The dollar made a steady start to the week on Monday

2024-05-27

Summary:

Summary:

The dollar started steady on Monday, with markets eyeing inflation data. Bullish sentiment fades as the US economy cools.

EBC Forex Snapshot, 27 May 2024

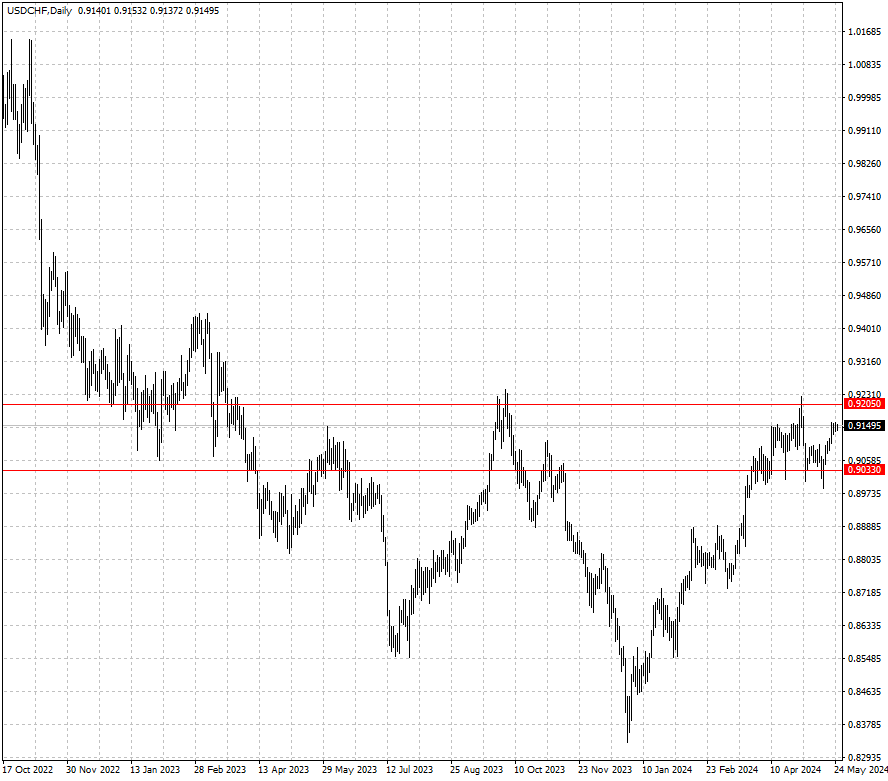

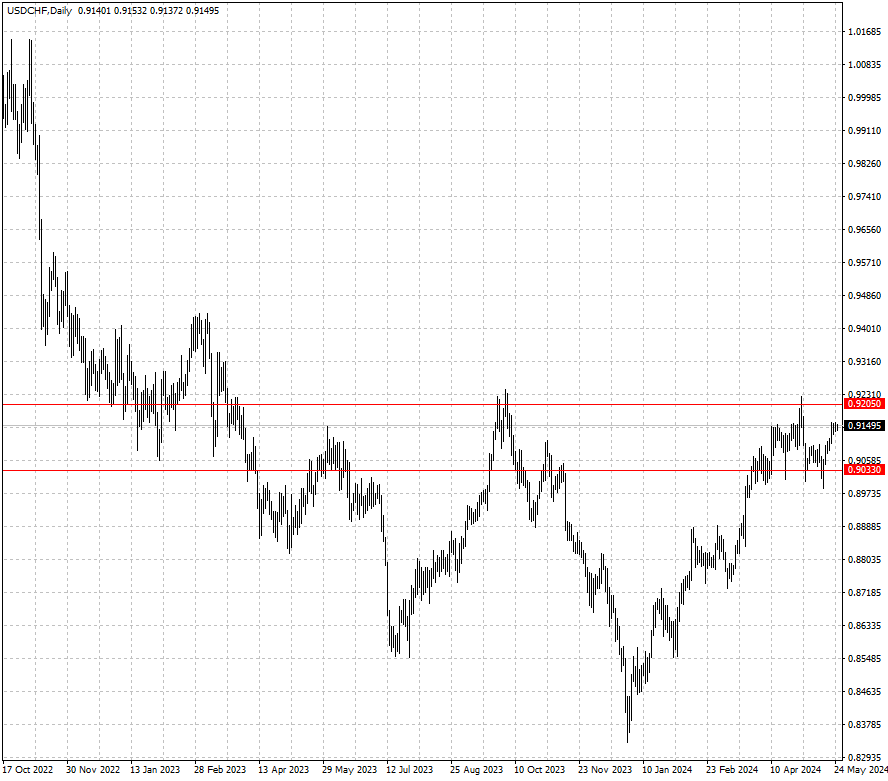

The dollar made a steady start to the week on Monday, as markets were focused

on a slew of upcoming inflation data. Bullish sentiment on the dollar is rapidly

receding amid signs the US economy is cooling.

While leveraged funds still held bullish wagers on the greenback last week,

asset managers among the group held a net short position for the first time in

six weeks, CFTC data showed.

Investors have been chasing income and selling low yield currencies such as

the yen and Swiss franc. The latter currency has been weak all year, trading not

far from the multi-month low hit earlier this month.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 20 May) |

HSBC (as of 24 May) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0793 |

1.0895 |

1.0725 |

1.0897 |

| GBP/USD |

1.2300 |

1.2712 |

1.2506 |

1.2824 |

| USD/CHF |

0.8988 |

0.9244 |

0.9033 |

0.9205 |

| AUD/USD |

0.6443 |

0.6729 |

0.6537 |

0.6695 |

| USD/CAD |

1.3478 |

1.3846 |

1.3623 |

1.3798 |

| USD/JPY |

152.12 |

157.68 |

154.09 |

158.48 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.