The Dollar Hovered near a One-Week High on Thursday

2024-05-23

Summary:

Summary:

Thursday saw the dollar near a one-week peak after its strongest day this month, spurred by Fed minutes hinting at potential rate hikes ahead.

EBC Forex Snapshot, 23 May 2024

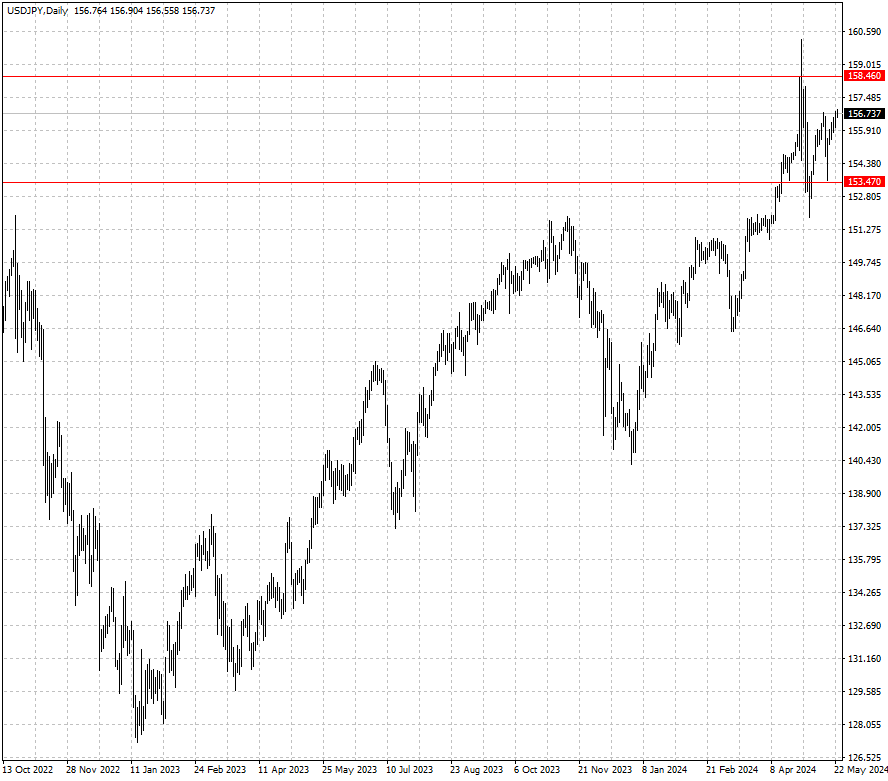

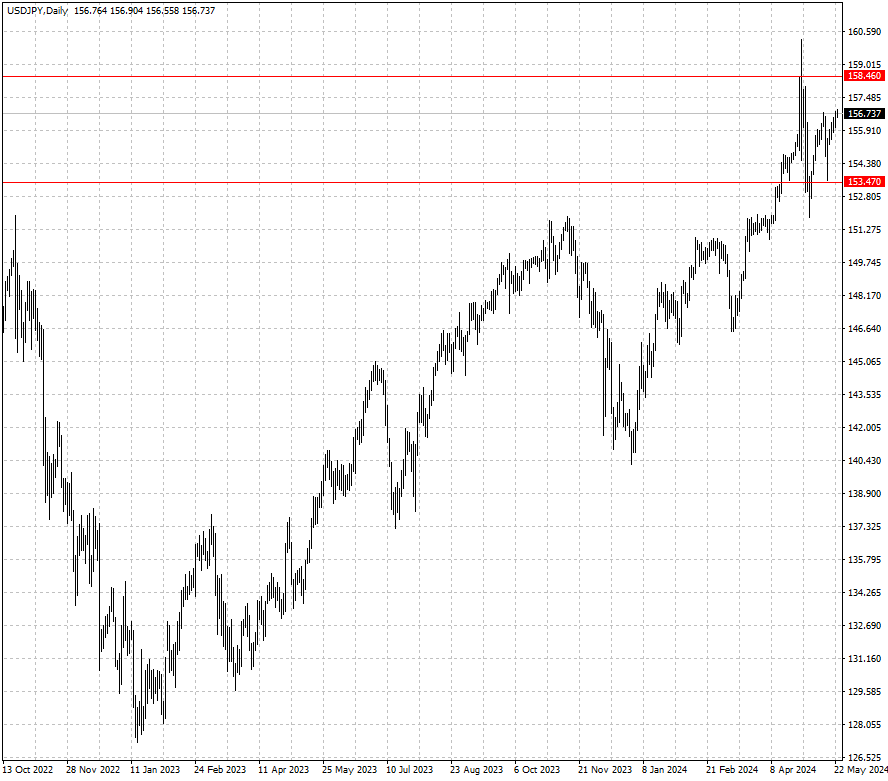

The dollar hovered near a one-week high on Thursday following its best day

this month after minutes of the last Fed meeting revealed some officials kept

the door open to more rate hikes.

The yen fell to the lowest since 1 May overnight in the face of possible

interventions. Japan’s 10-year sovereign bond yield reached 1% for the first

time since the rollout of stimulus measures in 2013.

Nearly half of Japanese firms find the yen's slide beyond 155 to the dollar

harmful to their business, roughly double the percentage of those who see the

currency's weakness as a positive, a Reuters survey showed.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 20 May) |

HSBC (as of 23 May) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0793 |

1.0895 |

1.0731 |

1.0903 |

| GBP/USD |

1.2300 |

1.2712 |

1.2518 |

1.2836 |

| USD/CHF |

0.8988 |

0.9244 |

0.9042 |

0.9214 |

| AUD/USD |

0.6443 |

0.6729 |

0.6545 |

0.6703 |

| USD/CAD |

1.3478 |

1.3846 |

1.3599 |

1.3774 |

| USD/JPY |

152.12 |

157.68 |

153.47 |

158.46 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.