The dollar slid on Thursday

2024-03-21

Summary:

Summary:

Thursday saw the dollar drop post-Fed's steady interest rate cut projections. Australia surged with robust employment data from last month.

EBC Forex Snapshot, 21 Mar 2024

The dollar slid on Thursday after the Fed marinated its projections of

interest rate cuts for the year. The Australian dollar jumped as data showed

employment rebounded sharply last month.

The country’s jobless rate dived to 3.7% as employers shrugged off signs of

an economic slowdown to boost staff numbers by triple the level expected. The

strong result dumbfounded economists.

Earlier this week, RBA governor Michele Bullock indicated a rapid increase in

unemployment could prompt the central bank to start cutting interest rates. The

labour market has been in for a bumpy ride.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 18 Mar) |

HSBC (as of 21 Mar) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0695 |

1.1017 |

1.0816 |

1.1000 |

| GBP/USD |

1.2503 |

1.2896 |

1.2623 |

1.2919 |

| USD/CHF |

0.8741 |

0.9000 |

0.8758 |

0.8948 |

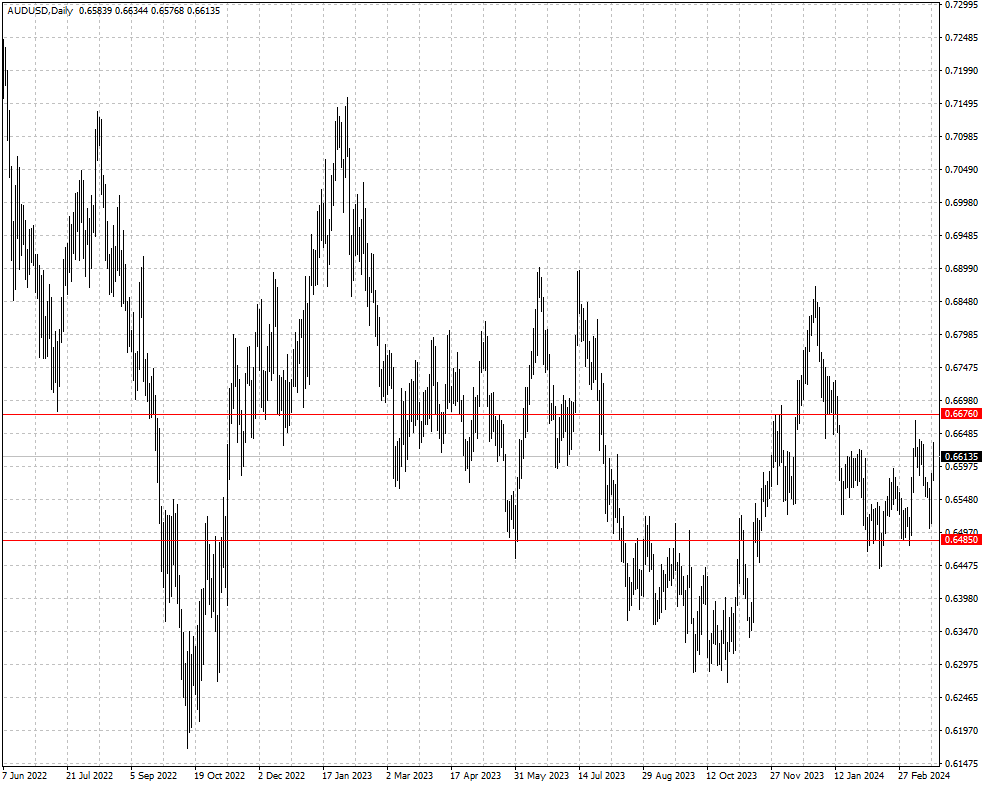

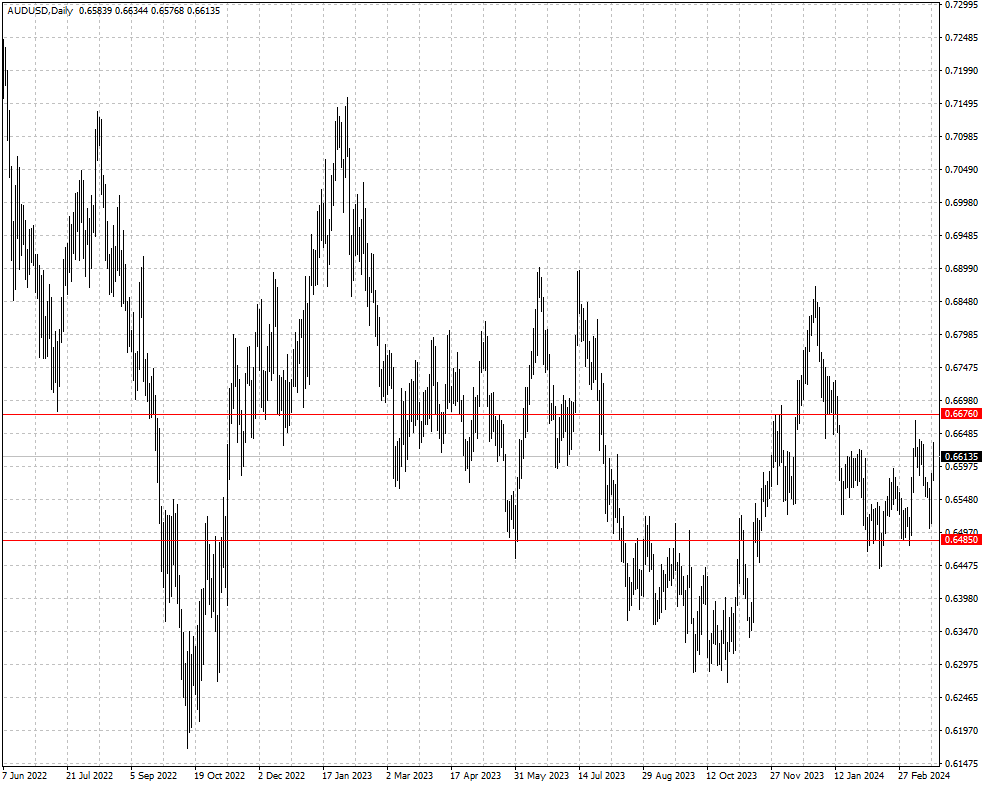

| AUD/USD |

0.6443 |

0.6691 |

0.6485 |

0.6676 |

| USD/CAD |

1.3359 |

1.3607 |

1.3400 |

1.3596 |

| USD/JPY |

146.26 |

149.21 |

147.86 |

153.24 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.