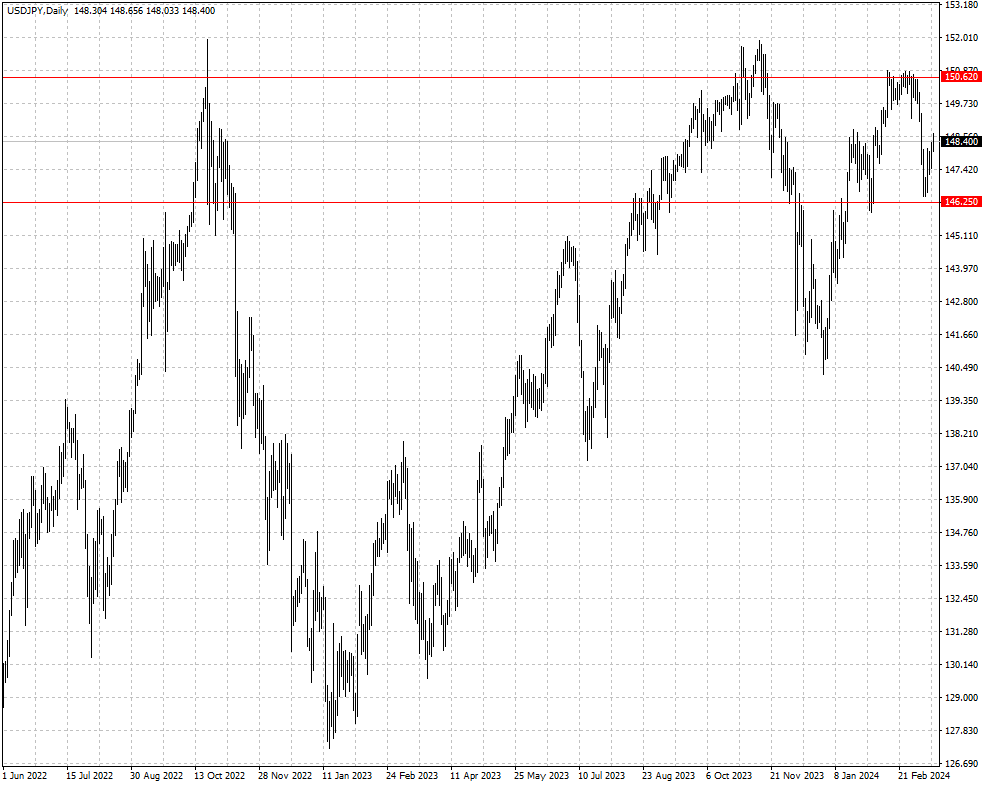

| USD/JPY |

146.68 |

150.89 |

146.25 |

150.62 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.